The Bank of Canada raised its benchmark interest rate by 50bps to 4.25 % as widely expected and pushing borrowing costs to the highest since 2008. Policymakers added they are also continuing their policy of quantitative tightening. Policymakers noted that economic growth remains strong although it is expected to stall through the end of this year and the first half of 2023. Also, the labour market remains tight while inflation is still too high and short-term inflation expectations remain elevated. Looking ahead, the central bank will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target, in a sign the tightening campaign could be near an end. The central bank has raised rates at a record pace of 400 bps since March.

No post-meeting press conference will be held.

Source: BoC

Source: BoC

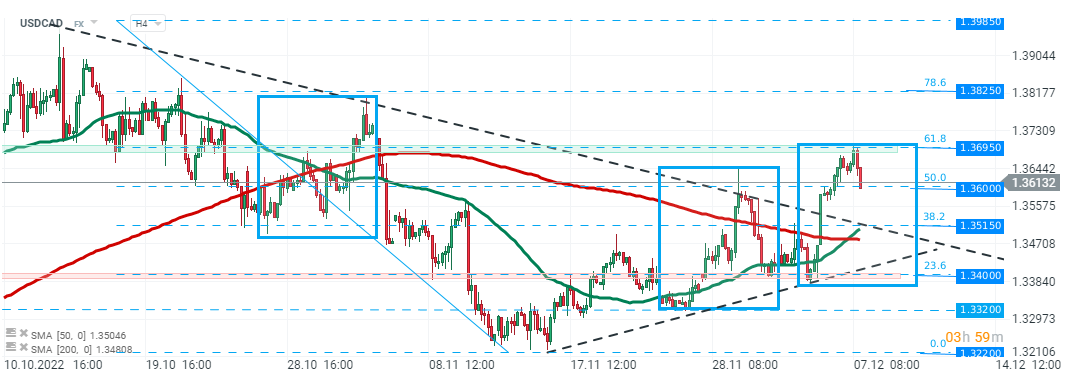

USDCAD fell sharply and is testing support level at 1.3600. Source:xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.