The pound to euro exchange rate has remained volatile in 2024, with the pound rising in value against the EUR for much of the year compared to the end of 2023. The GBP/EUR rate has often threatened to break out to its highest levels since August 2022. However, recent shifts in expectations suggest potential weakness for the pound, following the belief that UK interest rates have likely peaked and could be reduced by at least two times in 2024.

Looking ahead to 2025, the pound's performance against the euro will be influenced by several key factors, including economic growth projections, inflation rates, and future UK monetary policy decisions. If interest rate cuts materialize as expected, this could lead to further downward pressure on the pound, while any economic recovery or growth in the UK could provide support for the GBP. Analysts also suggest that ongoing political and economic uncertainties may continue to play a significant role in currency fluctuations.

For 2025, it is anticipated that the pound may continue to face challenges, but there is also the possibility of periodic gains should the UK's economic performance outperform expectations or if the European Union faces its own set of challenges. As always, exchange rate forecasts remain subject to change based on evolving economic conditions.

Stay updated with our live blog tracking key changes in the pound-to-euro rate and the latest analyst forecasts.

The pound to euro exchange rate has remained volatile in 2024, with the pound rising in value against the EUR for much of the year compared to the end of 2023. The GBP/EUR rate has often threatened to break out to its highest levels since August 2022. However, recent shifts in expectations suggest potential weakness for the pound, following the belief that UK interest rates have likely peaked and could be reduced by at least two times in 2024.

Looking ahead to 2025, the pound's performance against the euro will be influenced by several key factors, including economic growth projections, inflation rates, and future UK monetary policy decisions. If interest rate cuts materialize as expected, this could lead to further downward pressure on the pound, while any economic recovery or growth in the UK could provide support for the GBP. Analysts also suggest that ongoing political and economic uncertainties may continue to play a significant role in currency fluctuations.

For 2025, it is anticipated that the pound may continue to face challenges, but there is also the possibility of periodic gains should the UK's economic performance outperform expectations or if the European Union faces its own set of challenges. As always, exchange rate forecasts remain subject to change based on evolving economic conditions.

Stay updated with our live blog tracking key changes in the pound-to-euro rate and the latest analyst forecasts.

What could happen to the GBP/EUR exchange rate next and what are the key factors affecting the GBP and EUR? In this article we discuss the key themes influencing current prices and what we might forecast could happen to GBP/EUR prices in the coming months alongside key comments from XTB analysts, global economists and investment banks.

2025 Updates

14 January 2025: How is EUR/GBP performing so far?

EUR/GBP has had a strong start to 2025 and has surged in recent days as the pound has weakened sharply. The pound is the weakest performer in the G10 FX space so far in 2025, and sterling is down 3% vs. the USD. Although the euro is also lower vs. the USD, the pound’s excessive weakness has allowed the single currency to recover vs. the pound.

Right now, it is not clear when the pound will recover. All attempts at recovery have been short lived, and the pound continues to weaken along side UK bonds. UK bonds have sold off sharply as fears grow about the UK’s inflation and growth outlook along with concerns about the UK’s public finances. Until these concerns have been addressed, and until UK bond yields have stabilized, it is hard to see a meaningful recovery in the pound vs. the euro.

The chart below shows the 10-year interest rate spread between Germany and the UK along with EUR/GBP. UK yields are rising at a much faster pace than German yields, as you can see. However, the yield advantage is not benefitting the pound, as bond yields are rising due to a growing premium on UK debt due to concerns over the sustainability of public finances. This is fueling gains in EUR/GBP.

Chart 1: EURGBP and German 10-year yields – UK 10-year yields.

Source: XTB and Bloomberg, Past performance is not a reliable indicator of future results.

There are some key tests for the pound in the coming weeks, including growth and inflation data, government debt auctions and the public sector finance data. If bond yields continue to rise, then the pound may struggle to recover.

