Key Takeaways

- Geopolitical risks refer to political and economic uncertainties arising from global tensions, wars, and policy changes that can significantly impact asset prices.

- Investing amid geopolitical tensions requires understanding how these risks affect different asset classes. Some assets can significantly gain during those events, and some may face crashes

- The globalisation trend supported global economies and markets during the last decades. If this trend is changing, investors should analyse how it can impact their portfolio

- Some assets, such as commodities, precious metals and defence stocks, can gain during periods of geopolitical instability. However, this reaction is never guaranteed and easy to predict

- Diversification by focusing on less vulnerable stocks, hedging and collecting uncorrelated assets to portfolios can help to mitigate risks.

- Analysing aerospace & defence, consumer staples and utilities stocks, precious metals and soft commodities, as well as VIX may give investors an edge during geopolitical tensions

Geopolitical tensions, ranging from international conflicts to trade wars and political instability, can create significant uncertainties in the financial markets. Every uncertainty may be an opportunity, but some of the unexpected events may lead to significant market corrections and crises. Global trade tensions can lead to volatile asset prices and disrupt global economic activities. Answering the question of how to navigate these challenges may be crucial for maintaining a resilient investment portfolio. This article will explore how to invest amid geopolitical tensions, highlighting which assets are less vulnerable and which can benefit from such periods of instability.

Key Takeaways

- Geopolitical risks refer to political and economic uncertainties arising from global tensions, wars, and policy changes that can significantly impact asset prices.

- Investing amid geopolitical tensions requires understanding how these risks affect different asset classes. Some assets can significantly gain during those events, and some may face crashes

- The globalisation trend supported global economies and markets during the last decades. If this trend is changing, investors should analyse how it can impact their portfolio

- Some assets, such as commodities, precious metals and defence stocks, can gain during periods of geopolitical instability. However, this reaction is never guaranteed and easy to predict

- Diversification by focusing on less vulnerable stocks, hedging and collecting uncorrelated assets to portfolios can help to mitigate risks.

- Analysing aerospace & defence, consumer staples and utilities stocks, precious metals and soft commodities, as well as VIX may give investors an edge during geopolitical tensions

Geopolitical tensions, ranging from international conflicts to trade wars and political instability, can create significant uncertainties in the financial markets. Every uncertainty may be an opportunity, but some of the unexpected events may lead to significant market corrections and crises. Global trade tensions can lead to volatile asset prices and disrupt global economic activities. Answering the question of how to navigate these challenges may be crucial for maintaining a resilient investment portfolio. This article will explore how to invest amid geopolitical tensions, highlighting which assets are less vulnerable and which can benefit from such periods of instability.

What Are Geopolitical Risks?

Image source: Adobe Stock Photos

Geopolitical risks encompass a wide range of political and economic uncertainties that arise from conflicts, policy changes, and diplomatic relations between countries. World history knows this subject very well. In almost every period, some geopolitical tensions have risen; sometimes leading to military conflicts. Some investors, such as Bridgewater’s Ray Dalio explain this subject even deeper. Here are only highlights of this subject. So, geopolitical risks include:

- Wars and Conflicts: Military actions and territorial disputes can disrupt global supply chains and affect commodity prices, as well as freight shipping costs. Those periods can also support aerospace & defence stocks, which may be directly beneficiaries of conflicts and rising capital expenditures across the defence sector

- Trade Wars: Tariffs and trade barriers can impact international trade, affecting export-dependent industries and global economic growth. History shows that this kind of thing happened multiple times, since ancient times, Napoleonic wars through nowadays. In general, global markets and traders do not like any external boundaries, such as trade disrupting regulations

- Political Instability: Changes in government, political unrest, and regulatory changes can create uncertainty for businesses and investors. Also, significant shifts, so-called “sea changes” in global economic partnerships may influence markets.

- Sanctions: Economic sanctions imposed by one country on another can restrict access to markets and resources. For example, such sanctions can influence high technology like semiconductors or AI and companies (and their suppliers) behind it.

