Out of the hundreds, available ETFs, every investor wants to choose the one that will bring the highest return in the future. However, we cannot predict the future. In assessing the 'quality' of the ETF funds we choose, we can look at some basic information that will tell us more about the costs involved and, most importantly, whether they truly reflect the return of the asset, sector or index they track. In the following article, we will consider what ETFS to look out for.

ETFs are mainly aimed at long-term investors looking for ways to diversify their portfolios, which can save time analysing each listed company individually. Speaking of 'best' funds, the article will refer to those whose broadly defined quality is high. This, of course, does not prejudge future returns. Without a doubt, the very popular ETFs are those offering exposure to the U.S. stock market and indexes like the S&P 500 or Nasdaq 100, although funds for emerging market economies or precious metals are also popular.

Exchange traded funds (ETFs) make diversified exposure to global financial markets possible, without searching and buying hundreds or a thousand of stocks. From the precious metal, stocks of major companies around the globe, to bonds and emerging markets. Who has ever heard about bull market cycles, technology stock rallies or precious metals investments? Thanks to ETFs, investing gained popularity. However, in this article, we will learn more about how to select a high quality ETF, and we will present you with a few.

Out of the hundreds, available ETFs, every investor wants to choose the one that will bring the highest return in the future. However, we cannot predict the future. In assessing the 'quality' of the ETF funds we choose, we can look at some basic information that will tell us more about the costs involved and, most importantly, whether they truly reflect the return of the asset, sector or index they track. In the following article, we will consider what ETFS to look out for.

ETFs are mainly aimed at long-term investors looking for ways to diversify their portfolios, which can save time analysing each listed company individually. Speaking of 'best' funds, the article will refer to those whose broadly defined quality is high. This, of course, does not prejudge future returns. Without a doubt, the very popular ETFs are those offering exposure to the U.S. stock market and indexes like the S&P 500 or Nasdaq 100, although funds for emerging market economies or precious metals are also popular.

Exchange traded funds (ETFs) make diversified exposure to global financial markets possible, without searching and buying hundreds or a thousand of stocks. From the precious metal, stocks of major companies around the globe, to bonds and emerging markets. Who has ever heard about bull market cycles, technology stock rallies or precious metals investments? Thanks to ETFs, investing gained popularity. However, in this article, we will learn more about how to select a high quality ETF, and we will present you with a few.

