The dollar-yen pair remains near critical levels as traders weigh policy divergence between the Fed and BOJ amid increasing intervention risks and Japan's record budget approval.

Key Market Statistics:

- Current Price: 157.55

- 2024 High: 158.08 (December)

- Weekly Change: +0.8%

- YTD Performance: +10%

- Key Level: 160 (Intervention risk zone)

- Post-BOJ Meeting Range: 153.34-158.08

BOJ Policy Dynamics

Recent BOJ meeting opinions reveal mixed views on rate hike timing, with some members seeing conditions aligning for a near-term move while others advocate patience given uncertainties around incoming President Trump's policies. The central bank's new earnings estimates show potential losses of up to $13 billion under a 2% rate scenario, highlighting the challenges of policy normalization.

Political and Fiscal Landscape

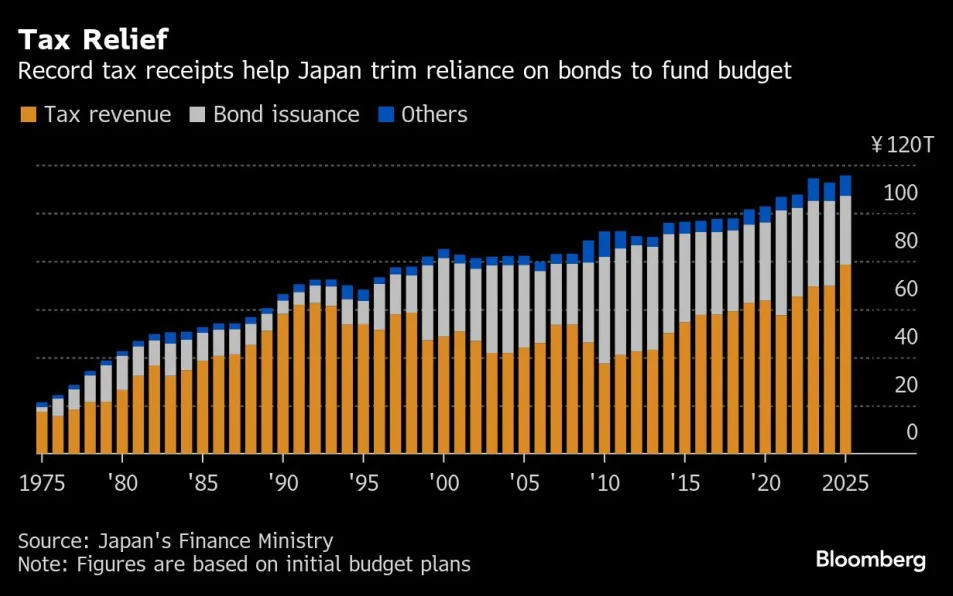

The approval of Japan's record ¥115.5 trillion budget for FY2025 marks a key test for PM Ishiba's minority government. The 2.6% spending increase, coupled with reduced bond issuance, signals fiscal consolidation efforts. However, political uncertainty around budget passage could influence BOJ's January rate decision.

Source: Bloomberg

Intervention Risk

Finance Minister Kato's renewed warnings against excessive currency moves have heightened intervention speculation as USD/JPY approaches 160. The recent climb to five-month highs has prompted increased official rhetoric, though actual intervention thresholds remain unclear.

2025 Outlook

While markets now price a 42% chance of January BOJ hike, rising to 72% by March, the trajectory remains highly dependent on wage trends and U.S. policy clarity. The interplay between monetary normalization, political stability, and currency market dynamics suggests continued volatility ahead, with 160 emerging as a key psychological and intervention risk level.

USDJPY (D1 Interval)

The USDJPY pair is approaching the late-April highs of 157-158, a level that previously prompted FX intervention. Following such intervention, USDJPY retraced to the 50-day EMA, suggesting that for bears, the target could be around 153.167.

Bulls, on the other hand, may aim for a retest of the all-time highs in the 160-161 zone. The RSI is consolidating near the overbought zone, which has historically signaled an additional leg up before a potential correction. Meanwhile, the MACD continues to gain but is narrowing, indicating that momentum may be diminishing. Source: xStation

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.