In which sectors are lean hogs used?

Pork is mainly used as a food source, but some parts of the animals are also used in the pharmacological and industrial sectors. The most frequently manufactured products include: insulin, estrogens, cortisone, cosmetics, glue, leather gloves and shoes.

Top producers of lean hogs

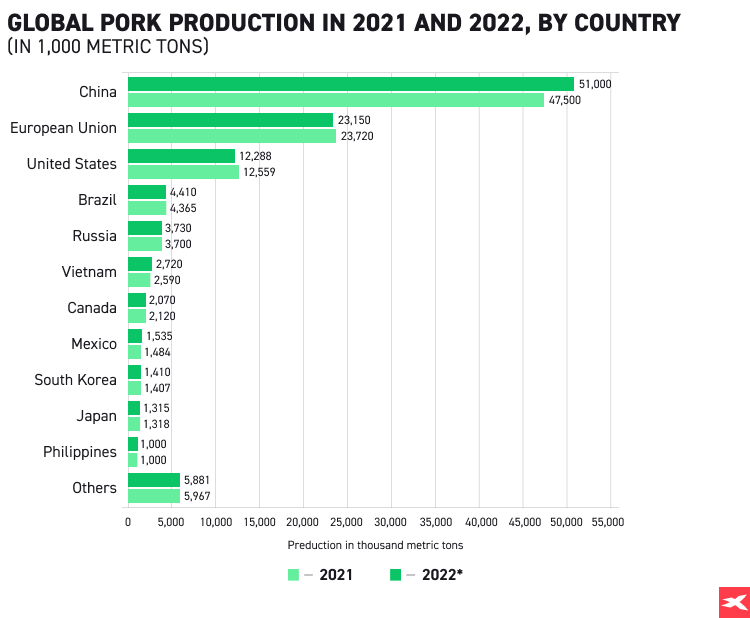

In 2021, the majority of pork came from China, which produced over 40 million metric tons of this commodity. The European Union and the United States are second and third major producers, respectively. In 2020, global pork production surpassed 100 million metric tons.

Most hog production occurs in China, the EU and US. Other notable producers are Brazil, Russia, Canada, Philippines, Mexico, Vietnam and South Korea. Source: Statista

Most hog production occurs in China, the EU and US. Other notable producers are Brazil, Russia, Canada, Philippines, Mexico, Vietnam and South Korea. Source: Statista

When making investment decisions, many investors look at the Hogs and Pigs Report, which is released every quarter and provides insights regarding the US pig crop, including inventory numbers and weights. Additionally, investors can find information about current supplies and projected supplies for the future. The CME Lean Hog Index is a two-day weighted average of cash prices.

What affects the price of lean hogs?

Several factors influence the lean hogs market, the most important of which are:

- Feed prices, which account for more than two-thirds of production costs. Before the pandemic, the price of livestock feed, especially corn, was negatively correlated with the price of lean hogs. As the price of corn increased, farmers often decided to sell their pigs even though they had not yet reached their target weight, to save on higher costs. As a result, there was an oversupply of pigs on the market. However, due to recent macroeconomic disturbances, this correlation has weakened.

Correlation between lean hogs and corn prices. Source: xStation

Correlation between lean hogs and corn prices. Source: xStation

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

- Weather - high temperatures, which sometimes occur in late summer and early fall, often reduce the activity of pigs and their tendency to reproduce. This may result in a lower number of births in the winter months and higher prices in the following summer due to the shortage of supply.

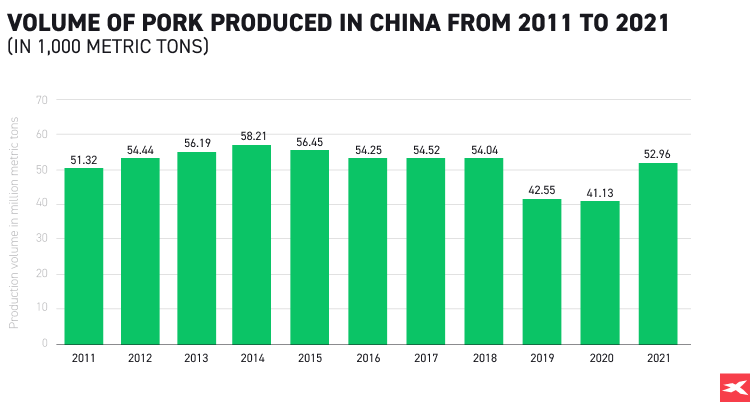

- Demand from China - the second largest economy in the world is not only the top producer, but also a major pork consumer that also accounts for approximately 20% of the global supply of pork imports. Around 54% of China's entire meat industry output is pork, which is also the most popular type of meat amid Chinese citizens. Demand from this country should increase in the future, taking into account its growing population and improving standard of living. Moreover, other developing nations, such as Mexico or Brazil, may also increase pork consumption as their economies get stronger.

Pork production in China returned above pre-pandemic levels. Source: Statista

Pork production in China returned above pre-pandemic levels. Source: Statista

- The price of other meat substitutes - nowadays, most consumers have a wide access to various products of animal origin, aside from pork, such as poultry, beef and fish. However, when choosing products, most people pay attention to prices. So if the price of pork increases, then it can be replaced by other, often healthier, alternatives. Therefore, many breeders have decided to limit the amount of antibiotics given to animals and to improve the diet, so that the final product is leaner and healthier. It appears that dietary trends may affect the demand and price of lean hogs in the near future.

What makes lean hogs an interesting investment opportunity?

- Inflation shield - due to surging inflation food prices rose sharply in recent times and this tendency is expected to continue. Therefore, investing in lean hogs is used by some traders as a hedge against the loss of purchasing power.

- Diversification - investing in lean hogs allows investors to diversify some portion of a portfolio out of stocks and bonds and allocates funds into the commodity market.

- The rising demand for pork from China might push the price of lean hogs, however, a lot will depend on the performance of the economy. Even without China, one needs to remember that the world population has increased exponentially, and competition for food will continue to strain the fundamentals of lean hogs and other foods when supply shortages appear.

How to trade lean hogs

Investors have several opportunities to invest on lean hogs, including shares, ETFs and futures. However Contracts for Difference (CFDs) are the most popular way to join this market. This financial instrument is now available at XTB under ticker LEANHOGS and enables speculation on the price of lean hogs without owning the underlying assets. However, first the client will have to pass an adequacy test, which allows them to assess whether he or she has the appropriate knowledge and experience to invest in CFDs. The possibility of taking long positions (purchase order) or short positions (sales order) in combination with the use of the financial leverage mechanism makes these types of contracts currently one of the most flexible and popular types of trading on the financial markets. However, one needs to be aware that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Summary

The lean hogs market provides an interesting investment opportunity, especially as the Chinese economy expands and, therefore, the demand for pork may increase, also partly because pork is a key ingredient in Chinese cuisine. It also provides some protection against inflation and is a great way to diversify your portfolio. However, one needs to remember that it can be extremely volatile, as the majority of the participants involved are pork industry players looking to hedge and secure prices, which often attracts a lot of speculators.

This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory.

The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments.

XTB S.A. is not liable for client’s any actions or omissions, in particular for the acquisition or disposal of financial instruments. XTB will not accept liability for any loss or damage, including without limitation, any loss, which may arise directly or indirectly, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

CFDs are compex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Is Gold Becoming the World's New Reserve Currency? | Gold Investing

The history and future of Natural Gas

The History of Gold Mining

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.