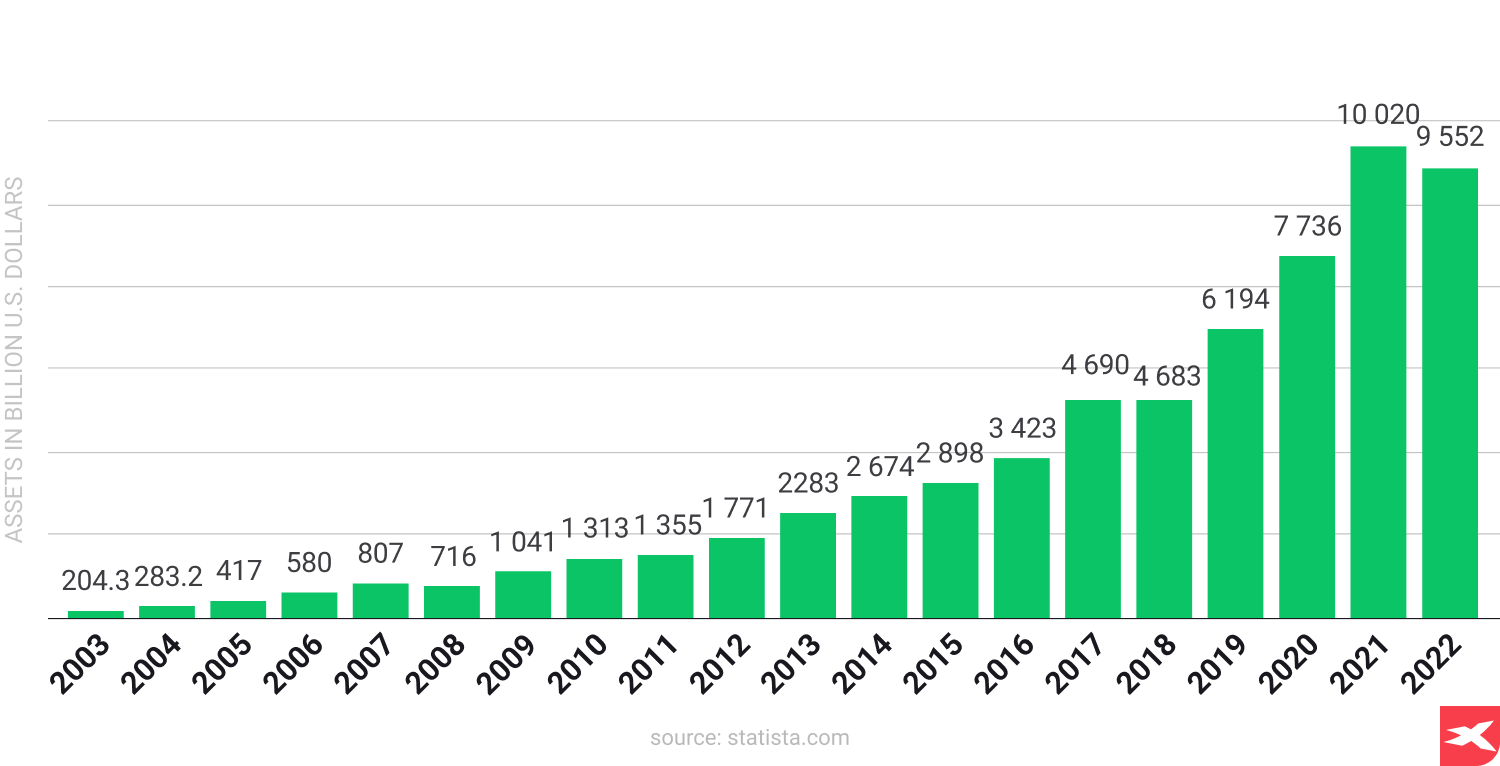

Source: Statista.com

Source: Statista.com

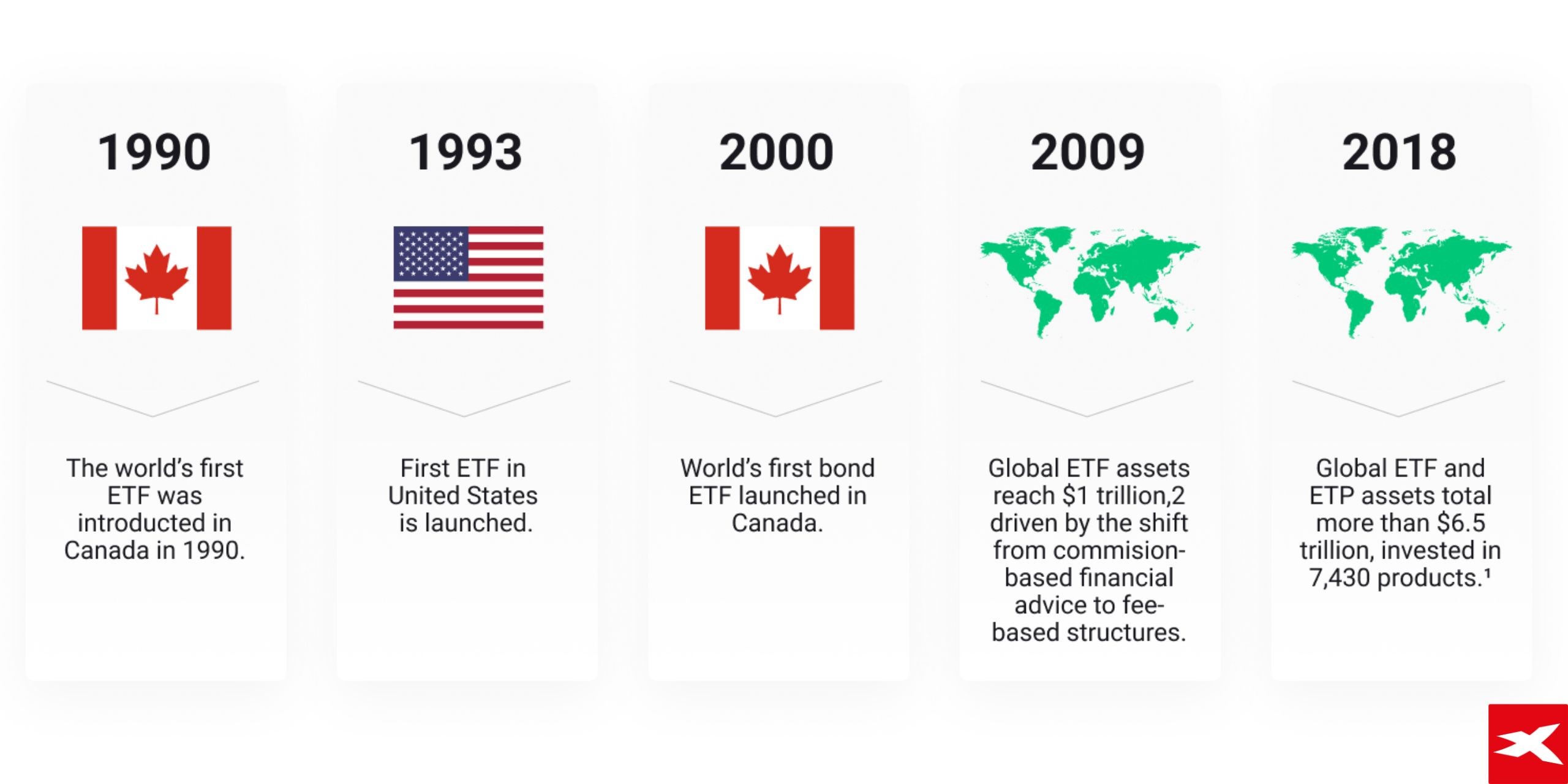

ETF investing highlights

Exchange traded funds (ETFs) are similar to stock market shares - they are priced and traded on stock market exchanges. ETFs usually track prices of stock market indices like S&P 500 or Nasdaq 100, specific market sectors like technology, finance, biotechnology, pharmaceutical etc. but also precious metals or even bonds.

There are two basic investment strategies - passive and active. Because of ETFs specification, which supports long term investors, they are usually considered an important element of diversified, long term portfolios. ETFs offer high liquidity, diversification (also geographically) and broad investment opportunities with tax efficiency. Their fees are usually much lower than on traditional mutual funds. Every investor can buy and sell ETFs when the stock market is open.

At the same time, ETFs also carry some investing risk. Remember that finding the best ETFs is very difficult. We can inform you about what we believe are the “best” performing ETFs (until now) but we never actually know if the performance of that ETF will be the same in the future. The level of return from ETF investing is determined by how the market will price what they hold in their portfolio (stocks, bonds, etc.) or- the behaviour of the prices of the assets they track (e.g. gas prices, gold, silver, etc.).

Source: Vanguard

Source: Vanguard

Exchange traded funds (ETFs) offer investors exposure to almost every asset class:

- Stock market indices (U.S. indices, European indices, emerging markets, etc.)

- Selected sector ETFs (for example new technologies, banks, biotechnology etc.)

- Green and ESG investments (renewable energy, electric cars etc.)

- Bonds (from corporate high-yield bonds, US 10-year “treasuries”)

