Uranium is one of the key energy resources on the planet and belongs to the so-called clean energy sources that do not leave a carbon footprint, which also perfectly fits the global pro-environmental trend among investors and institutions. The nuclear sector currently accounts for 11% of the world's electricity generation and 60% of clean energy respectively.

The recent big moves in the uranium market and the sentiment of the governments of the largest countries lead us to believe that this raw material may experience a true renaissance after more than a decade of bottoming out.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: XTB research

Meanwhile, conservative expert estimates say that humanity will double its demand for electricity by 2050. These estimates are very conservative, as statistics show that millenials, also called generation Y (born in the 1980s and 1990s) and generation Z (born between 1995 and 2010) spend on average even more than about 8 hours a day in front of smartphone and computer screens.

More and more processes will probably be automated in the future and, with the technological progress of humankind, the number of robots in use may also increase significantly.

All these factors suggest that humanity's electricity consumption will grow very fast, also due to the gradual distribution and absorption of technology in developing countries (Africa, certain South American countries and parts of Asia) where population growth is very dynamic. The inhabitants of these countries will eventually also start to benefit from advanced technologies, the internet, robots and industrial plants will become more and more automated.

An important element of speculation on the uranium market and one of its applications is also its use in the space sector as fuel to power various robots and machines capable of exploring the undiscovered surfaces of other planets. It is possible to install very efficient small reactors in such machines, which would provide them with energy for many years. Uranium seems to be in this range the base, irreplaceable and most efficient raw material, and using it in such machines potentially removes the external problems of energy consumption faced by robots currently used by NASA.

Source: XTB research

Source: XTB research

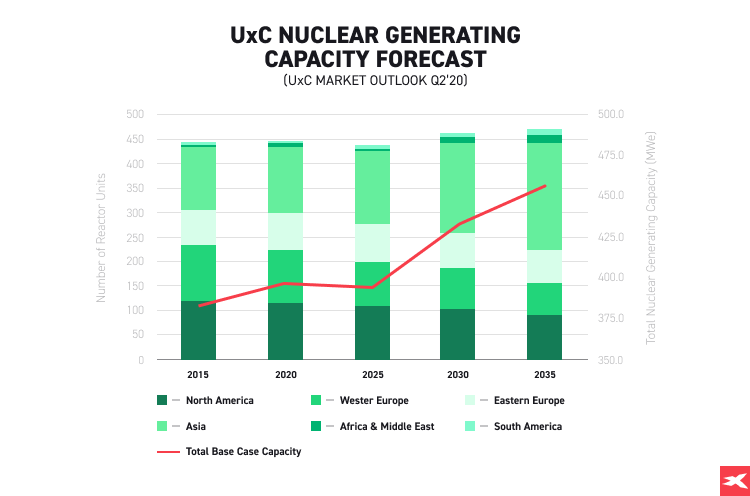

There are many reasons for the long-term future of uranium. There are over 50 new reactors currently in construction today, also in developing countries, with a growing demand for power. In the future, the number of reactors could even exceed 500.

Source: XTB research

Source: XTB research

Humanity, not wanting to abandon technological development, will eventually have to undergo an energy transition within the framework of ecology and adopt the most effective and safest energy solutions. Such solutions are provided by nuclear power plants, in which uranium is the main component of nuclear fuel.

Source: XTB research

Source: XTB research

A brief history of uranium mining and uranium bubbles

History

Uranium, as a natural oxide, has been used since at least 79 AD to dye glassware yellow. Such uranium glass with 1% uranium oxide was found near Naples, Italy.

Uranium glass fell out of favour in the late 1940s due to its association with war and nuclear weapons. There was also a growing concern over the health effects of “radioactive glass.” Currently, scientific studies have debunked this theory, concluding that uranium glass appears to have no harmful effects on human health.

Nowadays, uranium glass has collector's value, especially 19th century tableware, which may have as much as a 25% admixture of uranium.

The recognition of uranium as an element is credited only to chemist Martin Heinrich Klaproth. Klaproth also deliberately tinted glass with uranium, thereby starting a new fad for uranium glass as a household art item. In 1789 he announced the discovery of a new element and named it uranium, referring to the earlier discovery of the planet Uranus by the astronomer William Herschel. The isolation of uranium in its pure form by Eugène-Melchior Péligot in 1841 took place.

Source: XTB research

Source: XTB research

The most important discovery for the entire nuclear sector was the discovery of atomic fission. At first, scientists did not realise the importance of the discovery.

Austrian physicist Lise Meitner, working with Otto Hahn, understood the phenomenon. In the early 1930s, physicists discovered that if you bombard atoms with neutrons, radioactive decay occurs. The atoms release the neutrons and turn into slightly lighter elements. Meitner, Hahn and Fritz Strassmann started their own experiments in which they bombarded various elements with neutrons.

