What's the latest 2025 UK Interest Rate forecast for the next 5 years? When is the next interest rate decision in the UK? When will UK Interest Rates go down and how many rate cuts are forecast for 2025? There’s been a dramatic change to UK interest rates over the last year, with the Bank of England moving to cut UK rates from a peak of 5.25% in 2023 to 4.5% in February 2025, with more rate cuts expected in 2025. A slowdown in UK Inflation since 2023 has given the UK central bank headroom to cut rates but with inflation reigniting at the start of 2025, this could force the BoE to pause their current rate cutting path.. We analyse the economic context, BoE's policy stance, and global factors to provide insights on the forecast for UK interest rates. Learn what it means for borrowers, savers, and investors.

What's the latest 2025 UK Interest Rate forecast for the next 5 years? When is the next interest rate decision in the UK? When will UK Interest Rates go down and how many rate cuts are forecast for 2025? There’s been a dramatic change to UK interest rates over the last year, with the Bank of England moving to cut UK rates from a peak of 5.25% in 2023 to 4.5% in February 2025, with more rate cuts expected in 2025. A slowdown in UK Inflation since 2023 has given the UK central bank headroom to cut rates but with inflation reigniting at the start of 2025, this could force the BoE to pause their current rate cutting path.. We analyse the economic context, BoE's policy stance, and global factors to provide insights on the forecast for UK interest rates. Learn what it means for borrowers, savers, and investors.

LATEST LIVE BOE UPDATES

What is the latest 2025 forecast for UK Interest Rates and when might we see another rate cut?

The current UK interest rate stands at 4.5% after the BoE cut rates by 0.25% in its February meeting. In that meeting, the UK central bank said that substantial progress had been made on cooling inflation - which stood at 2.5% in Q4 of 2024 - allowing the BoE to gradually reduce interest rates. Despite the BoE citing concerns about persistent domestic inflationary pressures, weak economic growth proved the tipping point to reducing interest rates with two members of the Monetary Policy Committee in fact calling for a more aggressive 0.5% rate cut.

The next interest rate decision takes place on 20th March 2025 with the majority of investors and economists expecting no change to UK interest rates. That being said, the market still expects UK interest rates to fall throughout 2025.

When are UK interest rates expected to fall to 4%?

The market currently forecasts at least two further rate cuts in the UK interest rate for 2025, meaning that UK interest rates could end the year at a low of 4%. The timing of those rate cuts remains volatile somewhat with most investors and economists currently projecting two 0.25% rate cuts in May and August. Of course, those projections are subject to change with every data reading, especially if trade wars escalate globally under the Trump tariff plan.

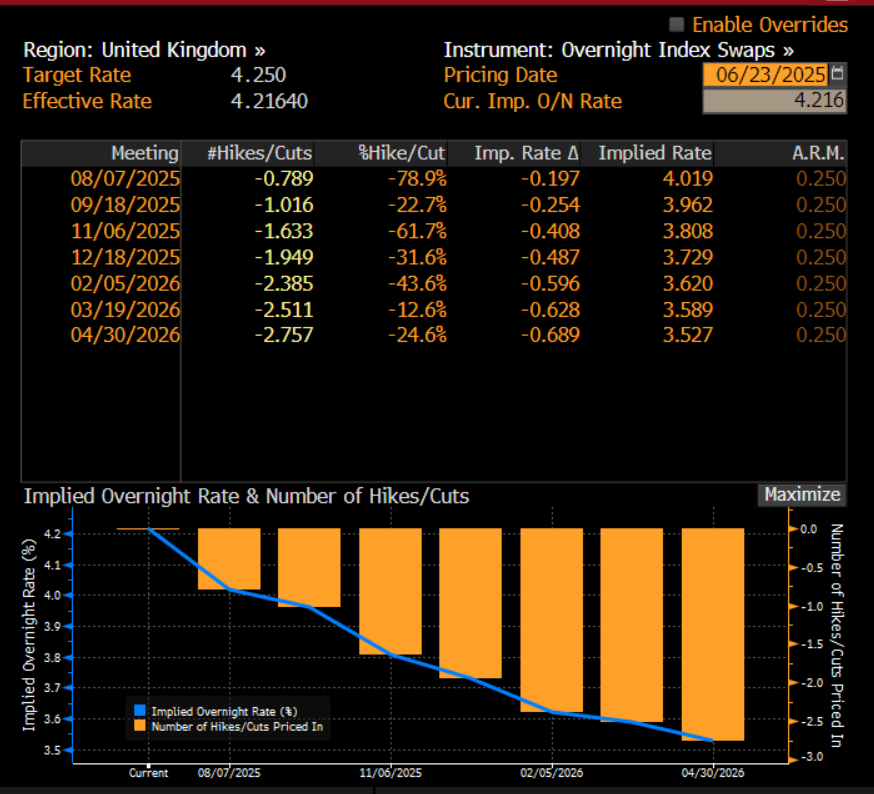

Chart 1: UK market-based expectations for interest rate cuts in 2025

Below you can find the latest Bloomberg projections for UK interest rates in 2025, which highlights the current market forecast for a 0.25% rate cut in the BoE meeting of 8th May 2025. The next rate cut is expected to arrive in the MPC meeting of 7th August 2025, which would see UK interest rates fall to 4%.

Source: XTB and Bloomberg, Past performance is not a reliable indicator of future results

How might US trade tariffs affect UK interest rates this year?

Tariffs are typically inflationary and so whilst it seems for now that the UK has evaded the eye of President Trumps tariff plans (with Mexico, Canada and China taking the bulk of the moves to date), this remains a volatile aspect which could put an end to UK interest rate cuts. The imposition of tariffs increases the costs of imports and these costs are typically passed onto consumers in the shape of higher retail prices. As such, if the US imposes tariffs on UK goods, which they have already warned that UK VAT (value added tax) rates of 20% has being unfair, we could see UK inflation grow far above current rates and thereby reducing headroom for the BoE to cut rates (as higher interest rates is typically the main consequence of stronger inflation).

Previous updates:

23rd June 2025 - Is the door open to another interest rate cut?

The Bank of England left the door open to another interest rate cut at their next meeting in August. The interest rate futures market is now pricing in a 79% chance of a cut, after more MPC members voted for a rate cut in June, and as the bank stressed the downside risks to growth as a bigger risk factor for the UK economy than inflation.

There are of course risks, and anything could happen between now and 7th August, when the BOE next meets. Geopolitics, especially the conflict in Iran, is a major threat to oil prices, even if they have been stable so far. If oil prices spike between now and then, the BOE may not be able to overlook the inflation risks posed to the UK economy. CPI in the UK is already running well above the 2% target rate at 3.4%, so we do not think that the BOE will tolerate any more upside pressure to inflation in the short term.

Looking through geopolitical risk, the BOE expects growth to moderate and for the labour market to soften, which could dampen wage growth in the coming months. There is a lot of time, and economic data releases between now and the next BOE meeting. The CPI data and labour market data will be important, along with Q2 GDP. Thus, for now the focus is on a rate cut for the UK this summer, unless the data strengthens or inflation risks mount. In that case, we could see the BOE try to row back on rate cut expectations.

Chart 1: UK interest rate futures chart

Source: Bloomberg and XTB. Past performance is not a reliable indicator of future results.

2025 Update: UK interest rate outlook

There has been a huge amount of volatility in the UK interest rate outlook in recent weeks. As growth fell but inflation remained above the BOE’s target rate, the market priced out the prospect of Bank of England interest rate cuts. At the start of 2025, the market expected just one rate cut from the BOE. This contributed to the sharp selloff in the UK bond market, which sent bond yields rising sharply and led to concerns about the UK’s fiscal sustainability.

However, as we move through January, an improving picture for inflation has seen a recalibration of interest rate expectations. The December CPI report saw service prices fall to their lowest level since April 2022, and the headline rate of inflation also retreated to 2.5%, which is within touching distance of the BOE’s 2% inflation target.

An improving backdrop for inflation is the key for unlocking future BOE interest rate cuts. In the aftermath of the UK price data, the market is now expecting just over 2 interest rate cuts for this year. The first rate cut is expected in February, there is currently an 88% chance of a cut at this meeting. The second cut is expected around the middle of the year. The increase in UK rate cut expectations has boosted the UK bond market, and UK bond yields have fallen sharply. The risk is that the UK’s growth outlook also deteriorates, and this causes a faster pace of rate cuts from the BOE later this year.

