News of yet another, more dangerous Covid variant took markets by a surprise today. Risk assets like equities or industrial commodities plunged while safe haven bets soared. Investors have once again turned to so-called "pandemic winners" and away from oil and travel companies. Declines in asset prices during previous pandemic waves were rather short-lived but this time a lot will depend on whether it will affect monetary policy outlook or not.

New coronavirus variant found in South Africa

New coronavirus variant that is in the centre of attention today was found in South Africa. While new Covid variants are surfacing from time to time, this one seems different as it is said to be much more transmissible and much more resilient to antibodies. On top of that, it is already widespread across South Africa and some cases were reported in Asian countries. As there is a risk that available treatments and vaccines will be ineffective against this strain, the threat of new lockdowns being imposed looks real. Not to mention that numerous countries, especially in Europe and Asia, have already considered imposing tougher restrictions to combat recent surge in cases.

Winners and losers

Magnitude of moves in the markets today is large and it is easy to distinguish winners from losers in this situation.

Oil as well as travel and aviation stocks are taking the biggest hit. It should not come as a surprise as lack of effective treatment against a new variant would likely push governments to impose travel restrictions in order to curb or at least delay spread of virus. Energy commodities, like oil or gasoline, drop 5-6% and Euro Stoxx 600 Travel and Leisure sub-index is also 5% down on the day.

As investors flee risky bets, safe haven assets like Swiss franc, Japanese yen or gold are on the rise today. Stock traders, trying to get ahead of potential lockdown announcements, turn their attention to the so-called "pandemic winners". Food delivery companies, providers of "stay-at-home" software as well as medical stocks defy overall bearish sentiment and trade higher today.

OIL continues to slide off its post-pandemic peak, dropping 5% today. Risk of new lockdowns, especially restrictions on travel, threatens to result in another oil demand destruction. Source: xStation5

OIL continues to slide off its post-pandemic peak, dropping 5% today. Risk of new lockdowns, especially restrictions on travel, threatens to result in another oil demand destruction. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Commodities drop - inflation relief?

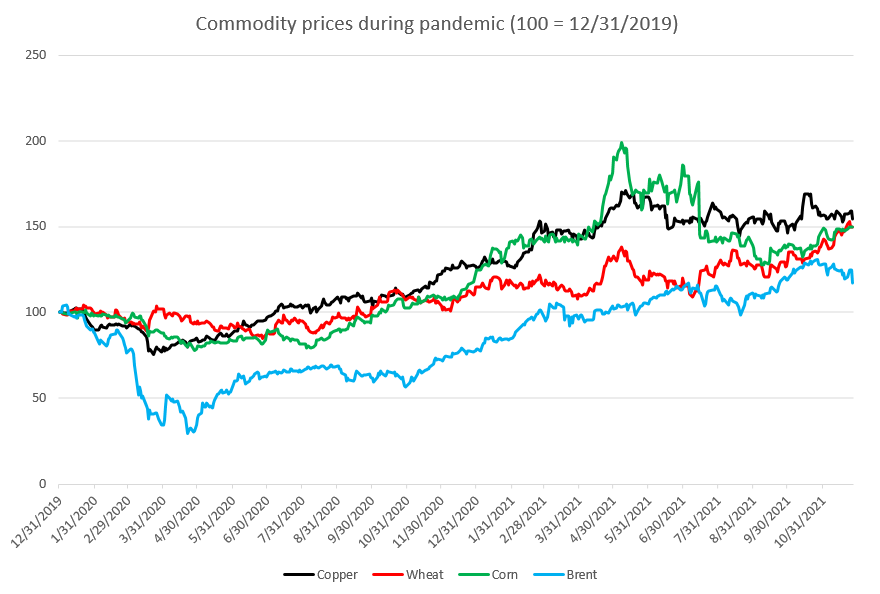

As strong declines can be spotted across commodities markets, especially oil and industrial metals, one could think that inflation cool-off is coming. However, the situation is not so obvious. Recall that at the beginning of the pandemic in 2020 commodity prices also plunged. While this provided some inflation relief at first, supply chain issues resulting from lockdowns pushed commodity prices to multi-year highs in the following months and levying new restrictions now could only magnify those still-not-resolved issues. A point to note is that the first wave of pandemic took markets by surprise and the global economy was by no means prepared for it. Massive oil demand destruction resulted in huge oversupply that eventually pushed oil prices into negative for the first time in history. Right now the situation is different. OPEC+ defied calls by United States and other countries to boost supply as it expected pandemic to intensify in winter season and mobility to decrease. It turns out oil producers were right, although they could not predict new virus variants, and seem to be better prepared for the situation now.

