The world is moving forward, and high economic development continues to generate significant levels of carbon emissions. The Earth's climate is changing, and restoring a sustainable environment will help humanity achieve long-term growth without disrupting the planet's ecosystem and the risks that supply behind its damage. A very important “green economy” trend has been hatched as a response to rapid climate change. However, it cannot happen without trillions of dollars worth of investment from the private sector.

Climate change creates powerful opportunities for companies that get given the ability to create successful business models based on the new green trend. Investors who choose to invest in this change can expect long-term returns and a positive impact on planet Earth. Of course, this cannot take place without the risks that always accompany investments. How to invest and, above all, how to understand the trend of investing in climate change? From electric cars to investments in uranium miners to investments in water. Examine how renewable energy, sustainable transport, and carbon reduction technologies can align your investments with environmental sustainability and potential growth. Read this article and get to know how to benefit and impact from climate change investments.

The world is moving forward, and high economic development continues to generate significant levels of carbon emissions. The Earth's climate is changing, and restoring a sustainable environment will help humanity achieve long-term growth without disrupting the planet's ecosystem and the risks that supply behind its damage. A very important “green economy” trend has been hatched as a response to rapid climate change. However, it cannot happen without trillions of dollars worth of investment from the private sector.

Climate change creates powerful opportunities for companies that get given the ability to create successful business models based on the new green trend. Investors who choose to invest in this change can expect long-term returns and a positive impact on planet Earth. Of course, this cannot take place without the risks that always accompany investments. How to invest and, above all, how to understand the trend of investing in climate change? From electric cars to investments in uranium miners to investments in water. Examine how renewable energy, sustainable transport, and carbon reduction technologies can align your investments with environmental sustainability and potential growth. Read this article and get to know how to benefit and impact from climate change investments.

Global net-zero efforts

The urgency to address climate change has stimulated a global effort to curb greenhouse gas emissions. The United States economy has set a goal to achieve the 0% CO2 emission by 2050 in the same way the European Union has. Probably, it can create huge investment opportunities for the private companies. As the world seeks to transition to a low carbon economy, companies are stepping up, adopting environmentally-friendly technologies to reduce their carbon footprint and mitigate climate change.

This shift not only contributes to the battle against global warming, but it also offers a myriad of investment opportunities. Companies focused on reducing greenhouse gas emissions are leading this movement. Advancements in carbon capture and clean energy transmission have made this sector a vital component of climate change mitigation strategies. These companies are not only generating a tangible impact on the climate crisis but also ushering in a new era of climate investing.

Energy transmission and niche sectors

- Greenhouse gas reduction technologies and clean energy transmission advancements offer lucrative investment opportunities and contribute significantly to combating climate change.

- Renewable energy and the EV market are experiencing rapid growth, with companies in these sectors presenting promising investment opportunities through technological innovations and international expansion.

- Not only EVs but also niche sectors such as uranium mining or investing in water supply infrastructure may be critical for the whole World economy.

Effective climate change investing requires navigating risks and rewards, leveraging investment research, and understanding the global market dynamics, with attention to long-term strategies and sustainable portfolio optimisation. In the battle against climate change, carbon capture technologies have emerged as a game-changer. By extracting carbon dioxide from the atmosphere, these technologies offer a promising solution to reduce both greenhouse gas emissions and carbon emissions.

Companies like Climeworks and Carbon Engineering are leading this innovation, operating facilities in Europe and the U.S. respectively. The field is diverse, with companies such as SAIPEM’s CO2 Solutions and LanzaTech advancing carbon capture with unique approaches, such as enzyme-based technology and converting waste gases into useful products. These groundbreaking technologies underscore the potential of carbon capture as a tool in our arsenal against climate change and a lucrative avenue for climate investing.

Clean energy transmission leaders

As the world shifts towards renewable power, the need for efficient and sustainable energy transmission intensifies. Companies worldwide are driving this change, developing solutions that contribute to a low carbon economy. Neoenergia in Brazil, for instance, emphasises sustainable solutions in its operations involving energy generation, transmission, and distribution.

European companies like E.ON focus on smart electricity distribution and robust electricity grid construction, respectively. These clean energy transmission leaders are not only playing a pivotal role in the energy transition but also present enticing investment opportunities in the renewable energy sector.

Energy transition and electric vehicles

The energy transition – the global shift from fossil fuels to renewable energy – presents a myriad of investment opportunities in energy solutions. This transition encompasses diverse sectors such as:

- Renewable energy

- Energy storage

- Hydrogen

- Carbon capture

- Electrified transport

Investments in the energy transition span beyond clean technology deployment to include the clean energy supply chain and energy transition-related debt issuance. Understanding these diverse sectors and their potential for growth is crucial for investors looking to capitalise on the energy transition. For example, Albemarle is the biggest world lithium supplier for electric vehicles, so this company may benefit from long term EV market growth. There are a lot of examples like that.