Upcoming economic data will continue to be scrutinized by financial markets, to see if the slowdown in UK economic growth materializes. Added to this, the downward pressure on inflation at the end of 2024 may not last. In April, the government will increase employer national insurance contributions, and businesses may pass these extra costs onto consumers. Also, there is some concern that the survey period for the December inflation report did not capture hotel and air fare price increases over the holiday period. This may trigger a reversal in these prices in the coming months.

One good month of inflation may not be enough to secure a series of interest rate cuts from the BOE, and we may see further volatility on the outlook for UK rates in the coming months.

Chart: UK market-based expectations for interest rate cuts in 2025.

Source: XTB and Bloomberg, Past performance is not a reliable indicator of future results

Chart - Bloomberg UK Interest Rate forecasts for the next 5 years and beyond

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

This article is updated every few days to bring you the breaking news and analysis concerning the latest UK Interest Rates Forecast for the next 5 years including as well as when is the next UK interest rate decision.

The Story For UK Interest Rate Forecasts So Far…

UK interest rates have been rising rapidly since December 2021 having hit record lows in August 2020 when the Bank of England (BoE) last reduced the base rate from 0.25% to 0.10% in response to the COVID-19 pandemic. Since then, rising inflation has dramatically changed the BoE’s interest rate stance with the UK’s Monetary Policy Committee (MPC) - which decides UK interest rates - voting to increase the UK’s base interest rate multiple times in an effort to curtail rising inflation, which is seen as a significant threat to the UK economy.

2023 has been a year of dramatic changes in interest rate predictions on how high UK interest rates will go. After initially forecasting UK Interest Rates would likely rise to as high as 6.5% by the end of 2023, those predictions changed dramatically after a summer of positive UK inflation data. This means that today, UK interest rate forecasts are much more mild than predicted at the start of the year, with the UK interest rate forecast for the next five years showing how UK interest rates have likely peaked at 5.25%. Thereafter, the answer to the important question of ‘when will UK interest rates start to fall’ appears to be throughout 2024 and 2025, with UK rates predicted to fall back towards 4% by the start of 2026.

In this article, we explore the UK interest rate forecast for the next five years, considering the UK’s economic outlook, the BoE's policy stance, the global context and latest developments to give you a complete overview of the UK interest rate situation.

PAST UPDATES

30th July 2024 - Bank of England forecast to finally cut UK interest rates on Thursday 1st August

The Bank of England meets on Thursday 1st August to decide on UK interest rates with the latest bloomberg survey predictions rating a 0.25% rate cut at 55%. With UK inflation remaining at the central bank’s 2% target and wage growth finally easing to 5.7% in May, its lowest level since October 2022, financial markets are predicting the BoE finally has some headroom to cut UK interest rates to 5%.

Here’s XTB’s Research Director Kathleen Brooks speaking ahead of the BoE rate decision this week:

“They will announce their latest interest rate decision, and their latest Monetary Policy Report, which will include GDP and inflation expectations. The market is currently pricing in a 44% chance of a rate cut from the BOE this week, and there are only 38bps of rate cuts priced in for the rest of this year. The market has been reluctant to price in rate cuts for a few reasons: residual inflation risks, especially service price inflation, some hawkish members of the BOE coming out and saying they won’t vote to cut rates at this meeting, and the chance of an upgrade to the BOE growth forecasts for this year and next. The latter point is worth noting, it would be odd for the BOE to cut rates at the same time as they raise their growth forecasts, and due to this we think that they won’t cut rates at this week’s meeting.”

22nd May - UK Inflation cools to 2.3% whilst UK services price growth remains elevated - dashing hopes for a widely forecast UK Interest Rate cut in June.

Data from the ONS out today cooled UK interest rate predictions that we will likely see a rate cut in June with UK Inflation cooling in April but not at the pace forecast by economists. UK inflation fell to 2.3% in April against market expectations for a quicker slowdown in prices to 2.1%. Nevertheless, this still marked the lowest level for UK inflation since mid-2020 and a major milestone in the return of inflation towards the Bank of England’s 2% target.

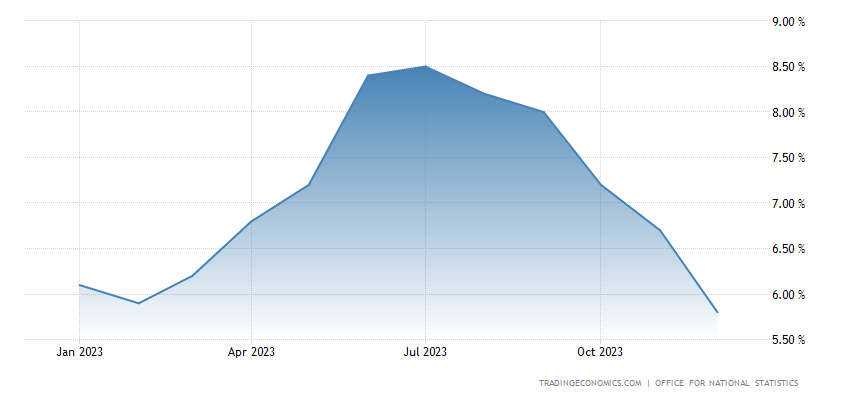

Chart - UK Inflation falls to 2.3% in April

So how does todays Inflation reading affect UK Interest Rate forecasts?

April’s inflation reading has immediately cooled market predictions for a first UK interest rate cut in June. Before today’s inflation reading, the market assigned a 50% probability for a UK interest rate cut in June. That has now fallen sharply to just 19% with the majority of market participants forecasting the first UK interest rate cut to come in September.

Heres XTB’s Research Director Kathleen Brooks commenting on the change in stance in her latest article ‘Sticky service prices puts rate cuts on ice’:

“April’s inflation data has triggered a rapid recalibration of UK rate cut expectations. The market had been pricing in a 50% chance of a June rate cut ahead of this report, but this has now sunk to 19%. The market is now expecting the first rate cut from the BOE in September, with sticky inflation wiping out the chance of a rate cut in the summer.

This data is not good news if you are looking to remortgage, it has also sent GBP/USD back above $1.2750, and we could see further sterling gains later today. We believe that this is bad news for UK equities, which may open softer later this morning.

We assume that the BOE will not be comfortable to cut rates next month, as not enough progress has been made on core inflation, and we will be listening to Huw Pill, the BOE’s chief economist, who speaks on Thursday, for signs that service price inflation remains too hot for a near term rate cut.”

10th May - Bank of England keeps rates on hold at 5.25% but talks up UK interest rate cuts with investors expecting them now ‘just around the corner’.

There was little surprise in the Bank of England's MPC meeting on Thursday 9th May, with UK interest rates kept on hold yet again at 5.25% - strongly forecasted by the market. Most likely what was interesting was a slight change in voting patterns, with Sir Dave Ramsden changing stance to vote for an immediate UK interest rate cut of 0.25%, joining fellow dove Swati Dhingra. It wasn’t enough to force other committee members but it does highlight a slow shift in attitudes amongst MPC members towards rate cuts.

Perhaps more interesting was the rhetoric from BoE Governor Andrew Bailey which followed the rate announcement. That rhetoric was broadly positive with the governor hinting that he was optimistic inflation will continue to fall and that it would help the central bank to start cutting rates sooner than later.

The market is still forecasting the first 0.25% rate cut to arrive in either June or August, with no real sway towards either meeting. The governor did explain that much of what could happen in June’s rate setting meeting will be dependent on UK economic data concerning jobs and inflation in the coming month. Any positive reports on labour market, wage growth and inflation cooling will add greater weight towards the first UK rate cut coming in the June MPC meeting.

For more insights towards the BoE interest rate meeting on 9th May, please see the thoughts from XTBs Research Director Kathleen Brooks here.

12th April - Bank of England now expected to announce just two UK interest rate cuts in 2024 after fears rise for persistently high UK inflation - Fed and ECB also scaling back plans for more rapid interest rate cuts.

There’s been a significant shift in market expectations towards projected UK interest rate cuts for 2024 in recent weeks, with traders quickly scaling back predictions. According to the latest probability index supplied from Bloomberg - which tracks traders' bets on UK interest rates - there will now be just two UK interest rate cuts in 2024 with the first UK rate cut likely to be announced around August or September. That marks a big shift from projections just a few weeks earlier, where at least three rate cuts were expected with the first likely timed for June.