- Energy and materials (e.g. commodity ETF on natural gas, copper)

- Precious metals (gold, silver)

- Dividend equity ETF (“distributing” model ETFs)

Good to know

- The outcome of any exchange traded fund is closely dependent on future, usually unpredictable in the short term

- Development of global markets and the economy may be crucial in general, but the investors' sentiments are stock market yield drivers, not any data. Market can overreact positively or negatively on almost every news

- In the long term, a strong global economy should be seen as a positive driver of the stock market - rising consumption means higher corporate profits and the possibility of beating analysts expectations - good for ETFs popularity and yields

- Decisions of central banks can affect not only the stock market but especially bonds (and bond ETFs) but also precious metals or energy commodities.

- A basic financial principle states that the lower the risk, the lower awaited potential return on investment (it doesn’t mean that there is no possibility of beating so-called efficient market theory). But it also implies its opposite - for taking higher risk, investors can expect a higher reward (but it is not said that they will ever receive it)

- Detailed information about each exchange traded fund can be found on its issuer's website. In the case of the most popular, the iShares ETFs - the institution responsible for their issuance is BlackRock.

Pros and Cons

ETFs have advantages and disadvantages, which we describe below to help potential investors analyse their potential and risks. Don’t forget about doing your own research and gaining knowledge - even if you invest passively. As RIP Charlie Munger said once to Howard Marks, “investing is simple, but it can’t be easy”. With that in mind, let’s look at the pros and cons of ETFs as an asset class.

