As anticipated by many on July 4, 2024, the United Kingdom will hold a general election. This election will involve voters across the UK selecting Members of Parliament (MPs) to represent them in the House of Commons.

The election is significant as it will be contested under new constituency boundaries established by the 2023 boundary review. These changes are expected to impact the distribution of seats, with some regions gaining and others losing seats based on population shifts.

This general election comes as part of the regular democratic process, and it will follow the dissolution of Parliament on May 30, 2024, leading to a 25-working-day campaign period.

With the UK less than six weeks away from the General Election, Keir Starmer’s Labour is leading ahead, after 14 years of the Tories ruling. Will this election be different and can it shake things up?

This article is updated every few days to bring you the latest news and analysis concerning the latest UK election.

As anticipated by many on July 4, 2024, the United Kingdom will hold a general election. This election will involve voters across the UK selecting Members of Parliament (MPs) to represent them in the House of Commons.

The election is significant as it will be contested under new constituency boundaries established by the 2023 boundary review. These changes are expected to impact the distribution of seats, with some regions gaining and others losing seats based on population shifts.

This general election comes as part of the regular democratic process, and it will follow the dissolution of Parliament on May 30, 2024, leading to a 25-working-day campaign period.

With the UK less than six weeks away from the General Election, Keir Starmer’s Labour is leading ahead, after 14 years of the Tories ruling. Will this election be different and can it shake things up?

This article is updated every few days to bring you the latest news and analysis concerning the latest UK election.