Geopolitics

Geopolitics is the study of how geographical factors influence global politics and power dynamics. It examines the strategic importance of locations, resources, and territorial boundaries. Geopolitics analyses the relationships between nations, including conflicts, alliances, and economic dependencies. It considers the impact of natural resources like oil, gas, and minerals on international relations. Geopolitics also explores how cultural, historical, and ideological factors shape the political behaviour of states. Ultimately, it helps understand how geographic elements affect national and global security and policy decisions.

Impact of Geopolitical Risks on Asset Prices

Geopolitical risks can significantly influence asset prices in various ways:

- Increased Volatility: Uncertainty leads to market volatility as investors react to news and developments. In those conditions usually, VIX index rises, while risky assets such as stocks are dropping

- Safe-haven assets: Investors may shift their assets to safer investments, such as gold and government bonds, during times of geopolitical uncertainty. Also, the US dollar may be a beneficiary of this kind of tension. Gold and US dollar are known as “safe haven” assets

- Currency Fluctuations: Political instability can lead to currency depreciation or appreciation, affecting international investments. For example, strengthening currency in the country, where stock market is based on export-oriented companies may be a shock signal to investors (Japanese crash from August 2024)

- Sectoral Impacts: Certain sectors, like defence, energy, and commodities, can be directly impacted by geopolitical events. Sometimes soft commodities (wheat, soybean etc.) gain amid war tensions, due to global supply shock risks. Also, defence stocks may be beneficiaries of rising global tensions

