In a world where technology drives nearly every aspect of life, one company stands as the invisible engine powering the devices we rely on every day — Taiwan Semiconductor Manufacturing Company (TSMC). Behind the screens of our phones, the intelligence of artificial intelligence, and the speed of cutting-edge electronics lies TSMC’s ground-breaking chips. TSMC has not only shaped the semiconductor industry but also transformed the global tech landscape.

From its modest beginnings to its status as an indispensable part of the global technology supply chain, TSMC’s journey reflects both Taiwan’s rise as a tech powerhouse and the rapid advancements in the semiconductor industry.

In a world where technology drives nearly every aspect of life, one company stands as the invisible engine powering the devices we rely on every day — Taiwan Semiconductor Manufacturing Company (TSMC). Behind the screens of our phones, the intelligence of artificial intelligence, and the speed of cutting-edge electronics lies TSMC’s ground-breaking chips. TSMC has not only shaped the semiconductor industry but also transformed the global tech landscape.

From its modest beginnings to its status as an indispensable part of the global technology supply chain, TSMC’s journey reflects both Taiwan’s rise as a tech powerhouse and the rapid advancements in the semiconductor industry.

Current performance and future outlook (2020-Present)

As of 2025, TSMC’s position in the semiconductor industry remains unparalleled. The company is the undisputed leader in advanced semiconductor manufacturing, particularly in cutting-edge process nodes like 5nm, 3nm, and even the upcoming 2nm. TSMC continues to play a critical role in the development of high-performance chips used in mobile phones, laptops, gaming consoles, data centers, and automotive systems.

It has been reported that Broadcom and TSMC are in discussions to divide Intel, the American tech giant, into two separate entities. According to a report from The Wall Street Journal on Saturday(15/02/25), both TSMC and Broadcom have shown interest in acquiring different parts of Intel. The talks are still in the early stages, with Broadcom focusing on Intel’s chip design and marketing operations, while TSMC is considering purchasing Intel’s semiconductor manufacturing facilities. Broadcom is exploring potential bids but will likely only move forward if it can find a suitable partner for Intel’s fabrication business. Meanwhile, TSMC is looking into acquiring Intel’s chip plants, possibly through an investor group. Sources indicate that Broadcom and TSMC are not collaborating, and the talks are still informal.

Intel’s interim executive chairman, Frank Yeary, is leading discussions with potential buyers and coordinating with U.S. government officials, who are concerned about Intel’s role in national security. Yeary’s primary objective is to maximise shareholder value.

The White House has expressed reservations about the prospect of a foreign entity taking control of Intel’s U.S. chip factories. A White House official mentioned that, although the Trump administration supports foreign investment in the U.S., it is "unlikely" to endorse a deal where TSMC would gain control over Intel’s manufacturing plants. Previous reports suggested that Trump administration officials had engaged in discussions with TSMC, which appeared open to the idea.

Intel has historically been a major beneficiary of U.S. government initiatives aimed at bringing semiconductor production back to the U.S. In November, the Commerce Department approved a $7.86 billion subsidy for Intel to increase domestic chip production.

However, Intel has faced mounting challenges recently, losing around 60% of its market value in 2023. This decline followed an ambitious but costly shift into manufacturing and artificial intelligence under former CEO Pat Gelsinger, who was driven out last year. This strategy has faced difficulties, leading Intel to explore the possibility of breaking up and selling off parts of its business.

On the other hand, TSMC’s financial performance has been consistently strong, with the company reporting impressive revenue growth and expanding profit margins. It generates significant income from its partnerships with tech giants like Apple, which relies heavily on TSMC for the production of its A-series chips for iPhones and iPads. Other major customers include AMD, which uses TSMC’s 7nm and 5nm nodes to produce its Ryzen processors, and NVIDIA, which relies on TSMC for its high-end graphics processing units (GPUs).

