Picture a bustling marketplace that never sleeps, where traders from around the globe are constantly buying and selling. This isn’t your ordinary marketplace; this is the foreign exchange market, better known as forex. The foreign exchange market is the largest market in the world, but it is worth noting that the forex market is dominated by speculators who trade trillions of dollars every day, all over the world. But currencies are not just about trading. How can they be used in investments?

Picture a bustling marketplace that never sleeps, where traders from around the globe are constantly buying and selling. This isn’t your ordinary marketplace; this is the foreign exchange market, better known as forex. The foreign exchange market is the largest market in the world, but it is worth noting that the forex market is dominated by speculators who trade trillions of dollars every day, all over the world. But currencies are not just about trading. How can they be used in investments?

The strength of each currency is always expressed in another currency, and the relationship between them is constantly changing. Investors should be aware of the currency exchange risks involved in investing in foreign currencies, and the potential for “hedging” that the forex market creates. Currencies are not just about buying banknotes at the exchange office. Understanding them in depth and gaining knowledge related to the analysis of economic data and situations can be an important part of a broader investment strategy.

Basics of currency investment

For investors, currencies may be seen not as an alternative to conventional financial markets, but as completely different assets. Of course, investing in currencies revolves around the buying and selling of currencies, with the aim of profiting from fluctuations in their value. But in general, currencies offer much more to investors because all assets are denominated in them, mostly in US dollars.

The growing interconnectivity of the globe and advancements in digital technologies continue to fuel the expansion of the market. The ease and convenience of online platforms have unlocked the world of forex to a whole new groups of private investors and traders.

- Forex is not like a stock market exchange, located in a specific location like New York or Hong Kong, restricted by conventional trading hours. It operates around the clock, five days a week, across major financial centres worldwide.

- From London to Tokyo, traders can exchange currencies electronically, responding in real-time to market fluctuations. Operating 24/5, the forex market offers uninterrupted opportunities and huge liquidity also for big, institutional investors.

Currency market operates on the principle of currency pairs. Think of it as a seesaw - when one currency goes up, the other must come down. The first currency in the pair is the base currency, which is always set equal to one. The second is the quote currency, whose value is determined by the exchange rate.

The currency pair dynamic underpins currencies investing, with key pairs such as EURUSD and GBPUSD accounting for a significant portion of the market’s volume. If we take the biggest one, EURUSD as an example we can see that base currency is EUR and quote currency is USD. If EURUSD declines, it means that EUR loses and USD strengthens. If EURUSD rises, it means that EUR gains and USD weakens. In effect, we can buy more US dollars with euros.

Why do world currency rates change?

There are two basic FX rate factors, which influence the strength of each currency in the world. Those are:

- Fundamentals such as monetary policy, economic conditions and perspectives, macro data etc.

- Psychological factors such as global risk perception, market conditions, geopolitical risks etc.

The currency rates depend on, among others, the economic situation of given countries. Thus, macroeconomic figures have an impact on currency movements. If the country’s economy grows quickly, the currency of such a country should be stronger. If the country’s economy experiences a crisis, the country’s currency should move lower. As a result, investors keep an eye on macroeconomic releases and events. When the currency weakens, we call it “depreciation”. When the currency strengthens, we call it “appreciation”.

6 basics exchange rates factors

- Inflation (lower inflation rate helps to purchase power and thus is long term positive but could be short term negative if it lowers rate expectations)

- Monetary policy (higher rates strengthen local currency, lower rates weaken currency)

- Fiscal policy (higher level of government debt is negative for the currency)

- Political stability (instability leads to a currency depreciation)

- Balance of payments (current account deficit causes depreciation of local currency)

- Economic performance of the country

Important: Usually, during weak investor periods and risk aversion, US dollar gains. Investors are choosing cash to boost their “greenback”. That’s why it’s named one of the ‘safe haven asset classes’. But remember, it’s not a golden rule, and it always depends on situations. On the other hand, euro usually gains when investors' risk appetite is higher, which means higher optimism level in the markets.

Economic indicators and their impact

Economic indicators act as a barometer, gauging a country’s economic climate. For instance, a high GDP indicates a robust economy, which can strengthen a currency. On the flip side, high inflation can weaken a currency’s buying power and cause volatility in exchange rates. These indicators provide a snapshot of a country’s economic health, helping traders to anticipate market movements and make informed investment decisions.

Political stability and currency strength

Imagine a boat in a stormy sea, tossed by waves and buffeted by winds. This is what an unstable political climate can do to a currency’s value. On the other hand, political stability can calm the waters, fostering investor confidence and strengthening a nation’s currency. It’s a testament to the fact that in the world of forex trading, not all change is driven by numbers.