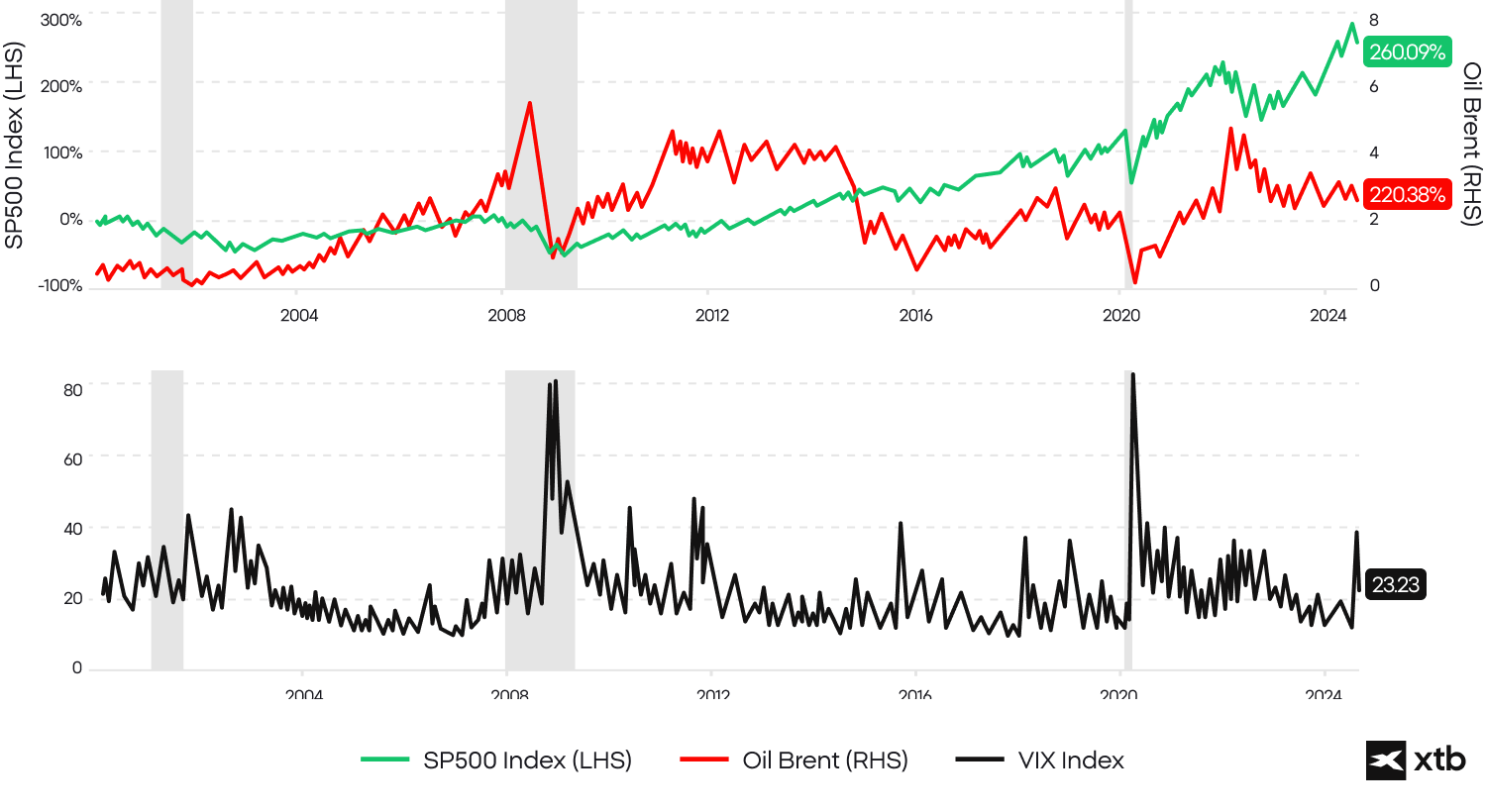

SP500 and Oil Brent return vs VIX volatility index

Past performance does not guarantee future results. Source: XTB Research

Historically, dropping oil prices and rising VIX signalled at least S&P 500 corrections. Geopolitical tensions usually distrupt the oil supply having the potential to move oil prices higher, while VIX rising reaction depends on conditions when wars and other geopolitical shocks happen, more or less pressuring stock market valuations. For example, the attack on Ukraine from Russia in 2022 didn’t pressure Wall Street because American companies were not highly related to those two economies. However, any broader conflict in Taiwan, China or the Middle-East has a potential for stock panic reactions.

Less Vulnerable Assets

Investing in assets that are less vulnerable to geopolitical risks can help protect your portfolio. These assets often provide stability during turbulent times:

- Precious Metals: Gold and silver are traditional safe-haven assets that tend to perform well during periods of uncertainty.

- Government Bonds: High-quality government bonds, especially from stable countries, can offer some security and steady returns.

- Defence Stocks: Companies in the defence sector can benefit from increased government spending on military and defence.

- Utility Stocks: Utilities provide essential services and often have regulated earnings, making them less volatile.

- Real Estate: Property in stable regions can provide steady income and potential appreciation, regardless of geopolitical tensions.

- High-Luxury Goods: Luxury goods such as expensive super cars or bags can rise despite geopolitical tensions and short-term sentiments shifts

Assets That Can Benefit from Geopolitical Tensions

Certain assets may actually gain value due to deglobalization, global tensions, and wars:

- Defence and Aerospace: Increased defence spending can boost the revenues of defence contractors and aerospace companies.

- Energy Commodities: Oil and natural gas prices can rise due to supply disruptions caused by conflicts.

- Agricultural Commodities: Trade restrictions and sanctions can impact agricultural supply chains, potentially increasing prices.

- Cybersecurity Stocks: Heightened tensions can lead to increased demand for cybersecurity solutions to protect against cyber threats.

