Whether you follow the news daily or only catch up on major stories at the end of a busy week, no one can deny that large-scale brands are under constant scrutiny by news outlets and social media audiences.

With the world watching every move they make; careful steps and considerations need to be made to avoid potential catastrophe that could see shares plummet.

Of course, no matter how many precautions are taken, sometimes, bad press is unavoidable. More often than not, it’s a poorly phrased sentence on a social media campaign or something completely outside of their control that sinks a brand’s stock.

Regardless, the only solution left for any brand once the flak starts flying is to enter damage control mode and try to mitigate the effects as much as possible. But like it or not, the stocks of any brand taking negative press are liable to drop in the following days and weeks.

But it’s not all bad news. On other occasions, good press can send a brand’s market share into the stratosphere.

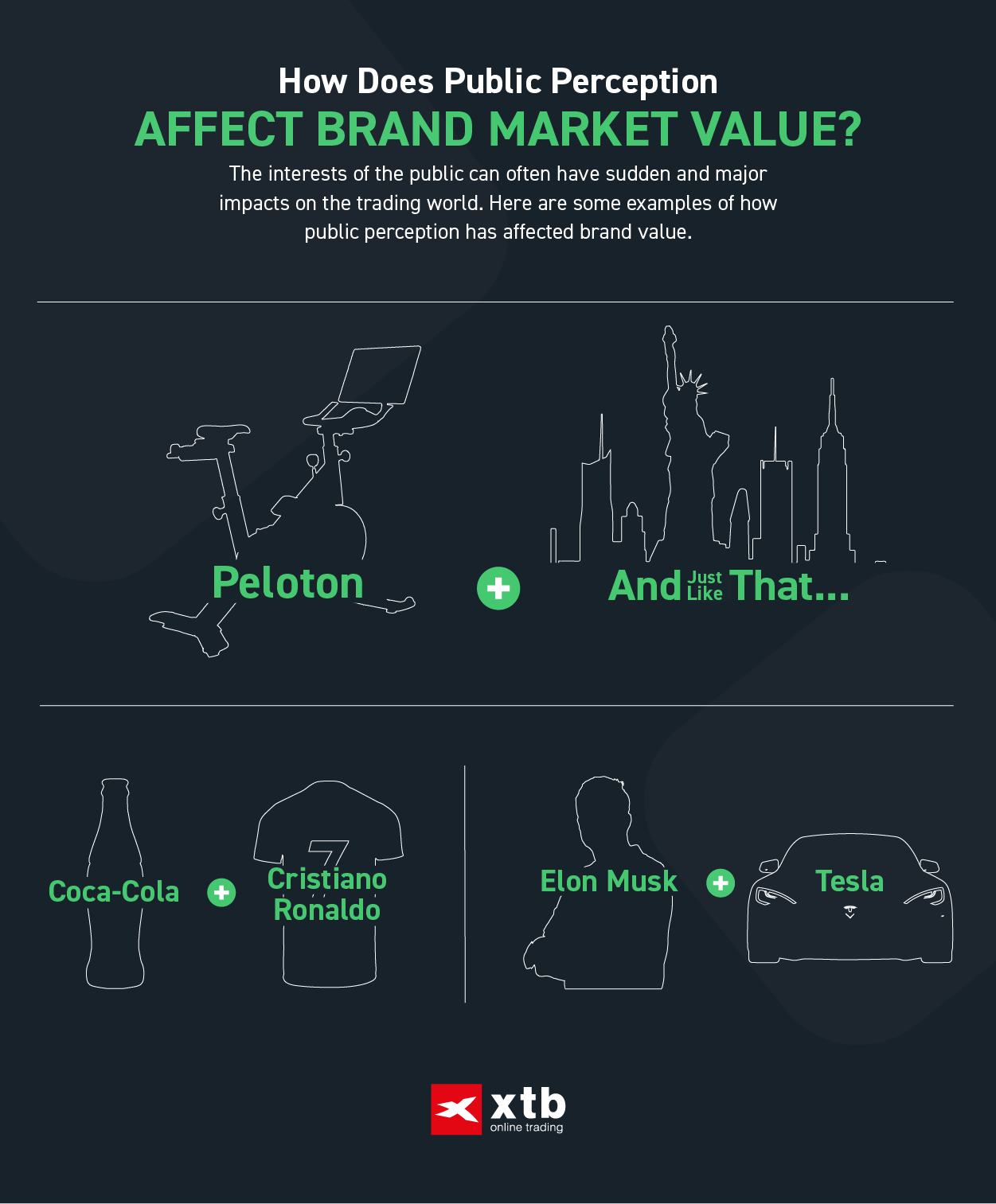

To see just how much public perception can impact the trading value of a brand, we’ve pulled together five examples of how a shift in public image has affected various brands’ stocks in both positive and negative ways. We’ll also touch on how you can integrate this knowledge into your trading strategy.

Cristiano Ronaldo and Coca-Cola

If you follow big sporting events, chances are, you saw this one coming. Cristiano Ronaldo’s simple and unassuming removal of two Coca-Cola bottles during his Euro 2020 news conference might have seemed irrelevant at the time, but that was before Coca-Cola saw a stunning $4 billion drop in their market value.