So what’s behind this change in UK Interest Rate forecasts?

Simply put, a raft of economic data out in the UK, EU and US in recent weeks concerning jobs, wage growth and inflation has cooled more aggressive attitudes towards rate cuts. Whilst UK inflation cooled to 3.4% in February - which marked its lowest levels since 2021 - the latest projections by the Bank of England suggest this fall is likely to be temporary, with price growth rising in the coming months. Moreover, in the United States, stronger than expected jobs growth and higher inflation has tempered expectations of US rate cuts, which is also playing a role in UK attitudes. If the UK cuts interest rates more aggressively than the US, it will likely put greater pressure on the pound which in turn could trigger sharp rises in inflation as the price to import goods from abroad becomes more expensive. So the BoE is likely to factor in not just UK economic data, but data from the US and EU in determining its rate cut forecasts.

Here’s our Research Director Kathleen Brooks latest comments on UK interest rates:

“The market is also pricing out the potential for the ECB and the BOE to cut rates before the Fed. The market now expects the first rate cut from the BOE in August. Next week’s UK CPI report will be crucial in determining if the BOE does cut rates in the first half of this year. If UK CPI follows the same trend as the US, then the chances of that happening are slim.”

You can read more about Kathleen’s analysis on the US inflation data and FX moves here.

21st March - Bank of England holds interest rates at 5.25%. Markets convinced the BoE will cut rates by 0.25% in June 2024, following a similar rate cutting path to the US Federal Reserve.

The Bank of England today voted to keep UK interest rates on hold at 5.25%, a decision widely expected by economists and investors. However the Governor of the BoE Andrew Bailey stated that things were ‘moving in the right direction’, widely seen as a good hint that the widely expected schedule for cutting rates remains on track.

What was important to see however was the voting pattern and if any members of the MPC changed their votes from holding rates to rate cuts as this would be seen as a sign of a shift in position within the MPC - the all important Bank of England committee which sets UK interest rates. Last time around, out of nine committee members, two voted for a rate hike, with one member voting for a rate cut, whilst the majority voted to keep rates on hold. This time around, we saw a shift in voting patterns, with the two members who voted for a rate hike last time changing to keep rates on hold. Whilst the majority of the committee (8 out of 9 members) voted to keep rates on hold, it marks a shift in attitude with no member voting to hike rates this time around. That shows the path is set for a rate cut in June 2024.

Table - How MPC members voted in the 21st March Interest Rate meeting

What is the current UK Interest Rate forecast after today’s MPC meeting?

What is the current UK Interest Rate forecast after today’s MPC meeting?

According to the latest Bloomberg predictions, the Bank of England is expected to cut UK interest rates at least three times in 2024 by 0.25% with the first rate cut expected to come in June 2024. Todays voting pattern amongst the MPC members has further cemented this forecast.

How did the markets react to the updated UK interest rate forecast?

The GBP fell in value against the majority of developed currencies after the Bank of England interest rate decision, which was widely seen as painting the way for a June rate cut. The GBP fell 0.5% against the US Dollar and 0.2% against the Euro on the day. We also saw a move in UK government bond yields, with the yield on two-year UK gilts falling from 4.14% to 41.12% after the announcement.

15th March - All eyes turn to next week’s Bank of England Interest Rate announcement. UK Interest Rates expected to remain on hold at 5.25% however…for now

Economists and investors alike are broadly aligned in the expectation that next week’s Bank of England interest rate announcement will likely see UK interest rates remain on hold at 5.25% but optimism continues to rise that this won’t be the case for much longer.

What is the forecast for UK Inflation in February? (due out on Wednesday 20th March)

UK inflation is expected to fall sharply in February, with price growth slowing to 3.5% from 4% in January, whilst core inflation - which strips out volatile items such as energy and food - is also expected to slow to 4.5% from 5.1%. Should both sets of inflationary data come to fruition as expected (or better), that would do much to help convince the Bank of England they have room to cut UK Interest Rates before July, especially given the significant drop seen in UK 1yr ahead inflation expectations.

What is the forecast for UK interest rates in next week’s MPC meeting?

UK Interest rates are forecast to remain on hold at 5.25% in the MPC’s 21st March meeting. The chances for a rate hike are next to zero whilst the chances of a surprise rate cut are lower than 1% currently according to Bloomberg forecasts of UK economists and traders. What will be most interesting at next week’s BoE meeting is if the UK central bank gives the market any clearer steers as to when to expect that first rate cut. There is currently a 60% probability of a 0.25% rate cut in June 2024, which would mark the first of three potential cuts in 2024.

29th February - Traders continue to forecast at least 3 interest rate cuts in 2024, with the first rate cut likely in June

UK traders and economists are continuing to price in a higher number of UK interest cuts in 2024 thanks to expected declines in UK inflation and weak UK growth. However, the scale of those cuts remains fragile with the Bank of England indicating that longer term inflation might remain somewhat sticker and above their 2% target.

Speaking to the UK Treasury Select Committee last week, Bank of England Governor Andrew Bailey confirmed similar comments from other MPC member that UK inflation is likely to fall to its 2% target in the spring - when lower energy prices are calibrated into inflation data - but that this decline is likely to be brief with UK inflation rising back above target later this year. This is what is likely to cap the number of UK rate cuts to three for the time being and whilst Governor Bailey has refrained from giving a timeline on when those cuts will happen, he did confirm that current market expectations appear consistent with the UK Central Banks thinking.

Here’s XTB Director Joshua Raymond latest thoughts:

“Little has changed in market forecasts over the past month towards the scale and timing of UK interest rate cut forecasts. We are still expecting three rate cuts of 0.25% between June and December this year, bringing UK interest rates down to 4.5%. Of course those cuts could be deeper should UK growth remain weak and UK inflation surprises to the downside. But the expectation is that UK inflation will price closer to 3% later this year than 2%, the latter of which is needed to convince of a more aggressive rate cut plan at the BoE.

We know already that the BoE is concentrating now on three specific data points to help it assess whether UK inflation can return to its 2% target consistently; UK labour data, UK wage data and services inflation. As such, my eyes are firmly fixed on a range of UK employment data out on 12th March, which comes just over a week before the next BoE rate decision meeting at the MPC. It’s clear that one hesitation amongst the UK MPC is the scale of wage growth in the past twelve months. Whilst there has been a clear trend lower in average wage growth - down from 8.5% in July 2023 to 5.8% in December 2023, average wage growth continues to significantly overshoot UK inflation and has the potential to embed stronger price rises as a consequence of higher production costs. I’m expecting wage growth to continue to decline rapidly as businesses refocus wage costs away from giving employees a temporary relief from higher inflation and more towards profitability and stability, especially given UK GDP has shown continued signs of weakness. If we see UK wage growth closer to 3.5%, that would breed confidence towards that much hyped first UK interest rate cut in June 2024.”

Chart - Average weekly UK wage growth

Source - Trading Economics

Source - Trading Economics

14th February - UK Inflation remains steady at 4% in January, traders boost bets that UK interest rates will be cut by 0.25% in June 2024

UK inflation remained at 4% in January when most economists had forecast UK inflation to nudge higher to 4.2%, giving investors and homeowners a boost that UK inflation remains on track to fall towards the Bank of England’s 2% target. Core inflation - which strips out volatile items like energy and food - also remained at 5.1% against expectations of a small rise to 5.2%.

Chart - UK Inflation remains steady at 4% in January

Source: Trading Economics

Source: Trading Economics

So what does this inflation reading mean for interest rate cuts?

Traders have increased bets that thanks to inflation remaining steady at 4%, UK interest rates will be cut by 0.25% in June 2024. Before today's inflation reading, there was a 40% probability of a UK interest rate cut in June and those odds have now increased to 70%. Part of the reason behind this is because inflation was expected to nudge higher in January, which didn’t come to fruition. Moreover, UK Inflation is widely anticipated to enjoy another substantial decline in the spring due to a drop in energy bills. That is expected to create headroom for the Bank of England to start cutting UK interest rates without risking further increases in the rate of inflation.

Moreover, traders are now pricing in at least 3 interest rate cuts of 0.25% in 2024, which is an increase from just 2 cuts forecast earlier this month. So it seems the market is moving faster towards a conviction that there will be a 0.75% cut to UK interest rates in 2024, starting from June.

