Soybean Market Overview

The global soybean market has grown rapidly over the past few years and given the increasing demand, especially from developing countries and its widespread use, there is a chance that this trend will continue in the coming years. According to data from Transparency Market Research, the global soybean market will grow to $ 215.746 billion by 2025.

The inhabitants of many developing countries will probably decide to change their previous eating habits in connection with the improvement of their living standards. This may translate into an increase in meat consumption and a greater popularity of healthy foods.

The soybean market could benefit from both of these trends, as the bean is used as a popular ingredient in livestock feed, and is also known to have health benefits.

In addition, supply can also be influenced by climate change trends that affect weather patterns and the production of soybeans and other crops.

Where Are Soybeans Being Used?

Most people believe that soybeans are mainly used in food production, especially in Asian countries, but three quarters of soybeans are actually used as animal feed.

In addition, soybeans are used in several other sectors:

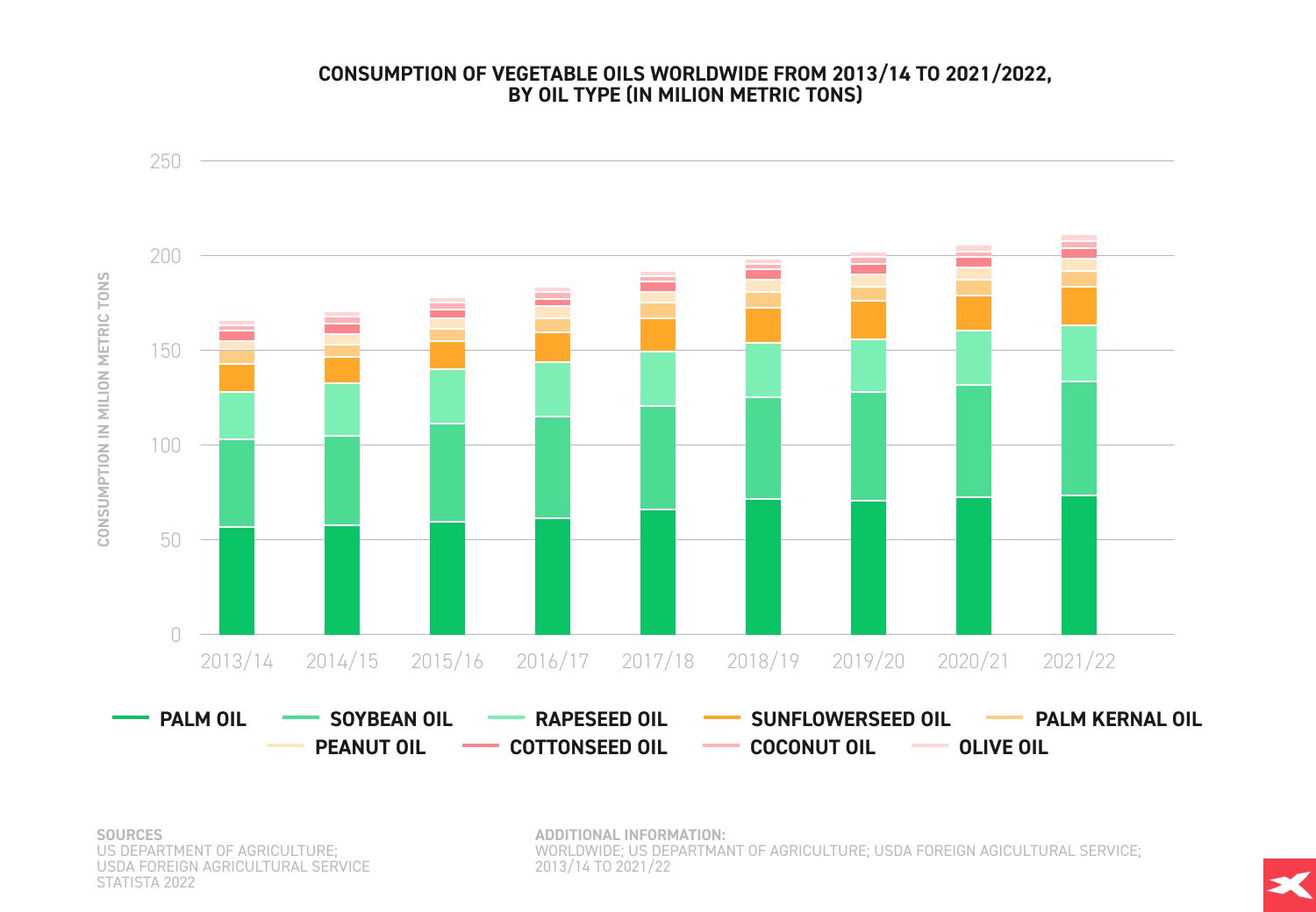

- Oil - about 18% of soybeans is made of oil, which is often used as an ingredient in many dishes, as well as cooking oil. After the oil is extracted, the remaining soybean meal is used as animal feed. Soybean oil is the second most consumed vegetable oil (after palm oil). SOYOIL CFD is a new instrument available on the xStation platform.

