What is a meme stock?

At its core, a meme stock refers to a publicly traded company whose stock price experiences rapid and extreme fluctuations, often driven by online communities, rather than traditional financial metrics. These stocks typically gain momentum through viral internet memes, catchy slogans, and grassroots online movements, rather than fundamental analysis or company performance. The rise of meme stocks is closely tied to the democratisation of information and the power of social media to amplify individual voices.

Social media platforms like Reddit, X (formerly known as Twitter), and Facebook will bring awareness to these companies as online communities partake in in-depth discussions speculating on the price performance of particular stocks.

This can lead to cult-like loyalty from retail investors and a massive jump in trading volume and price movements.

Despite the often-flawed analysis involved in these discussions, because of the high volume of participants, these forums have been known to influence the markets in unexpected ways.

How are meme stocks different from blue-chip stocks?

One of the defining characteristics of meme stocks is their unpredictability. Unlike blue-chip stocks, which are typically backed by solid fundamentals and stable financial performance, meme stocks can experience astronomical gains or catastrophic losses within a matter of days, or even hours. This volatility is fueled by the collective actions of retail investors, who band together on social media platforms to coordinate buying or selling activity, creating what is often referred to as a "meme stock frenzy."

The origins of meme stocks can be traced back to early examples like GameStop (GME) and AMC Entertainment Holdings (AMC), which captured the public's imagination in early 2021. These companies, once considered struggling or outdated by traditional investors, saw their stock prices skyrocket as online communities rallied behind them, driven by a combination of nostalgia, rebellion against institutional investors, and a desire to challenge the status quo of Wall Street.

GameStop is widely regarded as the first meme stock, whose price rose as much as 100 times over several months as its meme community crafted a short squeeze.

Since the hype in 2021, meme stocks seemed to have died down until recently. Key players such as GameStop and AMC have seen their share price stabilise at a price much lower than its peak and the extreme volatility seen back then seems unlikely. For this reason, many people believed that meme stocks were dead. However, this isn’t the whole truth, though they have simply evolved.

Whilst, indeed, forums such as r/wallstreetbets on Reddit are not as influential as they once were, many retail investors are still turning to social media to inform their investment decisions.

Over the past couple of years, users have become more fragmented across different platforms as other social media sites such as Discord and X have become more involved in the investment space.

New websites have also emerged that enable users to monitor activity on social media without having to access the site.

Why GameStop may not see the same interest as it did in 2021

The return of "Roaring Kitty" to social media coincides with a surge in meme stocks as of May 13, 2024. This online personality, known for their unique stock analysis, has reignited memories of the 2021 meme stock frenzy. GameStop's market cap jumped by $4 billion on Monday, reflecting a similar pattern.

![]() Source: X

Source: X

However, there are key differences between now and then. Notably, GameStop's share price is significantly higher, trading around $30 compared to $5 in 2021. This suggests it might not be the same bargain opportunity.

Chart 1: Gamestop's price is trading at $52 (+75%) and +380% in the past month at press time (14/05/2024).

![]() Source: xStation

Source: xStation

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Chart 2: AMC gains almost 100%, GME +75% and SunPower 60%. Russell 2000 gains around 1%. Companies considered to be meme companies are growth leaders in the broad Russell 3000 index.

