Key points for investors ahead of this week's crucial session, when the market will learn the latest US CPI data:

-

The market expects inflation pressure to remain elevated, with the main reading showing a year-over-year price increase of 2.9% compared to the previous reading of 2.7%.

-

Core inflation is expected to maintain the current price growth rate at 3.3% y/y.

-

Yesterday, the market learned that producer inflation data came in lower than expected, which is somewhat correlated

-

The Japanese yen is gaining today following hawkish comments from BoJ's Ueda

-

Lower US CPI data could increase the scale of this appreciation further

-

Trump's announcement regarding sudden tariff increases remains an element of uncertainty in creating dollar demand

Investors face a key session of the week, with US CPI data due at 14:30. The USDJPY pair is losing nearly 0.7% today, which is related to the low US PPI reading and hawkish comments from the BoJ president.

PPI Data:

-

PPI indicator: actual 3.3% y/y; forecast 3.5% y/y; previous 3.0% y/y;

-

Core PPI indicator: actual 3.5% y/y; forecast 3.8% y/y; previous 3.5% y/y;

Producer inflation in December failed to meet pro-dollar expectations. Both the general and core readings came in below forecasts (3.3% and 3.5% y/y respectively), slightly weakening hawkish investor expectations regarding US monetary policy in 2025.

Ueda's Statement:

President Kazuo Ueda's comments intensified speculation about a potential rate hike at next week's meeting (January 23-24). The president emphasized promising wage talks from the beginning of the year and recent meetings with branch directors, marking a significant change in communication strategy. These comments, following similar forward-looking statements from Vice President Himino, caused the Japanese yen to strengthen.

Overnight index swap contracts now indicate a 71% probability of a rate hike this month, up from 60% earlier in the day, reflecting growing market conviction. Source: Bloomberg Financial LP

Yield Dynamics

Japanese government bonds came under selling pressure, with 2-year bond yields reaching their highest level since 2008 (0.7%), and 30-year bond yields reaching a new peak since 2009. The BOJ's rinban operation noted increased sales, putting additional pressure on JGB futures.

What will the Fed do after CPI?

The US bond market, due to better economic data, has started pricing in a hawkish FOMC pivot and one rate cut in 2025. This translated directly into strengthening of the American currency, with the dollar index rising by 2.5% in just the last month.

Overnight index swap contracts suggest a 32 basis point cut in 2025, slightly more than one cut. Source: Bloomberg Financial LP

Yesterday's PPI came in better than expected, giving Wall Street hope for continued looser policy. Historically, PPI and CPI are correlated, but PPI is a measure more dependent on fuel prices, while CPI is influenced by various other factors (such as food prices, car prices, and rents).

Car prices are showing a return to price increases - so far small, but this factor will stop pulling overall inflation down in the medium term. Source: XTB

Trump as the "Wild Card" in the Inflation Puzzle

Any reaction in dollar-related pairs may not be long-lasting, however, as the main topic creating market uncertainty in the long term is Trump's policy regarding dynamic tariff increases. At this point, any rumors suggesting a more gradual model of their implementation were quickly denied by Trump himself, which is why markets are increasingly concerned about how the new policy will translate into inflation and thus future Federal Reserve decisions.

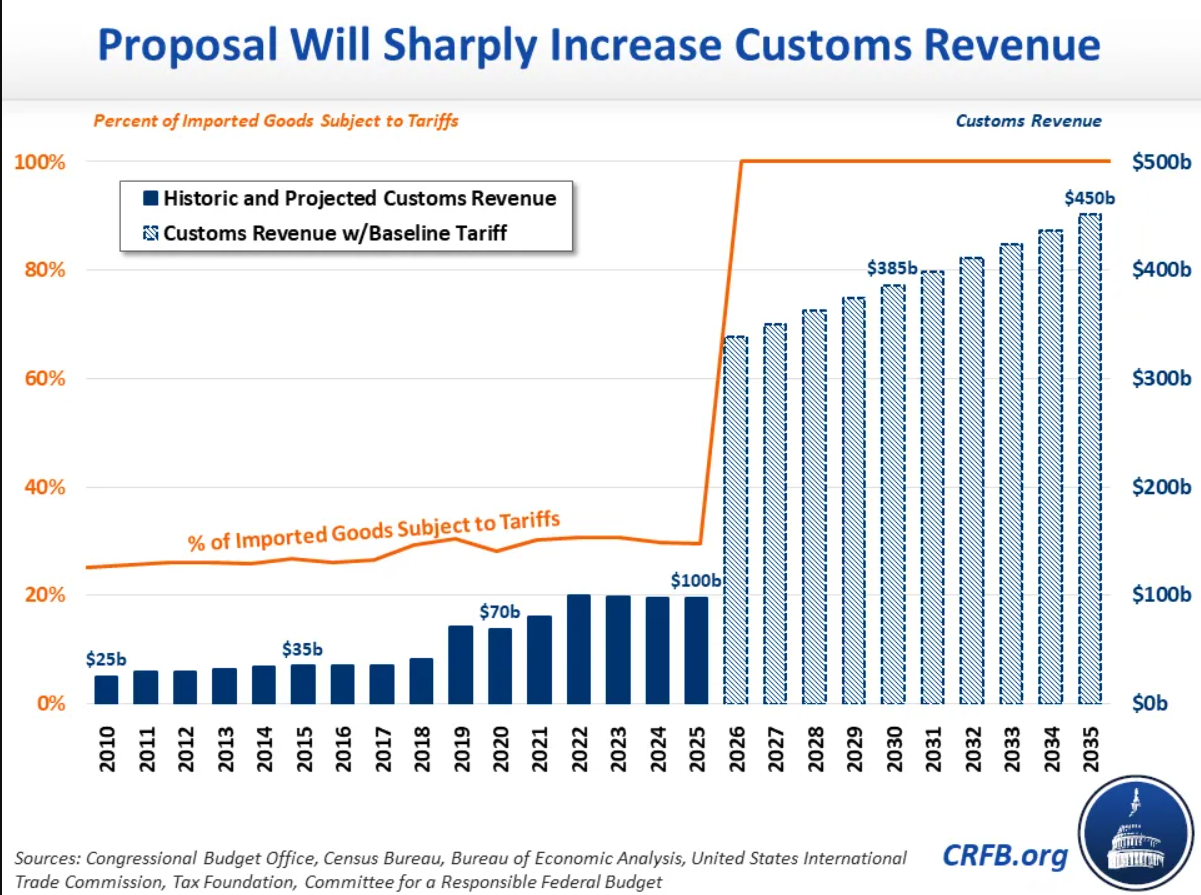

The market expects a jump in tariff rates and the revenue they generate for the government treasury. Source: CRFB

USDJPY (D1 Interval)

USDJPY has entered a critical zone associated with previous currency interventions. After today's comments, the pair fell below the 15-day EMA and slightly below the 78.6% Fibonacci retracement level from the downward movement. Key targets for bears include the 30-day EMA and 50-day EMA, followed by the 23.6% Fibonacci retracement level from the upward movement at 154.272. The RSI indicator signals bearish divergence, suggesting weakening upward momentum, while MACD confirms bearish sentiment. Source: xStation

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.