1st February - UK interest rates held at 5.25%. Bank of England is more split than ever as dovish pivot does not mean rate cuts

Dovish Pivot does not mean rate cuts as BOE sees inflation on a rollercoaster ride this year. BOE and Fed seem less dovish than the ECB, as longer-term CPI forecast is revised higher.

The Bank of England held interest rates steady on Thursday at 5.25%, but they did perform their own ‘dovish pivot’, they have removed the reference to further tightening in their statement. However, the market is finding out that dovish pivots do not mean rate cuts. The BOE Governor Andrew Bailey has pointed out that even if inflation does fall back to 2% this year, it is not job done. The problem with CPI is that the good news on price declines, mostly from falling oil and gas prices, will fall out of the index in the coming months. The BOE is concerned that inflation could do its own pivot, although they see inflation falling to 2% in the next few months, they are worried about it rising again.

The hawks aren’t for turning

We mentioned in our preview that one of the things to watch in this meeting is the vote split. This is fascinating, the BOE is more divided than ever, with one member voting for a cut, two members voting for a rate hike, and 6 members sitting on the fence. Megan Greene, who voted for a hike at the last meeting, shifted her stance to keeping rates unchanged, while Swati Dhingra voted to cut rates. The decision to hike rates by two MPC members was a shock to the market, as some were expecting all the hawks to shift to a neutral stance. They have justified their decision, according to the BOE meeting minutes, by saying that they are still worried about a tight labour market, rising wages and persistent inflation pressure. Considering wage growth remains well above the BOE’s target rate and CPI ticked higher in December, it doesn’t sound like they will be appeased on the inflation front any time soon. The BOE has made a slight dovish tilt, however the bar is still high for rate cuts. Like with the Fed, the market seemed more comfortable with rate cuts than the BOE, and it’s worth remembering that 6 members of the BOE voted for no change.

BOE walks the tightrope of forward guidance

The BOE is firmly on hold, and the BOE’s guidance is also not straightforward. In the meeting minutes they said that they will review the amount of time that ‘Bank Rate should be maintained at the current level’, and they also said that policy will need to remain ‘restrictive for sufficiently long’ to suppress inflation pressures. This does not support near term rate hikes, it suggests that the BOE is on hold, but the ‘higher for longer’ mantra has been put on notice, and if they see inflation pressures subside then they will cut rates.

The market impact of a less dovish Fed

The BOE’s message is less dovish than expected, and the market has responded by pushing up Gilt yields along the curve, the 2-year yield is currently up by 4 basis points and the 10-year yield is higher by 3 basis points. GBP/USD is clawing back some earlier losses, and is testing $1.27, and the FTSE 350, which contains domestically focused companies, is backing away from daily highs. The market is also recalibrating expectations of when the BOE will first cut interest rates. The market has pushed back the chance of the first rate cut from May to June, with a small chance of a cut in May. The market now sees rates ending 2024 at 4.07%, with just over 4 rate cuts priced in for next year.

Chart 1: World Interest Rate Probability

Source: Bloomberg

Source: Bloomberg

BOE and the Fed seem less dovish than the ECB

Andrew Bailey has struck a similar tone to the Fed, saying that they want to see further evidence of a sustained decline in inflation before they cut rates. In this way, the BOE and the Fed seem to be less dovish than the ECB. The BOE and the Fed are not willing to pre-commit to a rate hike at a certain time, in contrast, Christine Lagarde at the ECB has pointed to the summer as a good time for the ECB to cut rates. The BOE is following the Fed and is in data-watch mode, with Bailey saying that any rate cut will depend on how the outlook evolves. This increases the volatility around key UK data announcements like CPI, wage data and PPI.

UK only major economy predicting inflation falling below target

The BOE’s inflation forecast was unexpected and highlights how the BOE does not think that inflation will fall in a straight line. The BOE said in its Monetary Policy Report that the speed of price decreases is slowing, which is to be expected. The Bank thinks that lower oil and gas prices could push inflation below the 2% target rate in the near term, but only for a brief period, before inflation rises again. The BOE is the only major central bank currently predicting inflation to fall below its target rate this year, however, it is also the only major central bank predicting a bumpy path with highs and lows for inflation in the coming year. Overall, the BOE sees the disinflation trend continuing and it now sees CPI at 2.75% by year end, down from the current rate of 4%.

The forecast summary included in the Monetary policy report includes an upgrade for growth forecasts. The UK economy is now forecast to grow by 0.5% in Q1 2025, the previous forecast was for flat growth. However, the Bank’s modal projections for inflation have been revised lower in the near term, and higher in the longer term. The BOE now expects Q1 CPI to be 3.6%, previously it expected 4.4%. However, for Q1 2025, the BOE has revised its projection, with 2.8% CPI growth expected, previously it was expected to be 2.5%. The forecast for Q1 2026 has also been revised higher, previously this was expected to be 1.9%, which is below the BOE’s target rate, now it is expected to be 2.3%, with inflation not falling below the target 2% until Q1 2027.

Chart 2: Forecast Summary

Source: Bank of England

Source: Bank of England

17th January - UK Inflation posts surprising rise in December. Investors now doubting if UK Interest Rates forecasts will change after initially expecting an interest rate cut in May 2024

Bright spots for the UK’s inflation outlook

There was some good news in this data set, the largest downward contribution came from food and non-alcoholic beverages. Added to this, owner occupier housing costs, which have had a big upward impact on inflation in recent years, have stabilised. The annual rate remained steady at 5.3% in December, the same rate as in November. Not so encouragingly, the monthly rate for owner occupier housing costs rose by 0.4% in December, the same rate of growth as December 2023, most likely driven by rental costs as mortgage rates have fallen substantially.

As you can see, upward price pressures in December were a mix of temporary factors and more structural increases. The UK is now in line with its G7 peers, and the UK’s 4% headline CPI rate is below France’s inflation rate for the first time in two years.

Where could inflation go next?

There are three factors that could determine the direction of price growth in the future. Firstly, the minimum wage will rise by 12.4% for over 21 year olds from April this year. This could increase upward pressure on the CPI rate, if businesses try to pass through higher wage costs to consumers. Secondly, the energy price cap is expected to decrease by 14% in April, and the average energy customer could see a £268 reduction in their bills compared with January’s prices.

Lastly, concerns about the geopolitical tensions in the Red Sea and their impact on the global inflation rate, could be overdone. Even though events in the Red Sea are serious from a geopolitical standpoint, the effects on the inflation rate could be less severe. The oil price has failed to move significantly higher on the back of the Houthis attacks, and Brent crude is currently below $78 per barrel. Added to this, some ships are still sailing through the Red Sea, and a reroute around the horn of Africa adds approx. 9 days to a tanker’s journey to the West. This is not disastrous for the shipping industry, or for the price of consumer goods, in our view. We do not think that the global economy will face the same level of supply disruption as it did during the pandemic, and for now the markets are not in panic mode, for good reason.

On balance, XTB’s Research Director Kathleen Brooks thinks that the disinflation trend remains intact for the UK economy, and that price pressures remain manageable. However, wage growth linked to the rise in the minimum wage is unknown, and is a reminder that some upside inflation risks remain.

What does the inflation data mean for the Bank of England?

In the aftermath of the UK’s CPI data, the market has pushed back its expectations of when the BOE will start to cut interest rates. The first cut is now expected in June, a few days ago the market had expected the first rate cut to come in May. The market is now pricing in just over 4 rate cuts this year, it had been more than 5 rate cuts a few weeks ago. However, if we see further increases in the inflation rate in the coming months or if we see economic data pick up, then we could see expectations for the first rate cut from the BOE to move deeper into 2024, and potentially out to the late summer.

Chart: Bloomberg market based rate cut expectations

Source: Bloomberg

The UK is not alone in seeing rate cut expectations shift this week. Central bankers have given the markets a dose of reality on rate cut expectations in recent days, and we have seen a scaling back of expectations for the US and Europe along with the UK.

The market impact:

Sterling initially rallied on the back of the inflation data, however GBP/USD could not extend gains above $1.27. As we mentioned above, the Federal Reserve is also pushing back on the market’s expectations for US rate cuts, which is also putting upward pressure on the dollar. In the hours after the inflation data had been released, GBP/USD was mostly stable. UK bond yields also rose sharply on the back of this data. The 2-year Gilt yield rose by 19 basis points to 4.36% on Wednesday. UK stocks also came under pressure, as global risk sentiment waned, and as bond yields surged.