Pros

- Great for long-term and passive investing

- For both beginners and professionals

- Low entry barrier, low fees (TER) and high liquidity

- Limited risk and possibility of portfolio diversification

- Due to diversification, volatility may be lower compared to single stocks

- Possibility of investing in a bunch of assets like indices, bonds or commodities

Cons

- May not be appropriate for traders and short-term investors who prefer an aggressive investment style

- Lower risk is balanced by possible lower returns

- Investor-selected exchange traded fund may underperform compared to top companies or indices during bull markets

- Diversification does not guarantee returns and can also lead to losses

- In a portfolio, a few exchange traded funds can spoil the performance of those that are doing great

- Risk of misalignment of ETF in a portfolio

Source: Bloomberg Finance LP

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

High quality ETFs

As we said before, it’s hard to find the best ETFs to buy, but we will mention below 6, very high quality ETFs, with low costs (TER) and successful underlying index tracking.

Very popular ETFs include, for example:

- iShares Core MSCI World UCITS EUNL.DE - diversified developed countries stock market exposure

- iShares S&P 500 UCITS SXR8.DE - shares of 500 biggest US companies, listed on S&P 500 index fund

- iShares Nasdaq 100 UCITS SXRV.DE - stocks from Nasdaq 100 index - leading US technology companies index

- iShares MSCI World SRI UCITS 2B7K.DE - portfolio of companies with a high ESG index

- iShares Core MSCI Europe UCITS IMAE.NL - largest stock market companies in Europe

- iShares Core MSCI World EM IMI UCITS IS3N.DE - broader exposure to equities from emerging markets

- iShares MSCI Asia EM UCITS CEBL.DE - Asian (also Chinese) companies

The exchange traded funds listed above are certainly among the most popular but represent only a fraction of the hundreds of different funds offering diverse exposure to different segments of the financial market. For long term investors, expense ratio is very important, so we adjusted the ETFs with that information.

iShares Core MSCI World

Addressed for long term investors, may be a portfolio core assessing long term growth opportunities in developed countries. MSCI World covers 85% of listed equities in 23 economies which means geographically diversification and allocation between each developed country like US, Canada, Germany, Switzerland or the United Kingdom. This ETF has in its portfolio core well-developed companies with global business and provide big exposure on the US market.

- Investing goal: Tracking stock performance of companies from developed countries

- Number of holdings: 1513

- TER (Total Expense Ratio): 0.2%

- Distribution policy: Accumulating

- 15 Biggest stock holdings: Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla, Meta Platforms, United Health, Eli Lilly, Berkshire Hathaway, ExxonMobil, J.P. Morgan, Johnson & Johnson, Visa, Broadcom

- Sectors: Technology (22%), Financials (14.7%), Health Care (12.7%), Industrials (10.7%), Consumer Discretionary (10.7%)

- Standard deviation (3yr): 17.64% (as of 30 September 2023)

- Cumulative return (5yr): 42.49% (as of 30 September 2023)

- ESG Rating: A

- Rebalancing: Quarterly

iShares S&P 500 UCITS

The ETF guarantees exposure to 500 well-established U.S. publicly traded companies that often conduct global business. Exposure to the S&P 500 Net Total Return Index means that the ETF reflects the return of the S&P 500 index plus the dividends paid (Withholding Tax) by the companies listed in it. The composition of the S&P 500 index changes over time - some companies exit the index and are replaced by new businesses debuting in it. ETFs take this fact into account and do not require the investor to actively manage the portfolio. By purchasing it, the investor is assured that its quotations will reflect those of the S&P 500 - in all economic conditions and also in the long term.

- Investing goal: Tracking performance of S&P 500 NTR (Net Total Return Index)

- Number of holdings: 503

- TER: 0.07%

- Distribution policy: Accumulating

- 15 Biggest stock holdings: Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla, Meta Platforms, United Health, Eli Lilly, Berkshire Hathaway, ExxonMobil, J.P. Morgan

- Sectors: Technology (28%), Health Care (13.3%), Financials (12.6%), Consumer Discretionary (10.5%), Communication (9%)

- Standard deviation (3yr): 17.85% (as of 30 September 2023)

- Cumulative return (5yr): 57.98% (as of 30 September 2023)

- ESG Rating: A

- Rebalancing: Quarterly

iShares Nasdaq 100 UCITS

Investing in this ETF means broad exposure to US new technology sectors like software, hardware, semiconductor, digital advertising and also AI. What’s more also companies from biotechnology, retail and wholesale or telecommunications are the investment benchmark. This index is dominated by large and medium cap companies. It’s known as the global technology sentiments momentum benchmark.