Soybean oil is the second most consumed type of vegetable oil. Source: Statista

Soybean oil is the second most consumed type of vegetable oil. Source: Statista

- Biofuel - about 2% of soybeans are used to produce biofuels. In this segment, soybeans continue to give way in popularity to maize, but the interest of producers is growing every year.

- Crayons - for the production of ordinary crayons, petroleum is used, while soy crayons are a non-toxic substitute.

- Other uses - soybeans are also used in the production of candles, chipboard, biocomposites, carcasses, lubricants, foams, and other products.

Major Producers and Consumers

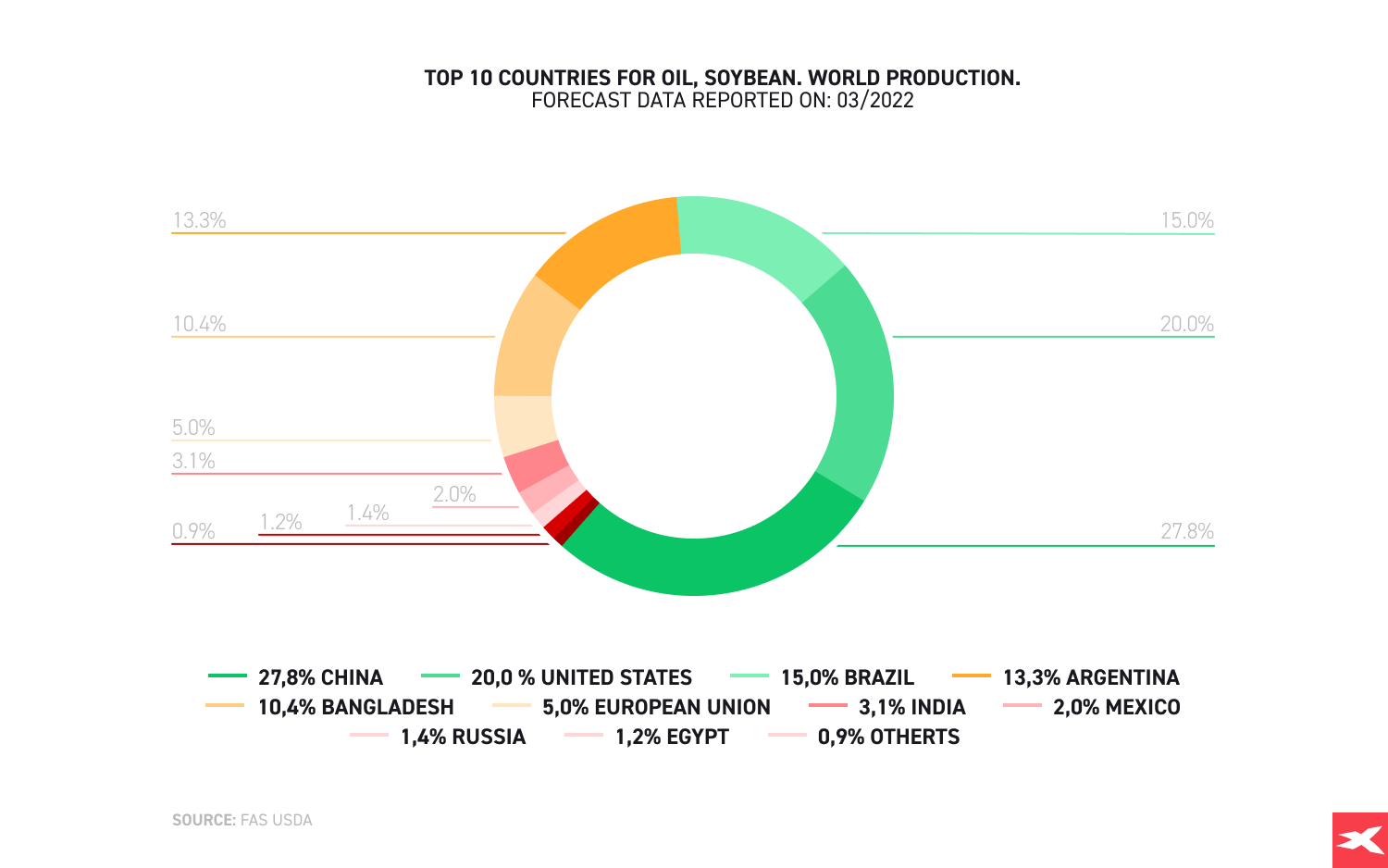

Globally, 80% of annual production comes from three countries. The largest producer is the United States, producing about 108 million metric tons each year, which is one third of the world's supply. Brazil ranks second, producing around 87 million tonnes per year; and Argentina ranks third with approximately 53 million metric tons produced each year. Other important producers include China, India, Paraguay, Canada, Mexico and the EU.

China, the United States, Brazil and Argentina are the biggest producers and consumers of soybean oil. Source: USDA

What Could Move the Price of Soybeans?

- US Dollar - similar to many other commodities, soybean prices are quoted in US dollars, therefore any greenback fluctuations may have significant fluctuations on soybean price. In general a weaker dollar may push soybean prices higher while a stronger dollar will mean lower prices.

- US Production - since the US is a major producer and exporter, any political turmoil or supply shocks caused by weather conditions may have a significant impact on the global production numbers.

- Alternative oils - rapeseed and castor oil are the main competitors of soybean oil. Availability, demand and changes in the pricing for these other oils often has an impact on soybean oil prices.

- Demand from emerging economies - countries such as India, South Africa and China whose populations are rising sharply are forced to import more soybeans. This can lead to an increase in the price of soybean products if supply remains at the same levels for extended periods of time.