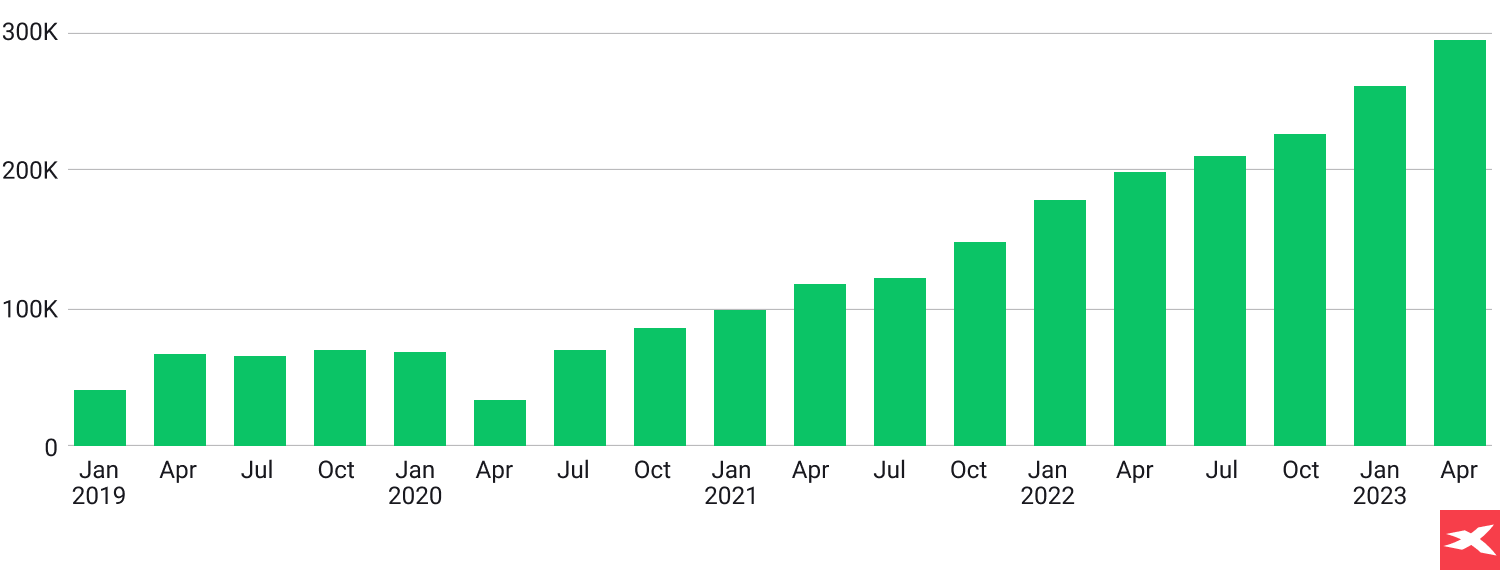

Electric vehicles are a very important part of climate change investments. In 2023 more US clients chose EV than ever. Only in Q2 2023 US consumers bought 300,000 new battery EVs. Also, battery ranges improved recently with a number of EV ranges at least 300 miles increased from 13 to 51 in 2023 according to US Department of Energy data. Investors can consider investing in companies such as Tesla, Albemarle, Nio or Xpeng.