![]() Source: Bloomberg

Source: Bloomberg

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

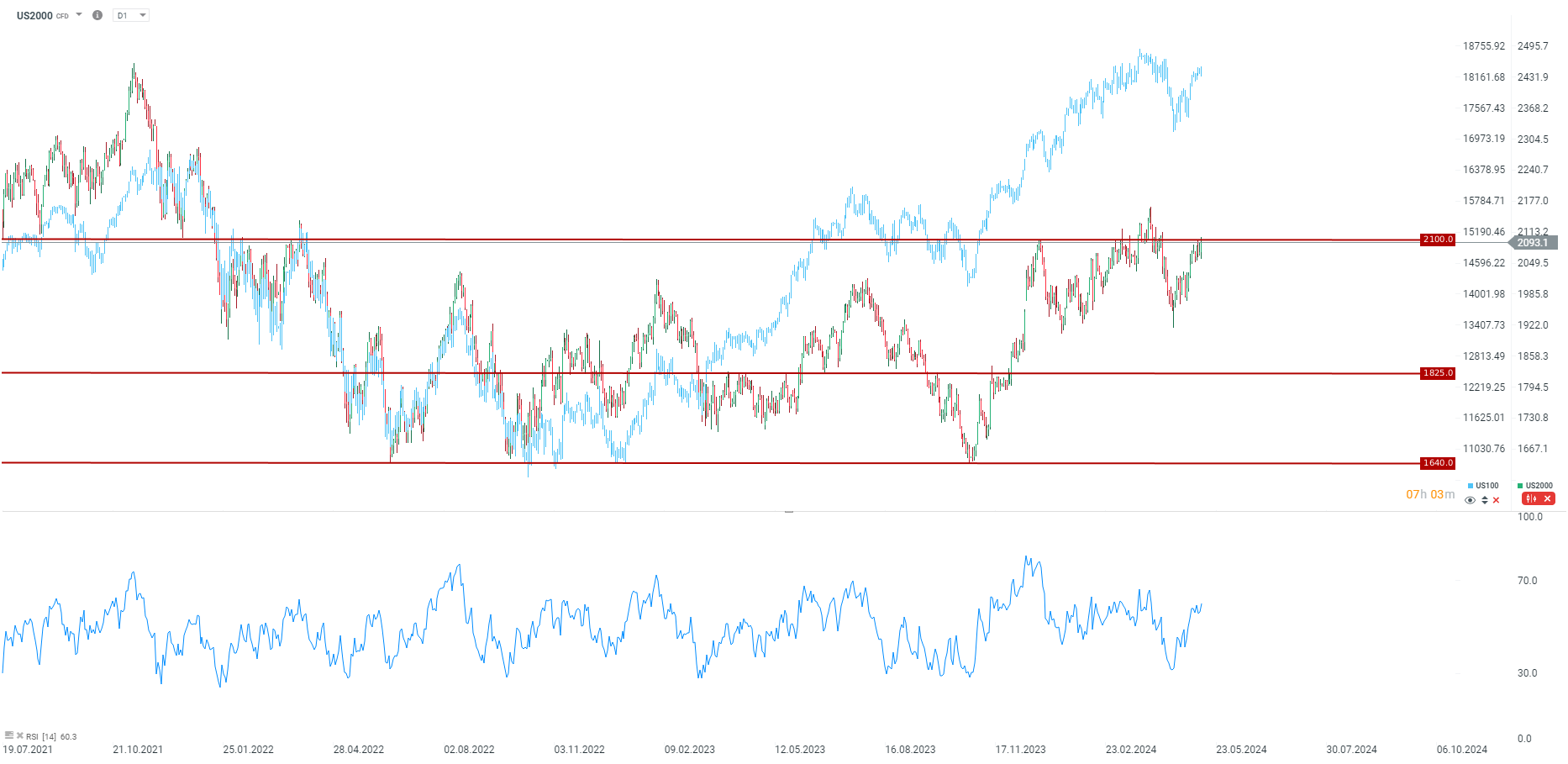

Chart 3: US2000 is trying to knock out recent local peaks, while it is more than 15% short of its historic highs. The situation on the US100 is completely different. The big difference in the indices is precisely the result of the overselling of smaller companies from the holiday season last year. Seasonality suggests that we may be behind a local low, with seasonal peaks likely in late May and then late July. Of course, further movements will depend largely on the health of companies and the outlook for monetary policy in the US, although of course the frenzied demand for meme stocks could lead to increased interest in smaller companies.

![]()

Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

This meme stock rally stands in contrast to the broader market. The S&P 500 is expected to open lower on Tuesday, and European indices show little movement as investors wait for Wednesday's US CPI data.

“Diamond hands” or “To the moon”?

Central to the meme stock phenomenon is the concept of "diamond hands" and "to the moon" mentality. Diamond hands refer to the unwavering resolve of investors who refuse to sell their shares, even in the face of intense volatility or pressure from market forces. Meanwhile, "to the moon" embodies the collective belief among meme stock enthusiasts that the stock price will continue to soar indefinitely, defying all logic and rationality.

Risk management

However, it's important to recognise the risks associated with meme stocks. While some investors have reaped substantial profits from investing in these companies at the right time, many others have suffered significant losses. The speculative nature of meme stocks means that they are susceptible to market manipulation, pump-and-dump schemes, and regulatory scrutiny. Furthermore, the euphoria surrounding meme stocks can quickly dissipate, leading to sharp declines in stock prices as quickly as they rose.

Despite these risks, meme stocks have undoubtedly left an indelible mark on the investment landscape, challenging traditional notions of market efficiency and investor behaviour. They have democratised investing in many ways, empowering retail investors to challenge institutional dominance and participate in market movements on their own terms. However, they have also underscored the need for investors to exercise caution, conduct thorough research, and understand the risks involved before diving into the world of meme stocks.

Final Thoughts

In conclusion, meme stocks represent a fascinating intersection of finance, technology, and social media. They have captured the imagination of millions, sparking heated debates about the nature of investing and the power of online communities to shape market dynamics. While they offer the potential for significant gains, they also come with inherent risks that investors must carefully consider. As meme stocks continue to evolve and capture headlines, one thing remains certain: they are here to stay, leaving an indelible imprint on the ever-changing landscape of finance. Please note, this article will be updated every few days to bring you the latest news and analysis.

PLEASE NOTE! Meme stocks typically see volatile price movements and as such are a higher risk investment. Meme stocks are not suitable for investors who have a low risk appetite and wish to invest over the long term.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.

Source: X

Source: X Source: xStation

Source: xStation  Source: Bloomberg

Source: Bloomberg