In the last decade of the 20th century, the internet hit the imagination of investors, starting the so-called dot-com bubble. Almost 20 years later, investors become again fascinated by disruptive technology of generative AI. How to invest in artificial intelligence stocks?

Artificial intelligence is no longer Sci-fi. From Hollywood screens, advanced algorithms have undergone a powerful evolution. They have improved productivity, accelerated data analysis and surprised hundreds of millions of people with their text and image generation capabilities. ChatGPT in 2022 was hailed as the fastest-growing app in the world. This revolution is ongoing, AI continues to improve, and companies that have the means and capabilities to use it have taken a special place in the minds of investors.

Now virtually everyone can use it, and the world's largest technology companies have entered the race to reach millions of consumers with their products: private and corporate. Like flywheels in a powerful mechanism, market laws have determined the industries that can benefit from the AI trend. In these industries, only some of the best-managed and technology-implementing companies can keep up with the trend.

From Microsoft's cloud computing and Nvidia's semiconductors enabling growing computing power (and more advanced AI) to Arista Networks' networking solutions. Let's find out which AI stocks stand to gain from the new technological shift that began in the second decade of the 21st century. In the following article, you will learn why AI has hit the floor of the world's largest stock exchanges. We will also try to identify the companies that can benefit from it.

In the last decade of the 20th century, the internet hit the imagination of investors, starting the so-called dot-com bubble. Almost 20 years later, investors become again fascinated by disruptive technology of generative AI. How to invest in artificial intelligence stocks?

Artificial intelligence is no longer Sci-fi. From Hollywood screens, advanced algorithms have undergone a powerful evolution. They have improved productivity, accelerated data analysis and surprised hundreds of millions of people with their text and image generation capabilities. ChatGPT in 2022 was hailed as the fastest-growing app in the world. This revolution is ongoing, AI continues to improve, and companies that have the means and capabilities to use it have taken a special place in the minds of investors.

Now virtually everyone can use it, and the world's largest technology companies have entered the race to reach millions of consumers with their products: private and corporate. Like flywheels in a powerful mechanism, market laws have determined the industries that can benefit from the AI trend. In these industries, only some of the best-managed and technology-implementing companies can keep up with the trend.

From Microsoft's cloud computing and Nvidia's semiconductors enabling growing computing power (and more advanced AI) to Arista Networks' networking solutions. Let's find out which AI stocks stand to gain from the new technological shift that began in the second decade of the 21st century. In the following article, you will learn why AI has hit the floor of the world's largest stock exchanges. We will also try to identify the companies that can benefit from it.

Investing in AI

Artificial intelligence brings with it a fundamental economic and technological change. Of course, this change, in order to take place, must be implemented not at the central level (the state), but at the private level (companies). This could mean a potential investment opportunity, as many of these companies are listed on the stock market. But as with any other investment, it also has some risks such as disruptive technology evolution or significant economic slowdown, which may limit business catalysts from AI.

- These companies are implementing and working on AI, and will reap direct and indirect benefits from it (deepening competitive advantages).

- This does not mean that these are, of course, the only companies and stocks worthy of interest. However, it is certainly worth considering exposure to the new, disrupting trend which fuelled Wall Street bull run since the start of the 2023

- The chairman of the world's largest semiconductor company, Taiwan Semiconductor C.C Wei indicated that 2024 is only the “tip of the iceberg” for the entire development of AI.

The development of artificial intelligence cannot take place without increasing computing power. Semiconductors are responsible, which companies need to buy in order to stay one step ahead of the competition and develop efficient machine learning algorithms.

But why invest in a new technology like AI at all?

- Artificial intelligence means greater productivity, including at the enterprise level.

- This can naturally improve their revenues and profits, including in completely new market areas

- AI is a transformative technology and has the potential to create entirely new industries and market niches

- By increasing production and business capacity, companies can, in theory, drive expansion, without increasing employment costs at the same time (at the cost of higher investment in AI-related R&D, of course)

- Companies that successfully develop AI and AI-related products are likely to gain strategic advantages over their competitors

- Historically, technology companies have given investors above-average returns (the price for which has been high volatility and dramatic declines in bull markets)

- The development of artificial intelligence means a race at both the technological and business levels, and historically high competition has provided a favourable growth environment

Of course, as with the Internet boom of 1995-2000, artificial intelligence will also directly earn a rather narrow group of companies. We will try to focus on this in the following chapters.