Meitner, together with Otto Frisch, proposed comparing an atom to a drop of water which, when hit by another drop, splits into two smaller drops. Together with Frisch they did the calculations and it turned out that a large uranium atom would split into two smaller ones: barium and krypton, release a few neutrons and, above all, a lot of energy. This was the first step towards understanding how nuclear fission works. An article on this subject was published in the journal Nature in 1939. Also Otto Hahn and Fritz Strassman are known as the discoverers of fission; the experiments were conducted in parallel.

This discovery is now considered a milestone in the nuclear sector. By using atomic fission, humankind gained access to the most powerful energy source we know.

Uranium market bubbles

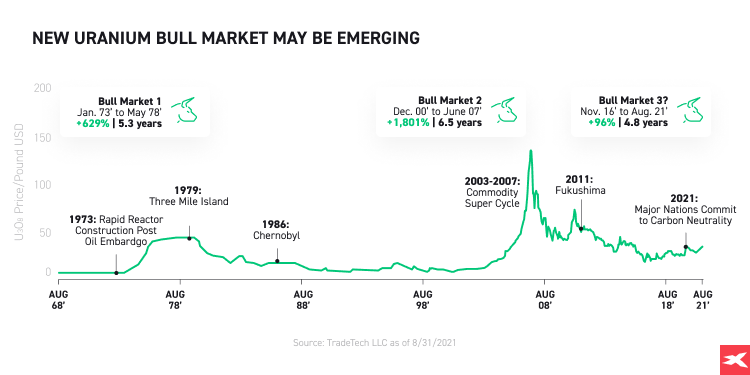

For almost a decade, uranium was not a fashionable commodity among investors, but since 2000 we have actually had two speculative bubbles on uranium, the largest of which occurred between 2005 and 2007. The subsequent rises in uranium were halted by the Fukushima power plant accident and global criticism of nuclear power.

The boom in uranium prices and mining companies between 2005 and 2007 was very dynamic. The immediate cause of the uranium bubble was the flooding of the Cigar Lake mine in Saskatchewan and the destruction of the Ranger mine by a cyclone, which caused a shortage of the resource and raised investor concerns about its supply. The Cigar Lake mine still contains the world's largest undeveloped deposit of high-grade uranium ore.

Other factors that sparked the previous bull market were the bold and extensive nuclear programmes of India and China, and the limitation of uranium resources available for use in armed conflict.

Growing demand, coupled with the nuclear market's excellent prospects and the scarcity of raw material, caused prices to soar. Investors became concerned about the supply of uranium, resulting in a demand shock.

The global crisis of 2007-2008 and the outflow of investors from risky investments contributed to the bursting of the uranium speculative bubble. After the market cleared up, the price of uranium seemed to be growing steadily again, with solid foundations behind it, and new mining companies began to emerge.

However, the end of the bull market and the failed uranium price rally in 2011 was mainly influenced by the unexpected accident at the Fukushima nuclear power plant, which interrupted the renewed uranium price rally. Since March 2011, the uranium price has fallen by almost half and has not been able to rise for 10 years. Investor sentiment around the uranium sector was very negative.

The failure of the reactors at the Fukushima plant was the most serious nuclear accident since the Chernobyl disaster. The cause of the accident was a massive earthquake off the coast of Honsiu, Japan. Thus, the cause was external and caused by natural forces.

The Fukushima accident did not cause any fatalities, except for two deaths linked to the incident by the World Health Organisation. Immediately after the Fukushima accident, the demand for uranium began to decline due to protests by environmentalists and a gradual shift away from uranium that started to take place.

It is worth noting that work in nuclear power plants is now considered among the safest in the world. Safety standards have been raised to sky-high levels since Fukushima and more serious accidents, especially core failures in nuclear power plants, no longer occur. Meanwhile, the labour market in mines and wind turbines costs the lives of many workers every year.

After the Fukushima disaster, Japan shut down all its reactors. The world lost one of its strategic customers for nuclear power. Japan began selling the remaining uranium in storage.

Meanwhile, mining companies and mines did not stop mining, hoping for a short-lived revolt by Japan. This also caused an excess of raw material on the market which further resulted in a drop in prices.

However, Japan remained sceptical of uranium and this has only started to change recently. Since 2016, nuclear power plants in Japan have been reopening and very slowly the demand is returning to levels seen before the collapse in 2011.

The mood towards nuclear power was dire after the Fukushima accident. Spain declared at the time that it would close all its reactors by 2020, Germany by 2022, and Belgium by 2024.