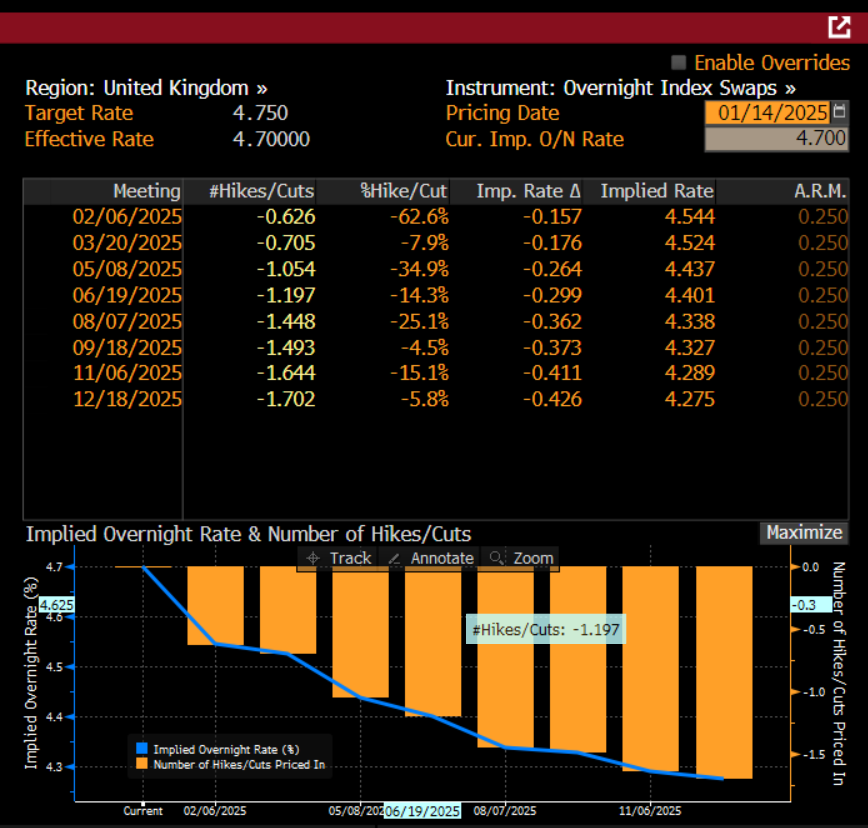

In the longer term, any recovery in the pound could be capped. One way to ease pressure on the UK bond market would be for the Bank of England to signal that it will cut interest rates at a faster pace in the future. So far, the BOE has been reluctant to do this due to inflation risks, however, if growth starts to falter then the prospect of a faster pace of rate cuts could become reality. Right now, there is just one full rate cut priced in by the BOE, as you can see below. However, with confidence levels rapidly declining for businesses, consumers and now financial markets, this increases the risk that the BOE will need to take more action.

Chart 2: UK market-based interest rate expectations

Source: XTB and Bloomberg, Past performance is not a reliable indicator of future results.

Typically, currencies drop when central banks cut rates. In the UK’s case, if the BOE signals that more rate cuts are possible this year, then we could see some recovery in the pound as this would ease distress in the bond market. However, gains could be capped as the pound would ultimately lose its yield advantage vs. other G10 currencies.

From a technical perspective, EUR/GBP is rising at such a rapid rate that the market may target whole number resistance levels in the short term. This means that there could be some stickiness around 0.8500, followed by 0.86, the highest level since August 2024. However, if you want to know where EUR/GBP will go next, watch the UK bond market.

04 October 2024: Why has EUR/GBP been trending lower in the last 18 months?

EUR/GBP has been trending lower for most of the last 18 months, however the pound has sold off sharply since the start of Q4, and there are signs that EUR/GBP may have made its low of the year and could recover from here. The low on 23rd September at 0.8325, was the weakest level since April 2022. Weakness in EUR/GBP was driven by stronger growth in the UK vs. the Eurozone, serious issues with the German economy and a larger interest rate differential between the ECB and the Bank of England, with the ECB expected to cut rates faster and deeper than the BOE.

However, the narrative around EUR/GBP has started to change in recent days. Firstly, UK economic data has surprised on the downside, and cracks are starting to appear in the UK’s growth outlook after stagnant growth in June and July. Just as clouds are gathering on the horizon for the UK’s economic outlook, Germany has been thrown a lifeline in the form of massive Chinese stimulus. This has led to hopes of an industrial recovery in Europe’s largest economy.

The pound has been buoyed by higher yields in the UK compared to the Eurozone for most of 2024 so far. However, this yield advantage is starting to decline, after Bank of England governor Andrew Bailey touted the prospect of more aggressive interest rate cuts now that inflation is moderating. There are 33 basis points of cuts priced in by the market for the BOE’s November meeting, which suggests that the market is now expecting a super-sized rate cut from the BOE at the same time as a 50bp rate cut from the Federal Reserve is priced out. The shift in interest rate cut expectations is weighing on GBP on a broad basis, and it is why the GBP is the second weakest performer in the G10 FX space since the start of Q4. The erosion of the yield differential between the UK and Germany, is also boosting EUR/GBP, as you can see in the chart below.

Chart 1: German – UK 10-year sovereign bond yield and EUR/GBP

Past performance is not a reliable indicator of future results.

Source: XTB and Bloomberg

As you can see, this FX pair is tracking the yield spread closely. As the yield spread narrows: i.e, UK yields fall back towards German yields, this is positive for EUR/GBP.

Another factor weighing on the pound is risk aversion. Since tensions between Israel and Iran have ratcheted up in recent days, the pound has experienced heavy selling pressure. This change in fortune is due to a scramble for dollars as FX investors rush to the safety of the greenback. The market has been accumulating pound longs for more than 6 months, which makes sterling vulnerable to a pull back. The same thing happened at the start of August, with the pound performing badly during periods of risk aversion. We expect this trend to continue through to year end.

A lower yield differential combined with selling pressure during periods of risk aversion could see further upside for EUR/GBP and £0.85 and then £0.86, the high from August, are key resistance levels to watch in the short to medium term.