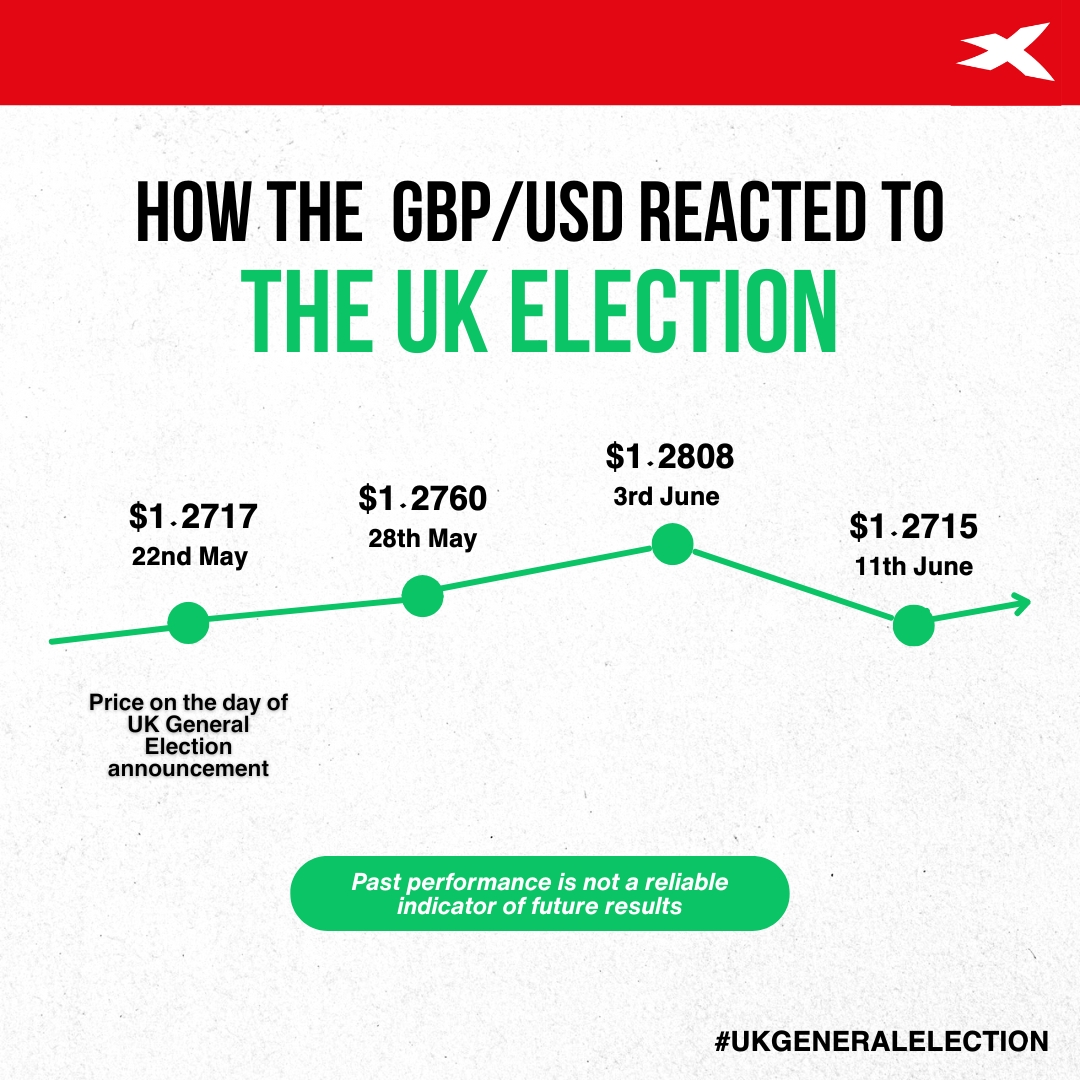

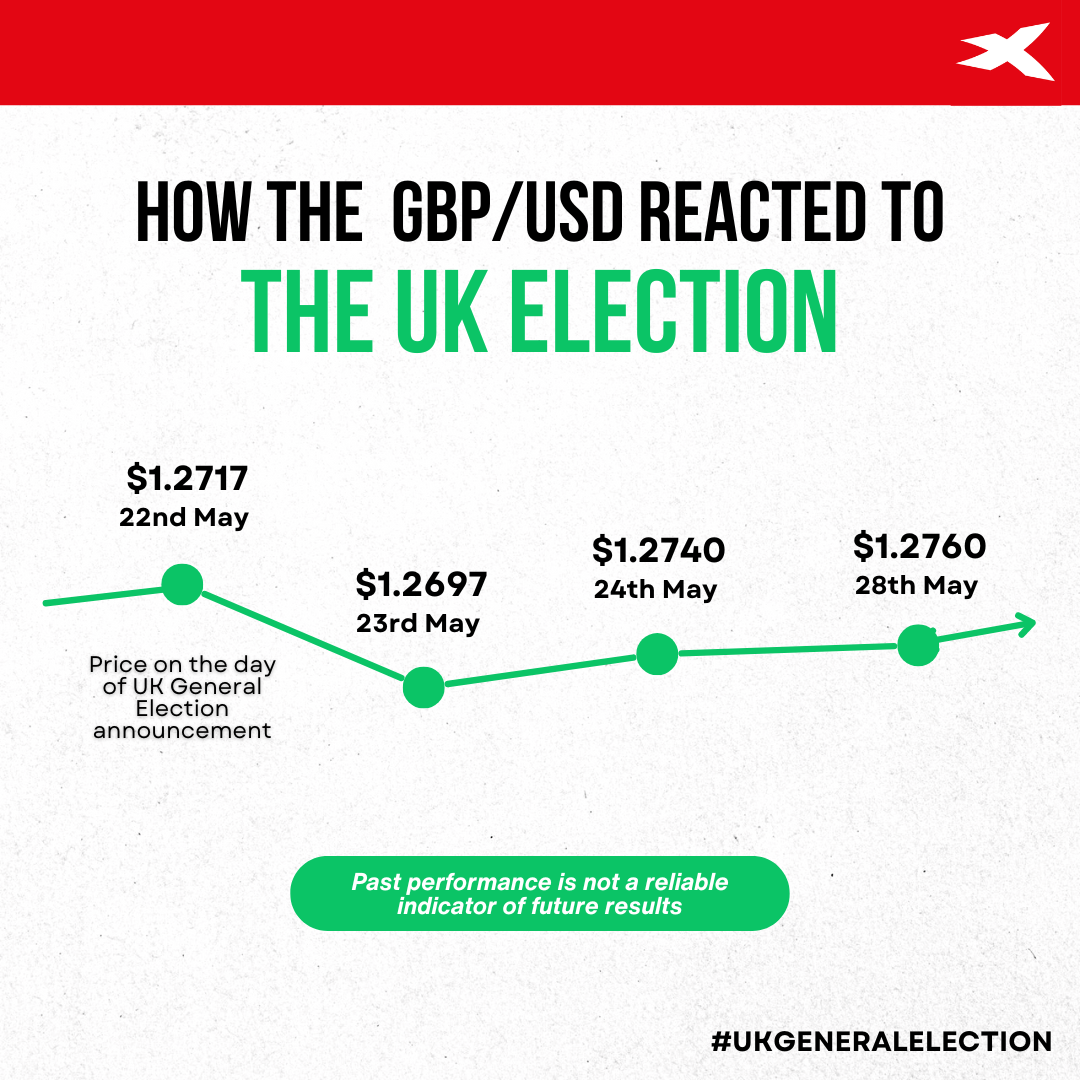

Chart 1: How the GBP/USD reacted to the UK election

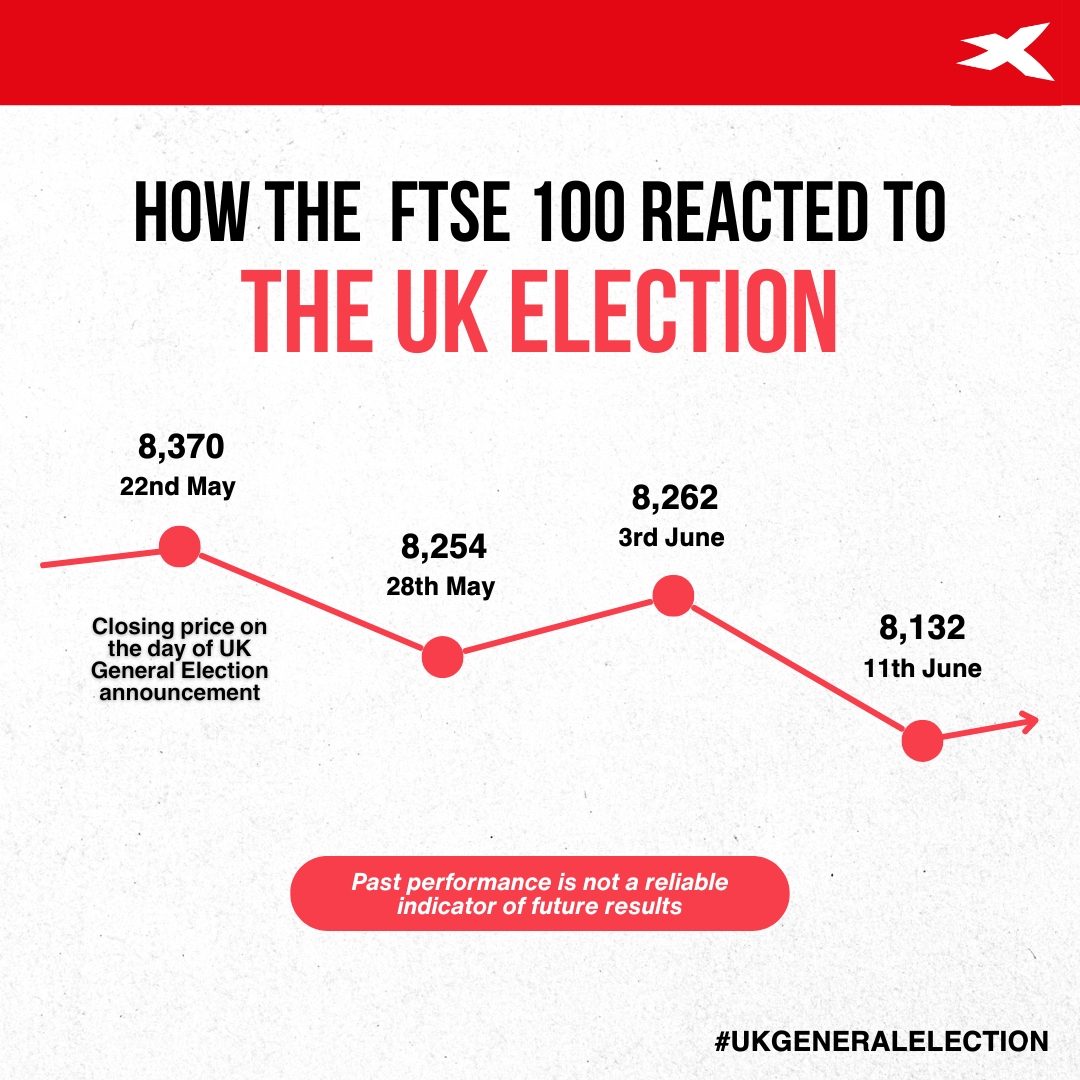

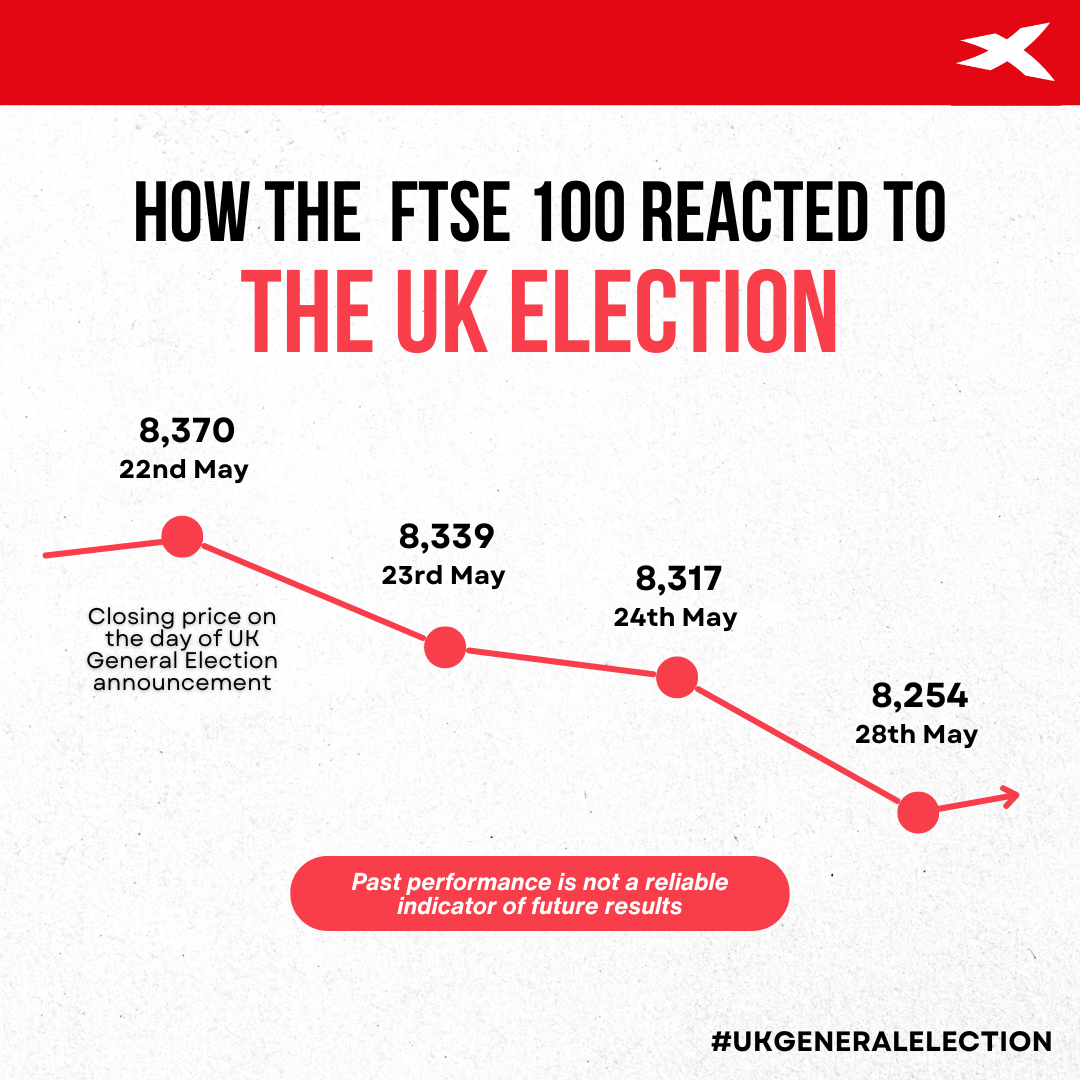

Chart 2: How the FTSE 100 reacted to the UK election

Chart 2: How the FTSE 100 reacted to the UK election

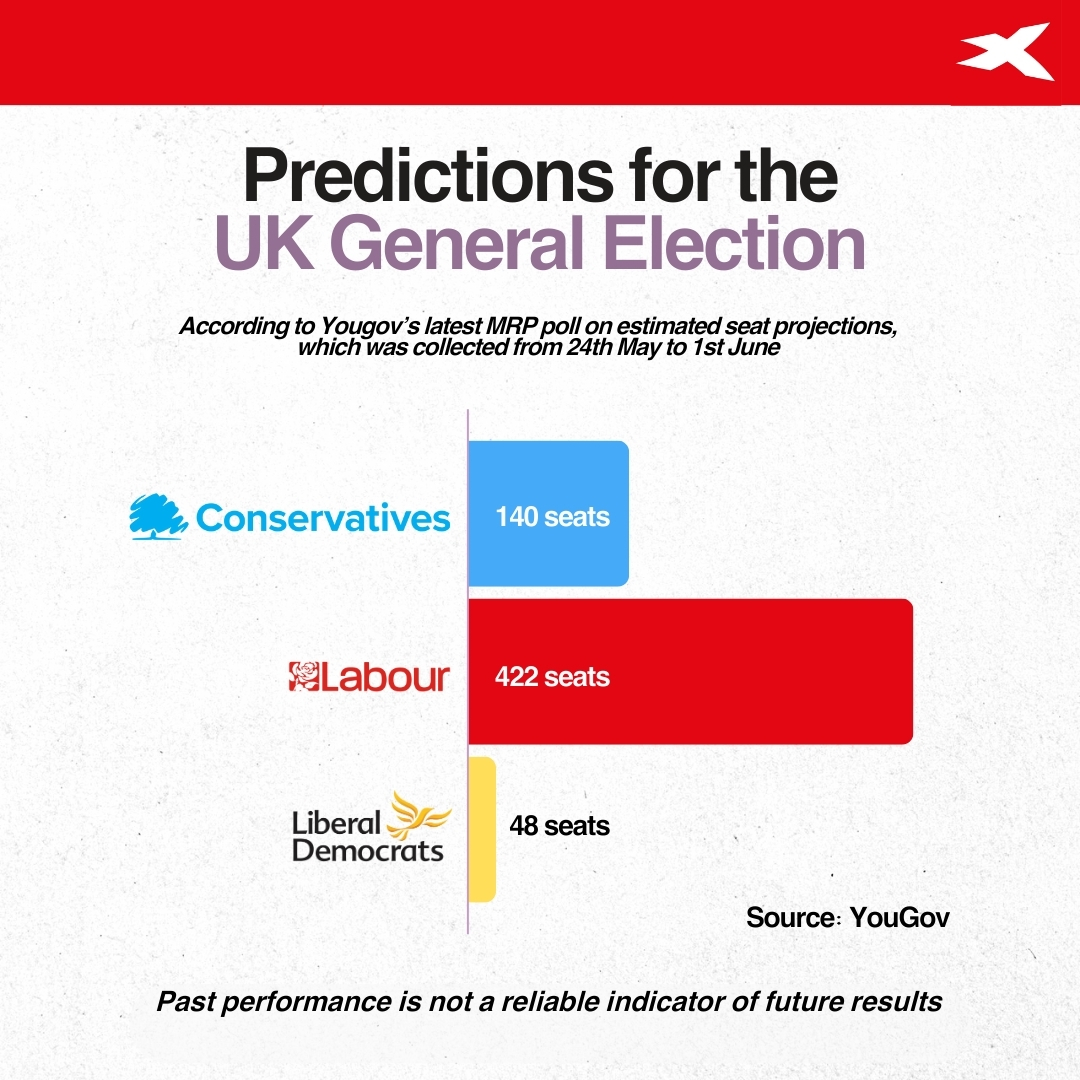

Chart 3: Predictions for the UK General Election

Source: YouGov

Source: YouGov

Source: YouGov

Source: YouGov

Chart 4: 2019 UK General Election Outcome

Source:YouGov

Source:YouGov

Live Updates

21 June 2024 - Labour's Strong Lead, Tories' Domestic Troubles, and the UK's Economic Outlook

We are now two thirds of the way through the UK’s election campaign, and the polls are still predicting a large majority for the Labour Party. The Labour Party is predicted to win 41% of the vote, with the Conservatives on 20%. Reform is expected to get the third largest proportion of the vote, and is currently expected to win 16% of votes, according to the BBC’s poll tracker.

There have been no major shifts or events in the campaign in the past few days that suggests that the polls could change dramatically, however, things have got worse for the Tory party. 50% of the current cabinet are expected to lose their seats and even current PM Rishi Sunak is expected to lose his Yorkshire seat to Labour, which is unprecedented.

