Summary:

-

UK release first ever flash PMIs

-

Both manufacturing and services readings miss

-

GBPUSD falls beneath $1.29 handle

The pound has fallen lower following the release of the first ever flash PMI readings for the UK which showed a contracting level of activity for both the manufacturing and services sector. These readings are intended to give an early look into the performance of these sectors in the current month and are in addition to the final readings which will be released at the start of December.

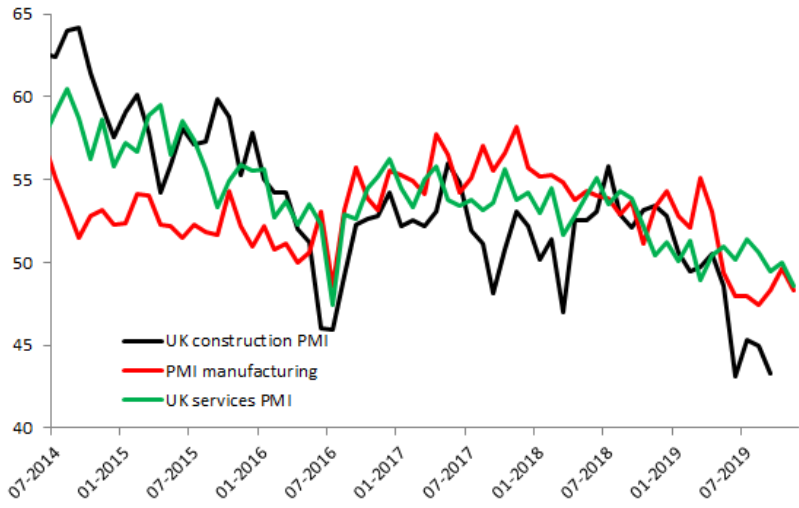

PMI readings for the UK continue to flash warning signs with the first look at the November prints for both manufacturing and services both firmly in contractionary territory. Source: XTB Macrobond

The data for November was as follows:

-

UK Flash Manufacturing PMI: 48.3 vs 48.8 forecast. 49.6 prior

-

UK Flash Services PMI: 48.6 vs 50.1 forecast. 50.0 prior

Both these readings are clear disappointments and in coming in firmly below the 50 mark indicate both of these are in contractionary territory. Looking under the hood we can see further signs for concern, with drops in output and new orders and while this could be explained away due to the heightened political uncertainty ahead of next month’s election there is little doubting the fact that the UK economy has pretty much ground to a halt.

While these data points are released sooner than the final readings and therefore will be less accurate, the methodology used to compute them means they are comparable. Going forward they could well begin to take on greater importance in terms of market moves, as traders react rapidly to the first look at the data - similar to what we see with the GDP numbers. There’s been a clear adverse reaction seen in the pound to the release, with the GBP/USD rate falling by around 50 pips to trade back below the $1.29 handle.

GBPUSD has dropped fairly strongly since the release with the pair falling back near its lowest levels in over a week to trade near the prior swing level of 1.2865. Source: xStation

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.