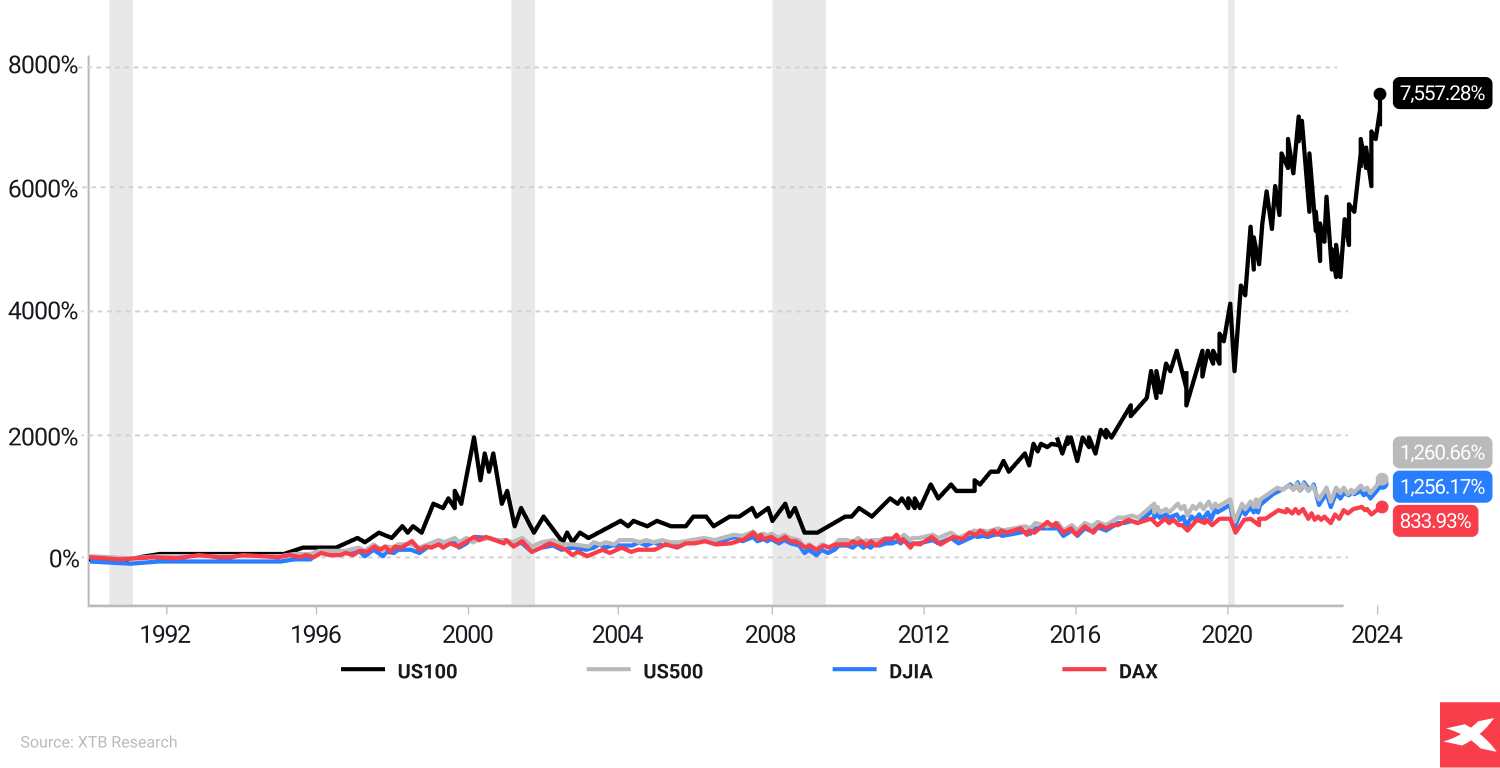

Historically, the volatility of the Nasdaq, as well as the investment risk premium for the Nasdaq, has been the highest among other US benchmarks, including Germany's DAX index. Since 1990, when new computer technologies were beginning to enter the mainstream market, the index's return has been more than 7,500% compared to 1,250% for the S&P 500. Source: XTB Research, Bloomberg Finance LP , Past performance is not a reliable indicator of future results.