Despite its dominance, TSMC faces challenges and competition from other players in the market, particularly Samsung, which has also made significant investments in advanced semiconductor manufacturing. However, TSMC’s strong track record in technology leadership, innovation, and customer loyalty places it in a unique position to maintain its competitive edge.

Additionally, TSMC expanded its global footprint with new semiconductor fabrication plants in the United States, including a major facility in Arizona. TSMC Arizona’s $65B investment in three fabs(factories) will create 6000 high-tech, high-wage jobs, and the company’s suppliers will bring tens of thousands more employment opportunities in construction and supplier jobs.This move is designed to help mitigate the risks associated with over-reliance on Taiwan and to ensure TSMC’s ability to serve its customers in North America more efficiently.

Taiwan Semiconductor Manufacturing Share Price

As of February,19, 2025 TSMCs share price is $202.19, or 1,090.00 TWD.

Source: XTB, Past performance is not a reliable indicator of future results.

Earnings

As of February 17, 2025, Taiwan Semiconductor Manufacturing Company (TSMC) has reported its financial results for the fourth quarter of 2024. The company reported revenue of $26.88 billion, a 37% increase year-over-year and a 14.4% rise from the previous quarter. It beat estimates and reported net income of NT$374.7bn, which beat estimates by 1.4%. It also reported a gross margin of 59% in Q4 2024, which was significantly higher than consensus. Looking ahead, TSMC has provided guidance for the first quarter of 2025, projecting revenue between $25 billion and $25.8 billion. It expects sales growth of 25% this year, which is stronger than the average analyst estimate of 22.45%. It also reported capital spending for this year at 34% compared to a year ago.

Its strong margins suggest that TSMC maintains good pricing power for now, but there are headwinds for the company. So far, chip makers have avoided President Trump’s tariff threats, but this could change down the line, and US companies like Apple and Nvidia could be forced to move to domestic chip manufacturers. Another threat could be waning demand for high end chips, after China’s DeepSeek proved that it has the technology to compete with US AI and at a fraction of the cost.

As we mentioned above, TSMC has gone some way to try and mitigate concerns about US tariffs hurting its business model, reports suggest that the company is considering taking a controlling stake in Intel’s manufacturing sites at the request of the Trump administration. Along with Broadcom, TSMC could ultimately take control of Intel, although this deal is not confirmed.

The stock has made multiple record highs this year, which suggests that financial markets are 1, not deterred by DeepSeek’s threat to the US AI dominance, and 2, demand for AI remains strong and this is a key theme for financial markets this year.

Chart: TSMC One Year Chart

Source: XTB and Bloomberg , Past performance is not a reliable indicator of future results.

Why are TSMCs chips so unique and how do they differ from other semiconductors?

1. Cutting-edge process nodes

TSMC is a pioneer in the development of advanced semiconductor manufacturing technologies, often leading the industry in introducing smaller process nodes. These smaller nodes (such as 7nm, 5nm, and 3nm) allow for chips that are more powerful, energy-efficient, and capable of handling more complex tasks. Their focus on developing these advanced process nodes has made them a go-to partner for companies looking to make high-performance chips for devices like smartphones, AI systems, and autonomous vehicles.

2. Unmatched manufacturing scale

TSMC operates some of the most advanced semiconductor fabs in the world, with a vast manufacturing capacity. Their ability to produce chips in extremely high volumes with minimal defects makes them the largest contract semiconductor manufacturer globally. This scale ensures that they can meet the needs of top-tier customers, like Apple, AMD, NVIDIA, and Qualcomm, who rely on TSMC to supply billions of chips every year.

3. Innovation in chip packaging

TSMC has pioneered several advanced packaging technologies that improve chip performance, power efficiency, and miniaturisation. For example, their 3D stacking and CoWoS (Chip-on-Wafer-on-Substrate) technologies allow for multiple chips to be stacked vertically, creating more compact, powerful, and efficient systems. These innovations are crucial in meeting the demand for increasingly complex and space-constrained applications like AI and mobile devices.

