Cryptocurrencies experienced a massive plunge yesterday in the afternoon. Bitcoin dropped over 15% in less than 2 hours while Ethereum dropped around 20% during the same period. While most coins recovered somewhat later on, prices remained deep below levels from the beginning of a week. Given such a steep drop investors' began to wonder - is the bull market on cryptocurrencies over?

Why did cryptocurrencies plunge this week?

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appIt is hard to find a clear answer for this question as it is usually the case with abrupt moves on the cryptocurrencies market. However, a point to note is that yesterday was the day when Bitcoin became a legal tender in El Salvador, the first country to make such a move in history. It is an unprecedented event but its impact on the cryptocurrency market may actually be limited. While Bitcoin will serve as a legal tender in El Salvador, US dollar will continue to do so as well. Authorities claimed that the move will allow citizens to send remittances in Bitcoin in order to avoid high transaction costs involved in USD money transfers. However, as Bitcoin is one of the first cryptocurrencies in the world, its efficiency when it comes to transferring money is poor and very often it is cheaper and faster to send transfers in fiat money.

Sell the fact?

The move to make Bitcoin a legal tender in El Salvador was announced at the end of June and Bitcoin has gained over 70% between the announcement and beginning of this week. Having said that, this week's drop may have been a sign of a "sell the fact" approach by investors. However, the rollout of Bitcoin as legal tender in El Salvador was troubled by technical glitches of the online wallet, what hints that adoption of cryptos as legal tenders may not be as smooth as one may have expected. While sell-off on the cryptocurrency market was halted yesterday and coins managed to recover part of their losses, another wave of selling arrived this morning. On one hand, it may be a reaction to broad deterioration in market sentiment (stocks plunging). However, it may also have been a reaction to an announcement from Coinbase, the largest cryptocurrency exchange in the United States. Coinbase said that it has been notified by the US SEC about a potential legal action against the company for its plans to launch a product that allows investors to gain interest on its cryptocurrency holdings.

Technical Analysis

In spite of the other arguments mentioned in the paragraph above, we think that the first one - "sell the fact" approach - best explains what's going on on the cryptocurrencies market. Having said that, an ongoing plunge may not necessarily lead to a long-term trend reversal as it could be just a brief correction. Note that cryptocurrencies experienced a similar steep drop in the past and it was not followed by a period of longer-lasting declines. Let's take a look at what the technical situation on major cryptocurrencies - BITCOIN, ETHEREUM and RIPPLE - tells us.

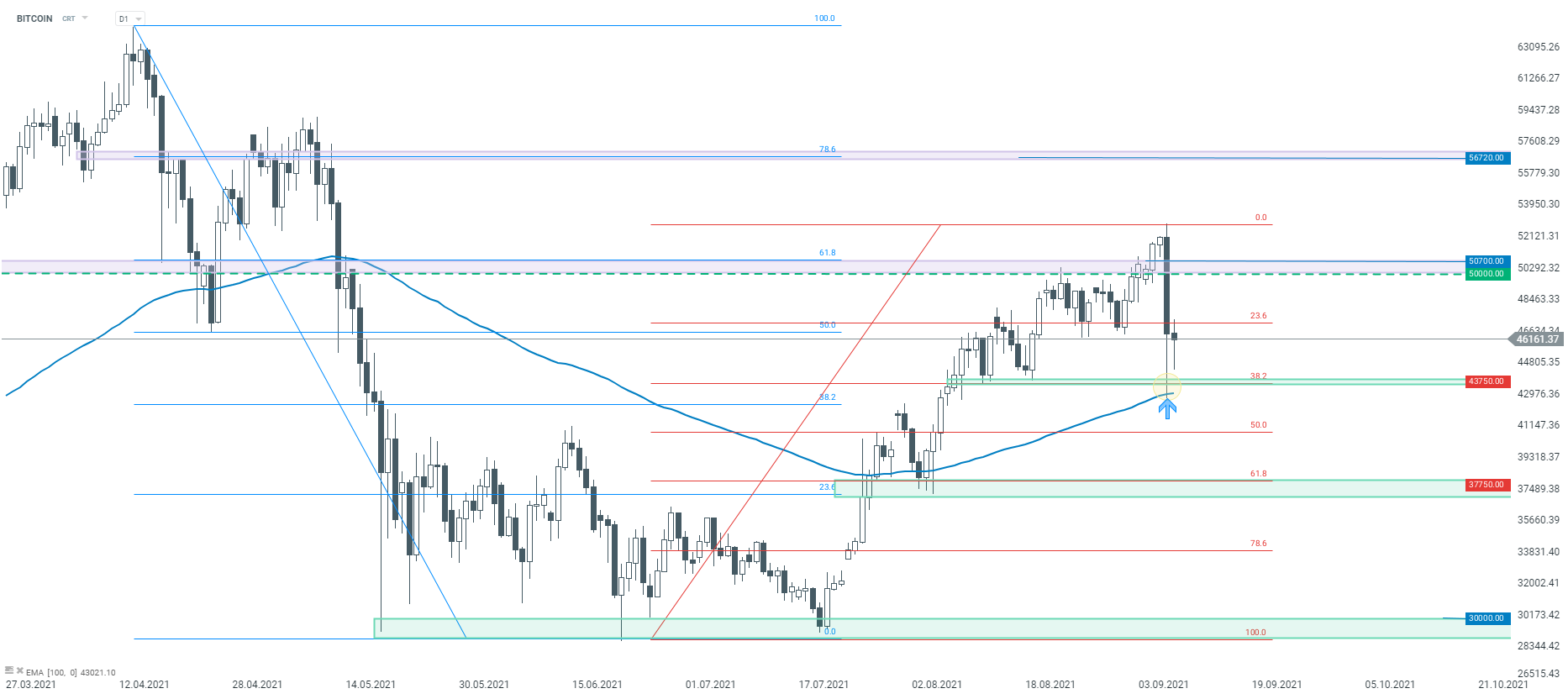

BITCOIN

Bitcoin has plunged around 19% from yesterday's daily high to daily low. However, taking a look at the bigger picture, we can see that this drop has barely exceeded 40% of the upward move started in July. After a positive price reaction to the 100-session EMA (blue line), Bitcoin started to recover and climbed back above the 38.2% retracement of the aforementioned upward move. A look at the chart at D1 interval also shows us that yesterday's plunge was nowhere near as steep as declines from April and May. Bitcoin is trading near the price zone ranging between 50% retracement of April-May drop and 23.6% retracement of recent upward impulse. This zone saw a few price reactions over the past month and climbing above would be seen as positive.

Source: xStation5

Source: xStation5

ETHEREUM

ETHEREUM halted recent upward move at the 88.6% retracement of the pullback launched in mid-May 2021. Price of this cryptocurrency reacted positively to the 55-session EMA yesterday in the $3,015 area. Note that this zone is additionally strengthened by the 50% retracement of the aforementioned upward move. Coin climbed above the 61.8% retracement later on, that served as the upper limit of a trading range from August ($3,330). Positive reaction to the important moving average as well as returning back above the $3,330 price zone can be seen as a positive technical development.

Source: xStation5

Source: xStation5

RIPPLE

A look at RIPPLE shows us that the price has reached a low at around 50% retracement of the recent upward move. Coin has later on recovered and now attempts to climb back above the price zone marked with the 38.2% retracement. Note that upward trendline can be found slightly above this zone and climbing above this technical hurdle would brighten near-term outlook for buyers.

Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.