- Investing goal: Tracking performance of 100 largest non-financial) companies listed on Nasdaq

- Number of holdings: 101

- TER: 0.33%

- Distribution policy: Accumulating

- 15 Biggest stocks: Apple, Microsoft, Amazon, Nvidia, Meta Platforms, Tesla, Alphabet, Broadcom, Costco Wholesale, Adobe, PepsiCo, Cisco, Comcast, AMD, Netflix

- Sectors: Technology (49%), Communication (16%), Consumer Discretionary (13.9%), Healthcare (7%), Consumer Staples (6%)

- Standard deviation (3yr): 22.49% (as of 30 September 2023)

- Cumulative return (5yr): 97.15% (as of 30 September 2023)

- ESG Rating: A

- Rebalancing: Quarterly

iShares MSCI World SRI UCITS

The index consists of several hundred companies with very high ESG Environmental - Social - Governance (clean energy, ecology, social responsibility and corporate governance) scores. The index reviews companies for their exposure to the defence industry (including nuclear weapons, controversial conventional firearms), alcohol, gambling or genetically modified organisms. Additional restrictions also apply to green energy and environmental protection, thanks to additional restrictions on companies in the coal, oil sands, power generation, gas and oil extraction sectors. Of particular interest to investors who highly value investments that meet ethical and environmental criteria above all else.

- Investing Goal: Tracking index composed of companies from developed countries with high ESG rating

- Number of holdings: 415

- TER: 0.2%

- Distribution policy: Accumulating

- 15 Biggest stocks: Tesla, Microsoft, Home Depot, Novo Nordisk, Adobe, ASML, PepsiCo, Coca-Cola, Walt Disney, Danaher, Intuit, Amgen, Texas Instruments, Verizon Communications, S&P Global

- Sectors: Financials (17%), Technology (15%), Consumer Discretionary (15%), Health Care (15%), Industrials (13%), Consumer Staples (8%)

- Standard deviation (3yr): 16.14% (as of 30 September 2023)

- Cumulative return (5yr): 65.89% (as of 30 September 2023)

- ESG Rating: AA

- Rebalancing: Quarterly

iShares Core MSCI Europe

This ETF gives investors wider exposure to the stock market by investing only in European equities. At the same high number of diversified stocks from developed countries companies may be a part of long term view of Europe as the important financial (Swiss banking - UBS) industrial (automotive - Volkswagen, BMW, Porsche or Mercedes), Consumer Discretionary (Nestle), Healthcare (Novo Nordisk) and luxury brands (LVMH) global player.

- Investing Goal: ETF is tracking performance of biggest listed companies from European countries only

- Number of holdings: 428

- TER: 0.12%

- Distribution policy: Distributing (dividends payable semi-annual)

- 15 Biggest stocks: Nestle, Novo Nordisk, ASML, Shell, LVMH, AstraZeneca, Novartis, Roche, HSBC, Total Energies, SAP, Sanofi, Unilever, BP, Siemens

- Sectors: Financials (17%), Industrials(16%), Health Care (15%), Consumer Staples (11%), Consumer Discretionary (11%), Materials (7%)

- Standard deviation (3yr): 15.59% (as of 30 September 2023)

- Cumulative return (5yr): 34.9% (as of 30 September 2023)

- ESG Rating: AA

- Rebalancing: Quarterly

iShares MSCI Asia EM

This ETF fund gives the investor diversified exposure to Asian equities and also Indian or Vietnam stocks, which may have even higher growth potential than China due to population growth and huge number of successful tech companies.

- Investing Goal: Tracking performance of selected ‘Asian only’ companies from selected emerging economies (MSCI EM Asia Index Net Total Return)

- Number of holdings: 642

- TER: 0.18%

- Distribution policy: Accumulating

- 15 Biggest stocks: China Construction, HDFC Bank, SK Hynix, Hon Hai Precision, Tata Consultancy, Netease, Ping an Insurance, Baidu, Mediatek, JD Com, Samsung, Bank Central Asia, BYD Ltd, Bank of China, POSCO

- Sectors: Technology (24%), Financials (23%), Consumer Discretionary (15%), Communication (10%), Industrials (5%)

- Standard deviation (3yr): 19.64% (as for 30 September 2023)

- Cumulative return (5yr): 3.38% (as of 30 September 2023)

- ESG Rating: BBB

- Rebalancing: Quarterly

iShares Core MSCI World EM IMI

Access to emerging markets may be limited to some investors, but iShares Core MSCI World EM IMI is here to solve this “problem”. The index gives exposure to over 2,800 companies from countries such as China, Brazil, India or even Vietnam. Because of it, investors will not miss out on the hidden growth potential of small companies outside developed economies. This ETF may be more risky due to the higher number of small countries, from ‘exotic’ markets but still may be a very important core of the diversified, global portfolio.