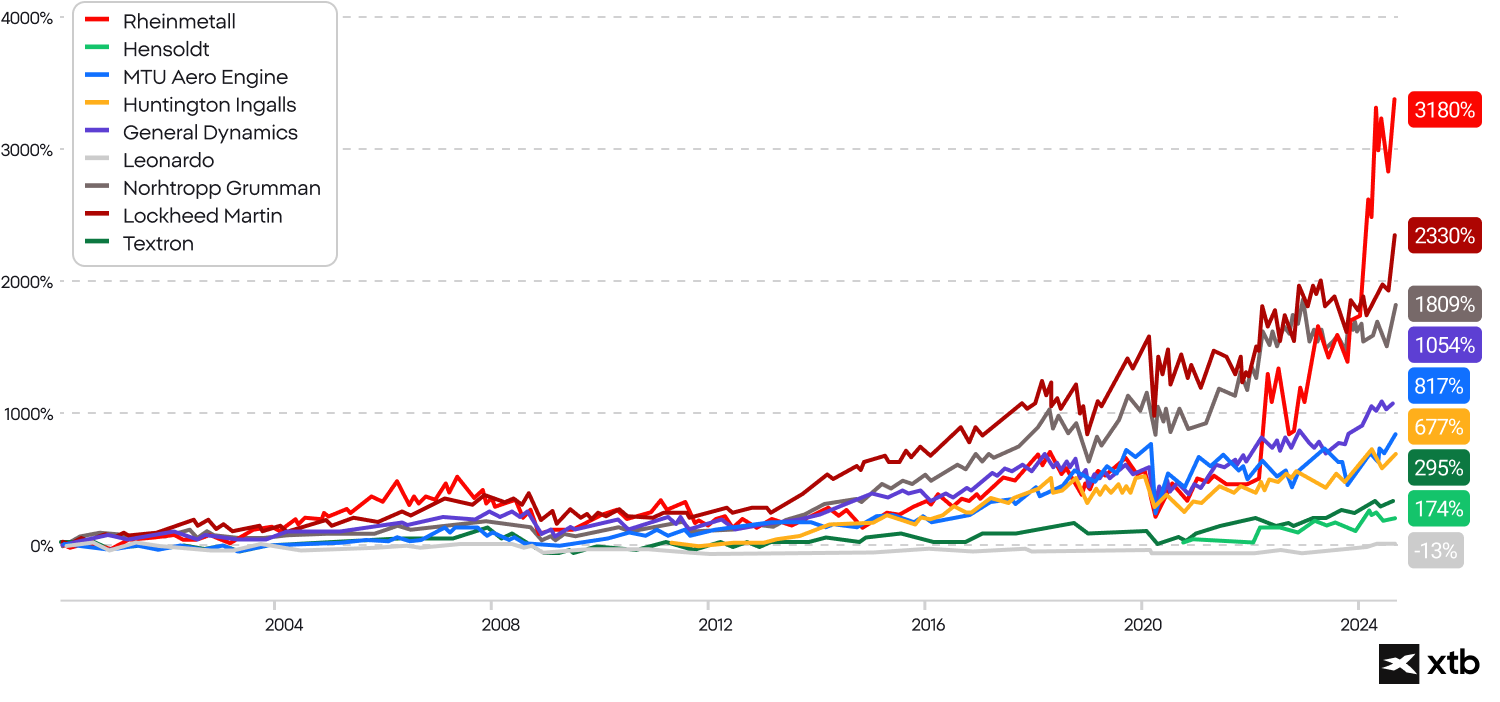

Return on Investment since Jan, 2000

Remember that past performance is not an indicator of future results. Source: XTB Research, Bloomberg Finance L.P.

As we can see on the chart, Russian-Ukraine war influenced global tensions and global Aerospace & Defence stocks surged since then, with German Rheinmetall leading the sea change in defence sector valuations and perspectives. The chart shows the biggest, US and European defence stocks in the long term time horizon. Since 2022 (Russia-Ukraine war) we can see a surge across shares of defence contractors.

Investing during periods of geopolitical tensions requires a well-thought-out strategy and sometimes proactive risk management. What’s even more important is a high level of stock market volatility consciousness. Here are several strategies and techniques to mitigate risks and optimise an investment portfolio under such conditions. Remember that it's not investment advice, each conflict era and reaction to unexpected events may be different. Also, past performance does not guarantee future results.

Image source: Adobe Stock Photos

1. Diversification

- Geographical Diversification: Spread your investments across various countries and regions to reduce exposure to any single geopolitical event. Investing in both developed and emerging markets can balance risk and return.

- Sector Diversification: Invest in multiple sectors, such as technology, healthcare, utilities, and consumer staples, to avoid being overly reliant on any one industry that might be adversely affected by geopolitical issues.

2.Safe-Haven Assets

- Precious Metals: Gold, silver, and other precious metals, tend to hold their value or even appreciate during times of geopolitical uncertainty.

- Government Bonds: Invest in high-quality government bonds from stable countries. These are generally considered low-risk and can provide a steady income stream.

