Summary:

-

JPY gains on risk aversion

-

Pompeo’s visit to Beijing did little to ease the trade conflict

-

IMF lowers forecast for the global growth highlighting trade issues as main reason

Trading during the Asian session was a bit thinner than usual as South Korea investors took a day off for holiday. In China we saw a modest recovery after yesterday’s heavy sell-off. All major Chinese stock indices pushed higher on Tuesday with Hang Seng (CHNComp) trading 0.9% higher at press time. Equities in the World’s second biggest economy could have been support by the FX factor as the PBOC set USD/CNY central rate higher (6.9019). Japanese Nikkei (JAP225) declined 1.3% following strengthening of JPY. Last but not least, in Australia S&P/ASX 200 (AUS200) slumped almost 1% erasing whole YTD gains and is now 0.77% below 2017’s close.

After two session of heavy selling AUS200 (S&P/ASX 200 futures underlying) found itself below 200-session moving average. As the Australian stock market is sensitive to the trade war due to countries relationship with China further escalation of conflict may cause the index to visit the support zone ranging 5915-5925 pts. Source: xStation5

After two session of heavy selling AUS200 (S&P/ASX 200 futures underlying) found itself below 200-session moving average. As the Australian stock market is sensitive to the trade war due to countries relationship with China further escalation of conflict may cause the index to visit the support zone ranging 5915-5925 pts. Source: xStation5

Aforementioned strengthening of the Japanese yen can be to some extent ascribed to increasing risk-off sentiment on the markets. Investors flew to safe haven assets after reports from the Michael Pompeo’s visit to Beijing showed the that rift between China and the US is widening. The US Secretary of State highlighted fundamental disagreements between two countries ranging from trade issues, through Taiwan and to the South China Sea. No breakthrough happened when it comes to trade relationships and no new developments concerning the disarmament of the North Korea spurred. Having said that, Pompeo’s visit to Asia resulted in nothing more than new signs of deepening tensions between the World’s two biggest economy. Apart from that, Bloomberg reported that the US Treasury Department may be set to name China a currency manipulator in a report scheduled to be out next week. According to the news agency Steven Mnuchin’s department is concerned with the recent depreciation of the Chinese yuan.