The most recent leadership debate didn’t change the dial for this election campaign. Labour leader Sir Keir Starmer was a little unstuck when he had to talk about former Labour leader Jeremy Corbyn. He also said that he thought Corbyn would have made a better PM than Boris Johnson. We shall have to see how this lands with voters in this weekend’s polls, especially since Starmer has been trying to move the Labour party away from Corbyn’s hard left stance.

PM Rishi Sunak should have had a platform to wax lyrical about the UK’s inflation rate falling to 2% and how he has turned the economy around, however, he was stumped by constant references to mishaps by the Conservative Party. The latest being a betting scandal involving the date the election was called. The Tory campaign is lacking energy and is embroiled in domestic troubles, which appears to be knocking it further off course as we get closer to the election.

Interestingly, there have been some positive economic developments this week, and these have not even helped to boost the Tory campaign. Inflation fell to 2%, the Bank of England opened the door to an August rate cut, and retail sales surged in May and consumer confidence is improving. Usually this would boost an incumbent leader, but this is not the case for the Conservatives, as they appear to have lost the support of the British public at large. This is what the polls are showing, we shall have to see if this is true on election day in just under two weeks’ time.

However, whoever wins power on July 4th, they do not have much fiscal room to play with. The country’s debt to GDP ratio is rapidly approaching 100% of GDP, according to the latest public finance figures, and public sector borrowing was £15bn last month, the highest borrowing for May since May 2021, the peak of the pandemic.

Financial markets and UK asset prices seem to be immune and are moving on the back of interest rate expectations and global trends. However, the rising debt load in the UK is worth watching. If either Labour or the Conservatives try to win votes by pledging even more public spending or tax cuts in the last two week’s of the campaign, then the bond vigilantes could visit the UK once more.

14 June 2024 - Manifestos week as it’s another terrible week for the Tories

We are now mid-way through the UK general election campaign, and it is fair to say that things have gone from bad to worse for the incumbent Conservatives. Rishi Sunak’s party has fallen behind Reform, the hard right UK party, for the first time ever. The latest polls for YouGov and the Times, that was released on Thursday night, puts Reform at 19%, the Conservatives at 18% and Labour having slipped to 37%, but are still on track to win by a big majority.

While all polls have a margin of error, it does suggest that Reform is commanding the same level of support as the Conservatives, which is a huge shift in a mere few weeks. For the Tories to imagine getting back into power in the future they may need to move further to the right to secure Reform support.

Some cabinet ministers have almost conceded defeat to the Labour party before a vote has been cast. However, this could be a strategic move. If the Tories don’t believe that they can catch up with Labour at this mid stage of the campaign, then why not warn people against giving the Labour party a record-breaking majority, and try to pick up votes that way? Thus, we could hear a lot more from the Conservatives about being a strong opposition to Labour in the final weeks of this campaign.