19 June 2024: French Snap Election Sends GBP/EUR Forecast into Turmoil

The recent French snap election, called by President Emmanuel Macron after his party suffered a heavy defeat to the far-right National Rally party, has sent shockwaves through the foreign exchange market. The election has introduced significant political uncertainty, leading to a decline in the euro against the British pound.

EURO/POUND STERLING Weakness

The euro has weakened against the pound, with EUR/GBP hitting a near two-year low. This decline is largely attributed to the political uncertainty surrounding the French election and the potential rise of the far-right National Rally party. The uncertainty has led to a significant shift in market sentiment, with traders becoming increasingly bearish on the euro.

The exchange rate reached its highest level in 22 months at 1.1886 after a poll showed Marine Le Pen's anti-EU party on course to win a parliamentary majority in France's legislature. Analysts at a European investment bank have upgraded their forecasts for the Pound to Euro exchange rate, now seeing 1.20 as a possible level in the coming weeks. The exchange rate is also building on recent gains thanks to the release of strong UK wage figures and rising Eurozone political uncertainty.

We saw the pair drop 0.14% after the European Central Bank cut interest rates but said it was not committed to cutting again, although analysts expect the next cut to come in September.

The market sentiment is mixed, with 79.17% of traders being net-long on EUR/GBP. This suggests that the current trend may continue, but the sentiment is less net-long than yesterday and more net-long than last week, indicating a mixed bias. The mixed sentiment is a result of the conflicting views on the impact of the French election on the euro.

French Fiscal Risk

The French government bond market is under pressure due to the fiscal challenges facing the country. This could lead to further widening of the 10Y OAT-Bund spread and potentially impact the euro. The fiscal challenges are a result of the French government's high debt levels and the need for significant fiscal reforms.

The European Central Bank's (ECB) monetary policy stance is also being influenced by political uncertainty. The ECB may need to be more accommodative to support the region's economy, which could further weaken the euro. The ECB's accommodative stance could lead to a decline in the euro, as it would reduce the attractiveness of the currency.

The French snap election has introduced significant political uncertainty, leading to a decline in the euro against the British pound. The risk premium associated with French politics and the potential fiscal challenges facing the country are key factors in the ongoing weakness of the euro. The mixed market sentiment and the potential impact of the ECB's monetary policy stance on the euro will continue to influence the GBP/EUR forecast in the coming days.

What are the latest developments in French politics?

President Emmanuel Macron has called for snap elections, set to take place on June 30 and July 7. This unexpected decision is seen by many as an "act of trust" by the president, but it also raises concerns about the potential rise of the far-right National Rally party.

The 28-year-old leader of the National Rally party, Jordan Bardella, is gaining significant popularity and could potentially become the next Prime Minister. His party's economic program is expected to be costly, with some projections suggesting it could be twice as expensive as the tax cuts implemented by former UK Prime Minister Liz Truss. The leftwing alliance, led by Jean-Luc Mélenchon, is trying to build a united front against Macron. However, the alliance is also touting populist and uncosted policies, which could lead to a significant shift in the political landscape. Macron's camp is facing challenges, with some doubting the wisdom of calling snap elections. The president's alliance could be squeezed out in run-offs between the far left and far right, according to projections.

On the other hand, the National Rally party has jettisoned its leader over a controversial alliance deal, which could impact the party's chances in the upcoming elections. Climate activists and renewable energy players are also concerned about the potential rise of the far-right, which could lead to a "void" in environmental policies.

French Minister Gabriel Attal is facing scrutiny over his potential role as Prime Minister, with some questioning his ability to lead the country. Former French President François Hollande has announced he will run as an MP in the upcoming parliamentary elections, citing the "serious" situation in France.

22 May 2024 - What is the pound-to euro forecast?

The GBP/EUR exchange rate has been in a sideways trend for much of the past few months trading between €1.13 and €1.15 (i.e. £1 buys €1.15). Yet the GBP/EUR exchange price has threatened to reach new multi-year highs on several occasions since July 2023 thanks in part to differing interest rate expectations in the UK and EU, as well as recent inflation data. On 22nd May, UK inflation slowed to 2.3% for April which despite reaching its lowest levels since 2020 came in worse than market expectations. That has resulted in investors changing their stance on the timing of the first UK interest rate cut from June to September and by effect strengthening the pound-to-euro exchange rate. With the ECB widely expected to start cutting euro interest rates in June - beating both the US Federal Reserve and UK Bank of England to become the first major central bank to cut rates - this is helping to push the pound-to-euro forecast higher.

There is now a broader expectation that should the GBP/EUR exchange rate rise consistently above €1.15 and if the BoE issues just a single cut to UK interest rates in 2024, we could see the pound to euro exchange rate reach as high as €1.16 to €1.17 by the end of 2024, which would be its highest levels since August 2022.

What is the best euro exchange rate for the pound (GBP/EUR rate)?

