CFDs are a group of instruments targeted at short-term investors interested in rapid market movements with high risk and high potential profits. What really makes CFDs different from traditional trading?

CFDs are a group of instruments targeted at short-term investors interested in rapid market movements with high risk and high potential profits. What really makes CFDs different from traditional trading?

Market volatility has attracted investors to the financial market for hundreds of years providing investment opportunities with all the opportunities and risks involved. Today, however, the market is much more dynamic, volatile and fast-paced than it used to be thanks to the development of technology, rapid circulation of information and access to the Internet. This has made CFD trading - 'Contract for Difference' - increasingly popular.

With CFDs, the trader does not actually own the instrument and therefore is not responsible for all the liabilities and problems related to it. For example, it is possible to speculate on the price of oil, copper or gold without owning any physical commodity and without waiting for its delivery. Thanks to the development of technology people can start trading CFDs from anywhere in the world. In addition to this, trading in Contracts for Difference is known as 'short selling' which gives the opportunity to make money on falling prices. CFD trading has evolved and today it can be used on forex, stock indices, commodities, precious metals, stocks and even cryptocurrencies. It involves the use of leverage to increase the Risk/Reward Ratio.

This investment method brings with it huge opportunities and risks that cannot be underestimated. In this article we will take a closer look and try to answer the questions: what are the pros and cons and, most importantly, how to start trading CFDs?

What is and how does CFD Trading work?

CFD stands for 'Contract for Differences'. It means that you don't become an owner of the instrument you are trading (company stock, index or commodity), but buy a contract for difference. When you trade CFDs you are only speculating on the movement of the price, which can of course go up or down. Your task as a trader is to predict the future price movement of the instrument you are speculating on.

In the case of stocks CFDs, leverage will allow you to buy more shares contracts than you would be able to buy in real stocks. In this case, your profit or loss will also be multiplied accordingly.

For example, let's take Tesla stock, which is trading at $1,000 in this scenario. With $1000 in your brokerage account you would only be able to buy 1 share of the company at the moment.

When you trade CFDs on this stock you will take advantage of the 1:5 leverage assigned to it. This means that in order to open a position on Tesla stock you will need 20% of the position value in margin. Thus, opening a position of $1,000 will cost you only $200. On the other hand, if you open a position for $1,000, the value of the contract will be $5,000, so you will buy 5 CFD shares contracts. If the price of the stock goes up, you will benefit much more than if it was a real stock and vice versa. If the price of the stock goes down, the loss will be more severe.

Due to the fact that you are only trading a contract for difference, you can also bet on the stock price going down if you think it is overvalued or you expect a sudden drop in its price. The market is characterised by high volatility and the prices of instruments constantly go up and down. You can enter such a trade using the SELL button. It is the opposite of a BUY position where you bet on rising prices. You will learn more about short selling later in this article.

This case illustrates in a good way the opportunities and risks involved in CFD trading. Thanks to leverage it is possible to make large profits with a much lower level of capital commitment, but you should always be aware of the risks of also higher losses associated with this form of trading.

In order to trade CFDs skilfully and look for market advantage, you will need a reliable, fast and intuitive trading platform, which will enable you to use your knowledge. In xStation5 you will find lots of technical indicators and market analysis to facilitate your decision making.

For more information on leverage and detailed information on CFD trading please visit our education section.

What is short selling?

Short selling is taking positions on falling prices. With this position you can make money when the prices of the instruments go down. Normally, traders lose money when prices fall. However, CFD trading allows you to trade under all conditions, even in the face of falling prices, but you have to remember - the risk is always very high and prices can always go up.

The word 'short sell' has its origin in the price behaviour. The downturns are usually more dynamic and last much shorter than the 'upward movement' also known as a bull market. You can see how US company prices and indices behaved in 2008 in the face of the Lehmnan Brothers bankruptcy or in March 2020 during the COVID-19 crash.

Thanks to the possibility of 'short selling' Michael Burry, the current owner of the hedge fund Scion, who criticised the American credit system, made a fortune on the Wall Street panic of 2008. This story is depicted in the film 'The Big Short'.