Currencies investing opportunities and use cases

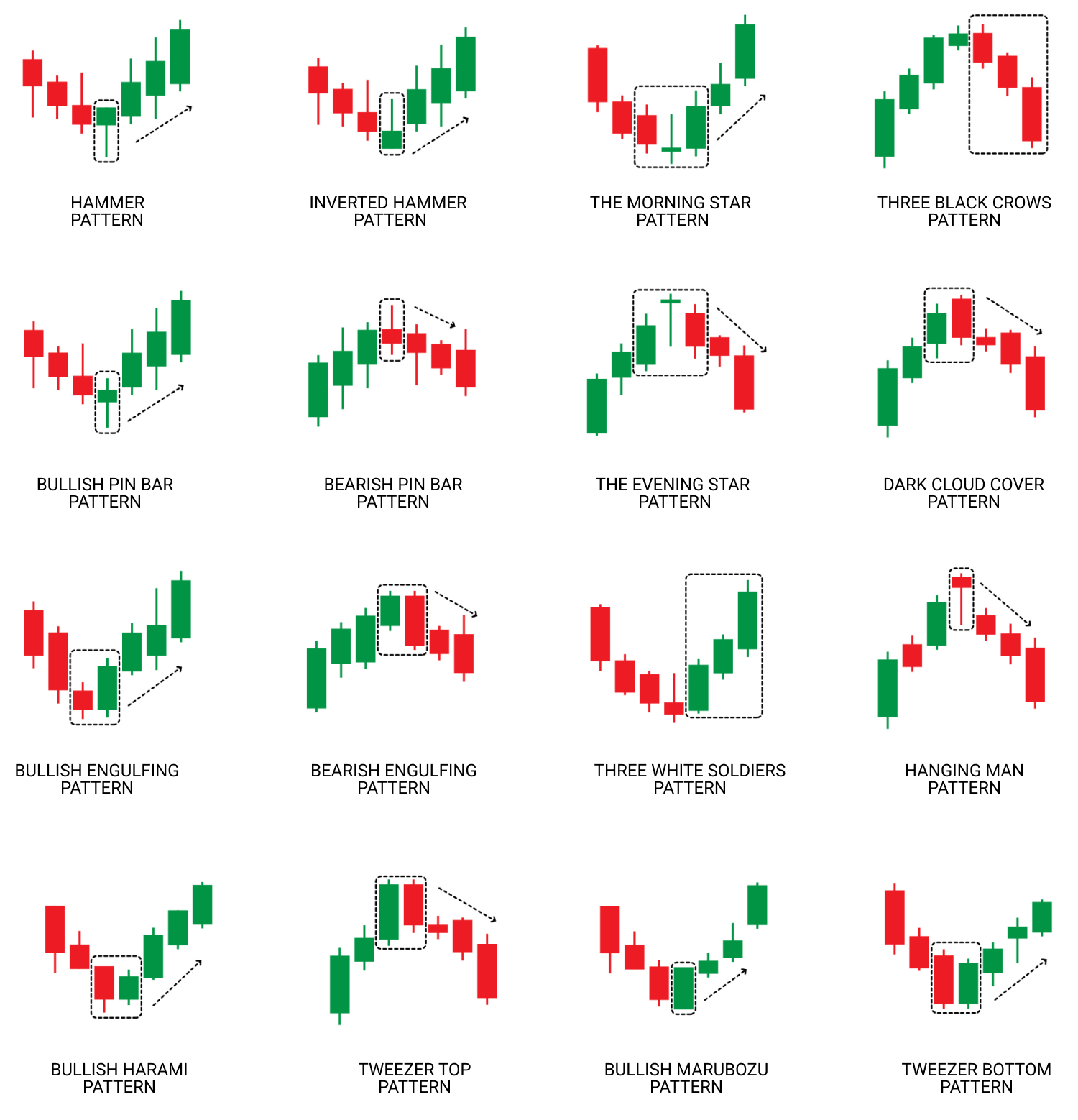

Much like an experienced sailor interpreting the winds, a successful forex trader depends on efficient strategies to steer through the market currents. Two of the most popular approaches are fundamental analysis, which focuses on economic indicators, and technical analysis, which uses charting tools to predict price movements. Combining these two approaches can give traders a holistic view of the market, guiding them towards informed trading decisions.

Much like an experienced sailor interpreting the winds, a successful forex trader depends on efficient strategies to steer through the market currents. Two of the most popular approaches are fundamental analysis, which focuses on economic indicators, and technical analysis, which uses charting tools to predict price movements. Combining these two approaches can give traders a holistic view of the market, guiding them towards informed trading decisions.

Currency investing

Investors who are buying shares denominated in another currency than currency, which is used for buying shares in stocks or ETFs, are taking so-called “foreign exchange risk”.