Source: Cox Automotive, CNN

Source: Cox Automotive, CNN

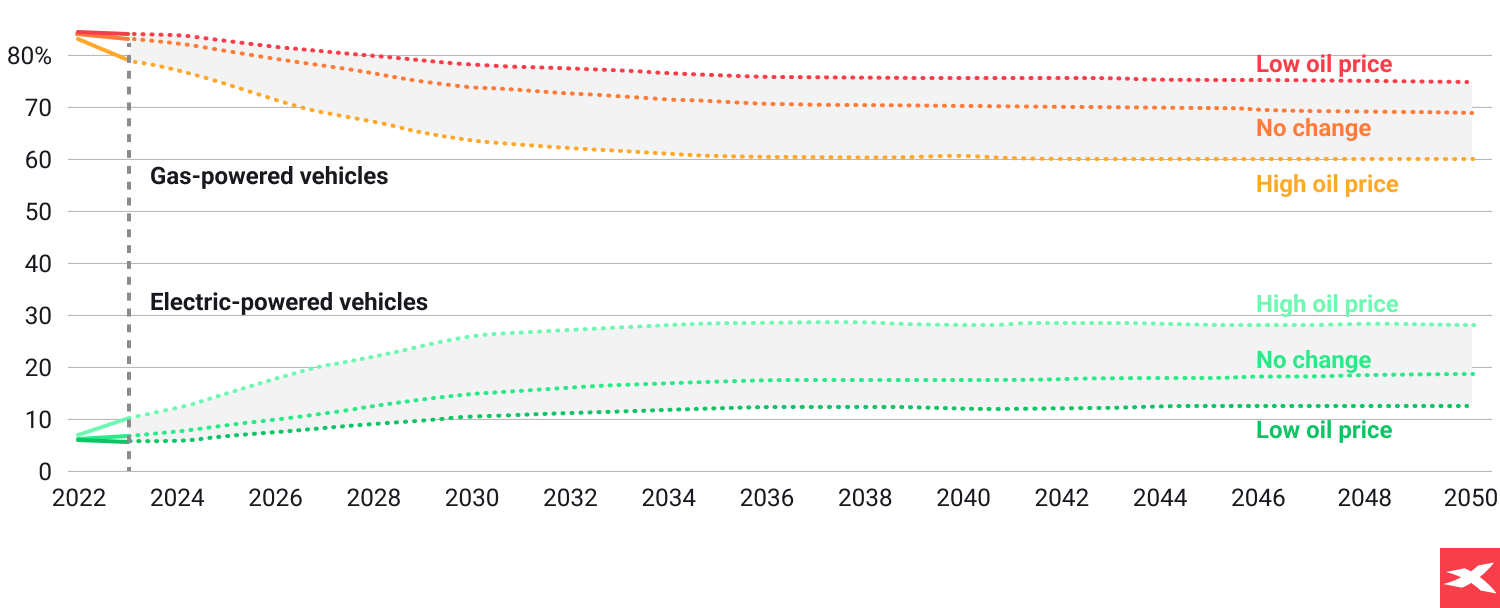

Note: Data includes sales of both BEVs and PHEVs from 2022 and sales projections for 2023-2050. "No change" represents sales with no new laws or regulations and oil priced at $101 per barrel by 2050, in 2022 dollars. Low oil price assumes oil is priced at $51/b. High oil price assumes oil is priced at $190/b.

Note: Data includes sales of both BEVs and PHEVs from 2022 and sales projections for 2023-2050. "No change" represents sales with no new laws or regulations and oil priced at $101 per barrel by 2050, in 2022 dollars. Low oil price assumes oil is priced at $51/b. High oil price assumes oil is priced at $190/b.

Source: US EIA, CNN

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

The rise of electric vehicles (EVs) marks a pivotal shift in the transportation sector towards sustainability. With global electric vehicle sales surpassing a significant milestone of 10 million units in 2022, the EV market has proven to be a rapidly growing segment.

This burgeoning market presents a myriad of investment opportunities. Industry leaders such as Tesla, and BYD are at the forefront of this revolution, actively combating climate change through sustainable transportation.

The transition to electric vehicles not only represents an opportunity for investors but also plays a critical role in the global effort to mitigate climate change.

Leading EV manufacturers

The electric vehicle (EV) market is dominated by several key players, driving the industry’s growth and innovation. BYD has emerged as the largest electric car manufacturer, overtaking Tesla with 1.9 million plug-in electric cars sold globally in 2022.

Leading manufacturers are not just focusing on the production of EVs, but also innovating for a more sustainable future. For instance, NIO is at the forefront of battery swapping technology, an innovation that enhances the usability and adoption of electric vehicles. Also, Toyota Motors plays significant role as EV hybrid producer;

As these companies drive EV adoption, they offer enticing investment opportunities in the sustainable transportation segment. Investors can also consider European EV producers such as Volkswagen (VOW1.DE) and Porsche (P911.DE).

Battery storage

As the adoption of electric vehicles accelerates, so does the need for efficient battery storage solutions. Companies like QuantumScape are focusing on the development of solid-state lithium-metal batteries, an innovative approach set to transform the EV sector.

Other key players, such as BYD and LG Chem, are recognised for their reliable energy storage systems, addressing a variety of energy storage needs.

These advancements in battery storage technology not only bolster the prominence of electric vehicles but also aid in building a sustainable energy ecosystem, offering promising prospects for climate investing.

Important: Such as any discretionary sector, also electric vehicles demand is cyclical. It will depend on economic conditions (recession risk) and even global petrol prices. The long term growth trend is not a guarantee that prices of stocks from the sector will rise constantly, without any downturns. It's a natural, economic and investing process, however investors with a strong mindset and research may use downturns to boost investments at lower prices (carrying trend-reversal risks).

Climate change investments

The renewable energy sector has witnessed considerable growth in recent years, unfolding a plethora of promising investment opportunities. Companies like NextEra Energy, Brookfield Renewable, and Clearway Energy have secured a strong presence in the renewable sector with significant wind and solar assets.

In addition, diversified firms such as Vestas, Orsted or Siemens Energy have become a part of the renewable movement, contributing through their wind turbine operations. The increasing prominence of renewable energy stocks provides investors with the chance to benefit from the transition to a low carbon economy and participate in the worldwide combat against climate change.