Volatility is here to stay

Overall, the UK’s inflation data suggests that inflation does not fall in a straight line. Also, as the market reacts to economic data, this has a big effect on interest rate expectations. When interest rate expectations shift, as they have in recent days, this causes volatility, which moves markets. This volatility also generates opportunities for traders. Looking ahead, we see a much higher rate of volatility in financial markets in the next few months as we wait for central bankers to start loosening monetary policy.

18th November - After Bank of England keeps UK Interest Rates on hold at 5.25%, financial markets are rapidly predicting UK interest rates are set to fall by around 1% in 2024, back down to 4.25%, according to Bloomberg market data

After the Bank of England decided to keep UK interest rates on hold at 5.25% for a third consecutive month, financial markets and economists are rapidly changing their focus from how high UK interest rates will go to when will UK interest rates go down. A crucial meeting by the US Federal Reserve last week highlighted that US interest rates are now expected to go down at least 4 times over the course of 2024. This has put extra pressure on the Bank of England to do so similarly and according to the latest charts tracking predictions by economists on the path of UK interest rates, it’s now forecast that UK interest rates could also go down significantly in 2024.

Here’s XTB’s Chief Market Analyst Walid Koudmani latest thoughts on when UK interest rates will go down:

“Following an intense week of central bank decisions with most of them being in line with expectations of keeping rates unchanged, it's become evident over the past few months that financial markets are aligned in the belief that UK interest rates have reached their peak and it would be surprising if the Bank of England were to implement an increase in UK interest rates in the near future, with such a decision likely only occurring in response to a substantial shock in inflation data. Meanwhile, predicting the timing of the initial interest rate cut, which would mark the first fall in UK interest rates since March 2020, is more challenging.

One thing that remains clear is that the UK economy is in a much worse position than both its European and US counterparts as GDP forecasts continue to indicate the potential for a recession which may trigger a response from the central bank. The BoE has also appeared to follow the US central bank (Federal Reserve) in its footsteps and may await the signal from it before starting its own rate cut cycle as rates are also expected to start falling in early 2024. In either case, new Bloomberg projections point to the possibility of the first rate cut being implemented by the Bank of England in the summer of 2024, followed by a gradual fall in rates throughout the following meetings with the target being reached in the coming years.That being said, I believe the chances of rates starting to fall closer to March or April 2024 are increasing.”

Chart - Bloomberg implied UK interest rates

28th November - UK Interest Rates forecast to remain at 5.25% before falling to 5% in August 2024. Here are the latest uk interest rate forecast according to Bloomberg market data

In early November the Bank of England kept UK Interest Rates on hold for a second consecutive month at 5.25%. That decision was widely expected by market participants and their attention has firmly turned to the timing of when UK interest rates will go down or be cut.

What has been clear for some months is that financial markets are in agreement that UK interest rates have hit their ceiling. It would be a shock if the BoE were to raise uk interest rates above 5.25% anytime soon and this decision would likely only come if there was a significant shock to inflation data in the coming months.

The timing of the first interest rate cut - which would be the first cut to UK interest rates since March 2020 when rates were cut from 0.25% to 0.1% in a symbolic move to help contain the market fallout from the Covid pandemic emergence - is far less predictable. In the past week several Bank of England policy makers has been hitting the newswires in an effort to temper expectations of a uk rate cut for the summer of 2024. Jonathan Haskel - an external member of the BoE’s Monetary Policy Committee - stated today that it could take at leats a year for the UK labour market to loosen which means that there is no scope to lower borrowing costs ‘anytime soon’. His words echo that of BoE Deputy Governor Dave Ramsden who told Bloomberg TV that high services price inflation was a sign of inflation becoming more ‘homegrown’ - a signal that UK inflation could remain much more stickier than that which would allow a rate cut.

The key message from central bankers has been - UK Interest Rates won’t rise any further but they also won’t fall for some time yet.

Here are the latest UK interest Rate forecasts according to data from Bloomberg

According to the latest implied rate chart by Bloomberg, UK Interest Rates are expected to remain at 5.25% until the summer of 2024. The first UK Interest Rate cut is expected by August 2024 with rates predicted to fall to 5.00% with a further rate cut expected by November pushing UK interest rates down to 4.75%.

Chart - Bloomberg Implied UK Interest Overnight Rate & Number of Rate hikes and Cut

21st November - BoE Governor Bailey warns consumers Inflation won’t fall quickly and UK Interest Rates forecast to remain higher for longer

In comments made to MP’s, the Governor of the Bank of England Andrew Bailey warned consumers not to underplay the potential for inflation to remain sticky despite positive declines in prices in recent months. Bailey commented “We are concerned about the potential persistence of inflation and we go through the remainder of the journey down to 2 percent…And I think the market is underestimating that.”

Currently the financial markets latest UK interest rate forecast is for UK rates to remain at current levels of 5.25% until August 2024 where markets are predicting the first interest rate cut of around 0.25%, bringing UK Interest rates back down to 5%. UK rates are expected to float around similar levels before further predicted cuts into 2025 likely to bring UK Interest rates down further to around 4.5%.

Importantly Governor Bailey reaffirmed market forecasts that UK rates are unlikely to rise further by confirming his belief that BoE’s current policy approach should be enough to bring UK inflation back to its 2% target over time. The key message from Bailey was that this return to 2% won’t be fast and in that sense the market might be wrongly assuming interest rates to be cut sooner than the BoE can do so. The latest forecasts by the UK central bank is for Inflation to be back under its 2% target by the end of 2025, which is partly explaining the market forecasts for larger cuts to the UK Interest Rate to happen in 2025 as opposed to sooner in 2024.

What’s the latest mortgage rate predictions for the UK?

Average UK mortgage rates have steadily declined in recent months thanks to a marked improvement in two crucial areas. First and foremost, UK inflation declined to 4.6% last month to hit its lowest level in two years, marking three consecutive months of positive data surrounding UK inflation. The decline in UK inflation has convinced most in the market that UK interest rates have now peaked and the conversation has quickly turned to the likely first rate cut to happen in the summer of 2024. That has meant the horizon for longer term mortgage rates has improved markedly since the summer.And secondly, UK government bond yields have steadily declined as exemplified by yield on 2-year UK government bonds falling from 5.49% in July 2023 to 4.57% today, a marked improvement. Mortgage rates are directly linked to bond market yields and so the improvement of UK bond yields has created a much more favourable rate environment for mortgages in recent months.

So what does this mean for predictions on UK mortgage rates? We’ve seen mortgage lenders react to the improving UK Interest rate environment by cutting prices on mortgages consistently over the past few months. The average mortgage rate offered for 2 year fixed mortgages is now priced below 5%. Average five year fixed mortgage rate is still exceeding historical averages to trade at 5.8%. Data from the FCA shows that 1.4m mortgages are up for renewal before the end of the year, meaning that a significant number of homeowners still face a shock of a big jump in mortgage prices when they renew in the coming weeks and months.

15th November - UK inflation cools faster than expected: UK Interest Rates not expected to rise further and latest forecasts are for a UK rate cut in August 2024

Data out by the Office of National Statistics on 15th November showed that UK inflation cooled down from 6.7% to 4.6%, which was better than initial forecasts for a slowdown to 4.8%. The data showed UK inflation is now at its lowest level for two years whilst core inflation - which strips out volatile items like energy and food - also falling better than expected to 5.7% from 6.1%.

Chart - UK inflation falls to a new two year low

Source: Trading Economics

Source: Trading Economics

What does the latest inflation data mean for the latest UK interest rates predictions?

XTB Director Joshua Raymond commented on the UK interest rate forecasts in the below note which was sent to the media after the inflation data was released:

“We’ve seen investors sell the pound today in reaction to the better than expected inflation data. As a result, the pound lost ground against every major currency in early trading including -0.1% against the dollar and -0.3% against the euro. That’s by no means a major currency move, but what it does show is that investors are convinced the Bank of England has finished hiking rates and they are starting to feel that the first interest rate cut - expected to come in August 2024 - is now more likely. Moreover, core inflation - which strips out the volatile energy and food items - also came in better than expected to 5.7% and that’s important to see.