- Investing Goal: Tracking index composed of large, mid and small companies from emerging markets

- Number of holdings: 3186

- TER: 0.18%

- Distribution policy: Accumulating

- 15 Biggest stocks: Taiwan Semiconductor, ISH MSCI China, Tencent Holdings, Samsung, Alibaba, Meituan, Reliance Industries, PDD Holdings, Infosys, Icici Bank, China Construction, HDFC Bank, SK Hynix, Hon Hai Precision, Tata Consultancy

- Sectors: Technology (20%), Financials (20%), Consumer Discretionary (13%), Communication (8%), Materials (8%)

- 15 Biggest stocks: Taiwan Semiconductors, Tencent Holdings, Samsung,

- Standard deviation (3yr): 17.49% (as of 30 September 2023)

- Cumulative return (5yr): 6.44% (as of 30 September 2023)

- ESG Rating: BBB

- Rebalancing: Quarterly

*Using the iShares Nasdaq 100 UCITS ETF as an example - a TER cost of $0.33% means that after a $10,000 investment - the first year's fees will be $33. The Total Expense Ratio (TER) consists primarily of the management fee and other expenses such as trustee, custody, registration fees and other operating expenses. Proven data above may change in time - the information is proven average at 9 October 2023.

In the search of the best performing ETFs

Selecting the appropriate ETFs is an essential step in your investment journey. During your ETF research, it’s important to ponder the following key factors for aligning with your investment objectives:

Selecting the appropriate ETFs is an essential step in your investment journey. During your ETF research, it’s important to ponder the following key factors for aligning with your investment objectives:

- Total Expense Ratio (TER)

- Objectives and strategy

- Performance and tracking record

- Liquidity and diversification

- Overall fund size (AUM), holdings and composition

- Tax efficiency

- Research and due diligence

- Brokerage account

To effectively evaluate ETF performance, it is recommended to:

- Compare it to other ETFs and its benchmark index

- Review fees very closely

- Monitor performance through account statements

- Evaluate tax efficiency through distribution history and capital gains

Important: The role of ETF is to do exactly what you want to achieve by having it in a portfolio. If any ETF underperforms a specific market sector or index it tracks, probably you should find a better one. The best known ETFs issuers are BlackRock (iShares), Vanguard, Invesco, State Street, VanEck, WisdomTree, JP Morgan, ProShares, Global X and PIMCO.

FAQ

ETFs typically offer exposure to dozens or hundreds of different listed companies. Investing in individual stocks involves buying shares of only one company (or more if an investor buys more than one company stock). Because of the larger number of stocks that ETFs accumulate, usually they have lower volatility compared to stocks. They are also not as prone to the risks associated with investing in only one company. Some index funds track the price movements of entire stock market indices, which include dozens to hundreds of stocks of different companies. Individual stocks are usually much more volatile than ETFs.

Some “Distributing” (Dist.) ETFs pay dividends to investors according to how much the companies in their portfolio pay out. Other so-called “Accumulating” (Acc.) ETFs, instead of paying out dividends, set aside the equivalent in the price of the ETF itself. Among others, the German DAX index does this similarly, as a so-called “Performance Index”. Its prices take into account not only changes in stock prices, but also dividends paid by German companies.

Yes, ETFs may be suitable for passive investors who plan to reap long-term returns and are focused on wealth management. This is all thanks to easy diversification, low investment costs and the simplicity of managing a portfolio composed of such ETF assets. At the same time also short term speculators or traders can also trade them.

The stock market has responded positively to the trend of globalisation, economic expansion, new technologies and stimulative policies of central banks like Fed or ECB. More and more investors and mutual funds joined the market and made sure that ETFs were an interesting investment alternative. Those capital inflows accelerated ETFs popularity. The great performance of the stock market has convinced investors that ETFs are what allow them to get instant exposure to stock market indices - without the need for specialised knowledge and the ins and outs of company valuation.

First and foremost, the advantage of ETFs is their easier accessibility to markets such as bonds and stock indexes. If it weren't for ETFs on the S&P 500, an investor would have to select the companies himself and determine their weighting in his portfolio to reflect the behaviour of the index. Moreover, he would sometimes have to actively manage it and make changes - with ETFs, there is no need to do so. A powerful advantage of ETFs is also the low fees for holding them.

Investing In ETFs - A Short Guide

Climate change investments: Maximising impact

How to Invest in Gold - How to buy digital gold with XTB

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.