4. Pure-play foundry model

TSMC operates purely as a foundry, meaning they only manufacture chips based on designs provided by their customers. This business model allows TSMC to work with a wide range of tech companies, from startups to established giants, without competing against them in the chip design space. TSMC focuses entirely on providing the most advanced manufacturing technology, giving customers the flexibility to focus on their own chip designs.

How TSMC’s Chips Differ From Others

1. Contrast with Intel’s integrated approach

Intel designs and manufactures its own chips, taking a more vertically integrated approach. While this provides Intel with more control over its product, it also means they can’t manufacture chips for other companies.

In contrast, TSMC, as a foundry, produces chips for other companies, meaning it has the flexibility to serve a much wider range of clients. TSMC’s commitment to staying at the forefront of process node advancements allows it to offer cutting-edge technology to customers who design their own chips.

2. Difference in process node leadership

TSMC is consistently ahead of the competition when it comes to advancing the smallest process nodes, which allows for chips that are faster, more power-efficient, and more capable. For example, TSMC was the first to mass-produce chips on the 5nm process and is now transitioning to 3nm technology.

Intel has faced delays in moving to smaller process nodes, and although it is still a leader in many areas of chip technology, TSMC has taken the lead in advancing the most cutting-edge manufacturing processes.

3. Focus on specialised applications

TSMC’s chips are highly customisable and specialised for various industries, including smartphones, high-performance computing (HPC), AI, and automotive. TSMC works closely with companies like Apple to create custom chips like the A-series processors that are used in iPhones and other Apple devices, which are tailored to specific use cases.

Intel and Samsung also focus on producing chips for a range of markets, but TSMC’s specialisation in advanced process technologies for cutting-edge applications (like AI and data centers) makes their chips particularly well-suited for emerging technologies.

4. Different packaging and integration strategies

TSMC leads the way in advanced packaging technologies, such as 3D stacking and chip-on-wafer-on-substrate (CoWoS), which allow for smaller and more efficient designs without compromising performance. These packaging techniques help improve the performance of chips in power-hungry applications like artificial intelligence and 5G networks.

Intel and Samsung also develop advanced packaging, but TSMC’s constant push to innovate in this area keeps them at the forefront of chip miniaturisation and integration. TSMC’s custom solutions are often ahead in terms of power efficiency and density.

5. Global ecosystem and flexibility

TSMC’s business model allows them to collaborate with a broad spectrum of companies, from tech giants like NVIDIA and Qualcomm to smaller startups, making them a highly adaptable partner in the semiconductor industry.

Samsung, like TSMC, also offers foundry services, but their focus is more divided between manufacturing chips for their own products (e.g., smartphones, memory) and providing foundry services. This makes TSMC the preferred choice for many companies that need pure play foundry support with the latest manufacturing capabilities.

6. Superior yield and reliability

TSMC has earned a reputation for maintaining exceptional yield rates in its chip manufacturing, which means fewer defective chips and more reliable products. This is crucial for industries where reliability is key, such as in automotive electronics or high-performance computing.

While other manufacturers like Samsung and Intel also produce high-quality chips, TSMC’s reputation for consistent quality has made them the first choice for customers who need the best performance at the most competitive yield rates.

What is TSMC’s current market position?

As of now, TSMC holds the title of the largest dedicated semiconductor foundry in the world, with a market share of over 50%. Its leadership in advanced chip manufacturing (especially for 5nm, 3nm, and upcoming nodes) secures its position as an industry leader. TSMC is widely viewed as one of the top stocks in the semiconductor space due to its reliable growth trajectory, technological advancements, and critical role in the global supply chain.