It’s worth remembering the positive inflation trend we’ve seen in recent months against market expectations. This is the third consecutive month that UK inflation data has not disappointed and it comes hot on the heels of better than expected US inflation data yesterday. We know from our clients that this week was such an important one for setting their interest rate expectations in the medium term and there was a degree of nervousness heading into yesterday morning’s session. So we are certainly seeing some relief from investors this morning helping UK stocks to rally by close to 1% in early trade. The inflation data is by no means enough of a sign for central bankers to declare victory over the fight against inflation. The fight was never about returning inflation from 11.1% to less than 5%. Given the turnaround in wholesale energy markets and supply, this was always likely. The real battle is returning inflation to around the 2% target and it's here where the battle is perhaps most difficult.”

7th November - Latest UK Interest Rate Forecast: Rates likely to remain at 5.25% until late 2024 with the first rate cut arriving in August 2024.

Last week the Bank of England moved to keep UK Interest Rates on hold at 5.25% for the second time in a row, with the decision widely expected by investors. However, the UK central bank also gave investors and mortgage holders more clues as to the likely path of UK Interest Rates for the next few years with the BoE expecting rates to remain higher for longer than initially planned.

So what are the latest forecasts for UK Interest Rates and how are rates likely to change over the next five years?

The latest predictions for the path of UK Interest Rates over the next 5 years are for interest rates to remain at or around current levels at 5.25% until the summer of 2024. That means UK interest rates will remain higher for much longer with a small chance of a further interest rate to 5.5% possible should UK inflation remain more sticky than expected. UK Interest rates are expected to end 2024 at around 5% before falling further to around 4.5% by the end of 2025, where they are expected to remain. That would mean that UK Interest Rates are following a similar predicted theme internationally, where US and EU Interest Rates are also expected to be cut from the summer of 2024.

Chart - Bloomberg Implied UK Interest Rate Wave

How might the latest UK Interest Rate Predictions change?

There’s been a few mixed signals from the Bank of England in the past week about the path of UK Interest Rates. On the one hand the BoE said - when keeping rates on hold last week - that they are prepared to hike interest rates again should inflationary pressures not recede and there are more chances of rates going up than down in the near term. However, this week the BoE’s Chief Economist Huw Pill stated that the bank could be in a position to ‘reassess or consider’ its stance on rates in the middle of 2024 - largely seen as an indication that it could be willing to start rate cuts from the summer of 2024.

So there is potential for the current 5 year UK Interest Rate predictions to change quickly in the near term. Much of this relates to the combined effects of high inflation and an underperforming UK economy. UK inflation had cooled off from previous highs but recently plateaued around 6.7%. With average UK earnings earnings rising and staying at record highs at 7.9% in July and holding at 7.8% in August, there is a real risk that these so called secondary inflationary effects could cement inflationary pressures in the UK economy, which could make further cooldowns in inflation (especially below 5%) much harder to achieve. Moreover, with the conflict in Israel/Gaza continuing to threaten contagion to the broader middle east region, there is the risk of higher energy prices which could create a second wave of inflation in the UK. So it’s easy to see how the risks on rates continue to be towards further rate hikes as opposed to sooner rate cuts.

That being said, any data pointing to a marked deterioration in the UK economy could bring the rate cut which is currently planned for August 2024 forward.

What are the key data points to watch for Interest Rate decision making?

The key focus for economists, mortgage holders (especially those on variable rates) and investors remains on inflation, earnings and GDP data. For rate cuts to come, UK Inflation data must be seen to be cooling down with momentum with average UK earnings stable.

We’ve put down some important data release dates to watch for the rest of 2023:

- 10th November 2023 - Q3 Preliminary GDP data released

- 14th November 2023 - Average Earnings data for September released

- 15th November 2023 - UK Inflation for October released

- 12th December 2023 - Average Earnings data for October released

- 13th December 2023 - UK Inflation for November released

- 13th December 2023 - Q3 GDP data revised

For more information on economic data, please see the calendar available on xStation.

2nd November - Bank of England holds UK Interest Rates at 5.25%. UK Interest Rate Forecast is for rates to stay at 5.25% for an extended period of time with increased potential for a further rate hike

Today the Bank of England's MPC voted to maintain UK Interest Rates on hold for the second time in a month at 5.25%, as widely expected by more than 80% of economists polled by Reuters. The MPC committee members voted in a similar pattern as last time around, with 6 members voting to maintain rates at 5.25% whilst 3 members voted for a 0.25% increase. That being said, the MPC did state their expectation that their monetary policy will need to remain ‘restrictive’ for an extended period of time despite the weaker economic outlook for the UK.

What are the latest UK Interest Rate forecasts?

The latest statement from the Bank of England has tempered the previous view amongst most market participants somewhat that UK Interest Rates have likely hit a peak at 5.25%. Whilst the markets still believe that UK Interest Rates are at or close to their peak, the chances for a further 0.25% rate hike has increased. That shows the BoE believes the war on inflation remains far from won yet despite the improvement in inflation data and any chance for an earlier than expected rate cut seems far from reality right now.

Certainly what has changed in the past 24hrs is the expectation of when UK Interest Rates might fall. Previously it had been predicted that UK Interest Rates were likely to stay at 5.25% until the summer of 2024 where we might then see a small rate cut to around 5.00% by the end of 2024, with rates falling further to 4.75% in 2025. Those predictions have now been pushed further out, with the latest UK interest rate forecasts being that interest rates will likely now stay at around 5.25% until Q4 2024 after which they might see a small 0.25% rate cut.

The clear message from today’s Bank of England MPC rate announcement seems to be that rates will continue to stay high for longer and rates are more likely to rise in the near term rather than get a cut, especially if UK inflation fails to cool down significantly in the coming months. Make no mistake, whilst still small, the chances of another Christmas rate hike has increased today.

31st October - 80% of economists convinced UK Interest Rates will remain on hold at 5.25% in BoE decision on Thursday 2nd November

Economists around the UK are united in their rate forecasts that the Bank of England will keep UK Interest Rates on hold at 5.25% when the central bank's MPC meets to decide on UK rates on Thursday 2nd November. Data compiled by Reuters showed that around 80% of economists polled expect UK rates to stay at 5.25% whilst 20% forecast UK Interest rates to rise by 0.25% to 5.5%.

It remains that the Bank of England continues to attempt to strike a fine balance between supporting fragile UK economic growth whilst also helping to cool uncomfortable levels of UK inflation, which exceeds the bank's 2% target.

Here’s XTB’s Chief Market Analyst Walid Koudmani’s UK Interest Rate forecast for Thursday’s big decision.

“At this stage, it would be a shock to the markets should the Bank of England hike interest rates again on Thursday. The vast majority of the market is convinced that the BoE will keep rates on hold for another month and adopt a wait and see approach to UK inflation data. We’ve seen two months of relatively positive developments on UK Inflation but with the conflict in the Middle East threatening to induce another wave of inflationary pressures to Europe thanks to higher oil prices, the Bank of England cannot be too aggressive here.

Most likely the UK Interest Rate forecast continues to be that Interest Rates have already hit their ceiling at 5.25% and will likely stay at current levels until mid-2024 where we might start to see some minor rate cuts. UK Interest Rates are likely to fall from there but are predicted to level off at around 4.5% in 2025. So in the medium term, we should continue to expect rates staying much higher than we have gotten accustomed to in the past decade.”

23rd October - UK Interest Rates forecast to remain at 5.25% with predictions that UK Interest Rates won’t start to fall until the summer of 2024.

The latest UK Interest Rates forecasts from various economists and data compiled by Bloomberg predict that UK Interest Rates will remain at 5.25% (current levels) for the time being and this is unlikely to change unless UK Inflation fails to show signs of a continued cooldown in prices.

The latest UK Interest Rate predictions mark a departure from previous forecasts which indicated UK Interest Rates could peak above 6% though these predictions came at a time when UK Inflation was running significantly higher than the levels economists had expected. Inflation has shown signs of a continued cooldown in recent months, with price growth declining from a high of 11.1% in October 2022 to 6.7% in September. UK Inflation remains much higher than the Bank of England wants, with the BoE targeting a 2% inflation rate which is seen as supporting sustaining economic growth.

What are the latest UK Interest Rate forecasts?

The latest projections for UK Interest Rates are as follows according to data compiled by Bloomberg and various economists:

UK Interest Rates have now likely peaked at 5.25% and they are expected to remain at current rates for some time. They are not expected to rise further - unless UK Inflation remains stickier - and are predicted to fall in the second half of 2024. The current market expectations for the Bank of England MPC meetings - which sets out the latest UK Interest Rate - is noted below (please note that the below market projections are always subject to change and are data dependent):

Bloomberg Chart - UK Interest Rate forecasts (Implied Rate Policy Rate Change)

What could affect the above predictions for UK Interest Rates?

