Most of XTB’s Indices and Commodities CFDs are based on future contracts. Their price is very transparent, but this also means they are subject to monthly or quarterly 'Rollovers'.

The future contracts we price our Indices or Commodities markets on normally expire after one or three months.

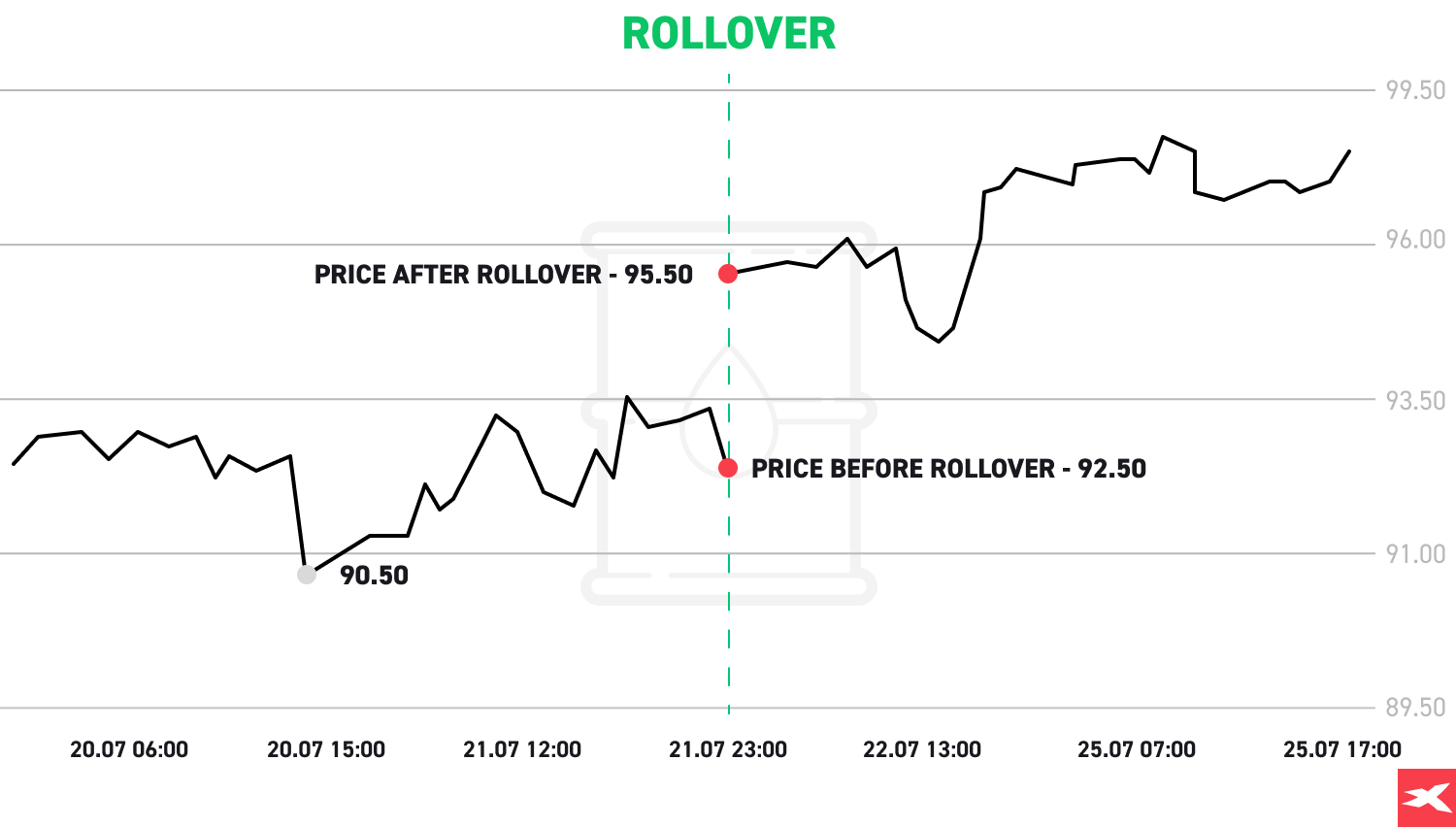

Therefore, XTB must switch (rollover) our CFD price from the old contract to the new futures contract. Sometimes the price of old and new futures contracts are different, so we must do a Rollover Correction by adding or deducting a one-time only swap credit/charge on the trading account at rollover date to reflect the change in market price.

What Is a Contract Rollover?

In a nutshell, a rollover is a purely technical operation that ensures the Contracts For Differences (CFDs) that you can trade on XTB's platforms always reflect market conditions in the best way possible.