At the same time, the "Megatons to Megawatts" program, an agreement between the U.S. and Russia to purchase enriched uranium, was in operation. Russia, while removing some of its nuclear weapons, sold the remaining enriched uranium to the US.

After the bubble burst in 2011 and uranium prices collapsed, few of the several hundred mining companies survived. Those that have survived to this day have spent years building up their fundamental value and backbone, and are now returning to the favour of investors.

Looking at the historical chart of uranium prices, we can conclude that the commodity is in a cyclical boom and its price is rising exponentially in the face of favourable price drivers. Mercenary geologist Mickey Fulp came to a similar conclusion, as he emphasised that uranium is a boom and bust commodity, meaning that every decade or so the price rises and then falls. The chart below shows a summary of historical bubbles in the price of uranium.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: XTB research

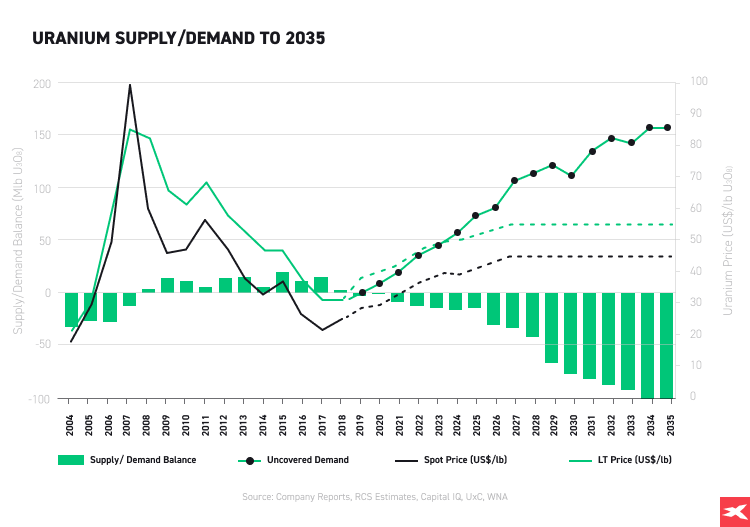

In 2021 the spot market saw the highest volumes since 1966 and cautious medium-term forecasts for uranium prices reached as high as USD 60 per ounce. Regular increases of several percent in the share prices of uranium mining companies and the appearance on the market of a new fund buying the uranium secured by physical deliveries at any price led to the uncovering of the 'real uranium price'.

This may have the potential to initiate a price rally of uranium on the spot market and the whole nuclear sector.

Source: XTB research

Source: XTB research

Benefits, use and the future of uranium

Pure uranium is a silvery-white metal with a high density. It’s also one of the hardest metals. It is malleable, ductile and an electrical conductor (specific resistance 28×10-8 Ω-m; 16 times greater than copper).

The main application of uranium is in the use of its isotope U235, which is a fissile material in nuclear reactors. These materials have found applications in nuclear power plants and in submarine propulsion.

The percentage of isotope U235 in natural uranium is 0.7%, which is too low for many applications. Uranium, therefore, requires processing to increase its isotope content in a process called enrichment.