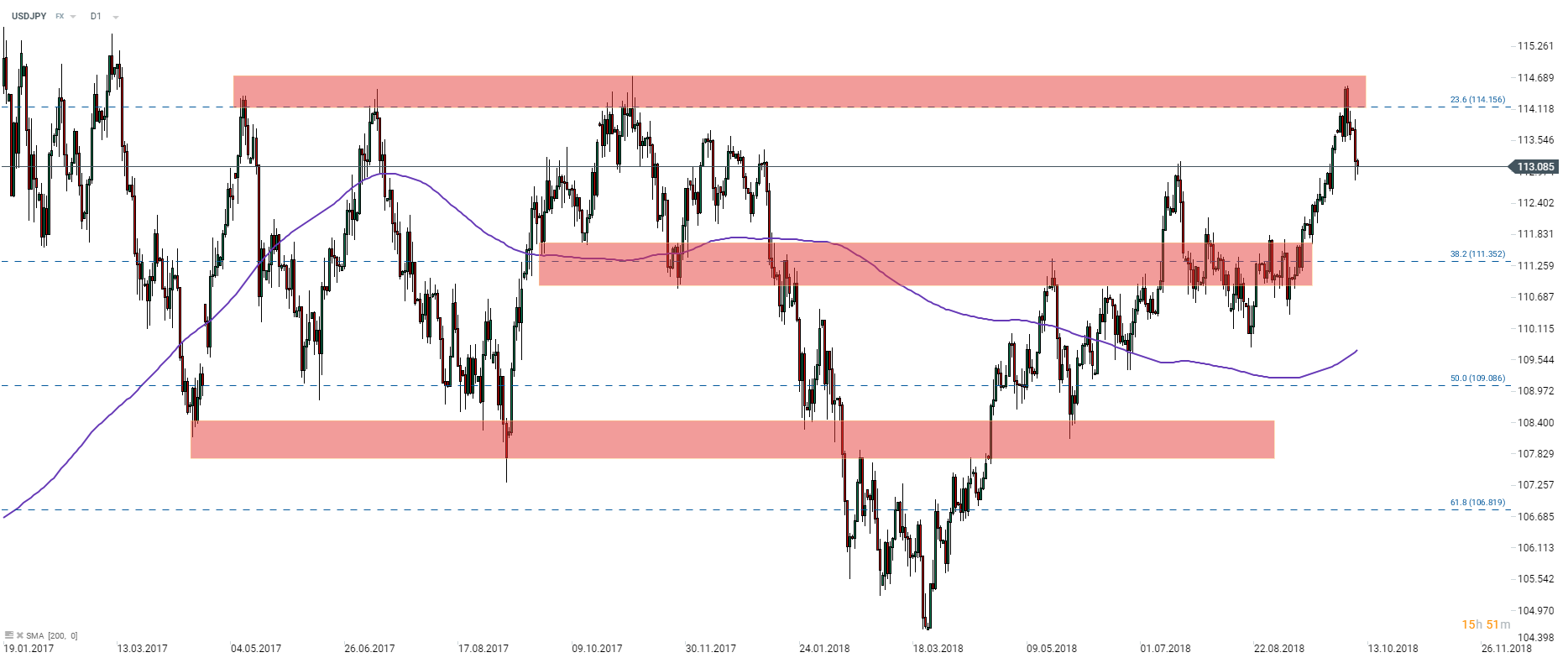

USDJPY reversed after climbing to the vicinity of multi-month highs around 114.30 handle. The pair is declining for the fourth straight day and a further pullback towards the 111 handle may be on cards. Source: xStation5

USDJPY reversed after climbing to the vicinity of multi-month highs around 114.30 handle. The pair is declining for the fourth straight day and a further pullback towards the 111 handle may be on cards. Source: xStation5

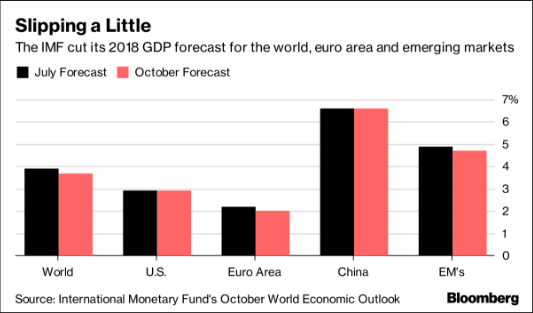

Another issue that could have supported a retreat to the safe haven markets is the updated global growth forecast from the International Monetary Fund. IMF revised lower its outlook on the global growth to 3.7% for 2018 and 2019 from 3.9% forecasted three months ago. It is the first downgrade the IMF made to the global growth forecast since mid-2016. The Fund said that the World may already be at peak of its growth cycle. Among reasons behind downgrade IMF named escalating trade conflict and unstable situation on the EM markets. Additionally, IMF highlighted that faster than previously expected pace of interest rates hikes in the developed countries bolsters capital retreat from the emerging economies and therefore further undermines perspectives for these countries. The outlook for the US was left unchanged in 2018 but IMF expects growth to slow in the years to come as the impact of the trade war with China will take its toll. Finance ministers and central bankers from the IMF and World Bank member countries will meet this week in Indonesia for the annual meeting. Trade issues are said to be on top of the agenda.

IMF revised lower the growth forecast for the whole World as well as EMs and eurozone. Source: Bloomberg, IMF

IMF revised lower the growth forecast for the whole World as well as EMs and eurozone. Source: Bloomberg, IMF

In other news:

-

Hurricane Michael is approaching the east coast of the North America

-

Italy Finance Minister Tria to defend Italian budget in parliament

-

US 10-year yield hits 7-year high near 3.25

-

VIX broke above 15 pts handle for the first time since June

-

ECB’s Villeroy says combination of the Italy’s growth and debt is “too unbalanced”

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.