In this article you will learn:

In this article you will learn:

- The idea of dividend investing

- Growth vs value stocks

- Dividend per share and dividend yield

- Record date and ex-dividend date

- Identifying best dividend stocks

Dividend investing remains an important strategy for a huge number of investors around the world. Others consider it almost a mystery in the face of evolving financial market conditions and fast-growing tech companies who often pay no dividend at all. What does dividend investing really look like these days? What is a dividend yield and how can you identify the best dividend stocks? How can you manage your dividend stocks portfolio? We will try to answer these questions in this brief article.

The idea of dividend investing

Let us begin with the basics, namely the idea behind investing in dividend stocks. The definition of a dividend may be explained in a very simple way – it is a share of profits and retained earnings that a company pays out to its shareholders. When a firm generates a profit and/or accumulates retained earnings, those proceeds can be either reinvested in the business or paid out to shareholders as a dividend. Even though there are many types of dividends (e.g. stock dividends or special dividends), the most common one is obviously a cash dividend, which means that a company pays it in cash directly into the shareholder’s brokerage account. Having invested in a profitable and well-established business, investors might be entitled to earn a regular income. In the long run, these proceeds could be very significant, depending on the amount of money invested in a particular stock. By many, this is considered the essence of long-term investing.

Growth vs value stocks

Obviously not all companies pay dividends – as mentioned earlier, some of them prefer to reinvest their earnings in the business as their main goal is to expand. It is crucial to understand the difference between two types of investments – growth and value stocks. Broadly speaking, growth stocks represent companies that are expected to deliver high levels of profit growth in the future. Such companies have often demonstrated better-than-average gains in earnings. As such businesses aim at further expansion, they either do not pay dividends at all or only pay out relatively modest amounts. In return, their stock price might potentially outperform the broad market

On the other hand, value stocks usually represent well-established companies that are trading below their true potential. Nevertheless, these firms still have good fundamentals as their business models are often steady and predictable. Even though their gains in revenue and earnings might be considered relatively modest (compared to growth stocks), they often distribute dividends. Therefore, dividend investors may find value stocks interesting, as their goal is to receive regular dividend payments.

Dividend per share and dividend yield

There are certain concepts that dividend investors should be aware of. First of all, the dividend per share (DPS) might turn out to be very useful, as it shows the amount of dividends for each share of stock during a certain period of time. It helps investors examine whether the company is able to increase its dividends over time. DPS is calculated by dividing the total dividends paid out over a certain period of time by the number of outstanding ordinary shares issued.

Another key figure is also dividend yield, which measures the dividend as a percent of the current stock price. Therefore, it shows the dividend-only return of a stock investment.

Dividend yield=Annual dividend per shareCurrent share price

Example 1: The company trades at £100 a share and pays £4 dividend once a year. Then, the dividend yield equals 4% (£4 dividend by £100)

Example 2: The company trades at £100 too, but it pays £1 dividend every quarter. Then the annual dividend amounts to £4 as well. In this case the dividend yield also equals 4% .

Obviously a dividend yield may be applied in order to compare various types of investments, for instance buying stocks, depositing cash in a bank, buying real estate for passive income, and many others.

Record date and ex-dividend date

After the company has declared a dividend payment, the firm sets a record date when investors must be on the company’s books as a shareholder to receive the dividend payment. Here comes a key concept of the ex-dividend date - investors must own the stock by that date to be entitled to the dividend. If one does buy a stock on its ex-dividend date or later, he or she will not receive the dividend. The ex-dividend date is usually set two days before the record days, which comes from the T+2 settlement cycle for stocks. Such an approach is used in most developed financial markets (for example, in the USA, UK and Germany). It is worth mentioning that investors who sell the stock after the ex-dividend date will still receive the dividend as the company’s decision who should receive the payment is based on the record date.

Example of the T+2 settlement: A record date is Friday while the ex-dividend date is Thursday. In this case investors must purchase the stock on Wednesday (or earlier) to receive the dividend.

Identifying the best dividend stocks

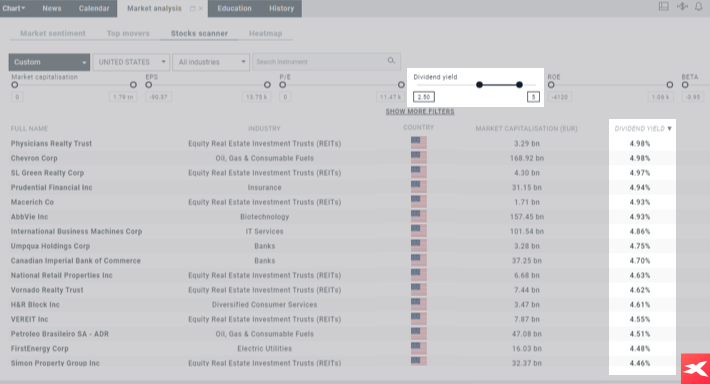

After a brief introduction of dividend investing, let’s now move on to identifying the best dividend stocks. Generally, dividend investors would like to earn a regular passive income - that is their main objective. Therefore, a strong dividend yield would be a key aspect in terms of identifying a promising investment. In fact, a great deal of companies provide a satisfying yield, which often exceeds 4%. Nevertheless, one should keep in mind that a dividend yield results from dividing a company’s annual dividend by its current stock price. When its stock price rises, the yield drops. On the other hand, should the stock price drop, the yield might unexpectedly surge. That is why an unusually high yield could indicate that the firm is going through hard times and investors are selling off the stock.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance. The stocks scanner may be found helpful for investors who seek certain dividend yields. Source: xStation5.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance. The stocks scanner may be found helpful for investors who seek certain dividend yields. Source: xStation5.