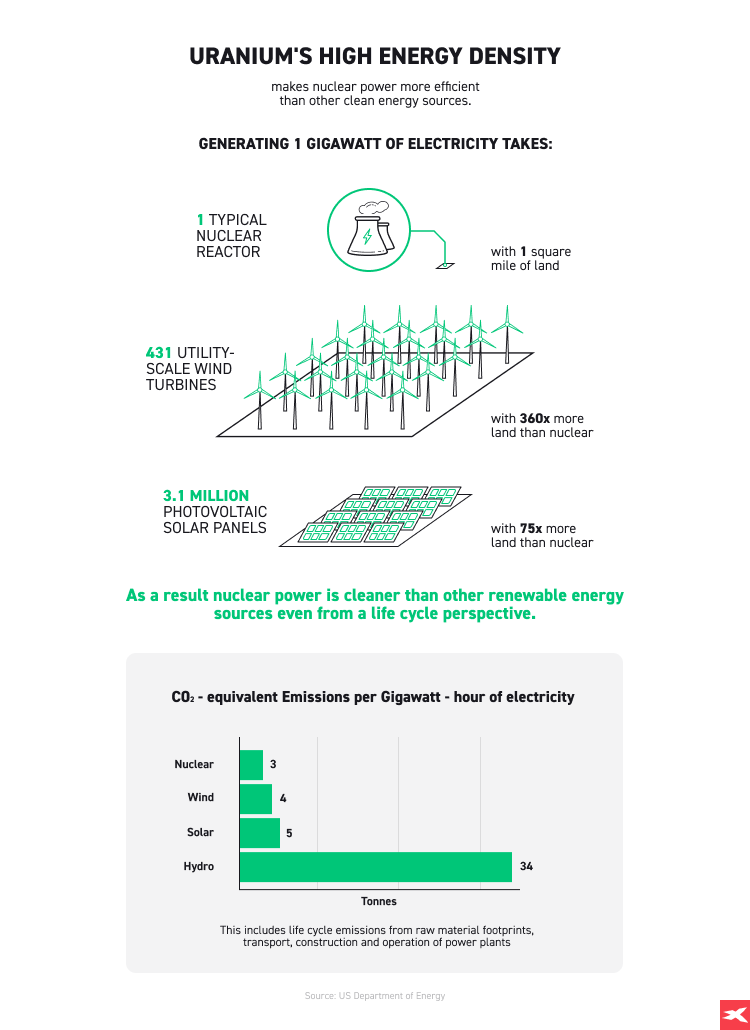

Because of its very high density and energy potential, uranium is the perfect “space” source of energy. 1 gram of uranium is as energetic as 1.5 tonnes of coal. It makes uranium the perfect high quality energy fuel for future spacecrafts and robots. At the moment, uranium is still known as the most condensed energy source used by humanity.

Other uses of uranium include:

- Uranium metal, because of its high mass number, is used as a shield in high energy X-ray generators.

- Uranium 238 as an isotope with a very long decay period (4,468×109 years) is used to determine the age of rocks.

- Uranium (practically depleted uranium) as a metal of very high density is used as a core for anti-tank sub-caliber missiles.

- Uranium is also used in photography and chemical analysis.

- Uranium is the main component of the majority of energetic and modern nuclear fuels (in combination with e.g. thorium or plutonium).

Source: XTB research

Source: XTB research

Spain has postponed its reactor shutdown to 2030, and similarly France, which was supposed to close 14 reactors in 2025, has moved it to 2035. Similar voices are being heard from Mexico, Russia and the USA.

It turns out that reactors with an assumed lifespan of 40 years can operate for as long as 60 years, and there is talk of extending the lifespan of some to 100 years. This may constitute a potential additional demand for uranium, which so far has not been included in any calculations and analyses.

Climate neutrality and clean energy dominate the development plans of both the European Union and the USA. It will be virtually impossible to achieve these goals with renewables alone. Renewable energy sources are also dependent on unstable external factors, such as weather conditions, sun and wind. Nuclear power plants, meanwhile, depend almost exclusively on the supply of uranium as the main fuel component.

Source: XTB research

Source: XTB research

According to analyses, renewables can also be unexpectedly inefficient, often generating only 30 or 40 percent of their expected output. In a world where demand for energy is growing exponentially and humanity is facing an energy and resource crisis, renewables are likely to prove insufficient and not effective enough even in the long term.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: XTB research

The Far East is also betting on nuclear power. By 2060, China plans to increase nuclear energy production by 382%. This means that almost 200 new nuclear reactors would have to be built. India and Korea are also interested in evolving their nuclear energy. China and India have a combined population of more than 2.5 billion, which means the demand potential in those markets is extremely high. The global demand for nuclear power and uranium stocks is growing rapidly.

Source: XTB research

Source: XTB research

Although uranium mining is a global activity, only a handful of companies account for the majority of production.

The top 10 uranium mining companies accounted for 85 % of global uranium production in 2020. The demand for uranium is global and comes from reactors around the world.

Top 10 countries for uranium consumption include:

USA - 93, France - 56 China - 50 Russia - 38, Japan - 33 S.Korea -24 India - 23 Canada -19, UK -15, Ukraine - 15 (numbers of operational reactors)

Source: Statista, May 2021

As countries around the world work towards decarbonisation, uranium's role in generating clean energy is set to grow.

The current market capitalization of the entire nuclear sector is less than $40 billion, still less than the combined capitalization of GME.US and AMC.US, still less than 1/20th of the market capitalization of TSLA.US shares.

This may indicate that the nuclear sector is still undervalued. Companies from the uranium sector and price of the commodity have strong upside potential and may attract more and more investors in the future.

There are a lot of rumours about fuel technology (using thorium and plutonium) and Small modular reactors (SMR).

In the US those reactors are completely legal and the US Advanced Reactor Demonstration Program was expected to help licence and build two prototype SMRs during the 2020s, with up to $4 billion of government funding. Also, China declared its interest in this technology and even built the first ever SMR in July 2021.

Such reactors also save the time needed to build one large reactor. The positive reception of this technology by the U.S. and Chinese government could signal a growing demand for SMRs in the coming years.