The best euro exchange rate in 2024 to date for the pound was seen on 13th February 2024 when the pound-to-euro exchange rate hit a high of €1.15. Since then, the euro exchange rate for the pound has traded in a narrow range between €1.14 and €1.15, with prices nearing the high of €1.15 twice more on 7th March 2024 and 22nd May 2024.

12 February 2024 - Getting carried away

This currency pair has had a torrid start to 2024 and is down 1.7% YTD. The euro has generally had a tough start to the year, as investors sold the single currency. A mixture of weak economic data from the currency bloc, especially its biggest economy, Germany, has not helped the performance of the euro.

German industrial production dropped by 1.6% in December 2023, it is down 3% compared to 2022, and it is still 10% below its pre-pandemic level. Germany is considered the world’s industrial powerhouse, yet a mixture of cyclical and structural factors is weighing heavily on this economy. Germany is now expected to have the weakest GDP growth in the Euro area for both 2024 and 2025.

Growth rates matter for currency crosses like EUR/GBP, and it is worth noting that the UK is expected to see stronger growth rates than the Eurozone in both 2024 and 2025, according to the latest OECD forecasts. While the difference is small, compared to recent years when the UK has underperformed its European counterparts, this is an important shift for the UK economy, and for GBP.

The weaker growth outlook for the Eurozone is also impacting interest rate expectations for the currency bloc. Relative interest rate differentials and the carry trade, are a key driver of currency markets. Financial markets are currently expecting the ECB to cut rates more than 5 times this year, in the UK the BOE is only expected to cut rates 3.5 times. By the end of the year, the UK’s interest rate is expected to be 1.7% higher than the Eurozone’s interest rate, and this is boosting GBP vs. EUR. This is also one reason why GBP has risen by 1.67% vs. the EUR since the start of 2024 and is the best performing currency vs. the EUR compared to the rest of the G10 FX space.

There is some evidence to suggest that the weaker euro is also a reflection of economic woes in China, due to the importance of China as a trading partner to the Eurozone. Thus, we may not see a meaningful recovery in the euro until we see China’s growth rates pick up. Right now, the market remains fairly bearish on the outlook for China this year.

From a technical perspective, EUR/GBP is approaching a key technical support level – the low from 11th July 2023. We will be watching this level closely, if EUR/GBP does fall below the 0.8500 level then it could open the door to a deeper decline towards 0.8250.

Chart: EURGBP

Source: xStation

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

21 November 2023 - Interest rate expectations push pound to euro rate lower as GBP loses ground against the euro

The Pound-to-Euro forecast has deteriorated in the last month with the pound weakening thanks mostly to changing interest rate predictions for the UK. Improving UK Inflation data - where the UK consumer price index (CPI) fell to below 5% for the first time in two years - has helped to change market consensus for UK interest rates, which are now expected to remain on hold at current levels of 5.25% until the summer of 2024 where rates might see their first cut. The impact of these changing UK Interest Rate forecasts has been for analysts to quickly evolve their predictions for the Pound-to-Euro rate with the pound weakening as a result.

In the last month, the pound has fallen in value against 10 major currencies including -0.2% against the euro, -0.6% against the Australian Dollar and -1.4% against the Japanese Yen. The pound has gained in value against the US dollar, but much like its own fate this has been mostly down to changing rate expectations in the United States with the US federal Reserve now seen as less likely to keep raising interest rates.

Chart - Pound performance against other currencies in the previous 30 days

Source: xStation

Source: xStation

So what is the latest pound to euro forecast and how might investors position themselves in the GBP-to-EUR rate?

We spoke to XTB’s Chief Market Analyst Walid Koudmani who shared his latest thoughts on the Pound-to-Euro forecast:

“Forecasts have been changing rapidly in the last few months for the Pound-to-EUR rate prediction as well as the pound against other currencies such as the USD and JPY. Interestingly the main story in the last six months was about how quickly UK interest rates will rise to and to what level. The same can be said about the European Central Bank and rising Euro rates. In recent weeks, that story has turned completely to now be about when interest rates might fall and which central bank will lead the way in cutting rates. That’s the key aspect which is shaping predictions for the GBP to EUR rate right now.

The European Central Bank and US Federal Reserve are both expected to be amongst the first major central banks to start cutting their respective interest rates - likely from the summer of 2024. However - and potentially most important for the Pound-to-Euro forecast - the UK is closing fast after the UK central bank gave strong hints that UK interest rates have likely hit a ceiling. Today in fact the Governor of the Bank of England confirmed that the UK central bank’s current policy approach should be enough to bring UK inflation back to its 2% target by 2025. That was interpreted by most to be a message that UK rates are likely to have hit a ceiling and this has been one of the major factors which put a cap on the strong run of gains for the Pound-to-Euro rate forecast.

The next phase will focus on which central bank cuts rates first and it's here that traders need to be careful. I believe it's clear central banks want to cut rates to support meager economic growth after the sharp rises in inflation over the past year. So they are looking for headroom in macroeconomic data which will allow them to cut rates faster than they are expecting right now. If we see UK inflation continue to decline faster than expected, that could bring expectations for a UK rate cut forward and as a result we might see the Pound-to-Euro rate decline more sharply.