Much fo the above is shaped by current expectations of UK Inflation with stickier inflation likely to force the Bank of England to keep rates higher for longer, whilst a sharp cooldown in price growth closer to the BoE’s 2% target could raise hopes that interest rates could be cut to spur fragile economic growth within the UK economy.

Interest Rates were kept on hold in July - when much of the market had expected rates to continue rising - after inflation data showed that price growth was cooling slightly faster than initially expected. As XTB’s Chief Market Analyst notes below in his comments, that sent a strong signal to the markets:

Koudmani commented: “The fact that the BoE took its first set of positive UK Inflation data in such an immediate way - by keeping rates on hold - sends a firm signal to the market that the BoE will only hike rates if the data forces it too. That makes a case now that when there is a 50/50 call to be made, the BoE is most likely to keep rates on hold or cut as opposed to play it conservatively and hike. They’ve firmly shown their hand in the July rate setting meeting and this is something that the market must heed.

What we need to see is a consistent decline in growth of prices within the UK to force the Bank of England to cut UK Interest Rates. That means we need to see UK inflation fall to below 4% before we are likely to see any move lower in UK Interest Rate forecasts and that remains far from certain due to a variety of reasons. In the immediate picture we still see supply constraints which are keeping UK production costs high. Moreover, wage growth remains at significantly elevated levels and these are ultimately being passed onto the consumers and is a clear threat to making UK Inflation much more sticky than initially expected. That could mean inflation runs higher for longer and would as a consequence force the Bank of England to keep Interest Rates high into 2024 and 2025.”

21st September - UK Interest Rates kept on hold at 5.25% in shock to financial markets. Is this the peak for interest rate rises? Latest Analysis

The BoE’s MPC kept UK Interest Rates on hold today in a big surprise to investors and economists who had largely expected the central bank to make a 15th consecutive rise in rates of 0.25% to 5.5%. The news sent the GBPUSD forex pair sharply lower to levels not seen since March 2023 as investors sold out of the pound in reaction.

Chart - The path of UK Interest Rates since 2014

Why has the Bank of England kept UK Interest Rates on hold?

The BoE has largely decided to adopt a wait and see approach when it comes to future interest rates after positive inflation data out yesterday showed price growth surprisingly cooled in August. The UK central bank has taken this as evidence that higher interest rates are already working enough to bring down price growth and it’s clearly concerned that further rate hikes might be deemed unnecessary at this time. More rate hikes hurt economic growth as it makes borrowing costs more expensive and encourages individuals to save money as opposed to spending it. Whilst this should help curtail the demand side effects that are driving inflation, it also saps economic activity and as such, the BoE is concerned that its efforts to bring inflation back under control could have broader implications for the medium term health of the UK’s economy. This is why the MPC is now hesitating towards making further interest rate hikes. That being said, it was a close call, with 4 out of the 9 members of the MPC voting to hike rates in today's meeting.

What does this news mean for UK Interest Rate forecasts?

Investors and economists alike are rapidly changing their interest rate forecasts in reaction to today’s BoE decision to hold interest rates at 5.25%. Before today it was broadly forecast that UK Interest rates would peak at around 5.75% by the start of 2024 and stay there until the second half of 2024 where we could start to see smaller rate cuts of around 0.25% to 0.5%. This would result in UK interest rates falling to around 5% by the end of 2024 and 4.5% by the summer of 2025.

The latest UK Interest Rate forecasts have now changed with most economists expecting UK Interest rates to peak at around 5.5% before falling to around 4.75% by the end of 2024 and 4.25% by the summer of 2025.

XTB’s Chief Market Analyst Walid Koudmani commented:

“Today the Bank of England published its interest rate decision which seems to have been a "close call" as recent strong wage growth indicated that a hike was almost certain and the market was pricing the probability of such a move at 70%. However, yesterday's inflation reading caused the probability of a hike to drop.

The actual decision turned out to be a surprise - rates were left unchanged at previous level as 5 MPC members voted to keep them unchanged while 4 MPC opted for a hike while governor Bailey was among those who voted for a no change in rates. The central bank also decided to cut gilt-purchases by 100 billion GBP over the next 12 months.

While rates were left unchanged, the BoE cautioned that further tightening is required if inflation persists which leaves investors in a precarious position as GBP took a hit on the decision with GBPUSD moving to a fresh daily low near 1.2234. The key message today is that rates are at their peak or close to it but with current data, it could be a dangerous signal to send the markets since if inflation keeps running hot, the BoE will need to hike once more and will look like they are chasing the curve yet again. Everything will depend on data coming out in the next few months and while inflation has shown signs of slowing, it remains unclear if it will continue this downtrend or force the BoE to make an instinctive move.”

20th September - UK Inflation surprisingly falls in August to 6.8%. Could help convince the Bank of England to pause interest rate hikes

Data out from the Office of National Statistics today showed a surprising fall in UK inflation growth from 6.8% to 6.7% in August when most economists had forecast a rise to 7%. Importantly, core inflation - which strips out the more volatile items such as energy and food - cooled sharply to 6.2%, which far exceeded initial expectations. The inflation data raises hopes that the cooldown of price growth in the UK could start to accelerate.

What does this improved UK Inflation data mean for UK Interest Rate forecasts?

Most economists remain convinced that the Bank of England will still hike UK interest rates from 5.25% to 5.5% in tomorrow's MPC meeting (at 12 noon). That would result in a fifteenth consecutive interest rate hike, with rates at their highest levels since early 2008. There are however now more doubts as to the steps for UK Interest Rates thanks in part to this positive inflation surprise, as discussed by XTB’s Chief Market Analyst Walid Koudmani below:.

Walid Koudmani commented:

“Make no mistake, this is a positive surprise. UK Inflation continues to see higher prices than most of the rest of the G7, which is a clear and present threat to UK economic growth. So the fact we are now seeing an accelerated cooling of core prices will do much to give the Bank of England pause for thought.

The BoE now faces a tough decision; do they continue to hike rates to help maintain this cooling of UK inflation or pause interest rate hikes to see which way the data points in the coming months? There is no easy choice because it’s clear from the data that UK inflation retains some heat. Average UK earnings remains at record levels and can help seed second round effects of high inflation which has the ability to keep price growth higher for longer. Nevertheless, higher rates damages economic growth and we’ve already seen substantial interest rate hikes already throughout 2023. It was claimed - by me and many others - that the Bank of England was far behind the inflation curve at the start of 2023. There is every chance that if they decide to continue to raise UK Interest Rates now that inflation has started to cool faster, they could be accelerating past the curve.”

Chart - UK Inflation surprisingly falls in August to 6.7% which could help convince the BoE to take a pause from hiking UK Interest Rates

Chart - UK Core Inflation (which excludes volatile items such as energy and food) cooled sharply to 6.2%, adding weight to the argument that the Bank of England might refrain from further interest rate hikes above 5.5%

12th September - UK wage growth continues to grow at record pace of 7.8%, increasing chances of higher UK Interest Rates in September

Data out from the Office of National Statistics on Tuesday 12th September highlighted the sustained pressure that wage growth may be having on UK Inflation. Annual growth of average pay excluding bonuses remained unchanged in July at 7.8%, which is the highest pace of wage growth since records began in 2001. Total pay including bonuses rose at a pace of 8.5% with much of this boost coming from pay settlements with NHS and civil service workers to end their respective strikes. However, this pay growth of 8.5% was stronger than economists had expected, with much of the market forecasting an unchanged reading of 8.2%.

What does this strong UK Wage earnings data mean for UK Interest Rates?

UK Interest Rates are widely predicted to rise from 5.25% to 5.5% when the Bank of England’s MPC next meets on 21st September 2023. If economists were looking for clues which might convince members of the MPC to pause its current interest rate hiking cycle, this set of wage data didn’t provide it. Wage growth adds further upward pressure to inflation as it increases business costs which ultimately get passed onto consumers in the form of price rises. This is why the Bank of England takes wage growth data seriously in its economic outlook. Importantly however, wage growth is now outstripping inflation meaning the average worker is finally seeing a change in their real income, something not seen for many years outside of the Covid era.

That being said, the UK unemployment rate rose - as expected - to 4.3% with around 207,000 people out of the workforce in July which was slightly more than expected. This ultimately may give economists confidence that wage growth at current levels might not be sustainable as with a rising number of people out of work, employers won’t have to offer the current levels of higher wages to attract talent for much longer.