Wind Energy Trailblazers

Wind energy, another pillar of the renewable sector, has seen substantial growth globally. Companies like NextEra Energy Resources, Orsted and Vestas Wind Systems have been at the helm of this revolution, operating significant wind generation capacities worldwide. Climate change is a global challenge that calls for a global solution. As such, the climate investment landscape is shaped by a multitude of players, including:

- Governments and policymakers

- Corporations

- Individual investors

- Sovereign wealth funds

Sovereign wealth funds, for instance, are increasingly recognising the importance of aligning with their financial mandate to address climate change. However, the path to climate investing isn’t always straightforward. Investors aiming to contribute to climate solutions encounter considerable obstacles, especially in regions such as South America, where financial limitations and high levels of debt hinder governmental climate initiatives.

Navigating these challenges requires strategic investment approaches, underpinned by thorough research and an understanding of the global dynamics of climate change investments. Not only wind, but also solar power generation has seen a significant uptick in recent years, with several companies leading the charge. Some of the leading manufacturers in solar power generation with expansive global operations are companies such as First Solar.

Pros and cons of climate investing

Investing in climate change has its own pros and cons, and investors should consider risks. We mentioned, below, the key positives and negatives of investing in green companies.

Pros

- Investing in climate change companies has a positive impact on the environment

- Bringing ecological and sustainable growth for the worlds economy may give investors both benefits and satisfaction

- Green companies have support from both private and public sectors, as well as politicians approval

- The climate change sector can count on both private and the country's investments

- Sectors such as electric vehicle are in the long term trend which may benefit shares owners

Cons

- Sector may be highly dependent on interest rates policy

- Public orders may be not sustainable as major economies public debt rise

- Stocks of companies with no positive cash flow may be hit from recessions

- Highly cyclical demand cycle

- A lot of competitiveness and technological disruption risks

Important: Companies need investment to grow and implement their strategies on a higher scale. Of course, any public company earns money from the stock market only once (during IPO or new shares issuance, to raise capital). But higher market capitalisation increases their capabilities, as well as reputation and recognition, which may be crucial to expand further.

Impact investing

As any other investment, investing in climate change has a variety of risks, and stock investing is very risky. However, in this kind of investment, your money may have a significant positive impact on the environment. Energy transition costs trillions of dollars and those are costs which humanity have to take, to achieve sustainable economies. It’s almost impossible to do it without private sector investments.

By investing in companies that prioritise sustainable investment and environmental protection, investors can help drive innovation towards more eco-friendly technologies and practices. This, in turn, can lead to reduced carbon emissions, cleaner air and water, and a healthier planet for future generations.

Investing in those initiatives also has financial benefits. Companies that prioritise sustainability tend to be more resilient to market disruptions caused by climate change regulations or public pressure for environmental action. Additionally, they are often able to attract socially conscious consumers who prefer products made by environmentally responsible companies.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Climate investments risk

Like any investment, climate change investments come with their share of risks and rewards. Regulatory and policy risks are key considerations, as changes in government policies can significantly impact the profitability of climate stocks. What are 5 basic, specific risks related to climate change investments?

Like any investment, climate change investments come with their share of risks and rewards. Regulatory and policy risks are key considerations, as changes in government policies can significantly impact the profitability of climate stocks. What are 5 basic, specific risks related to climate change investments?

Risks related to interest rates and the cost of debt

Some companies are not profitable and conduct business by financing themselves with debt. An increase in the cost of interest, coupled with a weaker economy, can raise the risk of bankruptcy and exhaustion of the business model. Higher interest rates also limit the ability to raise capital through the issuance of bonds (debt), as they may not meet an adequate level of market interest. This risk is especially true for companies that are not yet profitable and do not generate positive cash flow.

