Summary:

-

Financial Times report unveils exposure of the European banks to Turkey

-

BBVA (BBVA.US), UniCredit (UCG.IT) and BNP Paribas (BNP.FR) among the most endangered lenders

-

After Friday’s sell-off investors continue to push prices lower on Monday

The latest unprecedented drop in the Turkish lira valuation has drawn attention of the market participants as well as financial media. Financial Times issued a report on Friday that exerted quite a significant downward pressure on some of the European banks. Namely, the newspaper claimed that the European Central Bank is concerned about the exposure of BBVA (BBVA.ES), BNP Paribas (BNP.FR) and UniCredit (UCG.IT) to the Turkish market. Share prices of those banks took a dive as a consequence.

The Bank of International Settlements states that the Turkish banks have USD-denominated claims worth almost $150 billion while liabilities denominated in EUR are said to be worth as much as $110 billion. Given a steep depreciation of the Turkish lira against both the US dollar and euro, domestic lenders may find it harder to meet those commitments and in turn the risk of default of these institutions increases. The aforementioned European banks have a significant stakes in some of the Turkish lenders.

BNP Paribas (BNP.FR) plunged around 3.4% on Friday after the Financial Times report was released. Source: xStation5

BNP Paribas, the French bank specializing in both retail and investment banking, holds over 70% stake in the Turkish retail bank TEB. Taking the 2017 end-year book value of the company (the Bank was delisted therefore recent market capitalization data is unavailable) the BNP’s involvement could be worth around $1.7 billion. However, one of the Financial Times’ sources from within the BNP claimed that the Turkish exposure amounts to around 2% of the total BNP’s commitments therefore it is “very limited” and does not pose significant risk to the whole group.

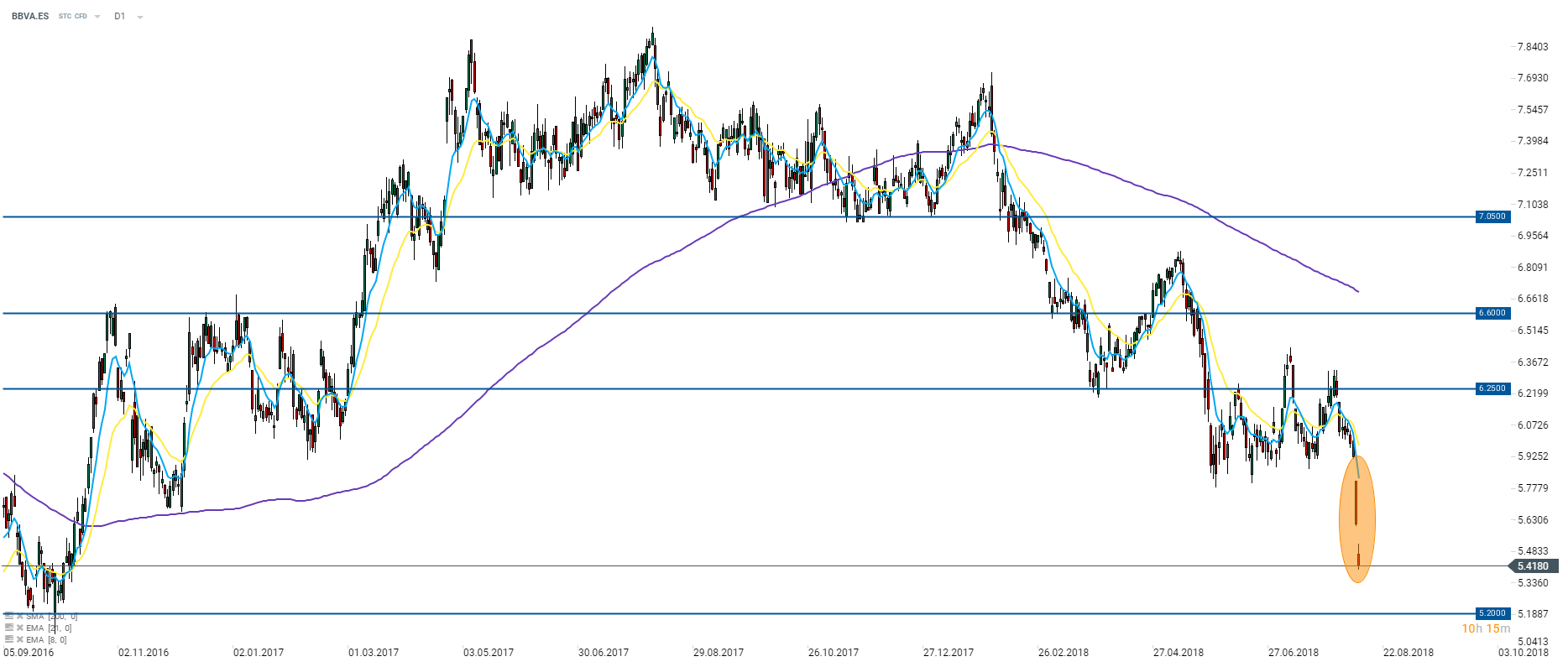

BBVA (BBVA.ES) erased almost 5.3% from its valuation on Friday, a move that has been extended to 8.7% today. Source: xStation5

Another institution mentioned in the report is BBVA, the second largest Spanish bank. BBVA holds close to 50% stake in the Turkish Garanti Bank. Taking the end-June 2018 market capitalization of Garanti we can calculate that BBVA had as much as $3.8 billion in lender’s shares back then. That amount has shrinked to around $1.7 billion now in case no reductions to this position have been made since then. However, Carlos Torres Vila, the CEO of BBVA, expressed last month that the Bank was very well prepared for such situation and has increased its exposure in the inflation-linked instruments while reducing the one in the FX loans.

UniCredit (UCG.IT) slumped 5.1% on the final trading day of the previous week. Another 4.4% was erased in the first half of Monday’s trading. Source: xStation5

Last but not least, the Italian UniCredit was named in the report due to its 40.9% stake in the Turkish Yapi Kredi bank. At the end of the second quarter of 2018 this stake was worth around $1.84 billion. However, due to the TRY depreciation this value has decreased to below $840 million now. UniCredit officials asked for comment expressed that the Yapi Kredi’s underlying performance is good and any impact resulting from the FX rates fluctuations would be absorbed by the Turkish bank’s own reserves.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.