3. Defensive Stocks

- Utilities: Utility companies often have regulated revenues and are less affected by economic cycles, making them a safer investment during turbulent times.

- Consumer Staples: Companies that produce essential goods, such as food and household products, tend to perform well even during economic downturns.

4.Income-Producing Assets

- Dividend Stocks: Invest in companies with a strong track record of paying consistent and growing dividends. Dividend income can provide a buffer against market volatility.

- Real Estate Investment Trusts (REITs): REITs can offer stable income through property rentals, which are less likely to be affected by short-term geopolitical events.

5.Alternative Investments

- Commodities: Besides precious metals, consider investing in other commodities like oil, natural gas, and agricultural products, which can perform well during supply disruptions caused by geopolitical tensions.

- Infrastructure Investments: Infrastructure assets, such as toll roads, airports, and utilities, can provide stable returns and are often less vulnerable to geopolitical risks.

Risk Mitigation Techniques

There is a phrase which tells us that “during market crashes, every asset correlation falls to 1”. However, it's not a serious observation. But it definitely may be a signal, that during market downturns, affected by geopolitical tensions, there can be a broader asset group whose valuation fell just because of stock market sentiments, with no fundamentals justifying that change. Let’s think about risk mitigation tactics.

Cash and Opportunities Searching

- Cash Reserves: Maintain an adequate cash reserve to take advantage of buying opportunities during market downturns. Cash also provides a safety net during periods of heightened volatility. Investors can search opportunities also outside of assets, directly affected by conflict or trade war

- Liquid Assets: Invest in assets that can be quickly converted to cash without significant loss of value, ensuring you have the flexibility to respond to changing market conditions. Also, almost always there is a group of assets which loses due to market sell-off with no fundamentals justifying that move.

Hedging and Futures

- Currency Hedging: Use currency hedging strategies to protect against foreign exchange risk, especially if you have investments in countries with volatile currencies. Also, investors can monitor prices of such assets as oil, wheat or VIX trying to capitalise on sentiment shifts.

- Options and Futures: Professional investors can use futures to hedge against potential losses in your portfolio. These financial instruments can provide downside protection during periods of high uncertainty.

Portfolio Review

- Rebalancing: Regularly review and rebalance your portfolio to ensure it remains aligned with your investment goals and risk tolerance. This can help you maintain an appropriate level of diversification and avoid overexposure to any single asset class.

- Stress Testing: Conduct stress tests on your portfolio to assess its performance under various geopolitical scenarios. This can help you identify potential vulnerabilities and adjust your strategy accordingly.

Staying Informed

- Monitor Geopolitical Developments: Stay informed about global events, political changes, and policy shifts that could impact your investments. Being proactive can help anticipate market movements and make timely adjustments.

- Economic Indicators: Keep an eye on key economic indicators, such as inflation rates, interest rates, and GDP growth, which can provide insights into the broader economic impact of geopolitical events. Remember, that stock market does not work in mathematical way

Strategies - Examples

Image source: Adobe Stock Photos

Below, we will present scenarios for two geopolitical conflicts, in the Middle East and China. It’s not investment advice, just “theoretical scenarios” which can give one the occasion to think about diversification and strategic planning in different ways. Also, as long as there are no signals that can guarantee any war, nor the Middle East, Europe or China, investors' behaviour may favour assets which will underperform if geopolitical tensions will seriously rise. Here is the breakdown.

Scenario 1: Rising Tensions in the Middle East

Suppose there are escalating tensions in the Middle East, causing uncertainty in global oil supplies and increasing market volatility. Here's how you might apply the strategies and risk mitigation techniques discussed:

1.Diversification

- Invest in energy companies outside the Middle East to reduce direct exposure to the region.

- Allocate funds to sectors less affected by oil prices, such as utilities and healthcare.

2.Safe-Haven Assets

- Consider gold and U.S. Treasury bonds to hedge against market volatility.

3.Defensive Stocks

- Add utility and consumer staples stocks to your portfolio for their stability and consistent returns.

4.Alternative Investments

- Consider investing in agricultural commodities that may benefit from supply disruptions.