If you want to try to make money on sudden, drastic price drops you can use not only short selling but also the VIX index, called the 'fear index'. This index tracks the volatility of the S&P 500 index and the volatility spikes when investor sentiment declines and panic ensues leading to selling of assets. When the projected volatility of the S&P 500 index increases, the VIX index also increases. So in the case of the VIX index, it is the other way around, if you are expecting a panic - you take a BUY position giving you exposure to a rising index. Alternatively, you can then take a position on a falling VIX index when you think the panic is over and prices can slowly start to rise again.

You can read more about the VIX index in the article How to start trading VIX.

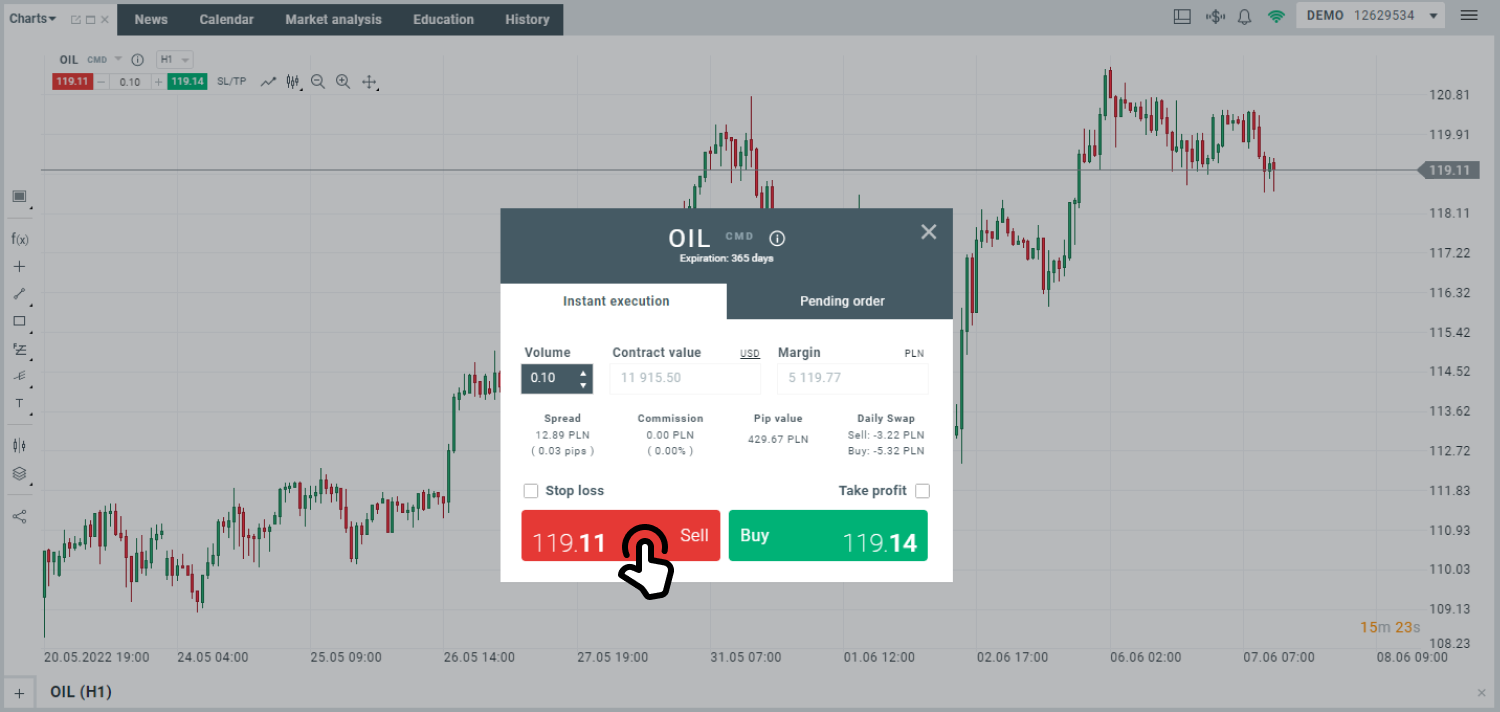

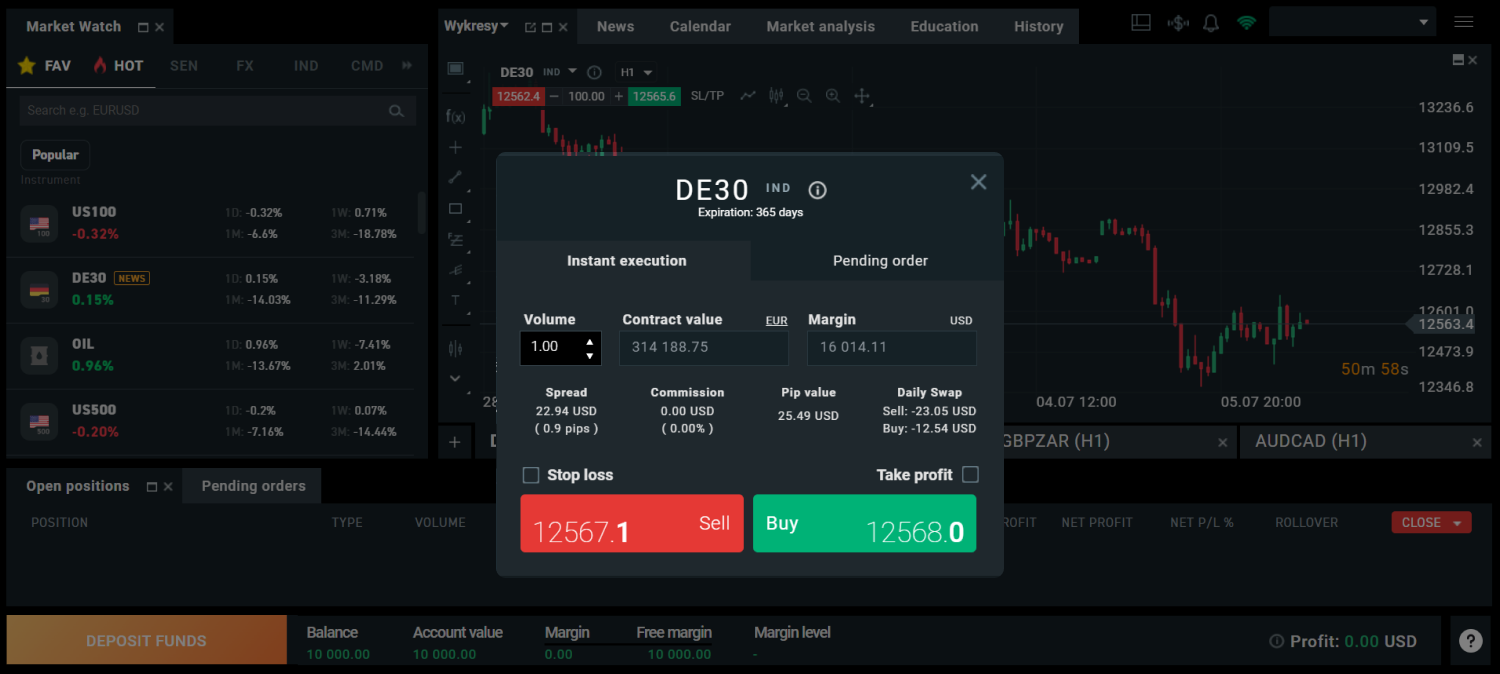

Short selling on the xStation5 platform

You open a short position on the platform in the same way as a long position. Instead of clicking on the green BUY button you select the red SELL button.

Source: xStation

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Position for rising prices 'long position' green BUY button

Position for falling prices 'short position' red button SELL

Defensive orders SL and TP

When trading CFD instruments, you have to take into account a high volatility of the price and result of the position. By analysing the chart and the changing situation, some traders decide to use automatic defensive orders so that they do not have to follow the chart all the time.

