ETFs have been gaining more and more popularity in recent years. It is no wonder, this passive investment tool is known for its very low fees, flexibility and simplicity, and compared to regular actively managed funds, ETFs are much cheaper and generally achieve much higher performance, with people being able to make their purchases or sales in real time, for example via mobile applications.

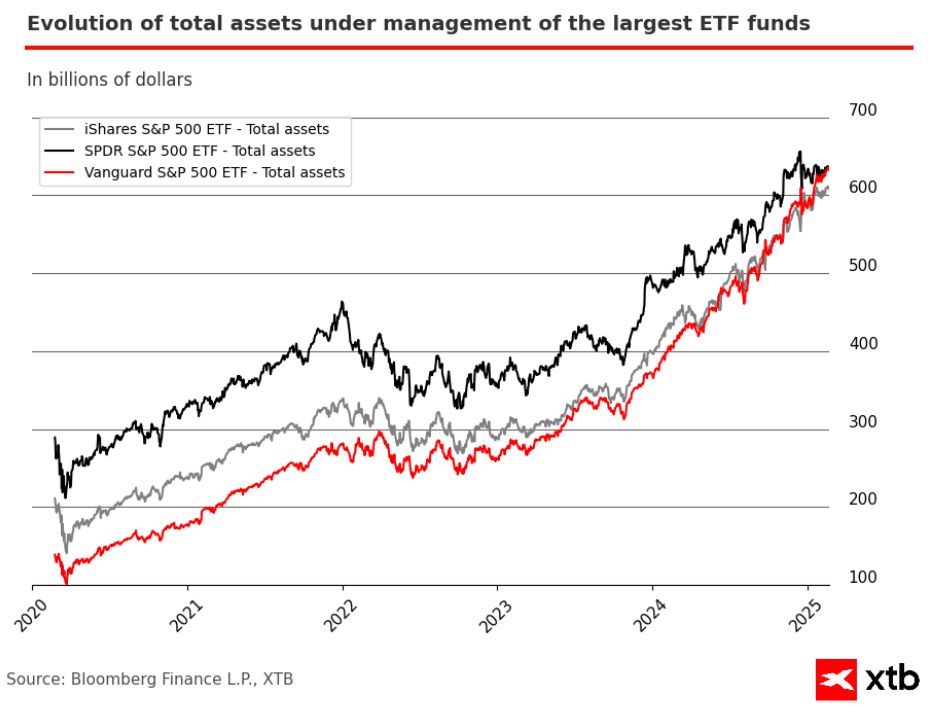

For many years, the world leader in ETFs for the most famous American stock index S&P 500 was the fund with the abbreviation SPY from State Street. However, a few days ago, the fund with the abbreviation VOO from the rival company Vanguard surpassed it in the volume of managed assets. There is currently 632 billion USD in the Vanguard fund and 23 billion USD has flowed into it since the beginning of this year. There is currently 630 billion USD in the SPY fund, see. picture.

ETFs have been gaining more and more popularity in recent years. It is no wonder, this passive investment tool is known for its very low fees, flexibility and simplicity, and compared to regular actively managed funds, ETFs are much cheaper and generally achieve much higher performance, with people being able to make their purchases or sales in real time, for example via mobile applications.

For many years, the world leader in ETFs for the most famous American stock index S&P 500 was the fund with the abbreviation SPY from State Street. However, a few days ago, the fund with the abbreviation VOO from the rival company Vanguard surpassed it in the volume of managed assets. There is currently 632 billion USD in the Vanguard fund and 23 billion USD has flowed into it since the beginning of this year. There is currently 630 billion USD in the SPY fund, see. picture.

Source: Bloomberg Finance LP, XTB, Past performance is not a reliable indicator of future results.

This is a significant milestone, as the SPY fund was created in 1993 and essentially defined what passive investing would look like for decades to come. Technically, it wasn't the first ETF in the world, that title went to a Canadian fund that was created a few years before this ETF, but it essentially started the passive investing revolution. For many years, this fund benefited from being the first fund of its kind in the world, and investors automatically considered it their first choice. Over the years, however, several competitors have emerged, the most famous of which are Vanguard and BlackRock. They are characterized by the fact that they offer practically the same product, but with much lower fees. SPY charges an annual fee of 0.095% (which is still significantly less than actively managed funds), while the largest competing ETFs from the aforementioned two companies charge only 0.03% per year.

Fees will probably be one of the factors that shift money from SPY to other ETFs on the S&P 500 index. In third place on this list in terms of the volume of assets held is the iShares fund from BlackRock, which manages approximately 611 billion USD, so it is possible that we will soon see the SPY fund move even to third place. Ultimately, this fee price war means that the main beneficiary of the benefits is the customer. Thanks to the competitive struggle, he can get access to ETFs on this index (albeit slightly different ones, since European regulation does not allow offering American ETFs in Europe, but in practice almost the same funds are offered in Europe and are even traded in Euros) for really extremely low fees while maintaining great flexibility and liquidity. Of course, we at XTB also offer several ETF funds from various issuers. The long-term nominal return on this index has been around 10% per year for the past 100 years or so, or around 7% per year after inflation, meaning that the value of an investment in the S&P 500 has doubled on average every 10 years. Over the past 15 years, returns have been even slightly higher, which is also attracting new investors and increasing the popularity of this investment vehicle.

Despite VOO becoming the new king, SPY remains a very popular instrument for investors and funds. Daily trading volumes on SPY are still much higher than on other ETFs. Investors therefore still use SPY to a large extent for more active trading due to its reputation and high liquidity.

Is Investing Small Amounts Worth It? A Comprehensive Analysis

Climate change investments: Maximising impact

Best ETFs to Look Out For

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.