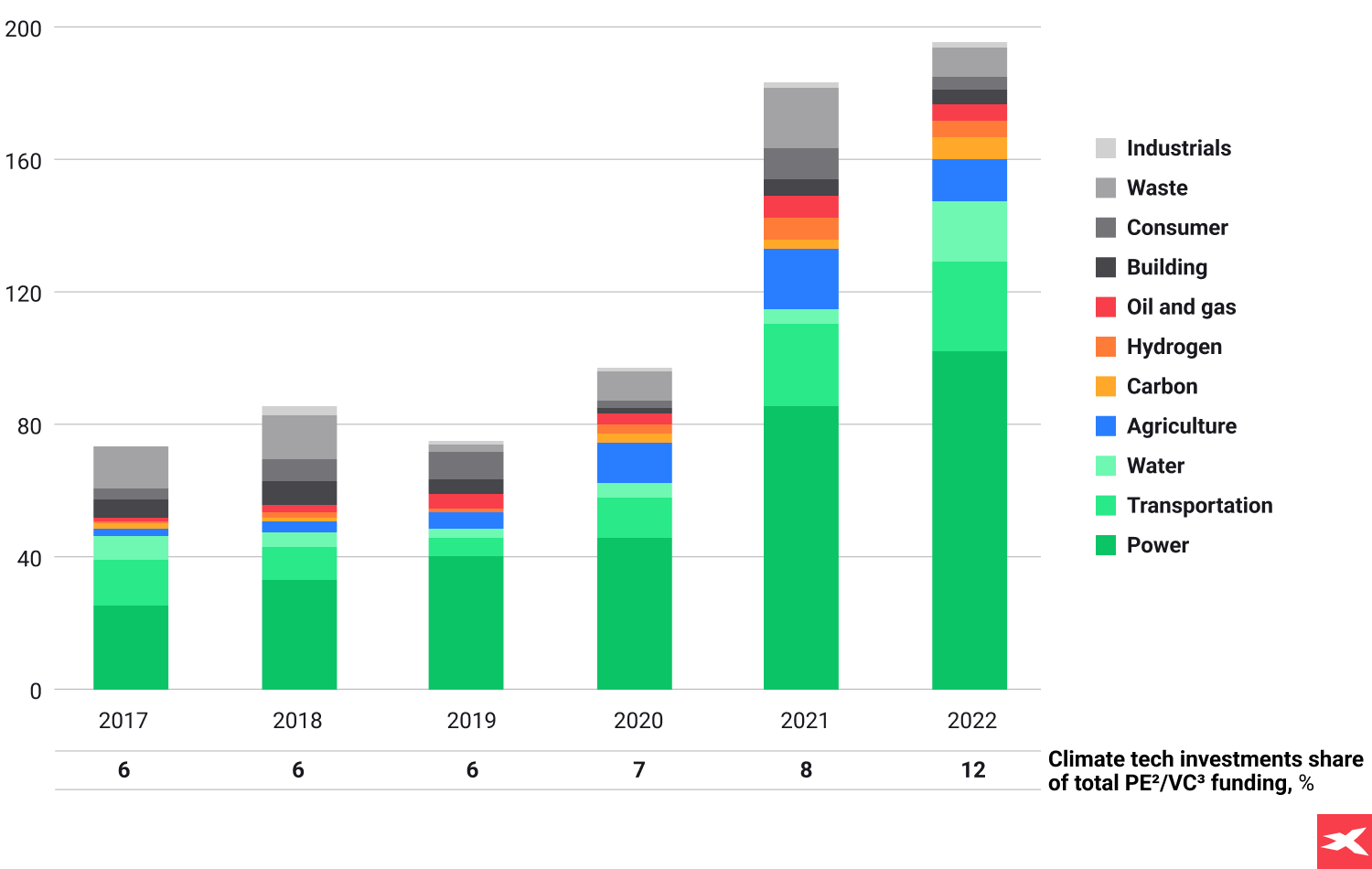

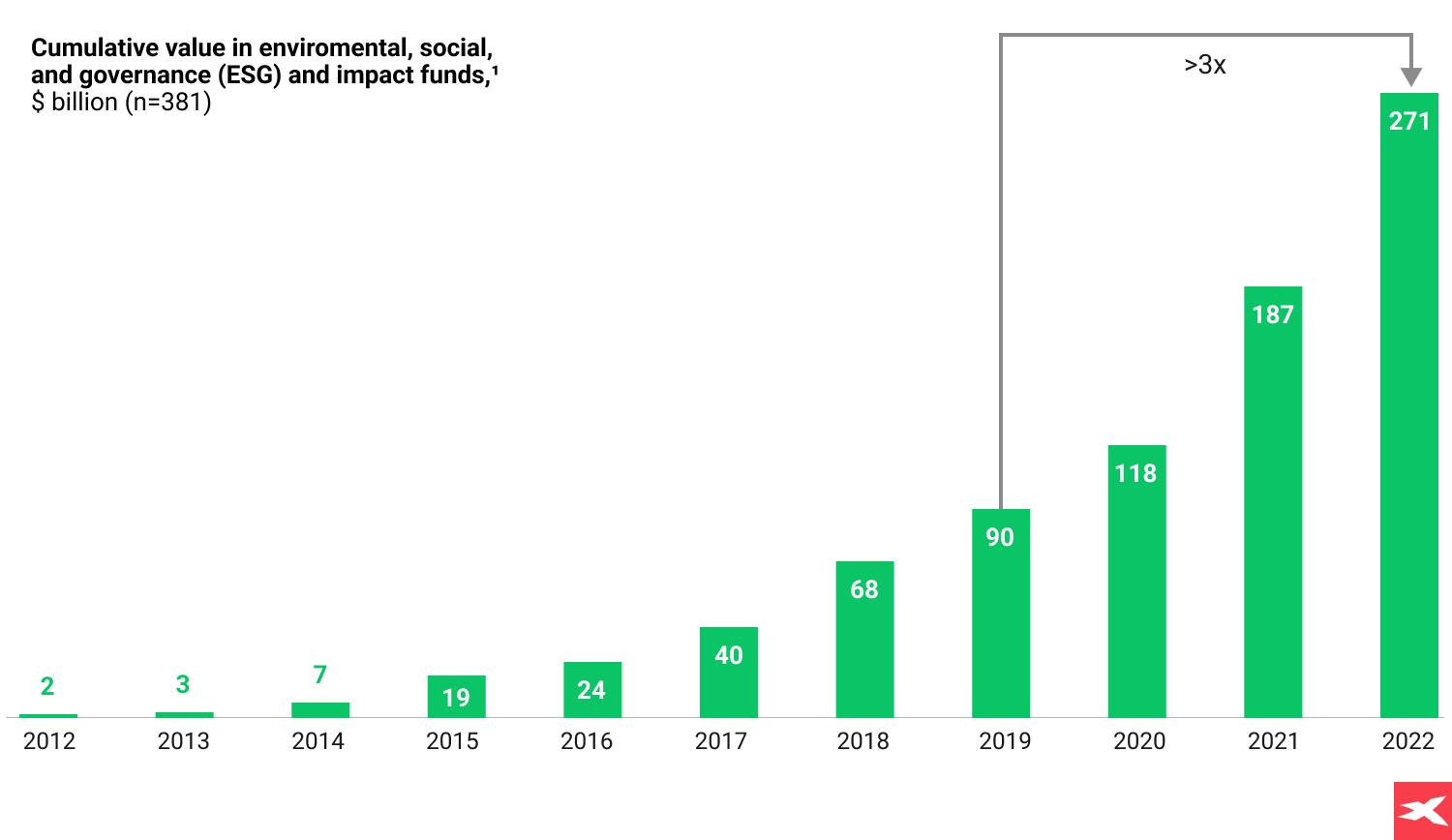

Since 2012 significant money has been raised for funds related with environmental change and ESG in general, however that period was quite “easy” due to low interest rates in both US and European economies. After the Federal Reserve “sea change” in 2022, next year may be harder, especially for non profitable companies and investors investing in climate change should be much more cautious. Source: PitchBook, McKinsay Reports

Competitors risk

Some companies are competing on many business fronts, such as margins or new technologies. Also, trends related to green and zero-carbon energy sources are generating significant competition. As an example, we can mention Chinese automotive brands competing with Tesla, or German car companies. Every company runs the risk that its product or business model will prove not strong enough to maintain or increase market share.

The risk of government contracts

Many green energy companies depend on government procurement and contracts signed with entire groups of countries. There is always the risk that such a contract will be suspended or broken, which can result in huge losses for the company. For shareholders, this can be all the more painful because stock prices usually discount such positive events in advance. As a result, the rupture of a contract can lead to dynamic stock declines. A good example here is the Danish company Orsted's contract with the United States, covering “offshore” wind farms along the US East Coast.

Risks of a recession

The recession poses a significant risk to many industries, including the climate change investment trend. When prosperity “evaporates” and economic growth slows, many companies and countries pull out of “unprofitable” investments, which hits the order books of “green energy” companies. Investors then view many projects and plans with greater scepticism and are risk-averse, which manifests itself in cyclical declines in stock prices.

Business model risk

Of course, climate change is underway and this is supported by scientific evidence. On the other hand, this does not mean that every company declaring its presence in this trend will make huge money from it. Investors should observe very carefully what a company is earning and what it intends to offer. For this, shareholders should regularly follow the quarterly reports of the companies they own, or opt to invest in better-diversified ETFs that track the broader “green investment” industry.