- Generally, to invest in currencies, you need to exchange the currency at a physical office or online, but the market also offers other, less obvious ways to gain exposure to a currency. Of course, the goal of investing in currencies is not to take a huge return but to diversify capital or have a little, additional gain. As any other investments, it also carries some risk;

- One such way is to buy assets, such as stocks or ETFs, denominated in a different currency than the currency they are being purchased for. In such a situation, for example, an investor using Euro to buy stocks listed in the U.S. Dollar, will reference an additional profit if the USD strengthens against the EUR. If the USD weakens against the EUR, such an investor will suffer an additional loss because of it.

First Example

An investor purchased 100 Tesla shares at $100 per share, using the EURO currency to make the purchase. When he made the purchase, the EURUSD exchange rate was 1. When he sold, he made a profit by selling his shares at a price of $120, and realised it at a time when the EURUSD exchange rate had risen to 1.10.

In such a situation, we see that since he made the investment, the Euro has strengthened against the dollar by about 10%. Such an investor will make a profit of about 20% from the difference in the price of the stock at the time of buying and at the time of selling, and an additional profit of about 10% from the change in the exchange rate.

Second Example

An investor purchased 100 Tesla shares at $100 per share, using the EURO currency to make this investment. When he invested money, the EURUSD exchange rate was 1,0. When he sold, he made a loss by selling shares at a price of $90, and realised it at a time when the EURUSD exchange rate had fallen to 0.9.

In such a situation, we see that since he made the investment, the Euro has weakened against the dollar by about 10%. Such an investor will make a loss of about 10% from the difference in the price of the stock at the time of buying and at the time of selling, and an additional loss of about 10% from the change in the exchange rate.

Third example

An investor purchased 100 Tesla shares at $100 per share, using the EURO currency to make the purchase. When he made the purchase, the EURUSD exchange rate was 1. When he sold, he made a loss by selling his shares at a price of $90, but he did it at a time when the EURUSD exchange rate had risen to 1.10.

In such a situation, we see that since he made the investment, the Euro has strengthened against the dollar by about 10%. Such an investor will have a flat result on his investment. The 10% loss from the difference in the price of the stock at the time of buying and at the time of selling, will be balanced by about 10% gain from the change in the exchange rate.

In summary, exchange rate risk has two sides. It can bring an investor additional profit if he expects his currency to weaken against the one in which the stock or ETF in question is traded (and if it will really happen). On the other hand, it can bring a loss if such a scenario does not materialise. Nevertheless, it is a sure way to gain additional exposure to the currency market.

Analysis and role of expectations

Currency prices are shaped by the markets. Sometimes there are so-called currency “Interventions”, by central banks, but even these are ultimately met with a market reaction. Sentiment is a powerful factor that affects currencies, sometimes in isolation from the fundamentals. Nevertheless, as a general rule, there are factors that affect currency prices positively, or negatively. Below we will list some of the basic ones. The reaction of a currency to published data largely depends on how a given reading measures against market expectations. Thus, strong data does not always mean a strengthening of the currency, and weak data can be perceived positively by the market if it manages to positively surprise forecasts.

Fundamental analysis

Fundamental analysis is like a compass, pointing traders in the direction of economic trends. By focusing on economic indicators like GDP, inflation rates, and employment data, investors can gain a deeper understanding of a country’s economic health. This, subsequently, can offer useful perspectives on a country’s currency’s potential value, assisting traders in guiding their investments towards profitability.

There are three main types of economic indicators – leading indicators, coincident indicators and lagging indicators. Nevertheless, leading indicators gather rather more attention as they are often used to make predictions. Among leading indicators we could find, among others, purchasing manager indices (PMI), ISM indices, home sales, building permits, weekly jobless claims, stock prices, and consumer expectations (e.g. University of Michigan sentiments index).

Monetary policy

Monetary policy is a policy of the monetary authority of a country (typically central bank) that decides about costs of borrowing money and regulates the monetary base (i.e. a quantity of money in circulation). In many countries, monetary policy is separated from fiscal policy as it increases credibility and stability of a currency. Central banks have three main conventional instruments – open market operations, discount rate and reserve requirements. However, they also have some unconventional instruments, such as quantitative easing (QE). Decisions of monetary authority have a real impact on the economy, which is why they are widely observed by market participants.

Dovish policy (expansionary) low interest rates, usually support currency strength

- lower risk-free rate

- may lead to inflation and job creation

- the goal is to support demand in the economy

- usually leads to currency depreciation

Hawkish policy (contractionary) high interest rates, usually support currency strength

- high interest rates

- higher risk-free rate

- may lead to disinflation and higher unemployment rates

- the goal is to reduce demand in the economy

- usually leads to currency appreciation

Fiscal policy

A fiscal policy is responsible for redistributing resources in the economy in a way that ensures desired functions of the state, redirects wealth in line with social policy targets and manages state assets (and debt). As state expenditures may vary depending on policies being employed and revenues vary depending on tax levels and economic conditions, the budget records different levels of deficits or (in a much rarer case) surplus. Changing budget balance renders (sometimes inadvertently) fiscal policy to be expansionary or contractionary.