5.Hedging

- Use currency hedging to protect against potential fluctuations in currencies of oil-exporting countries.

6.Speculation

- Analyse VIX fluctuations and watch out, does the Middle East conflict leads to sentiments shifts, sending awaited, future volatility index (VIX) higher

7.Portfolio Review

- Conduct a stress test to evaluate how your portfolio would perform if oil prices spiked or geopolitical tensions escalated further.

- Rebalance your portfolio to ensure it remains aligned with your risk tolerance and investment goals.

8.Staying Informed

- Monitor news and analysis related to Middle East developments and global oil markets.

- Keep track of economic indicators that might signal broader impacts on global growth.

9. Maintaining Liquidity

- Ensure you have sufficient cash reserves to take advantage of potential buying opportunities if markets overreact to geopolitical news.

Scenario 2: US-China War or Taiwan Blockade

Suppose there is a significant escalation in tensions between the US and China, potentially leading to military conflict or a blockade of Taiwan. This scenario could disrupt global supply chains, impact global trade, and increase market volatility. Here's how you might apply various investment strategies and risk mitigation techniques:

Diversification

- Geographic Diversification:

Increase investments in regions less exposed to US-China tensions, such as Europe, Latin America, or Africa. This reduces reliance on the economies directly involved in the conflict.

- Sector Diversification:

Allocate funds to sectors that are less reliant on global supply chains, such as healthcare, utilities, and local consumer staples, which may be less affected by trade disruptions.

- Invest in Non-Tech Sectors:

Given that technology is a key sector in the US-China dynamic, consider diversifying into non-tech sectors like finance, consumer goods, and agriculture to reduce exposure to potential tech supply chain issues.

Safe-Haven Assets

- Gold and Precious Metals:

Consider gold and other precious metals, as these tend to be seen as safe-haven assets during geopolitical uncertainties and can protect against inflation and currency devaluation.

- U.S. Treasury Bonds:

Consider U.S. Treasury bonds, which are considered one of the safest investments globally, providing stability amidst market turbulence.

- Japanese Yen and Swiss Franc:

Consider increasing exposure to currencies like the Japanese Yen and Swiss Franc, which are often seen as safe-haven currencies during global tensions.

Defensive Stocks

- Utilities and Consumer Staples:

Add more utility and consumer staples stocks to your portfolio. These sectors typically provide stable returns and are less sensitive to economic cycles, making them safer during geopolitical crises.

- Healthcare:

Invest in healthcare companies, which tend to be resilient in times of economic uncertainty, as demand for healthcare services remains relatively stable.

Alternative Investments

- Agricultural Commodities:

Consider investing in agricultural commodities, which might see increased demand if supply chains are disrupted. For example, soybeans, corn, and wheat could be alternatives if trade in other goods is impacted.

- Infrastructure Investments:

Look into infrastructure funds or companies that provide essential services. Infrastructure is often less affected by international trade issues and can offer stable, long-term returns.

Hedging

- Currency Hedging:

Use currency hedging strategies to protect against fluctuations in the US dollar and Chinese yuan, which could be volatile due to trade wars or sanctions.

- Options and Futures:

Employ options and futures to hedge against potential market downturns. For instance, put options on major indices can provide downside protection if equity markets react negatively to rising tensions.

Regular Portfolio Review

- Stress Testing:

Conduct regular stress tests on your portfolio to evaluate its resilience to potential scenarios, such as disruptions in the semiconductor supply chain or increased tariffs on goods.

- Rebalancing:

Rebalance your portfolio to ensure it remains aligned with your risk tolerance and investment goals. Adjust allocations based on the evolving geopolitical landscape and market conditions.

Staying Informed

- Monitoring News and Analysis:

Keep a close eye on developments related to US-China relations, especially any diplomatic moves, military actions, or trade sanctions that could impact global markets. Remember that any serious signals of easing tensions may cause huge market shifts

- Economic Indicators:

Track economic indicators that might signal broader impacts on global growth, such as manufacturing PMI data, global trade volumes, and consumer confidence indexes.