While commodity prices plunged in the early-2020, all of the losses were recovered within a few months. Source: Bloomberg, XTB

While commodity prices plunged in the early-2020, all of the losses were recovered within a few months. Source: Bloomberg, XTB

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

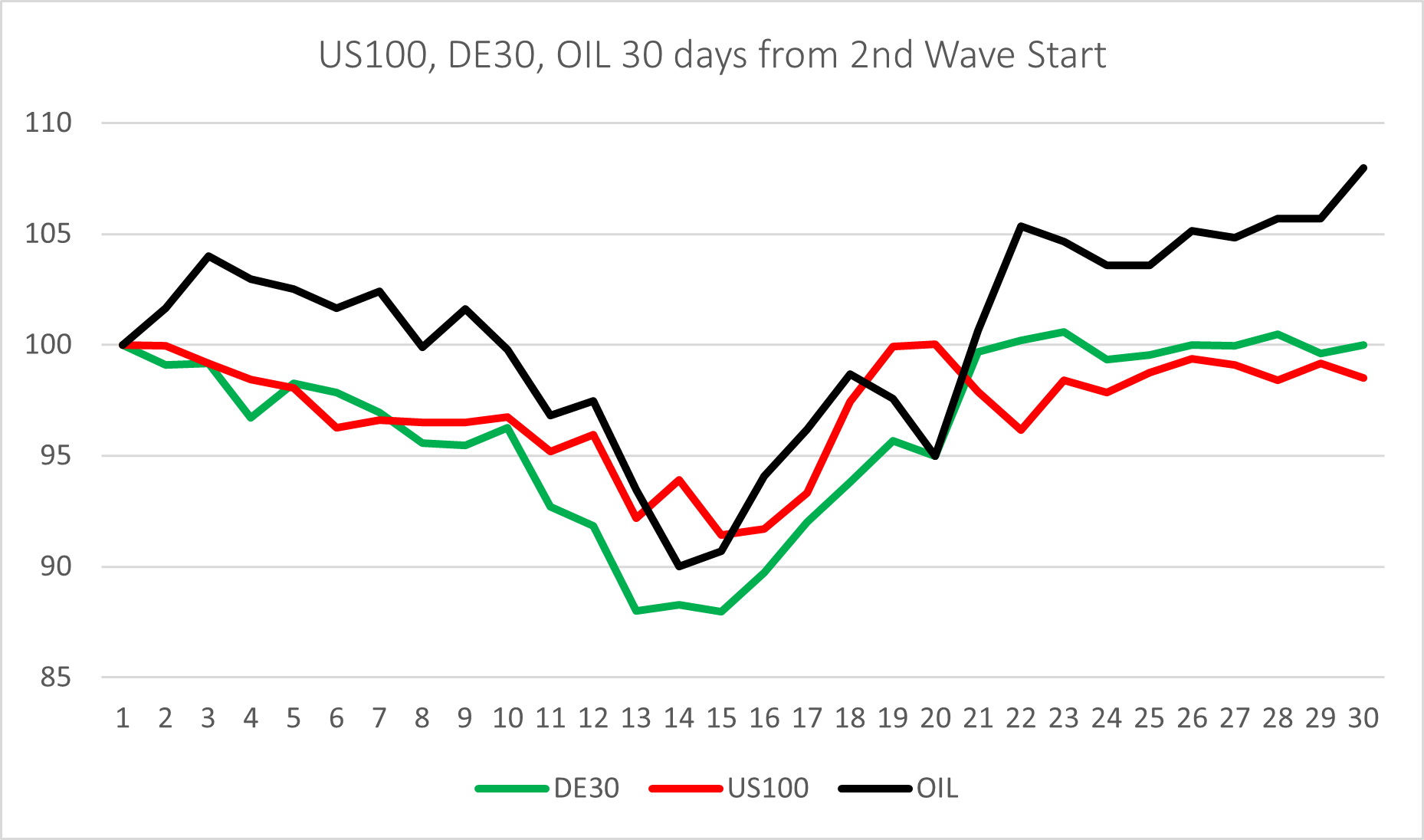

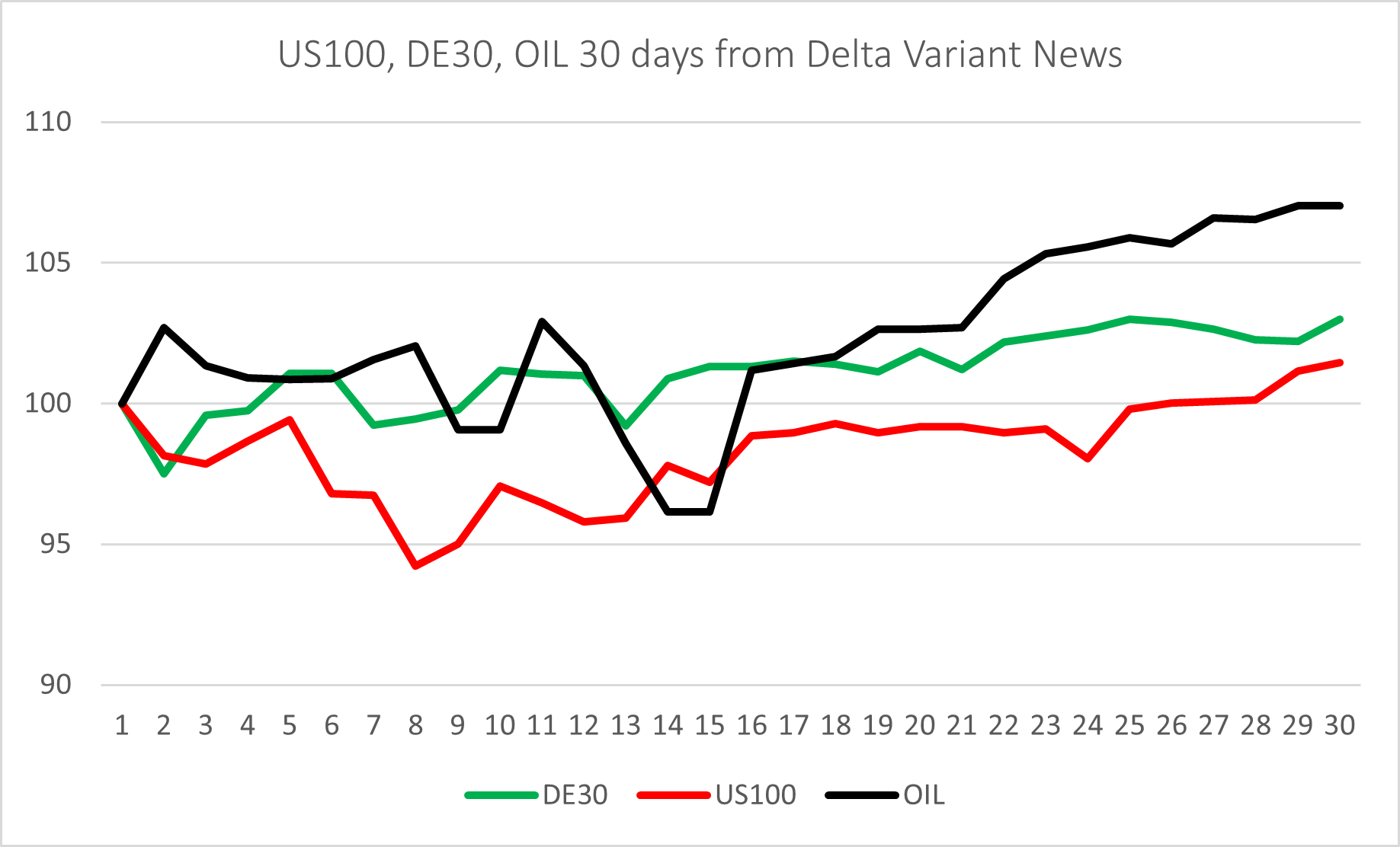

Lessons from second pandemic wave and Delta wave

Drop in asset prices at the beginning of 2020 was unprecedented. Investors were completely surprised by lockdowns and rushed to trim risk bets as if the end of the world was coming. However, as the world found its way through the crisis and markets recovered quickly, investors were more sanguine during the second pandemic wave in Autumn 2020 or the Delta variant wave in Spring 2021. As one can see on the charts below, Nasdaq-100 (US100), DAX (DE30) and Brent (OIL) experienced much smaller moves than during the initial pandemic shock. Moreover, those markets almost completely recovered within the first 30 trading days following the start of the second and Delta pandemic waves. Of course, it does not mean that the story will repeat this time as there are additional factors to consider. The most important being whether the situation will force Fed to delay policy tightening or not. Nevertheless, "fear-of-missing-out" and "buy-the-dip" approaches were very common among investors since the start of the pandemic and made pandemic drop good buy opportunities in the markets.

DE30, US100 and OIL during the first 30 trading sessions of the second wave of the pandemic. Source: Bloomberg, XTB

DE30, US100 and OIL during the first 30 trading sessions of the second wave of the pandemic. Source: Bloomberg, XTB

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

DE30, US100 and OIL during the first 30 trading sessions of the Delta variant wave. Source: Bloomberg

DE30, US100 and OIL during the first 30 trading sessions of the Delta variant wave. Source: Bloomberg

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Politics batter the UK bond market once more, as Starmer remains under pressure

The Week Ahead

Market update: recovery takes hold, but investors remain on edge

Is a recovery on the cards? A deep dive into why bitcoin is weighing on tech stocks

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.