A futures contract’s expiration date is the last day you can trade that contract. Prior to expiration, a futures trader has three options:

- Offsetting or liquidating the position

- Settlement

- Rollover

A rollover occurs when a trader moves their position from the front month contract to another contract further in the future. Traders will determine when they need to move to the new contract by watching the volume of both the expiring contract and next month contract. A trader who is going to roll their positions may choose to switch to the next month's contract when volume has reached a certain level in that contract.

Why Does XTB Need to Roll Over CFDs?

XTB offers all CFD contracts with a 365 day expiry. The majority of indices and commodities CFD are based on prices of futures contracts. For each market there is usually a long list of future contracts with different expiry dates ranging from one month to many years into the future. The highest volume is usually on the nearest contract. To trade the most active contract, a trader on the futures market needs to close one (expiring) contract and open another (the next one), paying transaction fees. CFD rollover does this for you, and there are no associated transaction fees!

Are Rollovers Free at XTB?

Yes, all rollovers are completely cost-free for all XTB clients.

Can I Lose Money on a Rollover?

A rollover is a purely technical operation and in most cases is profit-neutral. A change in price will impact the “profit” position, but at the same time exactly the opposite amount will be added to the “swap” position. For example:

- Current price of old OIL future contract (expiring) is 22.50

- Current price of new OIL future contract (to which we switch CFD price to) is 25.50

- Rollover Correction in swaps is $3000 per lot = (25.50-22.50) x 1 lot i.e. $1000

- If you have a long position - BUY 1 lot of OIL at 20.50.

- Your profit before rollover is $2000 = (22.50-20.50) x 1 lot i.e. $1000

- Your profit after rollover is also $2000 = (25.50-20.50) x 1 lot - $3000 (Rollover Correction)

- If you have a short position - SELL 1 lot of OIL at 20.50.

- Your profit before rollover is -$2000 =(20.50-22.50) x 1 lot i.e. $1000

- Your profit after rollover is also -$2000 =(20.50-25.50) x 1 lot + $3000 (Rollover Correction)

A detailed list of Rollovers dates for all instruments can be found in the Instrument Specification section of our website here.

Important information

It is crucial to remember that after calculating the swap points (which are the result of the base between two series of contracts of the underlying instrument), the value of the registers of the Customer's account will change. With a very large base, it may happen that the required MARGIN LEVEL is exceeded. In such a case automatic closure of the position will start, starting with the position that generates the lowest financial result and will continue until the moment when the required MARGIN LEVEL is achieved.

Customers should also adjust their active pending orders. If the order activation price set by the client is within the gap related to rollover, the order will be executed at the opening price of the instrument. To avoid this situation PENDING ORDERS must be removed before the end of the trading session of the instrument on the rollover day. In other words, if an investor places a pending order within the range of rollover gap, he or she may incur a loss, however the rollover process itself is cost-free.

Why Do Rollover Sizes Differ?

Various factors, such as interest rates, dividends and cost of storage, cause differences between prices of futures contracts for a single instrument. Normally, these differences are moderate, but sometimes certain commodity markets may witness large differences.

When Will the Next Rollover Take Place?

We do our best to provide all the information about incoming rollovers for the CFDs in advance. You can find this information in the rollover table on our website.

Check the information on scheduled rollovers here

How Do Oil Rollovers Work?

Because oil is a futures contract, it has an expiration date. If you hold a position over the monthly expiration date of the futures contract that price is based on, you will encounter a rollover. If you do not wish for your position to be rolled over, then you should close your position beforehand.

If you want to continue to hold your position over the expiration date, you need to close the old position as the contract expires and open a new one on the new futures contract.

What Happened on April 20, 2020?

An extraordinary rollover on WTI and Brent contracts took place. The active contract was changed from Jun20 to Jul20. The move is aimed at limiting risk of active contract price falling into negative territory (as it was the case for May20 contract). The price drop below $0 leads to a complete collapse in liquidity, which could result in an inability to roll over position to the next-month contract. A lot of futures traders experienced such a situation, what ultimately led to price dropping to as low as -$40 per barrel.

It should be noted that CFD contracts offered by XTB aim to replicate the price performance of a nearest contract that does not require investors to roll over manually. Once price drops into negative territory, rolling over would be much harder if not impossible. The rollover itself does not affect the financial result of a transaction as swap points are added or subtracted depending on the position size and shape of the futures curve.

Utilities, Homebuilders, Healthcare & Tech firms: Stocks To Look Out For ahead of the UK General Election

Climate change investments: Maximising impact

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.