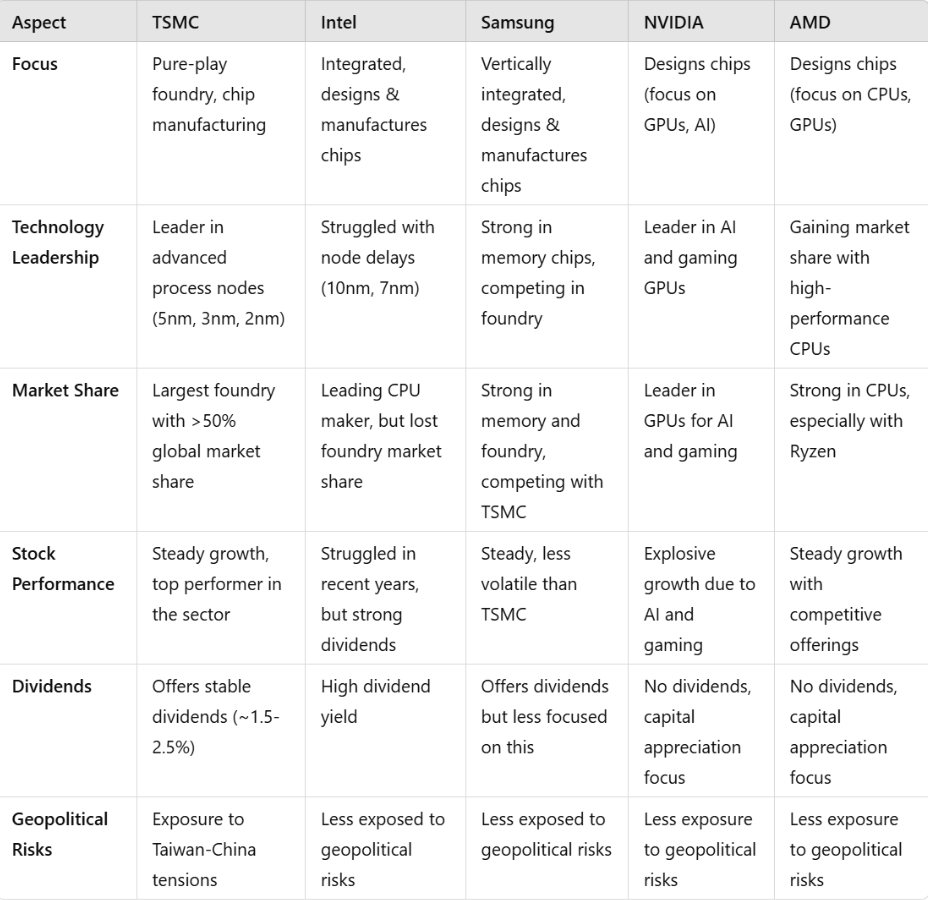

How does TSMC’s stock compare to other semiconductor stocks?

- TSMC is often considered one of the best-performing stocks in the semiconductor sector due to its dominant position in advanced manufacturing and its strong customer base. It is frequently compared to competitors like Intel, Samsung, and NVIDIA.

- While NVIDIA has seen explosive growth due to its role in AI and gaming chips, Intel has faced challenges in advancing to smaller nodes. Samsung competes in memory and foundry businesses but has a different focus than TSMC, which is solely a foundry.

- TSMC tends to outperform other semiconductor stocks in terms of growth potential and profitability, driven by its leadership in advanced technology nodes and market dominance.

TSMC history?

In 1987, TSMC was founded by Dr. Morris Chang, a Taiwanese-born American engineer and businessman. Prior to starting TSMC, Dr. Chang had a distinguished career at Texas Instruments and later as the president of the Semiconductor Manufacturing Corporation of America (SMCA). However, Dr. Chang saw an emerging need in the semiconductor industry for a specialised business model that would focus purely on manufacturing chips for other companies rather than designing and manufacturing its own products.

This vision led to the creation of TSMC as the first dedicated foundry in the semiconductor world. At that time, semiconductor manufacturing was primarily conducted by integrated device manufacturers (IDMs), which both designed and manufactured their chips. However, there was a growing demand from companies that had strong designs but lacked the expertise or capacity to fabricate their own chips. TSMC’s business model, which focused solely on chip manufacturing and offered foundry services to companies around the world, set it apart from existing players.