Maintaining Liquidity

- Cash Reserves:

Ensure you have sufficient cash reserves to take advantage of potential buying opportunities if markets overreact to geopolitical news. Liquidity can provide flexibility in adjusting your investment strategy.

- Access to Credit Lines:

Maintain access to credit lines or liquid investment products that can be quickly converted to cash if needed, providing additional financial stability.

Important: Remember that past performance (also analysts ‘calls’) does not guarantee superior future performance. What’s more, usually, if something is well-known on the markets, it’s hard to await outstanding returns from it. Behaving exactly the same way as the market consensus is losing a chance for superior results (but also market-underperforming). During any trade wars or tensions, assets may surprise investors, while investors oriented on deeper analysis and non-popular economies sectors may search for their advantage faster than the market will find the way to it. Second-level thinking may and some level of aggressiveness, supported by risk consciousness may be a huge investor advantage, when investing amid geopolitical tensions.

FAQ

Diversification is key. Spread your investments across different asset classes and geographies to mitigate the impact of any single geopolitical event. Usually, having uncorrelated (diversified) assets in a portfolio, supports its resilience. Those assets may be for example gold, shares of oil companies, soft commodities, US treasury bonds, aerospace & defence companies or healthcare & utility stocks.

During wars, companies with procyclical business models such as technology companies or freight may underperform, while wide moat, consumer staples companies such as General Mills, Archer Daniels Midland or British American Tobacco can attract investors' demand. Also, steel manufactures or rare earth metals miners such as Freeport-McMoRan can be potential conflict beneficiaries. Producers of weapons, ammo and aircraft or ships such as Lockheed Martin, General Dynamics, Rheinmetall or Huntington Ingalls may see significant Wall Street interest, if war risk increases.

Emerging markets can be more volatile and sensitive to geopolitical risks due to their reliance on foreign investment and export markets. Usually strong ‘weaponizing’ US dollar, which historically saw higher inflows amid conflicts, pressure emerging markets f/x rates. Also, conflicts have potential to disrupt global trade, hitting export from EM to ‘old economies’. Weaker Wall Street sentiments can cause significant, sometimes even panic, reactions in emerging markets.

Keep an eye on news related to international conflicts, trade policies, political changes, and economic sanctions. Monitoring these indicators, as well as studying history, can help you anticipate market movements. However, history teaches us that nothing is 100% certain.

According to so-called predictive market theory, asset prices carry some information. Higher volume, and rising oil prices as well as demand for gold, volatility in CBOT grains or aerospace & defence stocks, as well as the volatility index (CBOE VIX) and performance of local stocks market related to potential conflicts are maybe a signal that “something is happening”.

Geopolitical instability can lead to significant currency fluctuations, impacting the value of international investments and earnings for multinational companies. Usually the currency of the attacked country weakens; we saw this reaction during the Ukraine war in 2022, while the US dollar strengthened, amid rising inflows. However, future reactions will be always unknown and hard to predict, as each conflict starts and ends in different ways, potentially hurting one or another currency. Global financial markets usually don’t react to regional issues, and are less important for international trade conflicts.

Commodities, especially energy and precious metals, can serve as a hedge during geopolitical instability, but it's essential to understand the specific risks and dynamics of each commodity. Historically, grain, especially wheat futures on commodities exchanges such as the Chicago Board of Trade rallied, ahead of supply and demand shocks, caused by armies and market anomalies.

Arthur Cutten, in his autobiography "The Story of a Speculator," wrote about the impact of wars on wheat futures. "In times of war, wheat becomes not just a commodity but a crucial resource for nations. The fluctuations in wheat futures on the CBOT reflect the urgency and uncertainty of the period, as the demand for feeding armies and populations increases dramatically, driving prices to unpredictable heights."

In the XXI century, as armies need more oil than ever before, oil futures may be highly volatile, signalling potential trade disruptions and supply shocks, related with Middle-East and key transport routes, such as the Gulf of Aden, Red Sea or Taiwan Strait. Remember that trading in both hard and soft commodities is always risky, especially during highly volatile markets.

What is Next for the AI Trade?

Investing during a crisis: Strategies and Tips

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.