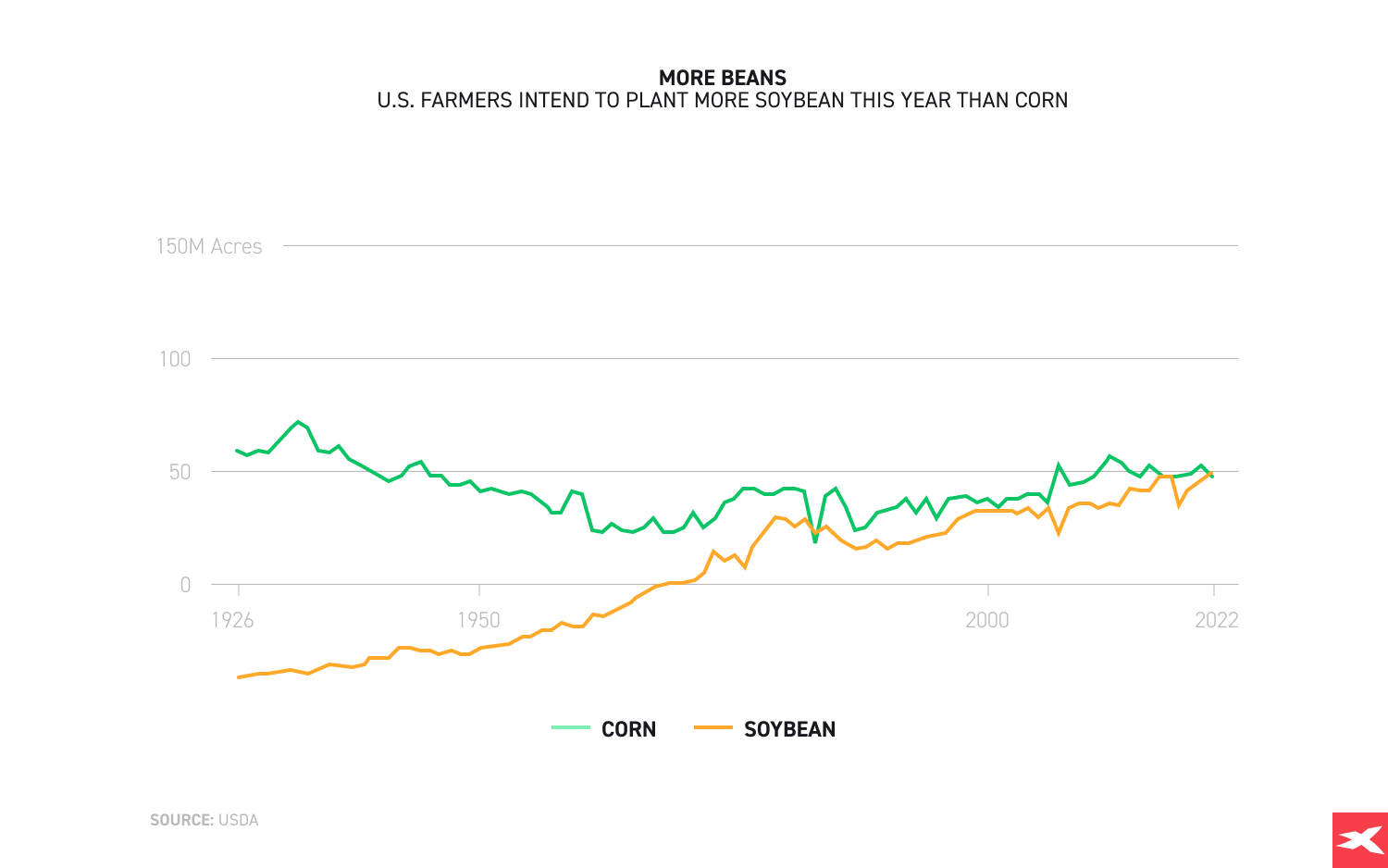

- Ethanol Subsidies - in order to increase ethanol production, the US government provides an incentive for farmers in the US to devote acreage to corn. If these subsidies stop, more farmers may switch to grow soybeans. This would boost supply and put pressure on the price of soybeans.

Economic Data That Affect Soybean Prices

- The USDA World Agricultural Supply and Demand Estimate (WASDE) report provides a comprehensive analysis of the soybean market, which often contributes to large price fluctuations.

- USDA Prospective Plantings Report indicates the number of acres in the US Midwest that will be planted for corn or soybeans.

- Grain stocks reports are released four times per year by the National Agricultural Statistics Service (NASS) and provide up-to-date information on soybean and other major grain and oilseed stocks by status and position (on-farm or off-farm storage).

- Crop Production Report is released on a monthly basis and contains crop production data for the US, including acreage, area harvested, and yield. The report also contains a monthly weather summary, a monthly agricultural summary, and an analysis of precipitation and the degree of departure from the normal precipitation map for the month.

How to Trade Soybean

Investors have several opportunities to invest in the soybean market, including soybeans shares, soybeans CFDs, soybeans ETFs, soybeans futures, and soybeans options futures.