16th August - UK Inflation slows to 6.8% in July but not enough to stop UK interest rates hitting 5.5% in September, analysts say

UK Inflation slowed to 6.8% in July, marking a continued cooling of UK inflation from the highs of 11.1% in 2022. Yet the slowdown was widely expected as most economists had forecast July should show UK inflation cooling to 6.8% thanks to a sharp drop in gas and electricity prices. On the outset, it's positive to see UK inflation remain in slowdown mode and cooling in much of the trajectory that analysts expect - having failed to cool in the speed most people had forecast in the first half of 2023. UK inflation is now at its lowest level since February 2022 and remains on track to hit around 5% before the end of 2023.

Chart - UK Inflation continues to fall, with price growth cooling to 6.8% in July

Core Inflation continues to be a headache

The troubling aspect in the UK inflation data reading concerned Core Inflation. UK Core Inflation - which strips out volatile items such as energy and food - remained at 6.9% when price growth had been predicted to slow to 6.8%. Core inflation remains elevated with price growth remaining between 6.8% and 7.1% since April 2023, meaning prices continue to rise at a steady rate across many products and sectors. Now when you combine this aspect with the extremely strong UK Wage growth data out on 15th August, where wages grew by 8.2% and far higher than most economists had expected.

Chart - UK Core Inflation remains elevated and troublesome

What is the current UK Interest Rate forecast? And when might UK Interest Rates start to fall?

According to Bloomberg data, the market is 99% convinced that the BoE will hike UK interest rates by 0.25% to 5.5% when it next meets on 21st September. And what’s more, the market continues to price in at least 1 or 2 more rate hikes between November 2023 and January 2024, with UK interest rates expected to hit a peak of between 5.75% and 6%. The July Inflation data is unlikely to do much to deter the Bank of England’s MPC members from refraining from further interest rate hikes in the next three months. For the BoE to pause its current cycle of hiking UK Interest rates, it is likely we will need to see Core Inflation start to decline much more markedly than we have seen in recent months and UK Wage growth start to cool. Stubbornly high core inflation is an example of price rises becoming much more sticky and longer term whilst wage growth poses a threat to medium term inflation remaining elevated as business costs rise and ultimately firms need to hike prices to maintain profit margins. Until the BoE starts to see those trends, it's very likely that UK Interest Rates will remain higher for longer. It’s for this reason that the market is not expected to see any UK rate cuts until well into 2024.

15th August 2023 - Record UK wage growth pace heightens chances of UK inflation running higher for longer

Data from the Office of National Statistics on Tuesday 15th August shocked the markets to print a record regular wages growth for the UK, with average earnings rising 8.2% in June from 7.2% in May (on an annual basis). That was far stronger than the market had expected, which was a smaller wage growth rise to 7.3%. Excluding bonuses, regular pay growth jumped to 7.8% against expectations of a drop to 7.4% (from 7.5% in May).

Chart - UK Average Weekly Earnings growth hits 8.2%

What does this wage growth data mean for UK Interest Rate forecasts?

Stronger than expected wage growth is a clear sign of secondary effects from rising inflation and further evidence that UK inflation is likely to stay higher for longer. In an effort to retain staff who are demanding more pay amidst the cost of living crisis, employers are having to offer higher wages to keep staff. By doing so, this increases the typical business operating costs which ultimately get passed to the consumer through rising prices, thereby seeding inflation into the UK economy more broadly and for the longer term. In essence, strong wage growth likely makes higher inflation stickier and therefore it forces the Bank of England to keep rising UK interest rates to help cool the demand side effects that it believes is a major part of what's driving UK inflation.

Markets are pricing in a 99% chance of UK Interest rates rising by 0.25% to 5.5% in September’s MPC meeting

It’s worth noting that on the back of stronger than expected UK wage growth data, the financial markets are now pricing in a 99% chance that UK interest rates will rise by 0.25% in September 2023 to 5.25%.

3rd August 2023 - UK Interest Rates rise to 5.25% in latest Bank of England move to curtail UK inflation

The Bank of England’s MPC moved to increase UK interest rates for a 14th consecutive time on 3rd August, by hiking rates to 5.25% - an increase of 0.25%. This increase was anticipated by the financial markets after recent UK inflation data showed prices had started to cool faster than expected. This latest rise means UK interest rates have now hit a new 15 year high.

UK Interest Rates are forecast to hit 5.75% - 6% by end of 2023

The current forecasts by economists and the markets alike remain that UK interest rates are expected to peak at between 5.75% and 6% by the end of 2023 or start of 2024. UK interest rates are not expected to fall until mid 2024 and are likely to fall to around 4.5% by 2026.

25th July 2023 - UK Interest Rates are forecast to rise as high as 5.75% by the end of 2023 before falling in 2024 - latest predictions

The latest set of UK Inflation data - which showed that UK price growth in June was slowing at a faster pace than initially expected - has convinced economists and financial markets to re-evaluate their forecasts for how high UK Interest rates may rise in the next six months. Only a few weeks ago it was expected that UK Interest Rates would likely rise as high as 6.5% by the first quarter of 2024. Now those forecasts have been reworked and financial markets are predicting UK interest rates will rise between 5.75% and 6% by Q1 2024.

Chart: Bloomberg Implied UK Interest Rates

Here you can see how the implied UK interest rate has changed markedly in July (green line) compared to original forecasts in June (yellow line). As of 25th July 2023, UK Interest Rates are now expected to rise from 5% in July to a high of around 5.75% in January 2024.

When might UK interest rates start to fall?

UK Interest Rates are now expected to fall towards the end of 2024 and well into 2025 after hitting highs of around 5.75% to 6% in the first three months of 2024. Economists are now expecting UK interest rates to remain around 5.50% to 5.75% for most of 2024 before starting to fall at the end of the year. UK Interest Rates are expected to fall by around 0.75% to 5% by mid-2025 and even further into 2026 where they are forecast to settle at around 4.5%.

When is the next Bank of England interest rate meeting and what are markets forecasting?

Below we list the key Bank of England MPC meeting dates and how interest rates might now rise at each meeting with the latest data:

- 3rd August 2023 - a rise of 0.25% could bring UK interest rates to 5.25%

- 21st September 2023 - a rise of 0.25% could bring UK interest rates to 5.50%

- 2nd November 2023 - a rise of 0.25% could bring UK interest rates to 5.75%

- 14th December 2023 - a rise of 0.25% could bring UK interest rates to 6.00% or the BoE could keep rates on hold at 5.75%

19th July 2023 - UK Inflation surprisingly slows faster than expected in June, increasing hopes that UK interest rates won’t need to rise to as high at 6.5%

Data out on 19th July showed UK inflation cooled faster than expected in June, falling from 8.7% to 7.9%. Economists had predicted prices growth to slow to 8.1%. Core inflation - which strips out energy and food - also slowed surprisingly to 6.9% when the market had expected prices growth to remain at 7.1%.

Why is it important to see UK inflation cooling?

It’s important on two fronts; first, because core inflation is finally coming down. Core inflation is seen as a better barometer of inflation because it strips out volatile items such as energy and food. So the fact that core inflation is now falling raises hopes that UK inflation may now start to cool off faster and broader than in the previous months. Second; this is the first data set out of the UK in many months which has shown inflation has declined faster than initially expected. Previously most UK inflation data and wage data has come in higher than economists expected. If we start to see inflation come in lower than forecast in the coming months, that will do much to change the guidance from the Bank of England and would raise hopes UK Interest rates won't need to go as high as 6.5%.

XTB’s Chief Market Analyst Walid Koudmani on whether this UK inflation reading might affect UK Interest Rate hikes:

“Make no mistake, this is a positive inflation reading but it's too early to warrant a dramatic change in forecasts for UK Interest Rates. Whilst it's great to see inflation fall faster than expected and core inflation is also finally falling, we cannot take one month of data in isolation. The general trend for UK inflation remains that it's much stickier than initially expected and as a consequence, UK interest rates will need to rise higher and faster to combat this. The market is still expecting UK interest rates to rise by 0.5% to 5.5% in August. I don’t believe the recent UK inflation data will change that outlook right now. However, if we do start to see July and August inflation data cool faster than expected with UK wage growth also pausing, that will do much to convince us that UK Interest Rates may not need to rise to 6.5% at the start of 2024.”