Right now it seems the battle lines for the Pound-to-Euro forecast is more about the race to cut rates and which central bank makes the first move.”

7th November 2023 - Pound-to-Euro forecast hinges on the race to cut interest rates after Pound gives us gains in GBP to Euro battle after hopes rise for early BoE rate cut

The Pound-to-Euro forecast took a strange turn in the past week with conflicting information coming out of the Bank of England, forcing economists and traders to revise their pound vs euro predictions in a matter of days and seeing the pound swing from strong gains to heavy losses against its EUR counterpart.

It all started with the BoE rate announcement on 2nd November, where the BoE’s MPC confirmed its decision to keep UK Interest Rates on hold at 5.25%. That decision was widely expected but what was not predicted was the statement from the UK central bank, who highlighted that it was ready to hike UK interest rates again should the economic data not improve and that UK Rates are likely to remain higher for longer. That triggered a mini buying spree in the pound, with the GBP gaining in value against the EUR having hit its lowest level in more than five months. This relief rally lifted the GBP by 1.2% against the EURO in the space of a week.

Yet that relief rally in the pound was short lived with investors quickly reversing positions in the GBP after comments from the Bank of England’s Chief Economist hinted a reversal of the previous rhetoric. Huw Pill hinted that the Bank could ‘reconsider or assess’ its stance on UK Interest Rates and the fact the markets are pricing in a first interest rate cut in August 2024 is ‘not unreasonable.’ That sentiment sent the pound tumbling in reaction, with the GBP losing 0.6% against the EUR in the last 72 hours as a result.

What is the latest Pound-to-Euro forecast?

Much of the current forecasts seem to be about a race to the bottom for interest rates. The markets are currently pricing in a first UK rate cut in August 2024, with something similar for the European Central Bank. That means the pound vs euro battle remains hotly contested and much of the latest GBPEUR forecast is reliant upon market consensus towards GBP and EUR interest rates. Typically the higher the interest rate, the stronger the currency but it's not always as simple as this, with economic growth and market forecasts towards future rates taken into consideration. The GBP EUR exchange rate continues to trade within a fairly narrow range between 1.10 and 1.18 with any significant breakout dependent on major moves from either the Bank of England or the European Central Bank.

Should the BoE surprise the markets and announce an unexpected rate hike, that could give a second wave to the pound with the GBP likely to appreciate in strength against the euro. Moreover, if expectations of an ECB rate cut are brought forward (bear in mind the ECB appears to be a step or two ahead of the BoE in terms of its actions on interest rates), that could help the pound vs the euro further.

For more information on BoE rate expectations, please see our live UK Interest Rate forecast article.

1st November 2023 - GBP declines in value against the EUR after poor month

The GBP fell against most major currencies throughout October 2023 resulting in a drop in value against the EUR after reaching a one-year high in August 2023. The GBP fell against the USD (US Dollar), EUR (Euro) and JPY (Japanese Yen) by between 0.3% and 0.7% in October, adding to the losses suffered in September.

Chart - The EUR regains some lost ground on the GBP since September 2023

Source: xStation

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Chart - Heatmap tracks the losses suffered by the GBP against major currencies in October 2023

Source: xStation

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

After a positive 2023 trading, why has the GBP lost value since September 2023?

Much of the recent decline in value of the GBP is linked to softening interest rate expectations. The GBP has risen in value in 2023 due to the exceptional pressures seen by UK Inflation, which hit a high of 11.1% at the end of 2022 and had continued to print much higher price increases than expected by economists throughout the first half of 2023. That forced the Bank of England to hike interest rates aggressively to help weaken demand side effects that’s pushing UK inflation higher. Stronger interest rate hikes improves the value of the GBP as it boosts demand for GBP by individuals and institutions to earn a better yield on their currencies.

However, data from the Office of National Statistics showed UK Inflation surprisingly cooled faster than anticipated in August, which helped to convince the Bank of England to refrain from further rate hikes in September to maintain UK Interest Rates at 5.25%, against defying market expectations for more hikes. With UK Inflation remaining flat in September, that has helped to convince investors and economists alike that UK Interest Rates right now have hit their peak and could remain around 5.25% throughout the next six months before a potential rate cut in the second half of 2024. That has softened demand for the GBP and is one of the main drivers behind the weakening value of the GBP against other major currencies in the past two months.

Morgan Stanley warns of the danger GBP’s premium value against peers could erode due to Britain’s current account deficit.

In a note to investors earlier in October, the famous investment bank Morgan Stanely also issued a warning to those GBP to EUR forecasts, highlighting that the GBP’s premium value could erode due to the danger of the UK’s current account deficit. The bank highlighted that UK goods trade is “deeply subdued relative to peers” since Covid, a factor likely exacerbated by the higher costs of goods trade post Brexit. That softening has been picked up in services trade.