Stop Loss

As the name suggests, a Stop Loss order can protect against deepening losses, the position will be closed automatically when the price goes below your specified level. Another type of stop loss order is a trailing stop loss, which tracks the price of an instrument at a distance set by you. Using a trailing stop loss may allow you to hold a position for a longer period of time, maximising your profits and limiting the risk arising from a sudden price movement.

Take profit

A Take Profit Order, on the other hand, will allow you to automatically close a profitable position at a price level that you deem appropriate. The closing level can be based on, for example, the technical analysis that you will make available at xStation5 or your own analysis of the market situation.

You can find more information about defensive orders along with the instructions for setting them here and in the xStation5 platform, in the 'Education' tab, where we present instructional videos.

Financial leverage

The use of leverage carries with it both a chance to open a large position with a small amount of capital employed and greater responsibility and risk.

When trading CFD instruments, the amount you invest to open a position is called a margin. The amount necessary to open a position depends on the instrument you are trading and the leverage assigned to it. Let us use an example.

If you were to open a minimum position of 0.01 lot (1 lot equals 100,000 units of the base currency) on the EURUSD currency pair, you will need approximately EUR 33, because the available leverage on the EURUSD pair is 1:30, meaning that in order to open a position you would need 3.33% of the nominal value of the margin. Thus you would open a position of EUR 1,000 (0.01 x 100,000) on a margin of EUR 33.

It is also important for you to become familiar with the terms Balance, Equity (Account value) Free Margin, and most importantly Margin Level.

The account balance changes only when you deposit, withdraw, close or open a position.

Equity is the amount in your balance plus the current result on your open positions.

Margin is the sum of your margins - the total amount taken to open positions in CFDs.

Free Margin is the amount you can still use to open new trades.

Margin Level is an indicator that counts the % of your margin. The formula is:

Thus if your Equity is 3300 EUR and the margin in a CFD position is 33 EUR your Margin Level will be 1000%.

However, if your account value is 35 EUR and the margin is 33 EUR your margin level will be almost 106%. (35 / 33 x 100 % = 106)

If on an open CFD position you have recorded a loss of 18 EUR, your account value is only 17 EUR. In this case, your margin level will only be around 51.5%, which means that an automatic Margin Stop defence mechanism is triggered, which will close your position in order to stop further losses if your margin level falls below 50%.

The mechanism's existence is a legal requirement and is a result of the regulations we are subject to as regulated by financial institutions such as ESMA and the FCA.

If the margin level falls below 80%, we will send you a Margin Call warning, which means that your margin level has fallen to dangerous levels and may result in closing your position.

If you wish to keep your CFD positions open while the Margin Level is falling, you can simply deposit funds into your account which will cause the Equity (account value) to increase and the Margin Level to rise. The information about the current level of % Margin Level is displayed in the platform, so you do not have to make calculations on your own.

You can read more about the Margin Stop mechanism here: https://www.xtb.com/en/education/margin-call.

Best CFD trading platform

CFD trading platforms are places where transactions can be made that involve buying or selling multiple assets, such as indices, stocks or commodities. At XTB we really understand market dynamism, that's why we provide a modern and reliable xStation platform in 3 different versions:

Available versions of xStation5 platform:

- in a desktop form installed on a computer;

- in a form displayed in a web browser;

- in the form of an application for mobile devices.

On our platform you will find the possibility to trade CFDs on thousands of different instruments, finding exposure to, among others, all major indices, precious metals, commodities and shares of thousands of companies listed on the global financial markets.

On our platform you will find the possibility to trade CFDs on thousands of different instruments, finding exposure to, among others, all major indices, precious metals, commodities and shares of thousands of companies listed on the global financial markets.

Free DEMO account

We understand that a novice trader or someone not yet familiar with our platform may want to test it first. This is why we provide a free DEMO account.

