Mixing a variety of investments is key to having a successful portfolio, and real estate is a great way to diversify your investments.

However, purchasing your own property can be expensive when you consider the deposit, monthly mortgage payment, insurance and maintenance. Also, a lot of people don’t want the headaches that can come from being a landlord.

Luckily, there are many ways you can invest in real estate without actually dealing with tenants. Below, we present the most popular real estate investments that do not involve physical home buying.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Types of property investments

Whether you invest in real estate directly or indirectly, real estate investors often enjoy the healthy returns they receive on their investment. According to data from Forbes, more billionaires made their wealth through real estate investments than any other category - by far.

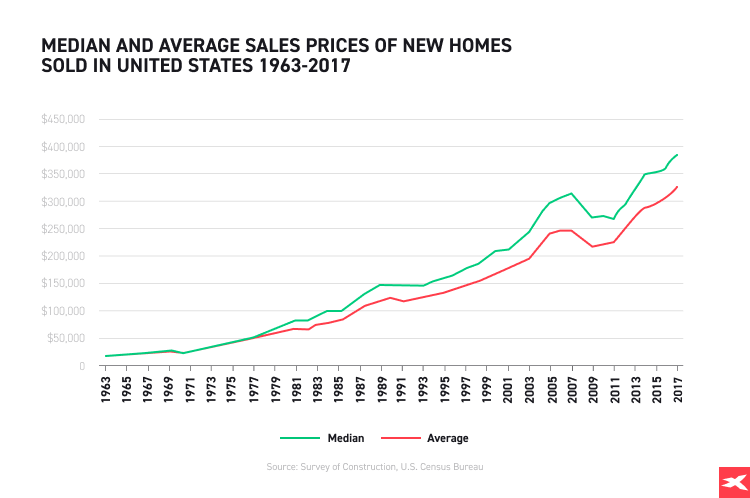

According to the U.S. Census Bureau data, sales prices of new homes (a rough indicator for real estate values) consistently increased in value from 1940 to 2006, before dipping during the financial crisis. Subsequently, sales prices resumed their ascent, even surpassing pre-crisis levels. This trend continued after the outbreak of the pandemic as many people considered real estate investment to be a good move, given the rising inflation that was diminishing the purchasing power of their savings on bank accounts.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Property investment is about generating a return either by investing in funds focussed on the property sector or by the physical act of buying, selling and developing property. Investors who bought physical properties can generate a regular income through buy-to-let properties or redevelop properties to increase their resale value (so-called flipping). Some investors will buy property in the hope that this will grow in value over time.

But investing in physical property also comes with a degree of risk. Landlords often face potential problems with tenants, property damage, the need for constant maintenance, repairs and periodic renovations. Also, buying a property as an investment carries the usual risk of returns not performing as expected or even the potential of a loss. This type of investment is a big commitment, requiring you to place potentially a significant proportion of your time and wealth into a single asset type. If your property investments go wrong, you ideally want other investment classes that will help to smooth out the loss across your whole investment portfolio. Timing is also an issue with property, because accessing your investment quickly is usually not possible.

For people who do not have enough money, time or skills related to repairs and maintenance, an interesting alternative may be investing directly in companies operating in the real estate sector or REITs.

REITs are a type of investment fund that only invests in property. A REIT is created when a corporation (or trust) uses investors’ money to purchase and operate income properties. REITs are bought and sold on the major exchanges, like any other stock. These funds consist of property companies that generate a profit from their property portfolios on the behalf of shareholders/investors. A corporation must pay 90% of its taxable profits in the form of dividends in order to maintain its REIT status, therefore, they do not pay corporation tax on their profits generated from rented property. REITs do need to comply with certain legal rules to qualify for this status. Investors who bought shares in the REIT receive a dividend based on the performance of the property portfolio, which can be a great way to generate passive income. Additionally, REITs give the opportunity to invest in nonresidential properties, such as malls or office buildings, that are generally not feasible for individual investors to purchase directly.

In addition, this asset group often performs well in times of uncertainty when many investors are looking for a safe haven. From the outbreak of the pandemic to April 2021, some REITs generated a better rate of returns compared to the S&P 500 composite and the broader finance sector.

The Zacks Real Estate – the development industry has surged 94% during this period compared with the S&P 500 composite’s rally of 49.1% and the broader Finance sector’s growth of 47.2%.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Another way to invest in the real estate market is to buy stocks of major development companies. The real estate development sector includes companies that own, develop, lease and manage properties and land. The sector is multi-faceted and includes the renovation of existing buildings and the purchase of land and other real estate parcels. While some developers undertake construction on their land holdings to eventually sell the properties to homebuilders, retaining the same for conducting operations is also a common practice. Operations of these properties provide recurring revenue sources for companies.

What may affect property prices in the future?

When the pandemic began back in March 2020, the values of a number of property types had been moving higher, contrary to the expectations of a drop. Many experts believe that prices will continue to climb in the upcoming years, supported by strong government’s policy (especially in the US), increasing demand, and significant funds which can be allocated for real estate investment. According to the American Jobs Plan, the Biden administration has proposed to spend around $2 trillion over the next decade. This includes $213 billion for housing infrastructure aimed to build stronger communities. The primary motive is to “build, preserve, and retrofit more than two million homes and commercial buildings to address the affordable housing crisis.”