Important: The case of the AI rally is in many ways different from a 20th century dot-com bubble because this time growth is justified by higher revenues and growing margins. Companies which drive this trend are the true, not only speculative, market leaders. What’s the same is a fact that huge investor optimism around a new technology is driving a bullish trend not only on Nasdaq 100, but also global stock market.

Understanding AI Stocks

Each company differs not only in its business model, quality of management, level of margins achieved and position in the industry. There are also many other subtle differences. This leads to the conclusion that it is crucial to understand each company individually.

However, understanding the operations of AI companies may be even more important. Many players who declare that they will benefit through artificial intelligence may in fact place themselves behind fast-growing competitors and lose the race.

- The perennial dilemma is that betting on winners usually means 'overpaying' for their stock. However, there doesn't seem to be any other way out, since the AI trend has been going on long enough that the market has had time to more or less form a conviction about its potential winners (based on fundamentals)

- The stock market is always pricing the 'future', and a high share price for a company is associated with a current (optimistic) valuation of its prospects and profitability. In a dynamic expansion environment, well-managed companies tend to regularly surprise the market with the scale of business improvement. A great example of this would be the exponential growth of Nvidia shares in 2023 driven by Data Centres revenues (AI chips sales), after a weak 2022 year.

So far, the biggest winners of the race are the largest technology companies. Why? Because of five, main reasons:

- Huge access to data, crucial to the development of their own AI (Microsoft, Google, Meta Platforms, etc.)

- Ability to hire and maintain powerful teams of AI software developers

- Significant cash resources that can be allocated to Research & Development

- Strong customer and consumer base where AI can be monetised as quickly as possible (contracts with major companies, hundreds of millions of browser or app users, etc.).

- High quality of the basic business model and competitive board management and CEOs

Important: A new trend has emerged at a time when US interest rates were at 40-year highs, which means high cost of debt. Speculative companies like Big Bear AI (and C3.ai (AI.US) have failed to catch up with the “mainstream” giants. However, the market quickly began to look around for 'alternatives' to BigTech investments. This led investors to gravitate toward the businesses of companies such as Arista Networks, and Super Micro Computers.

Is it too late for AI?

According to the artificial intelligence scientists and researchers community, the room for further technological expansion is still huge. Nevertheless, the companies that failed to increase their position in the new sector in the first 2 years probably “slept through” the most important growth momentum.

- So far, the stocks of the US “Magnificent 7” (the 7 largest US technology companies) have gained the most strongly. Of course, these are not the only companies that can benefit from the AI trend. We can see a bunch of companies from different sectors, where AI may be a huge not only speculative but also business catalyst.

The trend will bring a potentially favourable growth environment for companies that will effectively implement AI in services, applications, and for those that will provide the 'technological' infrastructure and background for the whole trend.

- Great examples here are Palantir (PLTR.US) which implement AI in the broad data analysis systems, Arista Networks (ANET.US), networking competitor Cisco Systems (CSCO.US), or Super Micro Computers (SMIC.US), which has specialised in the construction of so-called 'server racks' for data centres. In the future, we may also witness how demand for AI creates entirely new industries and potentially... New winners.

Top 6 AI exposure sectors

Artificial intelligence means a huge change in business models and products. Not all companies will be able to implement it as quickly and effectively. Of course, not for all companies, AI means a fundamental business change of similar magnitude. In the future, artificial intelligence could bring changes on many levels: from more effective advertising to deeper insights into consumer preferences.

Companies centred around a few industries, where AI development can translate directly and indirectly into higher revenues and profits, are most likely to benefit. We can compare it to the gold rush, where suppliers of equipment - shovels and pickaxes - earned more from gold prospectors. Below we will list some industries and companies which may be worth watching.

- AI chips: Nvidia (NVDA.US), AMD (AMD.US), Taiwan Semiconductor (TSM.US), ARM Holdings (ARM.US), Synopsys (SNPS.US)

- Semiconductor technology: Broadcom (AVGO.US), Intel (INTC.US), Photronics (PHTR.US), Lam Research

- Data centres and networking - Arista Networks (ANET.US), Super Micro Computers (SMIC.US), Cisco (CSCO.US)

- Cloud computing and AI services: Microsoft (MSFT.US), Amazon (AMZN.US), Adobe (ADBE.US), Google Cloud (GOOGL.US)

- Digital advertising and LLMs: Meta Platforms META.US), Alphabet (GOOGL.US), Microsoft (MSFT.US)

- BigData and DevOps: Palantir, DataDog

Over the past five years, AI technology has made significant strides. From vision and speech recognition to natural language processing and decision-making, AI’s capabilities have grown exponentially, leading to widespread applications across varied domains. These technological advancements have made investing in AI stocks a particularly appealing venture. Investing in AI stocks involves sifting through a maze of market hype to uncover real value.