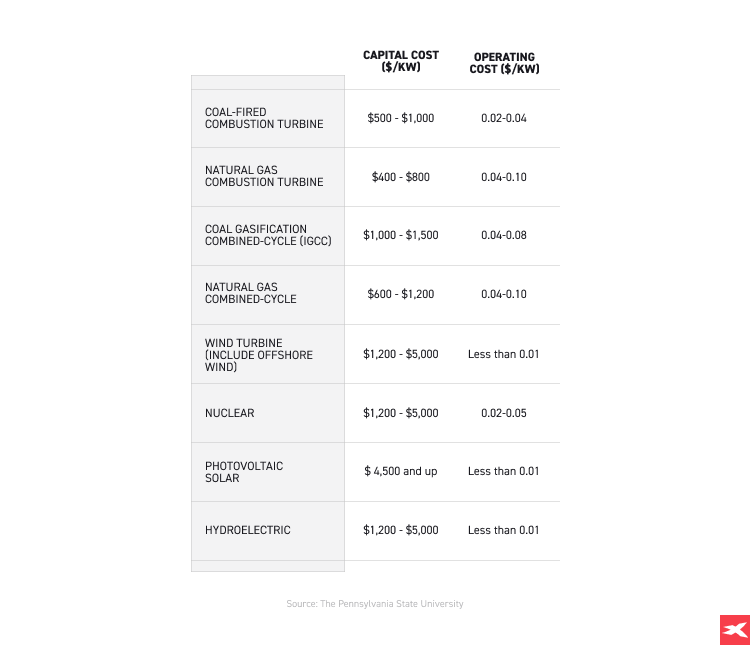

Nuclear technology is also low cost compared to other energy sources. The biggest cost is the construction of a nuclear power plant. There is also the issue of finding a qualified workforce of engineers and specialised physicists, which can be a potential problem when distributing nuclear technology worldwide to less developed countries.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: XTB research

Physical uranium resources on land are sufficient for humanity for about 300 years at the current demand. Currently, there are a growing number of mining uranium projects because uranium deposits are important for the long-term energy future of our planet.

However, scientists report that the uranium available in seawater is fully renewable and there are massive amounts in the oceans. All that remains is to patent the technology to do so.

It is possible that this time the zero carbon footprint policy will bring nuclear power back into favour and eventually make it the number one energy source on the planet.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: XTB research

How to invest in uranium stocks

You have the choice to trade or invest in uranium stocks. There are several differences between these methods. Of course, you can also do both at the same time.

Investing

Investing in uranium is possible through the purchase of shares of nuclear sector companies. Stocks like Kazatomprom (KAZ.UK) or Cameco (CCJ.US) are well known and also sometimes pay dividends.

Big uranium companies stocks like Kazatomprom or Cameco still give good opportunities and prospects for investors who avoid high risk and high volatility in the market. At the same time, prices of these companies can be also volatile, but less volatile than shares of smaller mining companies like NexGen (NXE.US) or Uranium Energy Corp (UEC.US).

Please note that XTB UK only offers trading CFD uranium stocks and not investing in stocks.

Trading

Trading uranium ETF CFDs is speculative and relies predominantly on price action.

The CFD type of uranium ETFs investment is a financial contract that you trade to earn the price difference between your open and closed positions. It’s also a good option for traders who like high risk ventures and dynamic trading.

You can trade uranium ETF CFDs (contract on price differences) and use financial leverage. Thanks to leverage trading, ETFs like Global Uranium X (URA.US) or North Shore Global Uranium (URNM.US) require only a certain percentage of the whole position. For example, using 1:5 leverage gives you the opportunity to open a 5000 USD contract by using only a 1000 USD margin. Thanks to CFD trading day traders can earn money even when uranium stocks fall down - by opening short positions.

Please note that this kind of speculation can be extremely dangerous and volatile because of the uranium ETFs market price action. Uranium ETF CFD trading gives traders an opportunity to maximise their profit faster even when price action is not very big, but losses can be also much bigger because of the use of leverage.

Trading uranium stocks online

There is no way to simply purchase a physical supply of uranium. The storage of uranium is also an additional, big challenge for investors. There is still low liquidity on the uranium spot price market, so right now it’s very hard to trade only on uranium spot price.

Therefore, in order to make money on the movement of the uranium market, the most optimal solution for individual investors and institutions is investing in companies from the uranium mining sector.

Online trading is also the easiest, has the most favourable charges conditions and allows you to customise your personal investment strategy by choosing CFDs on uranium ETFs or shares of uranium companies.

Online uranium investing and trading gives you exposure to the growth energy sector with great perspectives without leaving your home.

Uranium Stocks and ETF CFDs

Kazatomprom (KAZ.UK)

Kazatomprom is currently the largest uranium producer in the world, in 2020 it accounted for 23% of the raw material production. Kazatomprom mines uranium using ISR (In-Situ Recovery Mining) technology with health and safety and environmental standards (ISO 450001 and 14001 certificates).