However, alongside these risks come substantial rewards. Investments in green initiatives, although they may not yield short-term profits, are crucial for long-term growth. Grasping these risk and reward considerations is vital for investors aiming to make knowledgeable decisions in climate investing.

Assessing Future Performance

Understanding future performance is a key aspect of climate investing. Investors can evaluate the potential future performance of climate change stocks by analysing historical revenue and earnings growth, profitability ratios, and valuation ratios. Of course, there is no guarantee that companies will continue to grow in the future and how shares will react to that.

Additionally, the competitive landscape assessment, such as market share and barriers to entry, along with a company’s track record in innovations and patents, are key indicators that provide insights into its future performance. This enables investors to make informed investment decisions and capitalise on the potential of climate change.

Different markets and opportunities

Climate change investments span across diverse markets, making market understanding a key element of climate investing. Depending on investment goals and risk tolerance, investors can opt for passive strategies like tracking a climate stock index or active investing involving the selection and management of individual stocks.

Research tools and financial platforms providing ESG ratings and industry-specific trends enable investors to make informed decisions on climate stocks in diverse markets. This understanding of different markets is crucial for diversification and navigating the complexities of climate investing. Long-term strategies play a critical role in climate investing. Some key considerations for long-term climate investing include:

- Hedging against climate risk

- Specifically tailored portfolio optimisation techniques

- Considering the trade-off between short-term returns and long-term sustainability

- These strategies are important for investors looking to address climate change and its impact on their portfolios. Several countries have established Long-Term Strategies (LTS) for climate change.