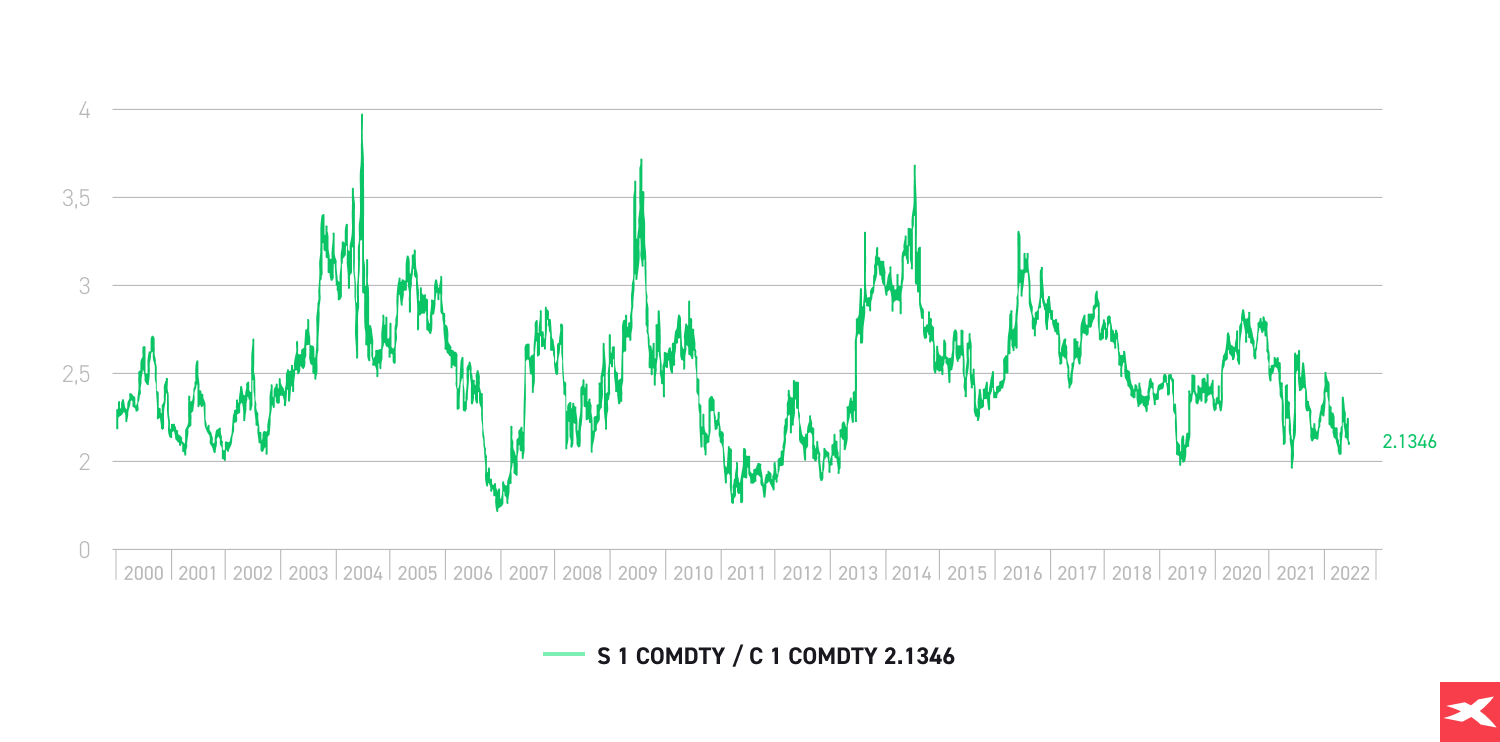

The price of soybean is highly correlated with other agricultural commodities, especially corn. Both grains require similar growing conditions, so farmers often start the planting season by choosing whether to plant maize or soybeans. It is helpful to find the current price of futures contracts for each grain and compare the "corn and soybean spread" - the ratio of the price of corn to the price of soybeans. Also, traders often bet on soybeans in relation to other agricultural commodities through spread trades, in which two different soybean futures contracts are simultaneously bought and sold.

It should also be remembered that weather conditions or diseases can have a significant impact on crops and often result in increased price volatility. In addition, investors need to be aware of other factors that may affect soybean supply, for example if meat prices fall, demand for soy-based alternatives such as tofu may also decline.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

In 2022 US farmers plan to plant less corn than soybean. If confirmed, it would be the third such situation in history after 1983 and 2018. The US government encouraged farmers to lower acreage in 1983 to prop up low prices while 2018 saw US-China trade war. Source: Bloomberg

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

In 2022 the ratio of soybean to corn price dropped significantly but remained above 2.00 - a level that historically saw reversals. Source: Bloomberg

SOYBEAN and SOYOIL markets are highly correlated. However, soybean prices tend to be more volatile than soybean oil prices. Source: xStation5

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Summary