Anyone can get acquainted with the interface, the operation and the educational videos that will accelerate the pace of learning. You will also be able to adjust the deposit on your DEMO account yourself. At any time you will be able to opt for a free conversion to the real platform and use the free account. Here you will find access to hundreds of financial markets, real-time quotes and you can start investing and trading CFDs.

Instant access to market news and analysis

Every day on the xStation platform our financial markets analyst department provides our clients with the newest information and market analyses in the 'News' tab. With access to fresh information and analytical material, you may be able to make your trading better and track hottest market news.

Technical Analysis Indicators

With access to hundreds of indicators to help you analyse the price chart, you'll be able to study the price reactions on your own and find the right moment to start CFD trading by buying or 'short selling'.

Professional assistance

Our multilingual customer support will be able to offer you professional assistance via chat, phone and email five days a week with information about your account situation and trades. Additionally, you will receive contact to your personal brokerage account manager to whom you will be able to address any questions.

Thousands of instruments

To meet our clients' expectations we provide real-time CFD trading. Our Trading and IT Departments work on improving our platform by posting new updates and ensuring its uptime, liquidity and security.

For more information about the features of our platform click here.

CFD Instruments

Each instrument has individual characteristics and is subject to fluctuations influenced by various macroeconomic, political or industry factors. Therefore, in order to help you better understand the specifics of the instruments you will start trading, we have prepared articles for you which you can find in our new educational platform. Knowledge can give you an edge, and 'understanding' price fluctuations can make your trading better.

The US100, which tracks NASDAQ index futures, is influenced by investor sentiment towards technology companies and the financial performance of the largest companies in the index, such as Apple and Microsoft, among others.

The gold market, on the other hand, is influenced by other, specific factors that cause metal prices to rise, often when investors feel uneasy about changes in world politics.

Uranium mining companies are influenced by demand from nuclear power plants and changing government attitudes towards nuclear energy.

CFD trading makes everything 'happen faster', the outcome of a position changes faster and you can see large profits and losses unfolding faster. That is why we recommend you to get familiar with our offer and the xStation 5 platform in order to test the trading opportunities we offer.