- Investing in AI stocks requires careful evaluation of a company’s financial performance, the quality and diversity of their AI products and services, and their market position within the industry.

- Diversification of AI investments is important, urging investors to spread their funds across different sectors, company sizes, and geographical areas to mitigate risk and maximise potential gains.

- Continuous monitoring of the AI industry is crucial, including keeping track of market leaders and technological developments, to make informed investment decisions.

Researching AI Companies

Investing in the AI industry is not a decision to be made lightly. It’s not just about picking the companies with the most advanced AI technologies; it’s about understanding their financial performance, assessing their AI products and services, and evaluating their market position. And even that may not be enough because investing is about the future - not the past, or even not about the presence.

Financial Performance

Several crucial indicators must be considered in evaluating the financial performance of AI companies. These include:

- Revenue growth

- Profitability

- Cash flow

- Debt levels

A detailed assessment of these financial indicators can offer essential insights into the financial standing of the AI company and its potential for growth. One key factor that significantly impacts AI companies’ cash flow is their utilisation of AI tools. Companies that effectively use AI tools can optimise their cash flow management, thereby enhancing their financial performance. Other factors include changes in payment terms, shifts in customer behaviour, and economic conditions.

AI Products and Services

Evaluating the AI products and services of a company is another critical aspect of researching AI investments. The performance of a company’s AI marketing tools, AI demand forecasting, and market demand data can provide important insights into the company’s ability to identify and address customer needs. A track record of meeting market demand is a strong indicator of a company’s potential for success.

The portfolio of AI products and services of a company can also significantly impact its stock value. Companies with a diverse portfolio of AI offerings can offer more opportunities for portfolio diversification.

Market Position

The market position of an AI company is another crucial factor to consider when investing in AI stocks. Factors to consider include the company’s current market positioning, the financial health of the company, and the robustness of their technology. Evaluating market share within the AI industry can also provide insights into a company’s competitive position. By analysing the market size and its growth projections, investors can get a clearer picture of a company’s potential for success in the AI industry.

AI and diversifying investments

Diversification plays a vital role in AI investment strategies. By spreading your investments across different AI-related companies or ETFs that span various industries, you can reduce risk and enhance potential returns. The subsequent sections propose strategies for diversifying your AI investments.

Investing Across Industries

AI technology is not confined to a single industry. Its broad applications have the potential to revolutionise numerous sectors in the market, leading to an AI revolution in industries such as:

- Healthcare

- e-Commerce

- Finance

- Manufacturing

- Transportation

- Education

By investing across various industries, investors can minimise sector-specific risks. Currently, AI technology is being utilised in a multitude of industries, including:

- Financial Services

- Insurance

- Healthcare

- Life Sciences

- Retail

- e-Commerce

To stay competitive in these industries, it’s crucial to utilise AI tools effectively. These industries make them potential targets for investment diversification. Of course, it’s still hard to say that companies from sectors like insurance or healthcare have money directly because of AI, but in the long term, those companies which will use AI faster and better probably, will outperform others.

Balancing Large and Small Companies

Diversifying investments between large and small AI companies can lead to reduced risk, enhanced potential for returns, and opportunities for portfolio diversification. Large, established corporations tend to be more profitable, while small startups may encounter challenges but offer the opportunity to participate in groundbreaking ventures.

Allocating funds to smaller, innovative AI startups offers the opportunity to participate in groundbreaking and transformative ventures in the AI space, along with the potential for substantial returns through venture capital funds.

Considering Global AI Opportunities

Investing in AI is not limited to a specific geographical region. AI development and adoption are occurring worldwide, presenting diverse investment options. For instance, the United States and China are the top countries leading in AI development. However, investing globally is not without risks. It’s important to consider factors like lack of transparency and explainability, potential job losses due to automation, and social manipulation risks. But with due diligence, the rewards can outweigh the risks.