To put that into greater context, that $4 billion loss in shares was the equivalent of 2% of Coca-Cola’s market value at the time. All gone thanks to the removal of a bottle by someone famous.

This is a classic example of a share drop that was entirely out of Coca-Cola’s hands. There’s not a lot they could do about Ronaldo not wanting a Coke, but it shows just how much of an impact popular, famous individuals can have on the public’s brand preferences with a single action.

That being said, Coca-Cola’s shares have already recovered, and most people have forgotten about the incident. Thus, the lesson to take away from this case is that, while sudden share drops can occur, if it’s a large and well-known brand, there’s no reason they won’t recover quickly.

Peloton’s ‘And Just Like That…’

In a more unusual case of public perception impacting brand shares, you may have heard of the ‘And Just Like That…’ episode that crippled Peloton’s market value. In the show, the character known as Mr Big, played by Chris North, suffers a heart attack and dies after his 1,000th workout.

As a comedy-drama, this shouldn’t be too shocking for any brand, except for the fact that Mr Big died after using a Peloton bike.

Unable to do anything about it, and probably not expecting a fictional event to have much of an impact on their shares, Peloton shareholders were likely shocked when the brand’s stock fell by a disastrous 11.3% on the day the show aired.

This put their stocks at the lowest level in 19 months, and they slid by a further 5% on the next day on mid-morning trading.

Peloton has yet to recover from this frankly massive impact, in spite of creating a parody ad with Ryan Reynolds’ company, Maximum Effort, in an attempt to capitalise on the crash in a positive way.

Brands that are heavily in the public eye due to TV and film always run the risk of receiving negative feedback, thanks to the way their products could be used, so always be careful if you’re looking to invest in brands that favour product placement.

Elon Musk and Tesla

It’s not just campaigns and social posts that brands have to be careful with. If a brand’s CEO is particularly prevalent in the public eye, anything they say and do can have a major impact on shares.

Elon Musk is perhaps one of the most well-known CEO’s out there, and he managed to debilitate Tesla’s shares on November 8th, 2021, with nothing more than a Twitter poll.

Possibly aimed as a casual joke, Musk put up a poll asking Twitter users if he should sell a tenth of his holdings in the electric-car marker in order to pay tax. When users voted in favour of the sale, Tesla’s shares fell by 4.9% in response.

This isn’t the only occasion where Musk’s Tweets have landed Tesla in hot water. Back on May 1st, 2020, Tesla lost $13 billion from its market value, due to Musk tweeting “Tesla stock price is too high imo”. By Friday, Tesla had lost 10.3% of its shares due to a single tweet.

You should always be careful when investing in brands with well-known CEOs. As shown here, even a casual tweet can have a massive impact on shares and lead to unforeseen losses.

Elon Musk and Crypto

Being as prominent as he is, it’s little surprise that Musk has impacted more shares than just his own. Throughout 2021 and into 2022, Musk has made a variety of tweets relating to cryptocurrency that have had major impacts on the crypto community as a whole.

One of the most infamous of these examples occurred on January 14th, 2022, when Dogecoin soared upwards by 15% after Musk joked “Tesla merch buyable with Dogecoin”.

Musk is arguably the reason Dogecoin took off to begin with. The currency initially started out as a joke before Musk tweeted about it on February 4th, 2021, skyrocketing its price by 50%.

This helps to show the positive side of a public-facing CEO having a positive impact on shares. But as we previously mentioned, investing in these individual’s brands, or brands associated with them, still comes with a healthy dose of risk.

Brexit

It might have fallen under the radar since the recent pandemic, but for a long time, the uncertainty around Brexit was having a major impact on world markets.

For example, prior to the Brexit referendum, Pound Sterling was trading at above $1.50. Afterwards, in June 2016, it slumped to a 31-year low.

Brexit has also had a big impact on businesses using the UK as their home trading base. According to a report from New Financial in April 2021, over 440 financial service firms have moved or are planning to move from the UK, in part due to the effect of Brexit.

Of course, the slump has not continued, and Sterling saw an increase back in December 2020 as conversation turned towards hope of a Brexit trade deal.

Major continental and global events, especially monumental ones such as Brexit, will always have an impact on shares, so be aware of shifts when trading potentially-affected stock.

It's clear that public perception can have a major impact on trading, even from the smallest of movements and words. But you shouldn’t be so quick to jump ship if a sudden drop occurs. Many of these publicly influenced dips tend to recover quickly, and unless you’re extremely unlucky, your trading likely won’t be affected. Instead, it’s the major events that you want to look out for when deciding to adjust your trading strategy.

Of course, one way to keep on top of trading news is by keeping up with XTB’s market news and market analysis. We’ve got our eye on the market at all times so you can trade with confidence. And for more tips and advice on how to trade effectively, we have many articles in our Knowledge Base and the XTB trading academy that can help you get the most out of your trading strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Understanding ISAs: A Tax-Efficient Way to Save and Invest

Choosing the Right ISA for You

Maximising Your ISA Contributions

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.