The company has its headquarters in Nur Sultan, from where it operates and sells uranium and uranium-containing products.

Using ISR technology, mining is done without blasting and without sending miners underground to bring uranium ore to the surface. The solution, containing the dissolved uranium, is brought back to the surface through "production wells". This solution is processed after mining to the surface.

The exploitation of uranium deposits with the ISR method is the most efficient and has no negative impact on the surface; there is no subsidence or ground disturbance and there is no surface storage of low-grade ores. This is also the cheapest method.

The main processing steps for uranium extraction take place deep underground (hence the term "in-situ"), resulting in lower production costs and inherently higher levels of health and safety due to very low mining risks. Once the resources are exhausted and the mining operations are completed, remote areas of the Kazatomprom mine are restored to their pre-mining condition, both above and below ground.

Kazatomprom has a total of 24 deposit areas, all located in Kazakhstan.

ISR uranium mining was first used in the 1960s, and by 2017, its use provided more than 50% of global uranium production. However, the ISR mining method can only be used in particularly favourable geological conditions.

All Kazatomprom production is done through ISR mining. Eight of the ten largest ISR mines in the world are operated by Kazatomprom, giving the company a strategic position in the market.

The processing, reconversion and production of fuel pellets for light-water nuclear reactors is another major industry in which Kazatomprom operates. China General Nuclear Power Corporation (CGNPC) and Kazatomprom are implementing a project to build a fuel assembly plant to meet China's future demand for finished nuclear fuel assemblies.

China periodically establishes new agreements with the Kazakh company and appears to be its potential permanent customer, also due to its geopolitical position.

Kazatomprom is also indirectly involved in the production of certain rare metals, making the company one of the world's largest producers of tantalum, niobium and beryllium. As one of only three such enterprises in the world, the plant has a fully integrated beryllium production cycle and the only tantalum plant in the Commonwealth of Independent States.

Metallurgical Plant "Ulba" currently ranks second in the world in the production of beryllium products and fourth in the production of tantalum products.

Kazatom also conducts scientific and research in the geological, chemical and physical sector.

Cameco (CCJ.US)

Cameco Corporation is also one of the world's largest publicly traded uranium companies. The company is based in Saskatoon, Canada. In 2015, it was the second largest uranium producer in the world, accounting for 18% of global production. The company was fully privatised in 2002. Currently, one in 10 households is powered by energy supplied by Cameco.

In 1996, Cameco acquired Power Resources Inc, the largest uranium producer in the United States. It then acquired Canadian companies Uranerz Exploration and Mining Limited and Uranerz U.S.A., Inc. in 1998.

Source: XTB research

Source: XTB research

In 2016, Cameco suspended operations at its Rabbit Lake mine due to low uranium prices. In 2017, Cameco suspended operations for at least 10 months at its McArthur River mine and Key Lake mill. If demand increases, Cameco has massive reserves of physical uranium and mines that it can open and resume mining.

Cameco operates two very large uranium mines in Canada: the McArthur River-Key Lake mine and Cigar Lake, a massive mine with access to top grade uranium deposits, and in Kazakhstan, the Inkai mine.

In the United States, Cameco operates uranium mines in the states of Nebraska and Wyoming through its U.S. subsidiary Cameco Resources.

Cameco is also the sole fuel supplier to Bruce Power, which provides 30% of Ontario's electricity through its nuclear power plant.

Uranium Energy Corp (UEC) is a U.S. mining company with a set of government licences and permits to mine its deposits in the western and central U.S. Potentially, the company - as one of the few U.S. nuclear companies with a clean licence situation - could enjoy strong demand from the U.S. nuclear sector in the future.

Uranium Energy Corp (UEC: NYSE American) is a U.S.-based uranium mining and exploration company. In South Texas, the Company's hub-and-spoke operations are anchored by the fully-licensed Hobson Processing Facility which is central to the Palangana, Burke Hollow and Goliad ISR projects. In Wyoming, UEC controls the Reno Creek project, which is the largest permitted, pre-construction ISR uranium project in the U.S.

Additionally, the Company controls a pipeline of uranium projects in Arizona, New Mexico and Paraguay, a uranium/vanadium project in Colorado and one of the highest-grade and largest undeveloped Ferro-Titanium deposits in the world, located in Paraguay. The Company's operations are managed by professionals with a recognized profile for excellence in their industry, a profile based on many decades of hands-on experience in the key facets of uranium exploration, development and mining.

NexGen Energy (NGX.US) is a Canada-based corporation with a focus on the acquisition, exploration and development of Canadian uranium projects. NexGen has the most significant position in the southwestern Athabasca Basin in the Canadian state of Saskatchewan, where it holds 199,576 hectares.