A superb dividend stock ought to be associated with regularity. Companies aspiring to be popular among dividend investors tend to have a reliable dividend policy, as it dictates the amount of dividends paid out to its shareholders, as well as the frequency with which the dividends are paid. Certain well-established companies pledge to increase their dividend every year. Despite booms and busts, many of them manage to deliver that impressive achievement. Obviously more such companies may be found in developed markets such as:

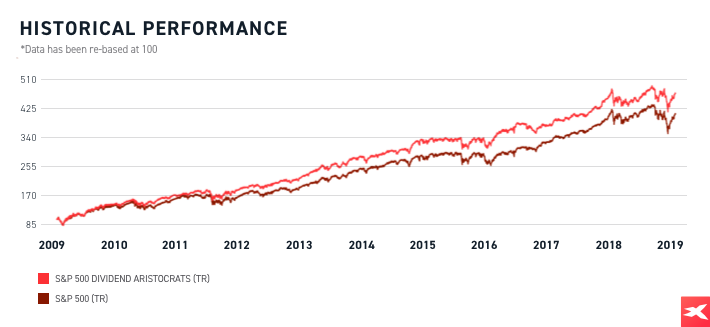

- Dividend Kings – S&P 500 companies who have increased their dividend for 50+ consecutive years.

- Dividend Aristocrats – S&P 500 companies who have increased their dividend for 25+ consecutive years.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance. S&P 500 Dividend Aristocrats Total Return (including dividends) has outperformed the S&P 500 Total Return since 2009. Source: S&P Dow Jones Indices

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance. S&P 500 Dividend Aristocrats Total Return (including dividends) has outperformed the S&P 500 Total Return since 2009. Source: S&P Dow Jones Indices

High quality dividend stocks can often be found among well-established companies that are market leaders. Ideally, the dividend stock has a strong brand, which is widely recognised in the industry. Picking a great dividend is all about the fundamentals. The company should have a healthy balance sheet with no excess debt. Depending on the industry, a firm’s debt-to-equity ratio shouldn’t be particularly high. Even though it might prevent the company from growing at its maximum potential, too much leverage poses a threat to dividend payments during crises.

Stable revenue and revenue growth seem to be crucial as future dividends may be easily predicted. As far as earnings and cash flows are concerned, investors should basically seek the same feature – steady growth or, at least, stability.

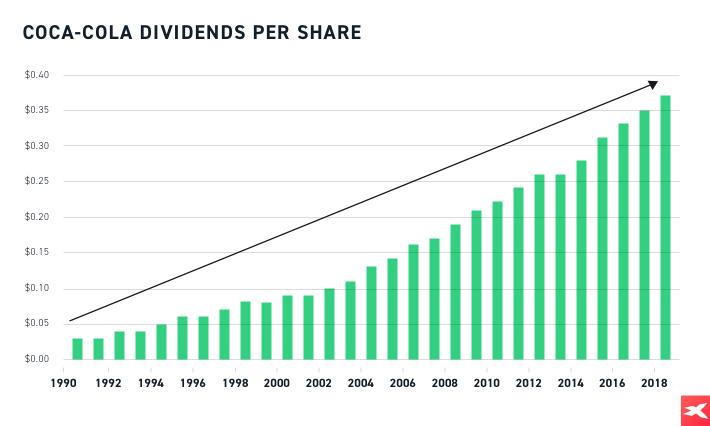

Growing businesses are not only able to provide meaningful dividend yields, but they are also raising their dividend per share over time. Think about companies that belong to dividend aristocrats or dividend kings – investors believe that they will continue to do so. Therefore, these companies are constantly striving to meet expectations.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance. Top dividend companies are able to constantly increase their dividend per share. Assuming that over time the stock price rises as well, investors might earn a significant return. Source: mauldineconomics.com

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance. Top dividend companies are able to constantly increase their dividend per share. Assuming that over time the stock price rises as well, investors might earn a significant return. Source: mauldineconomics.com

Summing up, dividend stocks can be seen as good investments for long-term investors, as they may offer a return if held for a number of years. In today’s low interest rate environment the choice is quite limited as bonds and bank deposits cannot compete with a great deal of dividend stocks. Therefore, the equity markets have been tempting more and more people – some of which have already decided to allocate their capital in either proven or promising dividend stocks.

This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory.

The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments.

X-Trade Brokers Dom Maklerski S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication.

In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.

Understanding ISAs: A Tax-Efficient Way to Save and Invest

Choosing the Right ISA for You

Maximising Your ISA Contributions

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.