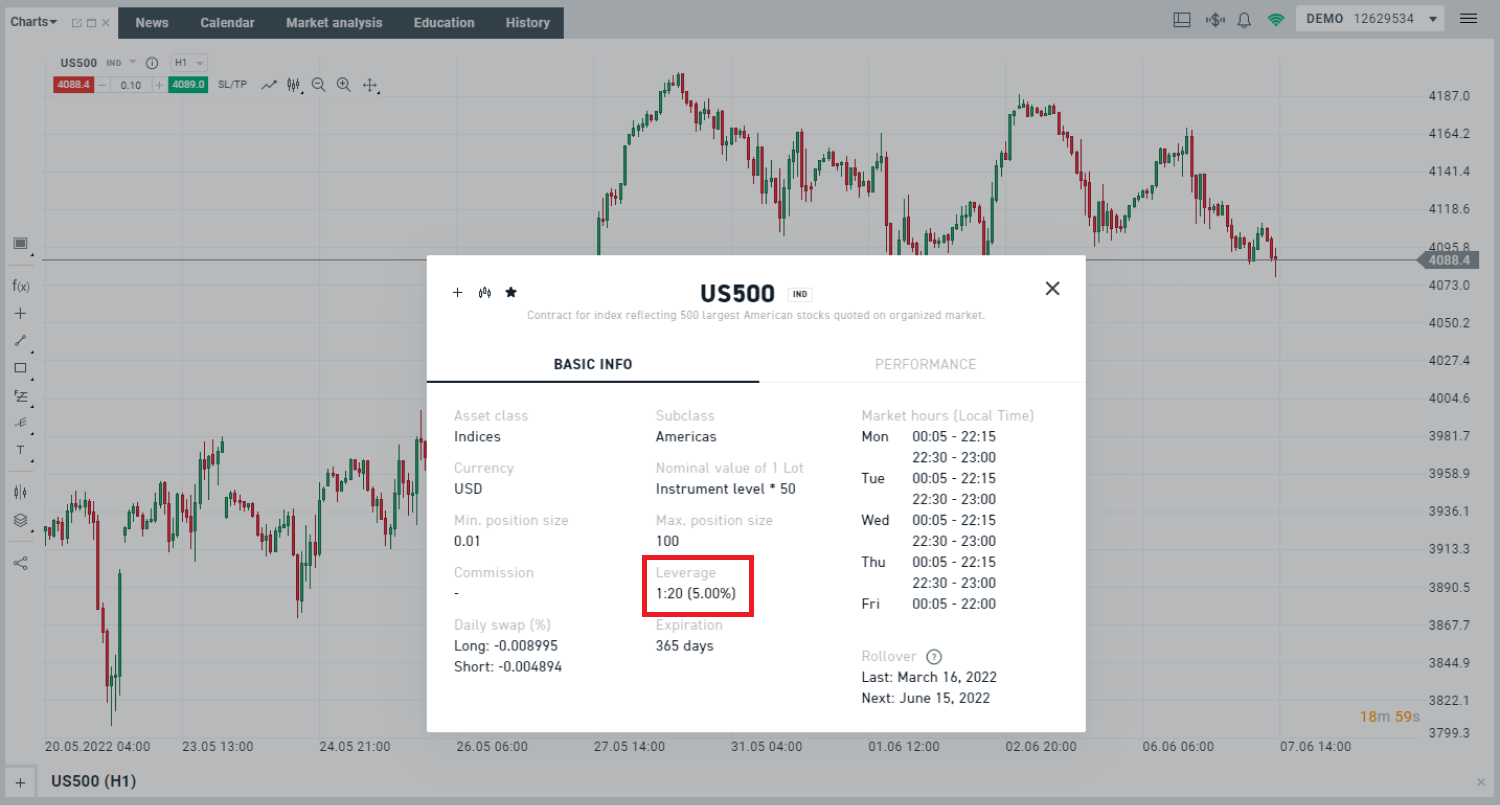

Each instrument is assigned a fixed amount of available leverage, which you cannot change by yourself. Additional, basic information about each of them can be found in our xStation platform, in the 'instrument information' tab.

Source: xStation

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

You may, of course, apply for the status of experienced or professional client, in which case the maximum available leverage will be changed. For this purpose you can also contact us, the sales department will give you precise information about the documentation in this regard. A detailed description of the requirements is available here.

Before you start trading on our platform the list of available instruments for CFD trading, together with information, can also be found here: Range of Markets

Pros and Cons

Of course CFD trading, just like any other form of capital investment, has its specific advantages and disadvantages. Exactly identifying which feature is a disadvantage and which is an advantage is an individual matter because some traders like the high volatility and the opportunities that come with it, while others may not feel comfortable with this kind of risk.

How to start trading CFDs in 11 steps

1. Visit our website www.xtb.com and register

2. Fill out the form, enter your details and upload necessary documents for verification.

2. Fill out the form, enter your details and upload necessary documents for verification.

3. Within 1 or 2 days you should have a live account and be able to start trading CFDs if all requirements are met. We will first need to verify your knowledge, experience in the market and risk appetite.