Morgan Stanley’s foreign exchange analyst David Adams commented on the potential impact to the GBP in his note:

“In a scenario where the UK current account deficit approaches disequilibrium, a weaker GBP is one clear channel that could return the economy to balance. Indeed, the rebalancing of the international payments position could come through the currency, the value of domestic assets, or a fall in domestic demand. In a free-floating market, the currency channel might be the least disruptive one. To gauge the range of adjustments that might be sufficient, we have built a so-called ‘fair value’ model of the exchange rate based on some basic fundamentals. Our model points to something like a 5-20% premium on GBP at current prices. In the extreme case of a meaningful…and structural current account deficit widening, this premium could be meaningfully eroded in order to attract capital at the margin in an increasingly capital-competitive world.”

For more information on UK Interest Rate forecasts, please see our live blog.

MAY 2023 - GBP/EUR rises to its highest level since December 2022

After trading largely sideways for much of the past six months from 14th December 2022 to 3rd May 2023, prices started to trade with more volatility in the past weeks which helped the exchange rate to break out of its trading range and reach new highs for the GBP. Previously the cross rate had been stuck in a trading range between €1.10 and €1.14.

Chart - EUR/GBP rate breaks out of its range in May 2023 thanks to GBP strength

Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

XTB’s Chief Market Analyst shares his latest GBP/EUR price forecast for the next three months

On where prices could turn to for the GBP/EUR, Chief Market Analyst at XTB Walid Koudmani said:

“Much of what’s driving this forex pair relates to the upturn in the strength of the UK pound (GBP), which has benefited immensely from rapidly changing expectations in the market towards UK interest rates. Previously it had been expected that UK inflation was likely to fall sharply from March but this just has not been the case. As a result, the Bank of England is now likely to keep hiking UK interest rates and this is helping to support the pound against major competitors such as the EUR.

Much of whether the GBP/EUR rate continues to climb will be based on the strength of UK inflation data in the next three months (April, May and June). The sharp fall in wholesale energy prices - where spot natural gas prices are trading more than 50% below prices in February - should drive a slowdown in inflation. UK inflation data for April is set to be released on 24th May 2023 and it’s expected to show a faster slowdown from 10.1% in March to 8.3% in April. If we do see such a cooling in inflation, that will help calm fears that UK inflation remains hot and we could start to see some profit taking in the GBP, which could as a result push the GBP/EUR lower. However, perhaps the sharpest reaction could come if inflation for April comes in above 8.5%. That would likely lock in further interest rate rises and could see a second wave of demand for the GBP.“