This portfolio is considered to be one of the most prospective known uranium areas given the mineralization discovered to date in the southwest along the Patterson corridor where the Arrow deposit is located. Through its subsidiary IsoEnergy Ltd, NexGen also holds a portfolio of highly prospective uranium prospects in the eastern Athabasca Basin. The Company does not currently have any large-scale uranium mining operations.

Stocks BHP Billiton (BHP.US) and Rio Tinto (RIO.UK) also give investors partial exposure to uranium. Those are powerful companies in the resources sector, but uranium mining and distribution is only a small part of their investment portfolio.

Uranium ETFs CFD

Global Uranium X (URA.US) provides investors access to a broad range of companies involved in uranium mining and the production of nuclear components, including those in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries. In the investment portfolio of this ETF are, of course, Kazatomprom and Cameco, as well as smaller uranium stocks like Denison Mines, NexGen Energy, Uranium Energy Corp, Paladin Energy and Energy Fuels.

NorthShore Global (URNM.US) acquisition of the fund by Sprott Investment was announced in early November 2021. Sprott is in the process of obtaining an exclusive licence to use the North Shore Global Uranium Mining Index (the "Index"), the performance of which is tracked by the North Shore Global Uranium Mining ETF.

Ultimately, the fund is expected to become the Sprott Uranium Miners ETF - which will be advised by Sprott Asset Management. The fund reorganisation is estimated to close in the first quarter of next year.

"We believe we are in the early stages of a bull market in uranium, and URNM is an excellent complement to the Sprott Physical Uranium Trust ("SPUT"), which is the world's largest physical uranium fund" - In the words of John Ciampaglia, CEO of Sprott Asset Management. "URNM is the only pure-play uranium equities ETF listed in the U.S. and we are pleased to provide investors with two attractive options for investing in this sector" Ciampaglia added.

The fund's portfolio currently also includes Kazatomprom and Cameco, but also SPROTT PHYSICAL URANIUM TRUST, Yellow Cake PLC and smaller uranium companies such as CGN Mining Corp. In the future investors are waiting for Sprott’s reorganisation of this ETF.

VanEck Vectors Uranium Mining + Nuclear energy (NLR.US).

- This fund seeks to replicate as closely as possible, before fees and expenses, the price and earnings performance of the MVIS®Global Uranium & Nuclear Energy Index (MVNLRTR).

- This index seeks to track the overall performance of companies involved in:

- uranium mining or uranium mining projects that MV Index Solutions GmbH (the provider of this index) believes have potential

- construction, engineering and maintenance of nuclear power facilities and nuclear reactors

- production of electricity from nuclear sources and supply of equipment

- supply of technology for nuclear power services

The VanEck ETF therefore has exposure to the nuclear sector, not just uranium mining companies.

The fund's portfolio includes companies such as Exelon Corp, Duke Energy, Dominion Energy, Cameco or Electricite de France.

The best time to start investing in uranium stocks

Over the past few years, it has actually been hard to find a commodity in the market that hasn't hit its ATH or at least come close to its former price highs. We had a boom in aluminium, copper, building materials, steel and other raw materials. But it turns out that uranium with its current spot price at around $50 is still almost three times cheaper than it was at the peak of the 2007 bull market.

However, taking into account inflation and the $140/150 levels at that time, it turns out that today the sentiment around uranium is still negative, despite significant increases in the price of the commodity of almost 70% since August this year. Uranium is a commodity that is required for use in nuclear reactors that use nuclear energy - so there will be demand for it as long as nuclear power plants are in operation. Meanwhile, there are currently plans to build at least several hundred around the world. This could result in growing demand for the resource.

Nuclear energy is currently the most efficient energy source known to humankind; uranium-powered plants can operate 24/7 regardless of wind, time of day or night. In addition, this uranium and the technology surrounding the nuclear sector is very important in the context of human expansion into space, which may give it speculative potential for price increases.

The energy for humanity must be constantly supplied, given the robotization, automation of production on a large scale and the growing market for cars and electric vehicles, the demand for electricity is likely to grow as usual faster than conservative assumptions and expert forecasts.

Such a huge discount and negative sentiment around uranium could not have continued had it not been for three accidents: Three Mile Island, Chernobyl and Fukushima. These disasters contributed to the dormant price of the commodity and the demand for uranium, although the market was definitely not asleep during those decades.