4. Login to xStation5 by going to www.xtb.com -> login -> xStation platform.

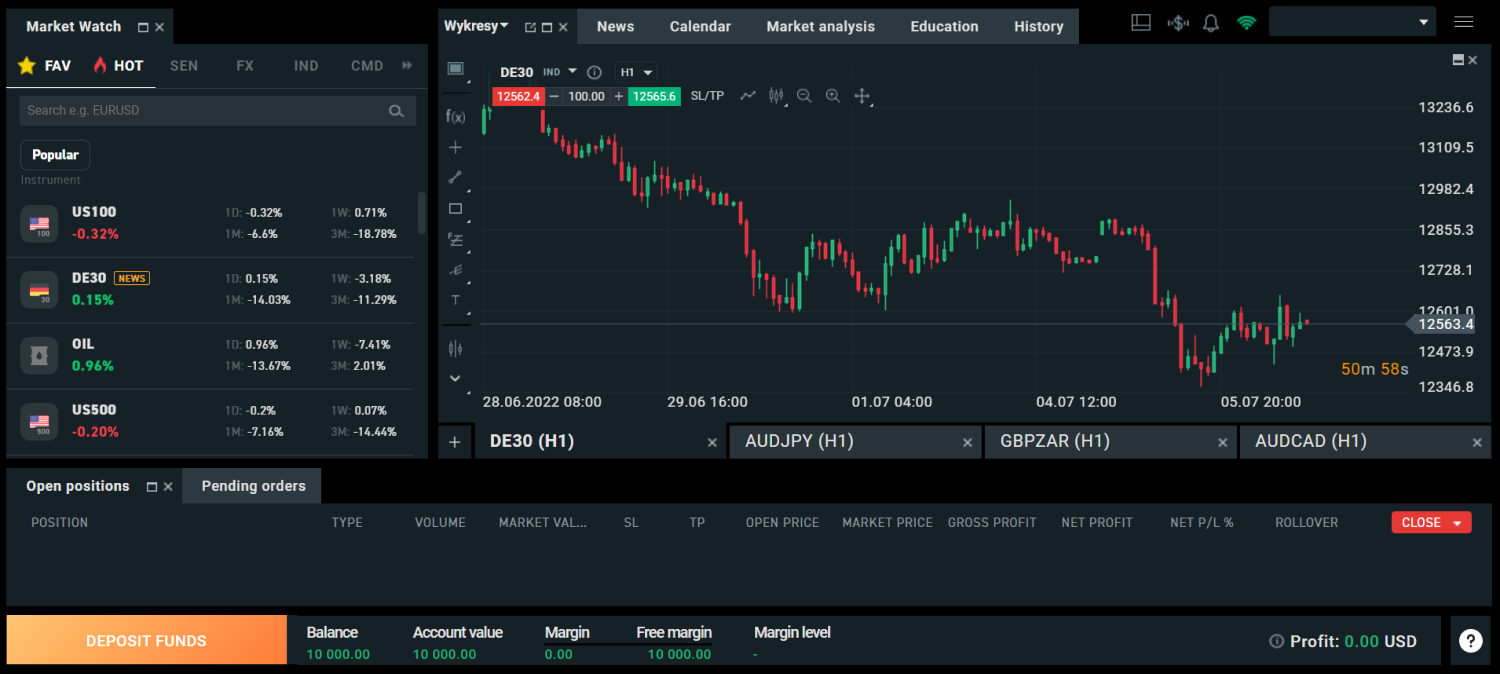

5. In the platform, in the tab Trading -> 'Market watch' you will find thousands of instruments available for trading arranged in special tabs.

Source: xStation

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

6. Search for instruments by simply entering the name of the instrument you are interested in f.e. GOLD or OIL.

7. Once you have searched for an instrument, you will find it on the left hand side. From this window you will be able to open its chart, read information about the instrument, available leverage and conclude your first transaction.

8. We provide an advanced calculator in the tab 'Market Watch' thanks to which you will not have to perform the necessary calculations by yourself.

Source: xStation

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

9. By pressing the BUY or SELL button you will make a buy trade if you bet on the rise, or a short sale if you bet on the fall of prices.

10. You will see your open position in the 'Open Positions' tab, and within this tab you can also close it by clicking on the red X to the right of it, or close only part of the open position by right-clicking on “Partial Close”.

11. When you close a position, the funds from it are immediately returned to your balance from where you can either withdraw them or enter into new transactions and continue trading.

Trading hours

CFD trading is available when the underlying instrument is available for trading and quotations are ongoing. In the case of shares, trading is open when the exchanges are open, quotations end at fixed and known times.

In the case of instruments such as index futures or commodity futures, the opening hours depend on the liquidity and trading hours of the underlying instrument as quoted on the CME, for example.