- Expansionary - lower taxes, rising government debt, higher budget deficits and spending (usually it means currency depreciation)

- Contractionary - higher taxes, lower level of government debt, lower government spending (usually to support currency strength)

Technical analysis

Technical analysis may be like a telescope, helping traders spot potential trends on the horizon. By using charting tools and indicators, traders can identify patterns in price movements, predicting potential entry and exit points for their trades. Thus, technical analysis acts as a navigational tool, aiding traders in mapping their course through the forex market.

The role of expectations

Expectations play a key role for financial markets. Market expectations may be often included in current prices. However, unexpected results may spur additional volatility on assets or investments tied to a given publication. Due to this, investors often keep an eye on all news, publications, and readings related to their investments.

Moreover, if a publication is stronger than previous print, but is still weaker than market expectations, it may affect markets negatively. In most cases, the reverse situation would have a reverse effect. On the markets that are efficient, only the new information (not yet discounted by prices) could affect prices. However, it’s important to know that market reactions are also driven by psychology, which makes some reactions almost unpredictable. Let’s see two examples here.

Past performance is not a reliable indicator of future results.

Germany - Industrial PMI

June 2023

Previous: 43,2

Forecast: 43,5

Actual: 41

EURUSD weakened and saw some panic reaction after much weaker than expected ‘recessionary’ PMI readings from Germany, which came on June 23, 2023. German industrial PMI at 41 points was much lower than 43,5 expected improvement by analysts (from 43,2 previously). This result was also the lowest since 2020 and even PMI ‘lows’ from 2019 were higher than that number. Also, services PMI was lower at 54,1 level vs awaited 56,3 reading (only a little lower than 57,2 previously). Do notice that many factors have an impact on the currency pair, and in this example these other factors came into play after investors digested a good PMI release. Source: xStation5

Past performance is not a reliable indicator of future results.

US - Q2 2023 GDP (revision)

Previous: 1,3%

Forecast: 1,4%

Actual: 2%

Here, you can see that unexpected data could also impact stock markets. In this case, the better-than-expected Services US GDP data pushed USDIDX (futures on US dollar index) higher. USDIDX surged on 29 June 2023 after better than expected US GDP Q2 revision which came in at 2% vs 1.4% exp. and 1.3% previously. After GDP upbeat, markets this day saw also strong US consumption data with much lower than exp. US jobless claims number (239k vs 265k exp.). Strong data supported expectations for further Fed interest rate hikes and maintaining hawkish policy for longer.

Economic indicators such as GDP, inflation, and unemployment rates serve as guiding beacons, providing insights into a country’s economic health. But it’s not all about numbers. The strength of a currency can also be swayed by political stability, reflecting investor confidence in a country’s governance and economic outlook. Analysing currency data can provide valuable insights into these factors.

FAQ

Investing in currency can be a profitable investment. Currencies have lower volatility historically than stocks but at the same time a goal of currencies investing is completely different than stocks. It’s very hard to have huge gains from currencies investing, but especially for long term investors, currencies may bring higher diversification and support their wealth. At the same time, if you are not an experienced trader, it is not advisable to engage in currency day-trading as this can also result in loss.

Investing in a currency like the Swiss Franc or American Dollar can be a popular choice, given their stability and an advanced banking system that supports its national currency. This is further bolstered by a strong market economy, high GDP, and low unemployment rate.

Forex trading involves the buying and selling of currencies with the aim of profiting from fluctuations in their value. By buying low and selling high, traders can take advantage of these market movements to make a profit.

If you think there are strong arguments that the currency you hold will weaken, you may decide to diversify by gaining exposure to foreign currencies. The argument for a weakening currency could include weak economic growth, higher inflation or very “dovish” central bank policies.

The most stable currencies in the world are considered to be the U.S. dollar or the Swiss franc, among others. In both cases, the central bank (Fed and SNB) controls the issuance of money. Over the decades, the U.S. dollar has earned the status of a so-called “safe haven” asset, which can gain during market tensions or crises, during which investors sell off stocks and “return to cash”.

It is possible to earn money by trading forex, but what matters more to investors is what happens to a currency in the long term. As we mentioned in the article, buying stocks in foreign currency can bring additional profit or, on the contrary, weaken investing results (exchange rate risk resulting in a loss).

Understanding Forex Volatility: Causes, Effects, and Strategies

Understanding Interest Rates

What is Next for the AI Trade?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.