Climate stocks and ETFs

Investors have the opportunity to bet on climate change and hundreds of “green” listed companies, which can benefit from it. Investors can choose stocks from a wide range of sectors from wind energy to nuclear power to investments in solar, water or hydrogen. In addition to listed companies, XTB's platform also includes key ETFs and shares of green, sustainable funds, known for ESG investing.

Wind: Vestas (VWK.DK), Orsted (ORSTED.DK), Enphase (ENPH.US), EDP Renovaveis (EDPR.PT), Brookfield Renewable (BEPC.US), Clearway Energy (CWEY.US)

Solar energy: First Solar (FSLR.US), Canadian Solar (CSIQ.US), Nordex (NDX1.DE), Solaredge (SEDG.US)

Nuclear: Cameco (CCJ.US), Uranium Energy Corp (UEC.US), Energy Fuels (UUUU.US), NexGen Energy (NGX.US), Kazatomprom (KAP.UK)

Electric vehicles: Tesla (TSLA.US), Rivian (RVN.US), Toyota (TM.US), Lucid (LUCD.US), Nikola (NKLA.US), Fisker (FSR.US), Arrival (ARVL.US), NIO (NIO.US), Albemarle (ALB.US), Toyota Motor (TM..US), Xpeng (XPEV.US), Quantumscape (QS.US)

Hydro: Norsk Hydro (NHY.NO), Nel (NEL.NO), PlugPower (PLG.US), L&G Hydrogen Economy UCITS (HTWO.UK), Bloom Energy (BE.US), Siemens Energy (ENR.DE), Veolia (VIE.FR)

Water: American Water Works (AWK.US), Evoqua Water (AQUA.US), United Utilities (UU.UK), Pennon Group (PNN.UK), Veolia (VIE.FR)

Electric Utility: Constellation Energy Corp (CEG.US), Electricite de France (EDF.FR), NextEra Energy (NEE.US), Greenvolt Energias (GVOLT.US), Eversource Energy (ES.US), Linde (LDE.DE)

ESG Investment funds: Brookfield Asset Management (BAM1.US), Liontrust Asset Management (LIO.UK)

ETFs (Exchange-Traded Funds) can hold dozens, or even a hundred, of companies from a selected sector in their portfolio. Their price is the result of a weighted average of all the stocks of the companies they track. ETFs help build a diversified portfolio and can potentially reduce investment risk. They are also a common investment choice for passive investors.

ETFs: Amundi CAC40 ESG UCITS (C40.FR), iShares MSCI EMU ESG Screened (SASU.UK), Invesco Solar Energy (RAYS.UK), iShares Global Clean Energy UCITS (INRG.UK), iShares Global Waters UCITS (IQQQ.US), L&G Clean Water (GGG.UK), iShares MSCI EMU ESG Enhanced (EDM4.DE), iShares MSCI USA ESG Screened (SASU.UK), Lyxor MSCI China ESG Leaders (LHKG.DE), iShares Global Water (IH20.UK)

Climate change has undeniably transformed the investment landscape, presenting a plethora of opportunities for investors looking to contribute to a greener future. From harnessing the power of greenhouse gas reduction to navigating the energy transition landscape, climate investing offers a unique blend of financial returns and environmental impact.

As the world continues to grapple with the climate crisis, the need for climate investing is more urgent than ever. By understanding the diverse sectors, risks, rewards, and long-term strategies involved, investors can make informed decisions and play a pivotal role in the global fight against climate change.