Detailed hours of trading sessions on particular instruments are specified in our xStation5 platform. By going to the tab Market watch -> Search -> Instrument name -> You will display the circled 'i' button 'Instrument information'. -> Once you click on it, you will see the exact time the quotes are available.

For example, for silver and gold the opening hours are 00:00 - 23:00 Monday to Friday

For US indices, on the other hand, trading is open Monday through Friday from 00:05 to 22:15 and from 22:30 to 23:00.

You can find up-to-date information about changes in trading hours due to holidays, stock exchange closures or suspension of trading in the underlying instrument in advance in the 'Company News' section of our homepage at www.xtb.com.

PLEASE NOTE! CFDs are not suitable for investors who have a low risk appetite and wish to invest over the long term.

FAQ

CFDs are financial instruments different from shares, indexes or bonds. However, the main difference lies in the access to short selling, leverage and specific orders such as stop loss, take profit or trailing stop loss, as well as in the functioning of the stop out mechanism.

CFDs are designed for traders accepting high risk. Thanks to financial leverage, market volatility can cause both rapid and significant losses, as well as profits. If market volatility is not a problem for you and you are looking for short term advantage or trends, CFDs may be right for you.

The loss from CFD trading is limited by the automatic stop out defence mechanism. Your account balance cannot be negative because of negative balance protection, so you can’t lose more money than you deposited on your account.

If you want to keep a loss-making position open, you will have to deposit additional funds into your account to increase your 'Margin Level'. This solution may be suitable if the price starts moving in your direction and the position will eventually bring you a profit. If, on the other hand, the price continues to move in the wrong direction, all the money you deposit may be lost in order to hedge the losing position. Before you start trading, familiarise yourself with how CFD trading is done by using a DEMO account, which you can open here, and familiarise yourself with our Knowledge Base.

If you trade on Stock CFDs, you are entitled to the dividend equivalent. Familiarise yourself with what is the ex-dividend date and the pay date. The dividend equivalent is paid on the ‘ex dividend date’ also known as the 'dividend cut off date'. The day of ‘ex-date’ is each listed company decision.

For BUY positions, when you bet on price increases (long) you will receive a positive dividend equivalent. At the same time, on the ExDate the dividend amount is cut off from the share price, meaning that this will result in a loss on the position. This loss will be offset by the positive dividend equivalent you receive.

For a SELL position, if you bet on falling prices (short), you will receive a negative dividend equivalent. At the same time, on the ExDate the dividend amount is cut from the share price, resulting in a profit on your position. This profit will be offset by the negative dividend equivalent awarded to you.

Both of these situations are strictly technical and do not directly affect the outcome of the position.

No. Leverage is assigned to an instrument and you cannot change it by yourself. Thus, for major currency pairs such as EURUSD you will have access to a leverage of 1:30, while trading shares you may encounter a lower leverage of 1:2.

It is also possible to get access to high leverage of 1:100 or 1:200 by going through the appropriate procedures to become a Professional Customer. You can contact your Sales Department or your Account Manager directly, who will explain the process to you.

The prices of CFDs are based on the prices of the underlying instruments. For instruments such as Stock CFDs, the underlying asset is always the current price of a listed company stock. The prices of the indices are real and up-to-date, however, it is the prices of the underlying instruments, which the CFDs 'track', that play an important role.

In other instruments such as the US500, OIL or NATGAS the underlying is a futures index or commodities quote. In this way the US500 is based on futures prices, which may be different from the actual S&P500 index ‘spot’ valuation. This is due to the different maturity dates of the contracts, as investors expect different valuations depending on the month of the quote, so there may be small differences. A similar situation occurs in the case of oil and natural gas, for which the underlying instruments are also the prices of futures contracts traded on the Chicago Mercantile Exchange exchange.

We always provide prices in real time with the best interest of our clients in mind.

Emissions Trading - How to Invest in Carbon CO2?

EURUSD Trading - How to invest in the EURUSD currency pair?

Energy Trading - How to invest in electricity & power?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.