- A new report from XTB explores the current coffee market and the four key factors that could lead to future price rises.

- The price of coffee is currently trading at its highest level in almost 10 years.

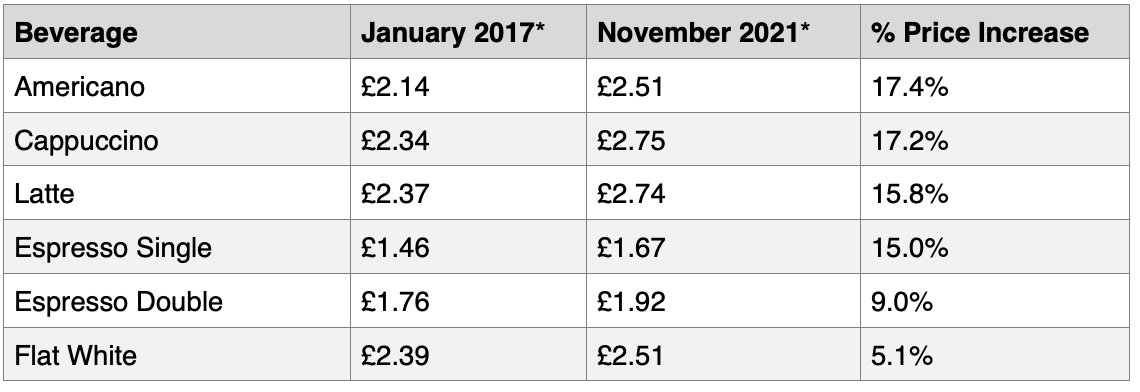

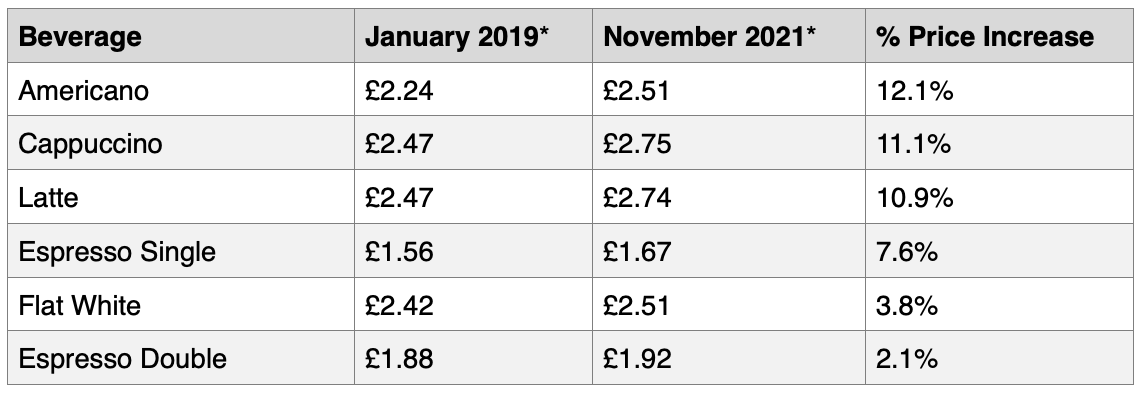

- The average price of an Americano, cappuccino, and latte have all increased by over 10% since January 2019, and over 15% since February 2017.

The cost of coffee has soared in recent months, with stock prices rising by nearly 100% YoY. This is the result of supply concerns and major transport problems around the world. But with prices now having reached their highest levels since 2012, will such huge changes affect consumers of the popular morning drink? And how much are we willing to pay for coffee?

How much will we pay for coffee?

The price of coffee is currently trading at its highest rate in almost 10 years. Depending on the region in the world, consumers could see a rise from 5-30% for specific types, methods of brewing coffee, or, above all, the cost of services in the current environment of rampant inflation. But what are prices currently looking like in the UK?

By analysing average drink prices from the most popular coffee chains in the UK1, the tables below show the percentage price increase between January 2017- and January 2019-November 2021, highlighting which drinks have experienced the greatest price hikes.

Looking at both tables, it’s evident that coffee prices have slowly been creeping up; the average price of an Americano, cappuccino, and latte in the UK’s leading chains have seen a rise of over 15% since January 2017 and 10% since January 2019. Despite costing an average of £2.51 in the UK, flat whites are experiencing the lowest increase in price, recording just a 5.1% jump since January 2017.

But what are the reasons for these price increases, and why is coffee trading at its highest levels for almost 10 years?

Weather anomalies

The weather is a key factor when it comes to coffee cultivation. Coffee must be grown in warm climates, on slopes where temperature fluctuations throughout the year aren’t significant. However, ongoing climate change is contributing to an increasing number of weather anomalies such as excessive rainfall, persistent droughts, or high temperature amplitudes.

Pandemic and a period of low prices

The pandemic has led to an unprecedented situation in which virtually the entire catering sector has come to a standstill. Arabica coffee is consumed mainly in restaurants and cafes, but the demand for this type of coffee has dropped dramatically. This has, naturally, translated into a decline in raw material prices, even to levels below 100 cents per pound, which, in turn, has led to farmers abandoning their coffee plantations to earn money with other crops (e.g. coca) or in other industries. Additionally, those who decided to stay had a problem harvesting due to the lack of workers.

Tight supply chains

The significant acceleration in economic activity following the first impact of the pandemic has strained global supply chains like never before. There was a shortage of containers in India, which impacted coffee and contributed to the upward pressure on sugar prices. In turn, in Brazil, the same ports are used for loading soybeans, sugar, and coffee. Increased demand for soy or sugar from other regions of the world has also led to increased delivery times - from the standard 30 days to over 100 days in the worst cases! In addition, the cost of transport itself has increased several times!

Demand and supply from the rest of the world

The return of demand in the catering sector has led to additional pressure on the limited supply. The trend of employees returning to offices is also visible, which will, once again, lead to an increase in orders from distributors. Supply constraints are not limited to Brazil, however; in Ethiopia, the threat of civil war contributed to supply problems, and prices in Cameroon continue to soar to all-time highs due to insufficient port shipments. The weather also has a strong impact on potential production in Vietnam and other Southeast Asian countries.

For more information, please see XTB's analysis on the price of coffee.

Methodology

To reveal the price increases of coffee over the last few years, data from UCC Coffee was utilised. This data highlighted the average costs of popular drinks, of different sizes, from the UK’s most popular coffee chains. The data was then compared, and a calculation was made to show the percentage price increase.

Source: UCC Coffee

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Is Gold Becoming the World's New Reserve Currency? | Gold Investing

The history and future of Natural Gas

The History of Gold Mining

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.