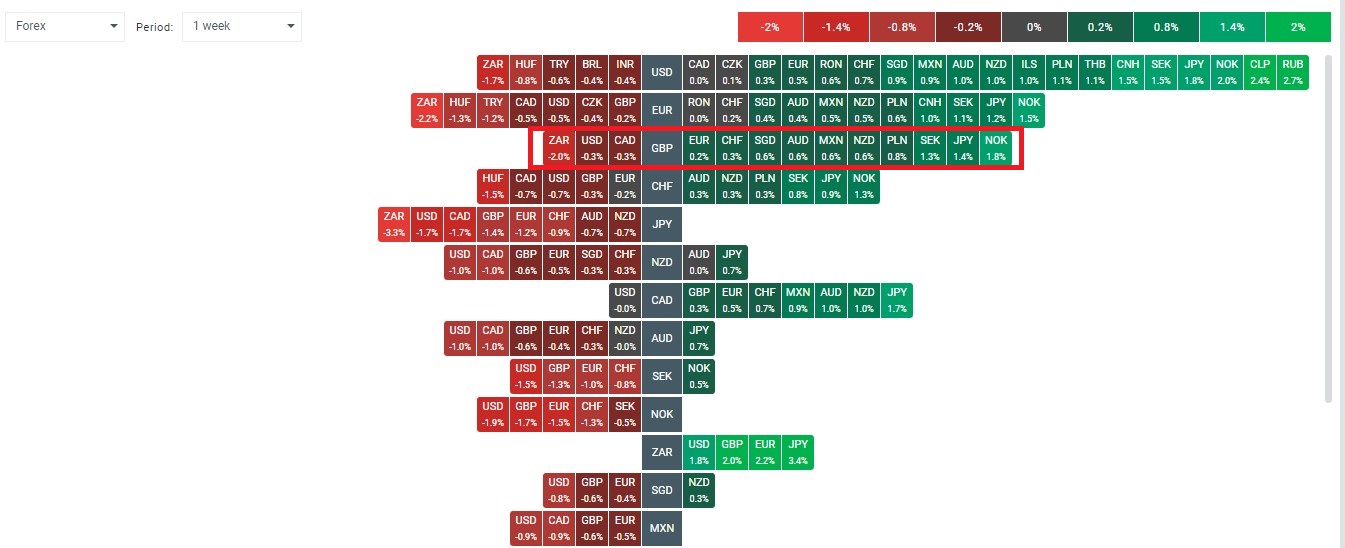

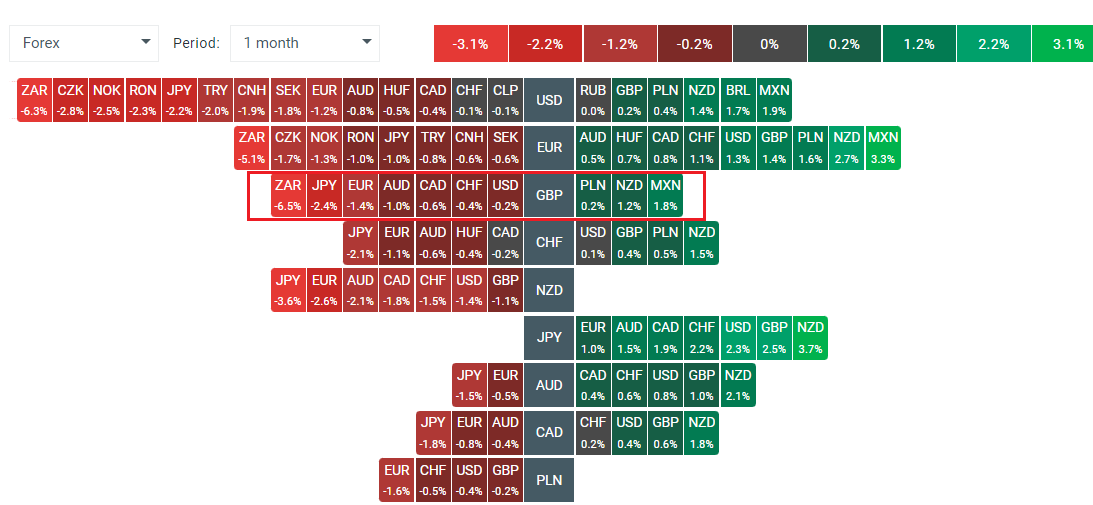

The strength of the GBP (British Pound) since May 2023 is playing a major role in GBP/EUR rate

In the past month, the GBP has strengthened against most major currencies. In fact, its value has risen by between 0.2% and 6.5% against a basket of currencies such as the USD (US Dollar), TRY (Turkish Lira) and JPY (Japanese Yen). This tells the story that GBP strength is playing a significant role in the GBP to EUR price and likely forecast in months to come. In the past month the GBP has fallen in value against three major currencies only; the Polish Zloty, the Mexican Peso and the New Zealand dollar.

Chart - Heatmap of GBP performance against most major currencies in May 2023

Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Source: xStation 5. Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

So what are the reasons behind the recent GBP strength which helped prices break out of its trading range? Let’s take a look at three key drivers:

1. Rising interest rates / Bank of England policy

In May, the Bank of England (BoE), the UK’s central bank, made its twelfth consecutive interest rate hike, lifting UK interest rates to 4.%, the highest since 2008. There had initially been hopes that the BoE would soon be reaching the highest point for UK rate hikes with macroeconomic data starting to soften, which would enable the BoE’s monetary policy committee to refrain from further rate hikes. However, data has simply not softened to the degree that the BoE had expected in recent months and this has triggered a change in view on rate hikes. The BoE is now expected to continue hiking UK interest rates to 5% or more. This change of view has been a strong factor behind the recent strength of the GBP. You can read more about our UK interest rate predictions here.

2. Higher than expected Inflation

One of the key data points triggering the recent change in stance towards UK interest rate rises is the pace of UK inflation. In March, the UK central bank had predicted that UK inflation would start to slow down from more than 11% to around 9% in April and continue to slow by the end of the year to reach around 4% by the end of 2023. However, UK inflation remained stubbornly high in April with prices growing at 10.1% and exceeding most analyst expectations. Learn everything you need to know about inflation here.

Chart - UK inflation rate (CPI) since 2018 Source: Trading Economics

Source: Trading Economics

3. European Central Bank policy

The European Central Bank has also set about hiking interest rates in the euro area, with their latest hike of 0.25% coming in its May meeting lifting rates to 3.25%. This marked its seventh rate hike since July 2022 but did mark its weakest rise with previous hikes coming in at 0.5% or 0.75%. The ECB also signaled during its May meeting that it had further room to raise rates further though most analysts expect one more small hike to come before this tightening cycle likely ends. This has put a cap on EUR gains and has also been a factor in why the GBP has managed to strengthen against its Euro counterpart. Learn about central banks.

How does rising interest rates affect the strength of the GBP or EUR?

Rising interest rates generally make a currency stronger. This is because higher interest rates make a country's currency more attractive to investors, who can earn a higher return on their investments by lending money through the bond market. As a result, there is more demand for the currency, which drives up its value.

There are a few reasons why higher interest rates make a currency more attractive to investors. First, higher interest rates offer a higher return on investment. This means that investors can earn more money by investing in a country with higher interest rates. Second, higher interest rates can help to protect investors from inflation. This is because higher interest rates make it more expensive for borrowers to borrow money, which can help to slow down the rate of inflation.