Manifestos: Labour tax plans weigh on markets

The other big news this week is the launch of the party manifestos. From a market perspective, the key points to note are what will the tax burden be under each party, what are their spending priorities and which sectors will be the winners and losers.

The IFS and BBC Verify have looked at all the main party’s manifestos and calculated that the tax burden as a percentage of GDP would be highest under Labour at 37.4%. Under the Conservatives it would be 36.7%. Some may argue that there is not much difference between the tax burden under the two main parties. However, although Labour has ruled out any increases to income tax, corporation tax, VAT and National Insurance, Labour have declined to exclude any increase in capital gains tax in their manifesto. There are fears that Labour, if elected, could gear up to increase capital gains tax to fund their public spending plans, and there are growing concerns that this will make the UK less competitive. The Labour party put growth at the heart of their manifesto, but some argue that this is all talk if they can’t explicitly rule out increasing capital gains tax and other wealth taxes.

The other points in Labour’s manifesto worth noting include:

- A windfall tax on oil and gas revenues to fund a ‘green prosperity plan’, that comes in at £5bn and will be partly funded with additional borrowing.

- Getting rid of waiting lists that are 18 weeks long in the NHS.

- Planning reform, industrial strategy, regulatory reform and educational reform to help to boost growth.

A sustained focus on growth is a welcome move, and it would also help to pay for Labour’s spending plans. However, the risk is that growth disappoints, as it has done in recent years. Also, while reforms are welcome to try and kick start the UK’s slow growth problem, they could take time to actually boost the economy. This means that Labour’s promise to not have national debt rising at the end of the forecast period, might need spending cuts or tax increases to meet this target.

Conservatives go big on tax cuts in desperate bid for votes

The main points from the Conservative manifesto include a return of help to buy to get people on the housing ladder. The Tories also pledged to scrap National Insurance for the self-employed, and to increase the personal tax-free allowance for pensioners. These tax cuts will be funded by cracking down on tax avoidance and by cutting the welfare bill by £12bn a year by the end of the next parliament. With more than 1 in 5 Brits of working age economically inactive, this is a tough job. The Tories also promised a cap on social care costs and more dentists for the NHS, increased defense spending and more flights to Rwanda. Migration is central to their campaign strategy, and they are also promising a legal cap on migration, although migration to the UK has risen to a record under the Conservatives.

The Conservative manifesto has not caught the public’s imagination, and Tory polling numbers have decreased since it was launched. The big winners this week appear to be the Reform Party, led by Nigel Farage, who is also positioning himself as the most effective opposition to Labour.

The impact on UK financial markets

UK asset prices have yet to react to this election campaign in a meaningful way. The FTSE 100 is poised to end the week lower and is currently down more than 1.5% in the past 5 days. However, this is a better performance than European stocks. The Eurostoxx index is currently down 2.6% in the past week, and the French Cac 40 is down by more than 5.4% on a currency-adjusted basis, after President Macron called for a surprise snap Parliamentary election for France.

In the aftermath of the Labour manifesto launch, the real estate, financial and consumer discretionary sectors were the worst performing in the FTSE 100. This could be a reaction to Labour’s manifesto promises and the potential increase in the UK tax burden under a Labour government. Worryingly, the FTSE 250, which is a more domestically focused index, is down by 2.5% in the past week, suggesting that stock markets could be getting jitters about a Labour government since they will not rule out any increases to capital gains taxes. This is something to keep an eye on, especially if Labour can maintain their lead in the polls.

The pound has mostly been moved by international factors, and UK bond yields are also stable and moving in line with global themes, rather than being directly impacted by this election.

6 June 2024 - UK election round up

There’s still nearly a month to go until the UK election, and this week has seen some seismic events that could determine the outcome of the UK general election on July 4th.

The first main event was the reversal from Nigel Farage, who previously said that he was too busy focusing on the US to run as an MP in the UK, who then announced that he was running to be an MP for the Reform UK party.

Farage could help Labour cruise to victory

The latest polling data makes for grim reading for the Prime Minister. The FT’s general election poll tracker from 4th June puts the Conservative Party at 24%, Labour at 44% and the Reform Party at 10%, above the Liberal Democrats, who are expected to win 9% of the vote. Other polls, such as the latest from YouGov, give Reform 15% of the vote, compared with 19% for the Conservatives, suggesting that Reform are snapping at Tory coat tails. Farage’s decision to run as an MP at this general election, has not done anything to stem Labour’s lead, and the latest MRP poll has Labour winning the biggest majority since 1924! However, it appears that Farage could split the Tory vote, making a win for Labour more likely. Markets like certainty, and if this helps Labour cruise to victory on July 4th then the prospect of an electoral upset is slim, which may be good news for UK asset prices, especially the pound, which does not historically do well when there is an electoral upset.