The Taiwanese government, recognising the potential for semiconductor manufacturing to drive economic growth, provided TSMC with significant financial and infrastructural support, helping it get off the ground. The company’s first wafer fab was built in Hsinchu Science and Industrial Park in Taiwan, a location that would become a hub for Taiwan's burgeoning tech industry.

Pioneering the foundry model (1987-1997)

TSMC’s early success was driven by its pioneering foundry model. The company’s commitment to providing advanced manufacturing services to semiconductor designers, without competing with them in the design space, proved to be a game-changer. As a result, TSMC quickly attracted leading tech companies, such as Apple, AMD, and Qualcomm, which relied on TSMC’s expertise to produce their chips.

In the early years, TSMC’s growth was propelled by advancements in process technology. The company introduced a variety of innovative techniques, such as deep ultraviolet (DUV) lithography, to create smaller, more powerful semiconductor devices. By the mid-1990s, TSMC had established itself as a key player in the semiconductor manufacturing landscape.

In 1997, TSMC went public, listing its shares on the Taiwan Stock Exchange. This move further boosted its profile and solidified its position as a key player in the global semiconductor industry.

Expansion and technological leadership (1997-2010)

By the turn of the century, TSMC had emerged as the world’s largest dedicated independent semiconductor foundry. A key factor behind this success was its commitment to cutting-edge research and development (R&D). TSMC’s R&D efforts enabled it to stay ahead of the curve in terms of manufacturing capabilities, allowing it to produce ever-smaller chips with higher performance.

The company also recognised the growing importance of advanced process nodes. TSMC invested heavily in developing smaller process nodes, moving from 0.35 microns in the early 2000s to 65nm in the mid-2000s. This move allowed TSMC to manufacture chips that were not only faster but also more energy-efficient, which was critical as mobile devices and other consumer electronics began to proliferate.

During this time, TSMC cemented relationships with some of the biggest names in the tech world, including Apple, which began to rely on TSMC for the production of custom-designed chips for the iPhone. Apple’s partnership with TSMC was a key factor in propelling the company into the limelight, as the iPhone became a revolutionary product that transformed the global smartphone market.

The shift to advanced manufacturing (2010-2020)

TSMC’s growth continued in the 2010s, driven by its relentless focus on innovation and advanced manufacturing techniques. The company moved from producing chips at 28nm and 20nm nodes to mastering 16nm, 10nm, and eventually 7nm process nodes, pushing the boundaries of semiconductor manufacturing. In 2018, TSMC became the first company to mass-produce chips using a 7nm process, which was a milestone that made it the go-to foundry for the latest generations of high-performance computing chips, including those used in smartphones, artificial intelligence (AI), and high-performance computing (HPC).

This period also saw TSMC expanding its production capacity and advancing its technological leadership with the development of extreme ultraviolet (EUV) lithography technology, which enabled the production of smaller and more efficient chips. EUV was crucial for TSMC to manufacture chips at the 5nm and eventually the 3nm process nodes.

By 2020, TSMC was not only the largest semiconductor foundry in the world but also the most technologically advanced. It had surpassed its competitors, such as Samsung and GlobalFoundries, in terms of both process technology and production volume. The company’s clients included some of the world’s largest tech companies, including Apple, Qualcomm, NVIDIA, and AMD.

Conclusion

TSMC’s rise from a small startup to the world’s leading semiconductor foundry is a remarkable success story that highlights the importance of innovation, strategic vision, and perseverance. The company’s technological prowess has reshaped the semiconductor industry, making it an essential partner for companies across a wide range of sectors, from consumer electronics to automotive and artificial intelligence.

With its focus on cutting-edge technology, robust customer relationships, and global expansion, TSMC is poised to remain a key player in the semiconductor industry for years to come. As the world becomes increasingly reliant on semiconductors for everything from smartphones to AI-driven technologies, TSMC will continue to be at the heart of this technological revolution.

What is Next for the AI Trade?

Investing during a crisis: Strategies and Tips

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.