However, it is important to note that the impact of rising interest rates on a currency's strength can vary depending on a number of factors, such as the country's economic outlook and the level of inflation. For example, if a country's economy is weak, rising interest rates may not have a significant impact on the currency's strength. Additionally, if inflation is high, rising interest rates may not be enough to offset the impact of inflation on the currency's value.

What are the key factors affecting the GBP to EUR exchange rate in 2023?

One factor that could support the pound is the Bank of England's (BoE) plans to raise interest rates. The BoE is expected to raise rates by 25 basis points in June, and another 25 basis points in August, which would lift UK interest rates to 5%, making it far higher than those of its ECB equivalent.

However, much also relates to market expectations on interest rates and its here where there is more uncertainty than in Europe. The market is convinced that more hikes are to come for the BoE but with inflation data remaining stubbornly strong, its still uncertain how high UK interest rates may rise to and just as importantly, how quickly they could fall in 2024 and 2025.

Another factor that could support the pound is the UK's economic recovery. The UK economy grew by 0.8% in the first quarter of 2023, and is expected to grow by 2.5% in 2023. This growth could lead to an increase in exports, which would also support the pound.

However, there are also some longer term factors that could weigh on the pound. One factor is the ongoing uncertainty surrounding Brexit and the UK’s trading relationship with the EU. There are also geopolitical aspects that could impact the performance of the GBP with a general election in the UK expected to come in 2024 which - according to the latest polls - could trigger a hung parliament.

Here are some additional factors that could affect the GBP/EUR exchange rate in 2023:

- The outcome of the French presidential election - geopolitical instability could threaten the strength of the EUR

- The direction of commodity prices - a continued decline in energy prices could quicken the pace of inflation cooling, forcing Central Banks to hold off from further rate hikes

How does the GBP/EUR forex pair work?

The GBP/EUR forex pair is a currency pair that measures the value of the British pound sterling (GBP) against the euro (EUR). It is one of the most popular currency pairs in the world, and is traded on a daily basis by millions of people.

The price of the GBP/EUR pair is determined by supply and demand. When there is more demand for the pound than there is for the euro, the price of the GBP/EUR pair will rise. When there is more demand for the euro than there is for the pound, the price of the GBP/EUR pair will fall.

There are a number of factors that can affect the supply and demand for the pound and the euro, including:

- Interest rates: When interest rates in the UK are higher than interest rates in the Eurozone, investors will be more likely to buy pounds, which will push up the price of the GBP/EUR pair.

- Inflation: When inflation is higher in the UK than in the Eurozone, investors will be more likely to buy euros, which will push down the price of the GBP/EUR pair.

- Economic growth: When the UK economy is growing faster than the Eurozone economy, investors will be more likely to buy pounds, which will push up the price of the GBP/EUR pair.

How do you trade the GBP/EUR forex pair?

Investors can trade the GBP/EUR pair through a forex broker like XTB. When you trade the GBP/EUR pair, you are essentially speculating on whether the price of the pound will go up or down against the euro. If you think the price of the pound will go up, you will buy and profit from every rise in value of the forex pair. If you think the price of the pound will go down, you will sell and profit from every fall in price. Of course, if the prices go against your trade direction, you will suffer a loss.

Here is an example of a CFD trade on GBP/EUR:

Let’s say the Investor believes the pound will appreciate (rise) in value against the euro.

- Investors open a long position on GBP/EUR.

- The investor deposits $1000 to cover the trade

- The investor's broker sets a margin requirement of 5%.

- This means that the investor only needs to put up $50 as margin to control a position of 1000 GBP.

- The price of GBP/EUR rises from 1.1000 to 1.1100.

- The investor closes the position and takes a profit of $100.

- Had the price of GBP/EUR fallen from 1.1000 to 1.0000, the investor would lose $100

In this example, the investor made a profit of $100 on a $50 margin investment. This is a return of 200%. However, it is important to note that CFD trading is a risky investment, and investors can lose money as well as make money. You can learn more about how to invest in Forex CFDs here.

How can you manage your risk when trading GBP/EUR?

Here are some tips on how to manage your risk when trading GBP/EUR forex pair:

- Consider stop-loss orders: A stop-loss order is an order to sell a security if it falls below a certain price. This can help you to limit your losses if the price of the GBP/EUR pair moves against you.

- Consider take-profit orders: A take-profit order is an order to sell a security if it rises above a certain price. This can help you to lock in your profits if the price of the GBP/EUR pair moves in your favor.

- Understand leverage carefully: Leverage can magnify profits, but it can also magnify losses. It is important to use leverage carefully and to only trade with amounts that you can afford to lose.

- Diversify your portfolio: Diversifying your portfolio means investing in a variety of assets. This can help to reduce your risk if one asset loses value.

- Do your research: Before you trade any asset, it is important to do your research and to understand the risks involved as well as the various bits of technical and fundamentals that might help drive price change during your trade.

UK Interest Rates: Projections over the Next Five Years | BoE Analysis

Understanding Forex Volatility: Causes, Effects, and Strategies

Investing in Currencies

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.