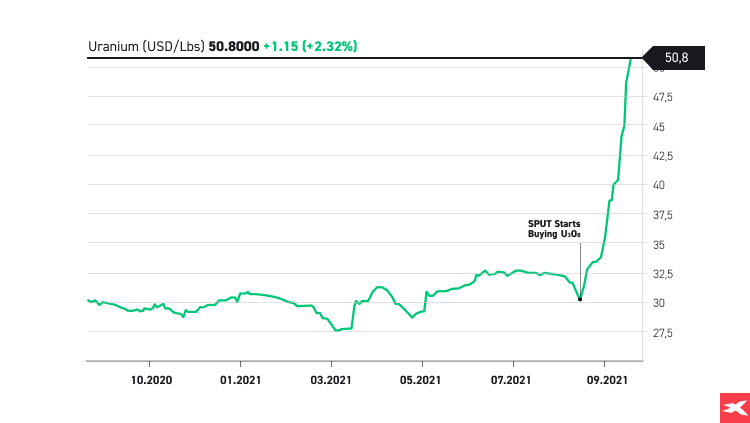

This year's “salvation” for the uranium market was the Canadian Sprott Physical Uranium Trust SPUT, owned by Eric Sprott, a Canadian billionaire with investments in commodities, precious metals and mining companies.

The market moves of the fund, which began buying uranium backed by physical deliveries at any price and in any quantity while accepting any spot price, in a way “revealed’ the actual price of the raw material.

By that time, although the spot price of uranium was hovering around $25 per pound, transactions were regularly occurring at prices as high as $80, at which prices some power plants agreed to buy uranium from mining companies. It is estimated that at price levels of $60 per pound, uranium mining becomes profitable for most uranium miners.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: XTB research

Commodity industry insiders have decided not to ignore reports that the spot price of uranium differs from the actual price at which transactions take place and Sprott has decided to buy uranium backed by physical deliveries for fear of ever higher commodity prices in the future. Thus, paradoxically, the fund that decided to enter the market at a price bottom for fear of higher and higher commodity prices in the future began to increase the price of uranium by buying it out of the market; the fund continues to accumulate uranium and this looks like a strategic move on the part of Sprott's investors.

If miners resume mining and the volume of uranium sales to power plants, as well as the demand for uranium, increases significantly, then investors can expect another bull market in uranium.

Kazakh giant Kazatomprom has also initiated similar actions to the Sprott Physical Uranium Trust.

Kazatomprom bought a 48.5 percent stake in a $50 million investment to purchase physical uranium from Astana-based ANU Energy OEIC Ltd. The other members of the fund structure are: 48.5 % National Investment Corporation of the National Bank of Kazakhstan and 3 % fund manager Genchi Global Limited.

According to information from Kazatomprom’s homepage, the fund is expected to raise $500 million to purchase physical uranium from institutional and private parties. The $500 million raised will fund further purchases of physical uranium supplies.

“The Fund will leverage Kazatomprom's combination of uranium market expertise and NIC's proven track record, with the AIFC (Astana International Financial Center) offering investors direct exposure to the attractive opportunity presented by the long-term fundamentals of the uranium market and nuclear industry," Sharipov also added that " The creation of ANU Energy OEIC Ltd. is a project that has been in development for almost four years as part of Kazatomprom's broader fundamentals-focused strategy; the Fund will operate in an environment of declining commodity supply benefiting investors.” - Mazhit Sharipov, Kazatomprom CEO

“ANU Energy being developed through AIFC in Kazakhstan will be the first uranium fund to provide potential direct access to investors from emerging markets of various categories particularly those focused on clean energy investments as well as commodity funds and sovereign wealth funds,” Kazatomprom added.

The current time seems to be very strategic for the entire nuclear market.

Add to this the global energy crisis caused by the shortage of raw materials, supply chain problems or very high prices of energy raw materials, and the market of uranium companies may benefit from it. The attitude of large investors in the nuclear sector, including state institutions, also looks optimistic.

Uranium stocks trading hours

What about trading hours for uranium stocks? This information is especially important for day traders. Trading of uranium shares is available during the week from 15:30 CET to 22:30 CET for the US exchange or from 9:00 to 17:30 for the London exchange from Monday to Friday, but it depends on which exchange the company is listed on.

Trading uranium stocks is not possible during weekends because the market is closed. When the market is open, prices of stocks companies and ETFs are of course constantly fluctuating during trading hours.

Of course the best time for uranium companies trading is during periods of very high liquidity, when market volatility is higher. When there are high trading volumes in the market, volatility increases. This situation is a big opportunity not only for investors, but also for day traders, who are using leverage to take large profits even on short positions.

High volatility could be influenced by publishing important political or company news or financial results. Uranium mining companies' stocks are sometimes extremely volatile and price action during one trading day can be even bigger than 10%.

Emissions Trading - How to Invest in Carbon CO2?

Is Gold Becoming the World's New Reserve Currency? | Gold Investing

Brent Crude Oil: The mesmerising world of this black gold bonanza!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.