The soybean market has recently experienced spectacular increases and many factors indicate that this tendency may continue in the future, taking into account the use of this grain in many areas. Soybean oil seems to be particularly interesting, as its popularity increases every year, which makes it an interesting investment opportunity. XTB provides access to both of these markets. The way to get exposure to soybean is to trade SOYBEAN or SOYOIL CFDs. Contracts for differences are instruments with many interesting features which affect the uniqueness of this product. They:

- are derivatives whose price is based on the price of based instrument

- are leveraged

- allow investing on both the rising prices and falling prices

The possibility of taking long positions (purchase order) or short positions (sales order) in combination with the use of the financial leverage mechanism makes these types of contracts currently one of the most flexible and popular types of trading on the financial markets. Nevertheless one needs to remember that these markets tend to be highly volatile, which could have disastrous consequences when markets move against you. For example, if you believe that soybean price will fall in value, you simply go short on soybean CFDs and your profits will rise in line with any fall in price below your opening level. However, should the price actually rise, you would suffer a loss for every rise in price. How much you profit or lose will depend on your position size (lot size) and the size of the market price movement. The main and by far the most important disadvantage of CFD trading is the potential for significant losses beyond the initial contract value, so a deep understanding of these instruments and proper risk management system needs to be implemented in order to avoid significant losses. Find out more about CFD trading - What Is CFD Trading?

Is Gold Becoming the World's New Reserve Currency? | Gold Investing

The history and future of Natural Gas

The History of Gold Mining

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.