Rishi performs better than expected in debate

The other big news this week was the first leaders debate that took place on Tuesday evening, 4th June. The style of the debate meant that each candidate only had 45 seconds to respond to questions put forward by the audience and the public. This was not a lot of time to explore in much detail the policies of either party. Rishi Sunak accused the Labour leader of planning to put taxes up by £2,000 per household, although this figure has not been verified. It was mostly a bad-tempered debate between the two, however, polls in the immediate aftermath of the debate show that Sunak narrowly beat Starmer in the first debate, according to a YouGov/ Sky News poll. We shall have to see if this narrows the polls or gives the Conservatives a boost after a bruising start to their campaign.

No meaningful impact on markets, yet

Overall, this election campaign is not having much of an impact on UK asset prices so far. The pound is one of the top three performers in the G10 FX space in the past week, UK short term gilt yields have fallen more than 15 basis points this week in line with other major global sovereign bond markets, and UK stocks have mostly been drifting sideways and following global trends. Thus, at this stage of the election campaign, a surprise outcome is not expected, which is keeping UK asset prices stable.

India’s market a mayhem a warning about election risk

However, elections elsewhere this week highlight how volatile markets can become when there is an unexpected political outcome. In India, Narendra Modi’s BJP party did not win the large majority in this election that the market had expected, and instead has managed to scrape through to power with the help of some smaller parties. This was a big shock for financial markets. It makes the prospect of Modi’s land and labour reforms, which were considered positive for economic growth, harder to get through India’s parliament. There was a wild reaction in Indian asset prices on the back of lower-than-expected support for the BJP. India’s Nifty 50 index fell nearly 10% and the Indian rupee fell to a record low vs. the USD. The Nifty has recovered most of its losses now that the BJP is confirmed as the next government, however, there has been some large withdrawals from foreign institutional investors. While we think that the stock market may continue to recover and perform well, the rupee may be harder to gauge going forward, and it has not recovered from its election shock.

Nigel Farage and unexpected electoral outcomes

Unexpected outcomes have a big impact on financial markets. At present, an unexpected outcome is unlikely in the UK election. However, there is still a way to go before voting day. For now, the biggest risk that we can foresee is if the Conservatives see a further dwindling of support, and Farage’s Reform Party look like they will come in second place, behind Labour. This would not be good news for the pound in our view, as it would mean that an anti-EU party would be gaining ground in the UK. We will be watching the polls closely in the coming week.

28 May 2024 - Shadow Chancellor, Rachel Reeves, delivers a speech on her economic plans at the Rolls Royce factory

On Tuesday, the main news revolved around Rachel Reeves, the shadow chancellor, delivering a speech on her economic plans at the Rolls Royce factory. This venue choice carried symbolic significance, as Rolls Royce is the top-performing stock in the FTSE 100 so far this year, with gains exceeding 50%. By allowing Reeves to launch her election campaign at their facility, it suggests that the company is comfortable with the prospect of a Labour government.

Reeves' speech was designed to be relatively market-neutral, likely a deliberate move in the wake of the Truss/Kwarteng budget debacle. She ruled out presenting a Budget immediately after the election, indicating it would more likely occur in the Autumn. Reeves confirmed three tax increases: VAT on private schools, changes to the tax regime for Private Equity executives, and windfall taxes on Oil company profits. However, she did not outline extensive spending plans, except for justifying the VAT on private school fees to fund additional public sector teachers.

Reeves' mantra of 'securenomics' emphasises adhering to strict fiscal rules and avoiding unfunded tax and spending promises. Her message was relatively dull, but this is likely intentional, as Labour aims to avoid the perception of jeopardising fiscal stability, as seen with the Truss administration. While Reeves' speech did not significantly impact UK stocks (the FTSE 100 opened lower this week), the GBP/USD is strengthening, nearing the $1.2800 mark. This could indicate that the market is impressed with Reeves' economic command and may also reflect the support expressed by 120 business figures who signed a letter in The Times on Tuesday, backing a Labour government.

Next week will see the first TV debate between Sunak and Starmer, which will be closely watched as the election campaign intensifies.

How will the election impact the UK economy?

A report by Citi found that the MSCI UK index, which tracks large and mid-sized British companies, has historically performed differently depending on which political party wins the election. On average, the index rises about 6% in the six months following Labour victories, while it falls around 5% after Conservative wins.

The report also suggests that the FTSE 250, an index focused on UK-based mid-cap companies, tends to do better than the FTSE 100 (which includes larger, more international companies) after elections. This outperformance is especially strong after Labour wins.

Labour’s shadow chancellor, Rachel Reeves, along with party leader Keir Starmer, have highlighted throughout the year that the party will focus on delivering “economic stability, with tough spending rules” to try and keep taxes and inflation as low as possible. As seen on their manifesto “Labour will deliver stability with iron discipline, guided by strong fiscal rules, robust economic institutions, and a new ‘fiscal lock’ to ensure we never repeat the mini budget that sent mortgage rates soaring”.

