ARM Holdings (ARM.US) published fiscal-Q4 2024 earnings report yesterday after close of the market session. While results for the January-March 2024 quarter were better-than-expected, fiscal-2025 guidance offered by the company has been seen as somewhat disappointing. This has triggered a post-earnings share price drop in the after-hours trading yesterday, and stock continues to trade around 8% lower in premarket today.

As we have already said in the opening paragraph, fiscal-Q4 2024 results from ARM Holdings were not bad. In fact, they were better-than-expected. Revenue grew more than expected, driven by significant beat in License revenue. ARM said that licensing business revenue performed well due to multiple high-value license agreements for AI chips being signed. Cost of revenue was higher-than-expected, but it was mostly due to higher-than-expected revenues. Gross margin came more or less in-line with expectations. However, other profit measures, including operating income, EBITDA and net income, beat expectations significantly.

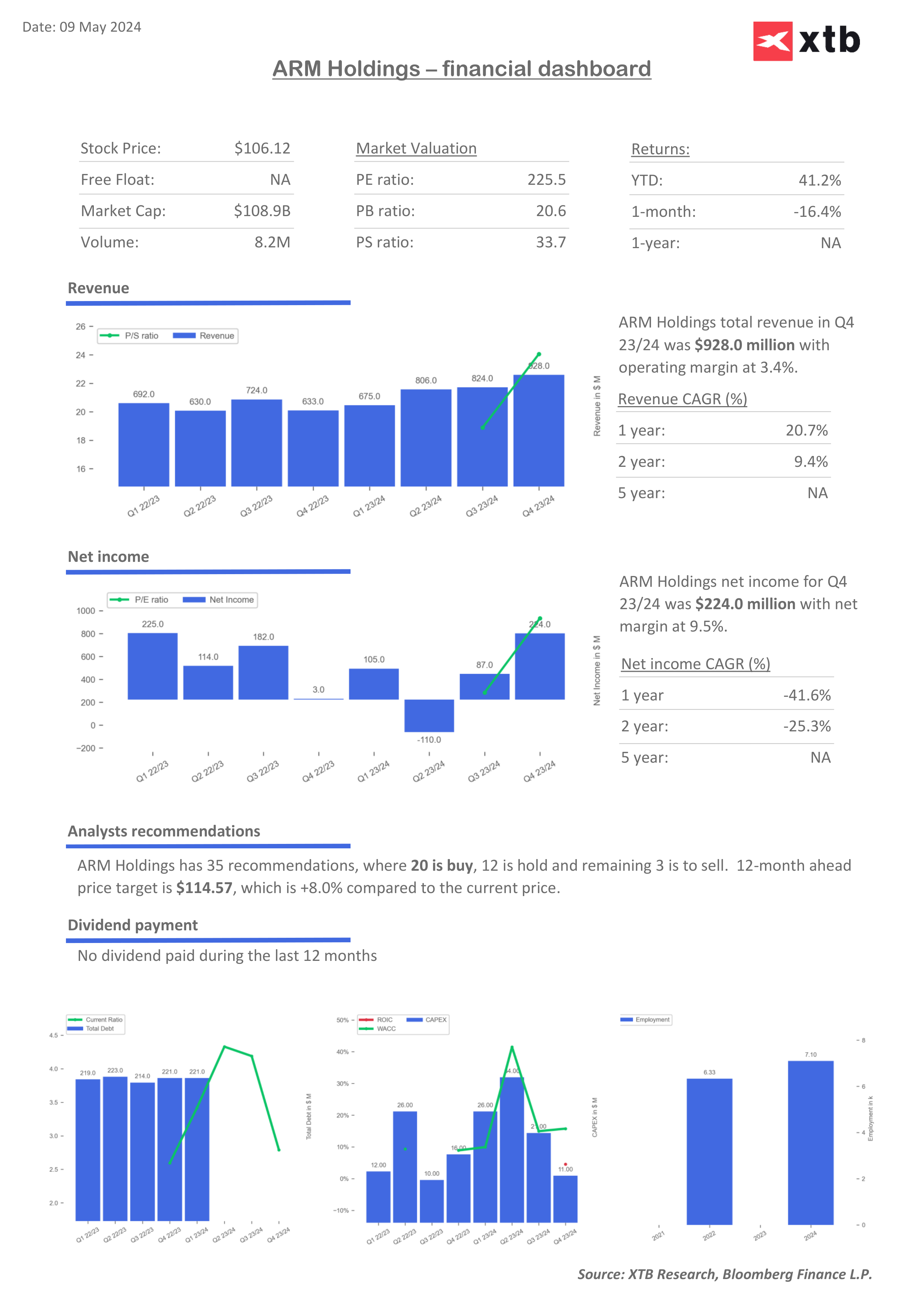

Fiscal-Q4 2024 results

- Revenue: $928 million vs $880.4 million expected (+47% YoY)

- Royalty: $514 million vs $504.2 million expected (+37% YoY)

- License and other: $414 million vs $376 million expected (+60% YoY)

- Cost of revenue: $41 million vs $37 million expected

- Gross profit: $887 million vs $840 million expected

- Gross margin: 95.6% vs 95.7% expected

- Adjusted operating expenses: $511 million vs $490 million expected

- Adjusted operating income: $391 million vs $356 million expected

- Adjusted operating margin: 42.1% vs 40.5% expected

- Adjusted EBITDA: $429 million vs $397 million expected

- Adjusted EBITDA margin: 46.2% vs 45.1% expected

- Adjusted net income: $376 million vs $321 million expected

- Adjusted net margin: 40.5% vs 36.5% expected

- Adjusted EPS: $0.36 vs $0.30 expected

In spite of those better-than-expected results, company's share price dropped in the afterhours trading as guidance offered was seen as disappointing. While fiscal-Q1 2025 forecast (calendar April - June 2024) was better-than-expected with revenue and EPS guidance midpoints exceeding analysts' expectations, a full-year fiscal-2025 guidance disappointed. Full-year revenue guidance midpoint of $3.95 billion was lower than expected, while operating expenses guidance was higher than expected. ARM has a very high valuation - higher P/S ratio than any of the Nasdaq-100 stocks - so the company needed to provide a very outlook not to disappoint investors. However, it looks like it failed to do so.

Fiscal-Q1 2025 guidance

- Revenue: $875-925 million vs $868 million expected

- Adjusted operating expenses: 'about $475 million' vs $478 million expected

- Adjusted EPS: $0.32-0.36 vs $0.31 expected

Full-year fiscal-2025

- Revenue: $3.80-4.10 billion vs $4.01 billion expected

- Adjusted operating expenses: 'about $2.05 billion' vs $2.01 billion expected

- Adjusted EPS: $1.45-1.65 vs $1.53 expected

ARM Holdings (ARM.US) trades 8-9% lower in premarket, following release of fiscal-Q4 2024 earnings report that included disappointed forecasts. Stock is currently trading at around $96.70 in premarket, the lowest level since May 2, 2024. A near-term support zone can be found in the $95 area. Source: xStation5

ARM Holdings (ARM.US) trades 8-9% lower in premarket, following release of fiscal-Q4 2024 earnings report that included disappointed forecasts. Stock is currently trading at around $96.70 in premarket, the lowest level since May 2, 2024. A near-term support zone can be found in the $95 area. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.