Evaluating AI Investment Risks

Like any investment, AI investments carry their unique set of risks. Market volatility, for, can lead to fluctuating investor sentiment driven by news and developments in the AI field. This can result in a highly volatile market environment for AI stocks. Also, a very competitive environment means that the trend may change dynamically. What’s crucial for AI investors is monitoring revenues directly from artificial intelligence demand.

- Investors should also be aware of potential regulatory changes that could impact AI investments. Measures targeting operational resilience and handling AI-related privacy concerns are just a few examples of potential regulatory changes that could affect AI investments.

- Ethical concerns such as data privacy, algorithmic bias, and broader societal implications of AI also pose potential risks. These concerns have the potential to undermine public trust and market confidence, thereby exposing investors to reputational harm and regulatory scrutiny for AI companies.

- Monitoring the leading players in the AI industry is an essential component of the investment strategy. Current industry leaders in AI stocks include:

- Nvidia (NVDA.US)

- Arista Networks (ANET.US)

- Taiwan Semiconductor Manufacturing Co. Ltd. (TSM.US)

- Microsoft (MSFT.US)

These technology companies have a proven track record in machine learning and are paving the way in AI development.

Monitoring AI Industry Developments

Keeping abreast of the latest developments in the artificial intelligence AI industry may be also important for informed investment decisions. The recent technological developments in the AI industry encompass:

- Faster and higher quality of data analysis

- Natural language generation and speech recognition

- Virtual agents and decision management

Formulating a long-term AI investment strategy that matches your financial goals is vital for successful AI investing. AI-driven solutions that analyse financial transactions and recommend tax-efficient investments can help align your financial goals with AI investment strategy.

Understanding the risk tolerance is also essential when developing a long-term AI investment strategy. The alternative for stock specific investments may be Nasdaq 100, which includes almost all the biggest and highest quality US technology companies, which can benefit from AI. AI stocks present a unique investment opportunity, offering the potential for substantial returns. However, like any investment, they come with their own set of risks and challenges. By conducting thorough research, diversifying your investments, monitoring industry developments, and creating a long-term investment strategy, you can navigate the exciting world of AI investing.

FAQ

It’s very hard to choose the best AI company. The future is unknown, however, if one wants to be sure that an investment has direct exposure to AI trends. For sure, one of the most popular AI stocks are Nvidia (NVDA.US), Arista Networks (ANET.US), Microsoft (MSFT.US) or Super Micro Computers (SMIC.US) but their future performance remains uncertain.

These companies are leaders in utilising artificial intelligence to improve products and provide AI services to businesses. It’s also worth noting that sometimes ‘it’s not what you buy, it’s what you pay’ and AI stocks may be overvalued due to high demand for speculation and a ‘bubble market’, which can vary stocks from the intrinsic value. Remember especially about market sectors such as:

- AI chips (and various semiconductors around that)

- Data centres and data analytics

- Computer networking

- AI applications and services

Yes, you can buy shares in AI either by investing in individual companies involved in the AI sector or through ETFs, such as Nasdaq 100, which will give You an exposure to a broader technology companies market. Both options require careful consideration of the associated risks and costs.

Consider investing in tech firms like Microsoft, Nvidia, Alphabet (Google) or Arista Network or ETFs that track the technology stocks performance, such as Nasdaq 100, to gain exposure to AI development. You should not invest too much money in the beginning. If you will be professional, your risk tolerance will grow with time, but always remember the basics. The stock market differs broadly from fixed income and your future returns are always unknown. Learn to benefit from business momentum.

To evaluate the financial performance of AI companies, consider key financial indicators such as revenue growth, quality of management, profitability, cash flow, and debt levels. This will provide insight into the company's financial health. Some investors are also using alternative data such as workers and client opinions and many more. Red companies quarterly financial statements to stay informed, tracking current business performance and challenges.

Diversifying AI investments can reduce risk and enhance potential returns by spreading investments across different AI-related companies or ETFs spanning various industries. Of course, a cost of diversifying may be a lower investment return, however a concentration in only one, 2 or even 3 companies may be perceived as too risky for a lot of investors. It’s due to specific risks such as business exposure, clients risk or random events hitting profitability.

What is Next for the AI Trade?

Investing during a crisis: Strategies and Tips

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.