On the other hand, Rishi Sunak, party leader of the Conservative party is pledging to “ Halve inflation to ease the cost of living and give people financial security, grow the economy to better-paid jobs and opportunity right across the country and reduce debt to secure the future of public services.”

The impact on Sterling and FX

Interest rates are a much bigger driver of the FX market at this stage, and we don’t think that the FX market will be particularly affected by this election. The Conservative party has pledged to halve inflation to ease the cost of living and give people financial stability. However, as we get closer to the election date, we could see some volatility in sterling on a broad basis, especially against the rest of the G10 FX space. If there is a surprise in this election: either a surprise during the campaign period, or a surprise outcome like a hung parliament that may lead to a drawn out power-sharing agreement, then we could see sterling weaken, especially vs. the USD and the EUR.

XTB’s Research Director, Kathleen Brooks, said: “So far, the UK election announcement has been fairly uneventful for UK financial markets. Both parties do not want a repeat of the Liz Truss/ Kwasi Kwarteng budget that caused havoc for UK asset prices, especially bonds and the pound. This is why both parties are trying to sound as sensible as possible when it comes to the economy.

Labour is trying to position itself as the party that can be best trusted with the future of the UK economy. Rachel Reeves is talking about fiscal stability and no unfunded tax cuts. She has yet to lay out her spending plans, however, she has ruled out a budget immediately after the election, which means the next Budget will most likely take place in the Autumn.

After her recent opening speech of the campaign, the pound rallied, suggesting that, for now, UK financial markets are comfortable with a win for Labour.

As we have said, a hung parliament could be the biggest shock to the market, and if that happens then it could trigger volatility in UK asset prices, but for now, that looks like a low probability event.”

What stocks should you look out for?

Homebuilders

- Taylor Wimpey, Vistry Group, Barratt Developments Plc, Redrow Homes

We believe both parties are likely to pledge to increase homebuilding. As seen on the Labour's manifesto they pledge to build 1.5 million more homes with first time buyers getting first dibs. During this election cycle both parties could pledge to cut stamp duty to boost home purchases, or they could offer subsidies for the home builders to help them to achieve house building targets. This could boost homebuilding stocks.

Water Utility Companies

- Severn Trent, United Utilities

The Labour party has pledged to take a more hands on approach with the UK’s water companies after a spate of scandals about sewage spills and unclean rivers and waterways. During recent months, Labour has pledged to stop water utility bosses handing out bonuses to themselves and others and giving the regulators more power over the water companies if they don’t clean up after sewage spills. Labour has also pledged to introduce fines for water companies if they illegally discharge sewage into rivers. This could be bad news for the stock prices of water companies in the run up to this election, especially if Labour maintain their current lead.

Healthcare companies

- GlaxoSmithKline, AstraZeneca, Smith & Nephew

Both parties are expected to invest more in the NHS and social care. We expect Labour to focus more on cutting waiting lists and funding the NHS compared to the Conservatives. If Labour maintain their current lead in the polls then this could boost the UK’s healthcare sector, for example, Smith & Nephew, the healthcare supplier. AstraZeneca, GlaxoSmithKline, Eli Lilly and Novo Nordisk could all benefit if the Labour Party promises more money for cutting edge drugs to be made available on the NHS. Also, if either party gets serious about cutting the UK’s obesity rates, then weight loss drug makers including Eli and Novo could benefit.

Artificial Intelligence

- Microsoft, Google

Some analysts think that if the Conservatives win, they will regulate AI companies with a lighter touch than the Labour Party. Since the UK is set to become one of the big early adopters of AI, the outcome of this election could impact the big AI providers, for example Microsoft and Google. The impact on their share prices might be mild, but if the winning party of the UK election is serious about AI, either allowing it to enter the UK market unimpeded, or if they want to tightly regulate it, then this could have an impact on some of the tech giants.

Points to watch out for

- The UK asset markets were very calm after the election announcement earlier this week.

- Expectations determine how volatile financial markets will be in the lead up to an election and after the result. For example, Labour is currently in the lead by a wide margin. If this is maintained until 4th July then UK assets including stocks and sterling, could be fairly calm during this election cycle. However, if the polls narrow or if there are signs that there will be no clear winner from the July 4th vote, then political uncertainty could impact UK asset prices.

- Overall, there is an expectation that this will not be a particularly volatile election season, since Labour has a large majority, and the differences between the Conservatives and Labour are not that big. However, the prospect of a hung parliament after the vote would trigger the most volatility.

- Worth noting, stock markets tend to do well in the first year after an election, especially if there is a change of leadership. Thus, a win for Labour could be good news for stocks. The market tends to welcome new Prime Ministers with fresh ideas.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.