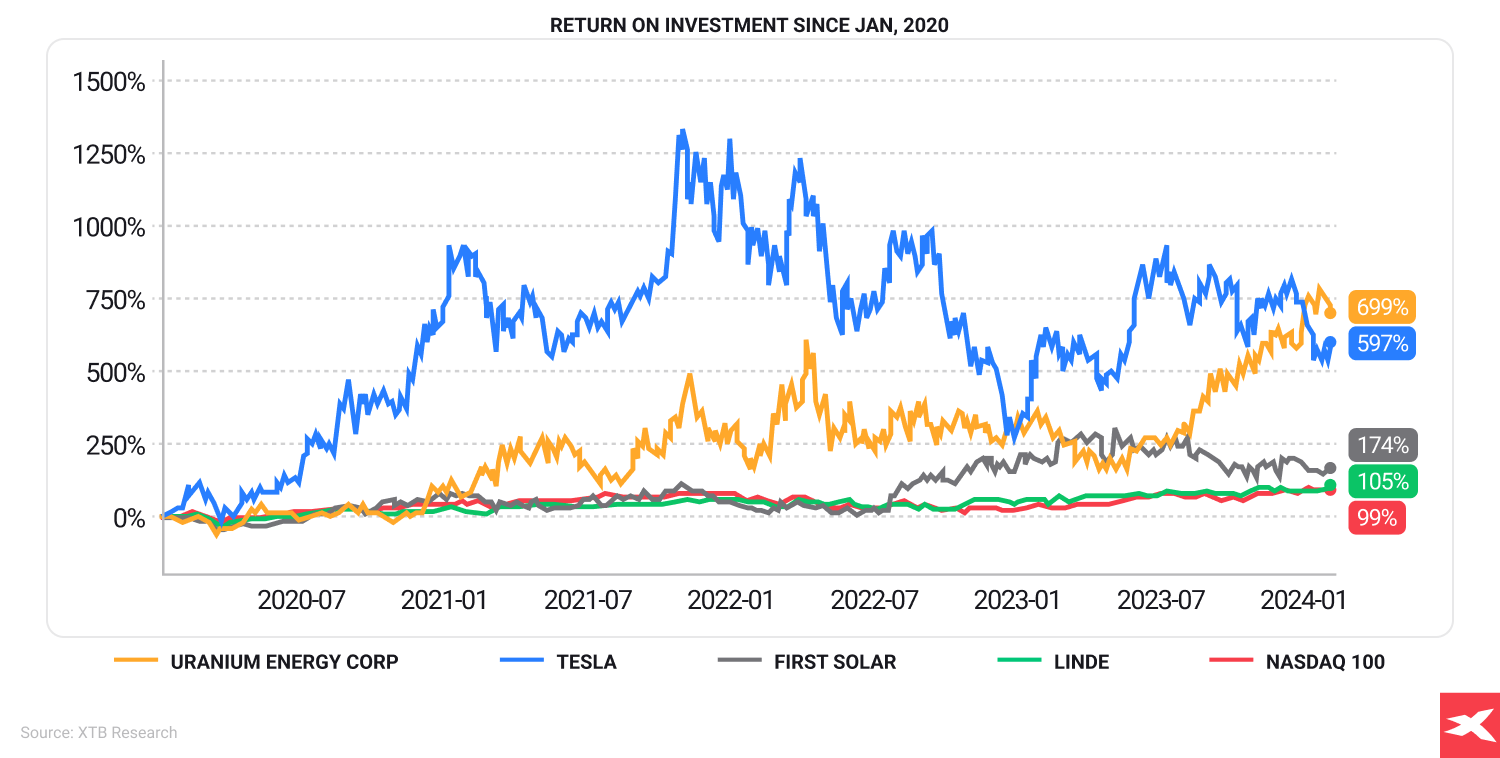

Over time, investing in the most profitable and successful climate change stocks gave investors outstanding returns in 2020, with Uranium Energy Corp (UEC.US) shares surging 700% and European leader of chemicals and green gas technologies Linde outperforming Nasdaq 100. Source: XTB Research

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Disclaimer

This marketing communication is intended for informational and educational purposes. It is not investment advice or information that recommends or implies an investment strategy. We do not propose any investment strategy nor provide any investment advisory in this material.

This material does not consider the client's personal financial situation, needs and investment objectives. It is also not an offer of sale or subscription. It is not a solicitation to buy, advertise or promote any financial instrument. We have created this commercial publication with objectivity and diligence. We present facts known to the authors at the time the document was prepared. We do not include any evaluation elements.

Information and research based on historical data or results and projections are not reliable indicators of the future.

We are not liable for your acts or omissions, in particular for your decisions to buy or sell financial instruments based on the information contained in this marketing communication. We also cannot be held liable for any damages that may arise from the direct or indirect use of this information

Your Capital is at risk. The value of your investments may go up or down.

FAQ

Investing in achieving the UN's Sustainable Development Goals in line with the Paris Agreement may require $6.9 trillion annually until 2030, with global infrastructure investment estimated to cost $90 trillion by 2030 (World Bank, 2019 study). It’s hard to estimate a correct value of climate change investments because of goods inflation and fluctuations on global commodity prices. But it’s obvious that global “net-zero” policy costs a lot of money, and we are only in the beginning stage of deploying it.

Investing in climate change stocks is important because it helps combat climate change and provides potential financial growth opportunities by supporting businesses contributing to a sustainable future. Investors which believe in the climate change trend may search companies, which may benefit from providing solutions, in the long term.

Climate investments involve allocating financial resources to projects, initiatives, and technologies that help mitigate the effects of climate change and support the shift towards a sustainable, low-carbon economy. This can be done by individuals, businesses, and governments. Those technologies may be wind turbines, solar panels or even uranium mining.

When considering climate change investments, it's crucial to understand regulatory and policy risks related to companies contracts, technological disruption, and the sector's sensitivity to interest rates, new laws and other regulations. These factors can significantly impact the success of such investments.

Key players in the renewable power sector include Tesla, NextEra Energy, Vestas Wind Systems, Brookfield Renewable Corp. There are also a bunch of other companies which are major contributors to the industry. Investors may focus also on smaller companies which may arise in the future, giving possible outstanding returns. However, risk management should be every investor’ highest priority, so remember about doing research and investing money that you can afford to lose.

What is Next for the AI Trade?

Investing during a crisis: Strategies and Tips

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.