Moreover, if the economic recovery continues, then it should support demand and consequently increase the value of commercial real estate. This in turn creates new investment opportunities for development companies. In addition, the pandemic significantly accelerated the development of the e-commerce sector and the widespread adaptation of remote work, forcing landlords to reconsider the use of commercial and office properties. For this reason, many people chose to move out of the big cities and move to the suburbs or to their small hometowns, which is leading to higher prices in the local markets. The analysts believe that this trend is likely to continue for many years to come. Moreover, increasing tenants' requirements regarding the quality and functionality of buildings should have a positive impact on the development industry. In fact, tenants are increasingly demanding flexible work spaces and amenities, such as shared meeting spaces, better indoor air quality and non-contact technologies. Hence, despite the rising costs of materials, the demand for such modern buildings is growing, which is a positive sign for the development industry.

Investment products available for XTB clients

Below we will briefly describe interesting stocks and funds from the property sector in which you can invest via our trading platform.

REIT ETFs

Vanguard Real Estate ETF (VNQ.US) seeks to provide high income and moderate long-term capital growth by investing in stocks issued by commercial REITs. Using a full-replication process, the fund seeks to hold all stocks in the same capitalization weighting as the index. REITs and real estate securities included in the index must have enough shares and trading volume to be considered liquid. Vanguard’s Equity Index Group uses proprietary software to implement trading decisions that accommodate cash flow and maintain close correlation with index characteristics. Vanguard’s refined indexing process, combined with low management fees and efficient trading, has provided tight tracking net of expenses.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

iShares U.S. Real Estate ETF (IYR.US) tracks a market-cap-weighted index of US real estate equities and captures much of the real estate space, including REITs and firms investing directly or indirectly in real estate through development, management, or ownership, including property agencies. The fund may invest in stocks of all capitalisation that are trading on major US exchanges. It generally invests at least 80% of its assets in the component securities of its underlying index and in investments that have economic characteristics that are substantially identical to the component securities of its underlying index.

REIT stocks

ARMOUR Residential REIT, Inc. (ARR.US) invests in and manages a leveraged portfolio of mortgage-backed securities (MBS) and mortgage loans. The company invests in residential mortgage backed securities issued or guaranteed by a United States Government-sponsored enterprise (GSE), such as the Federal National Mortgage Association or the Federal Home Loan Mortgage Corporation, or a government agency, such as the Government National Mortgage Association (collectively, Agency Securities). The company also invests in Interest-Only Securities, which are the interest portions of Agency Securities that are separated and sold individually from the principal portion of the same payment. The company raises funds for additional funding through equity offerings (including preferred equity), unsecured debt securities and convertible securities (including warrants, preferred equity and debt), among others.

Annaly Capital Management (NLY.US) is one of the largest mortgage real estate investment trusts with investment strategies across mortgage finance and corporate middle market lending. The company borrows money, primarily via short term repurchase agreements, and reinvests the proceeds in asset-backed securities. The company has about $94 billion in total assets. On Sept. 9, the company's board announced a common stock cash dividend of $0.22 per common share for the third quarter 2021.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

AGNC Investment (AGNC.US) is an internally-managed mortgage real estate investment trust that primarily invests in agency MBS on a leveraged basis. It finances its holdings through collateralized borrowings structured as repurchase agreements (repos). On Oct. 7, AGNC declared a cash dividend of $0.12 per share of common stock for October 2021.

Developers stocks

CBRE Group, Inc. (CBRE.US) engages in the provision of commercial real estate and investment services. It operates through the following segments: Advisory Services, Global Workplace Solutions and Real Estate Investments. The Advisory Services Segment provides a comprehensive range of services globally, including property leasing, capital markets (property sales and mortgage origination, sales and servicing), property management, project management services and valuation services. The Global Workplace Solutions Segment provides a broad suite of integrated, contractually-based outsourcing services globally for occupiers of real estate, including facilities management, project management and transaction services (leasing and sales). The Real Estate Investments Segment comprises investment management services provided globally, development services in the United States and United Kingdom and a service designed to help property occupiers and owners meet the growing demand for flexible office space solutions on a global basis.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

The Howard Hughes Corp. (HHC.US) engages in the development and management of commercial, residential, and mixed-use real estate. The company focuses on the development and sale of land in large-scale, long-term community development projects in and around Las Vegas, Nevada; Houston, Texas; and Columbia, Maryland. The firm operates approximately 453,000 square feet of restaurant, retail, and entertainment properties situated in New York.

Summary

Investing in real estate is often one of the best ways to grow your finances, meet certain financial goals, and build an attractive portfolio. Done right, real estate investing can be lucrative and create an additional income stream. And many of the best real estate investments don’t require showing up at a tenant’s every beck and call. Thanks to REITs and development company stocks, anyone can invest in real estate, even if they only have a little money to start.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory.

The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments.

X-Trade Brokers Dom Maklerski S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication.

In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.

Green Investment - How to invest in a greener future?

Climate change investments: Maximising impact

ETF Trading - What are they and how to invest in Exchange Traded Funds?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.