- US indices extend yesterday's euphoric gains

- Joe Biden to meet with Xi Jinping at G20 summit

- Michigan consumer sentiment index far below expectations

The three major U.S. indexes started today's session sharply higher, but in no time after the opening, supply managed to swamp demand. Nevertheless, the Dow Jones is already gaining 0.11%, while the S&P500 and NASDAQ are up slightly by 0.2 and 0.3%, respectively. Yesterday's CPI reading showed that price pressures have begun to ease and comments by Fed members gave markets hope for a pivot. The reading of the latest data presented by the University of Michigan shows that consumer sentiment and propensity to spend is clearly weakening. At the same time, however, inflation expectations remain at still high levels, which may give the Fed a warning against a too rapid pivot:

Current consumer sentiment: Reading: 54.9 Expectations: 59.5 Previously 59.9

Expected consumer sentiment: Reading: 52.7 Expectations: 55.5 Previously: 56.2

Short-term inflation expectations (annual): Reading: 5.1% Expectations: 5.1% Previously: 5,0%

Long-term inflation expectations (5 years): Reading: 3.0% Expectations: 2.9% Previously: 2,9%

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app- Annual inflation expectations turned out as expected and 0.1% higher than previously, while long-term inflation expectations increased. Significantly, neither short- nor long-term inflation expectations declined (!) The data has mixed overtones and signals still lively concerns around price pressures in the US economy. Bank of America analysts indicated that the scenario for 2023 may be optimistic for the stock market given the likely peak in aggressive Fed policy, the peak in inflation, and the peak in US dollar strength and bond yields in 2022.

- Improved sentiment toward risky assets was indirectly influenced by comments from Kremlin spokesman Dmitry Peskov, who indicated that 'the goals of the special operation in Ukraine can be achieved not only through military means but also through negotiations.' This is the umpteenth time in a row that the Kremlin has declared its readiness to negotiate, but the victorious frontline Ukraine still refuses to sit down at the table. The Ukrainian army command has announced that it has pushed Russian forces out of occupied Kherson.

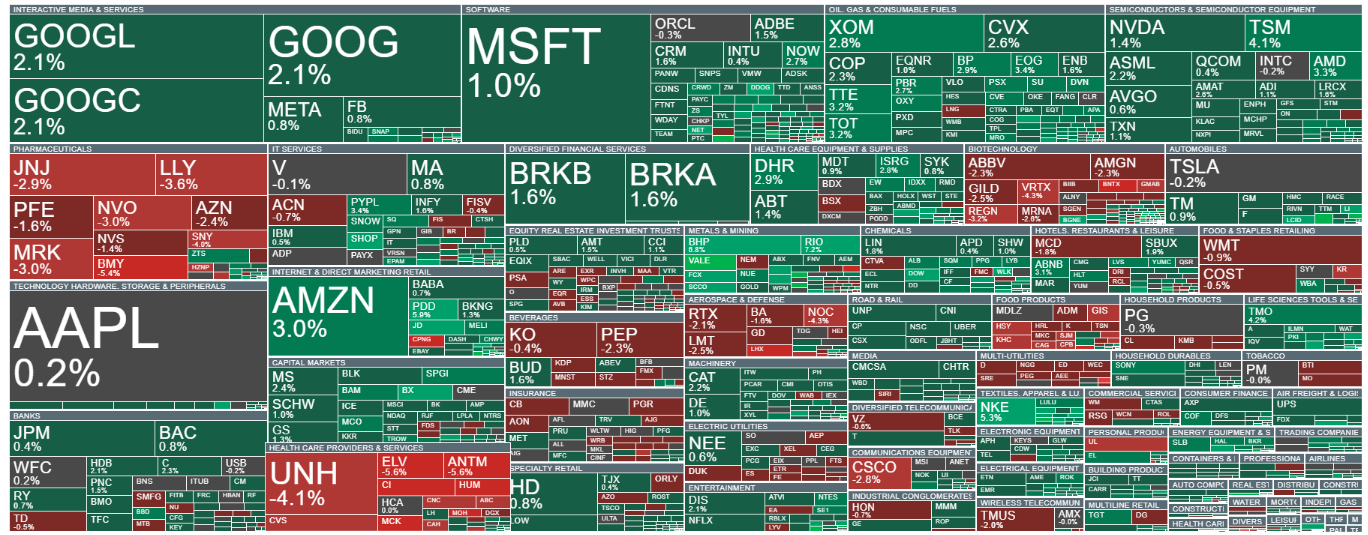

Also helping to improve sentiment overseas were comments from China's Foreign Minister Lijan Zhao who confirmed Biden's meeting with Xi Jinping at the G20 summit. Zhao also stressed that China still hopes to cooperate with the Americans and chart a new path in mutual diplomatic relations. In addition, Russia and the U.S. are expected to hold talks in Cairo on a nuclear arms treaty, which has removed some of the risk around the nuclear crisis. U.S. defense companies benefiting from 'war sentiment' lost ground on today's comments in global diplomacy. US stock market by sector. Dominating the increases today is the technology sector where Amazon and Microsoft stocks are leading the way. Oil companies Chevron and ExxonMobil are also doing well. A clear slowdown is credited to the Aerospace & Defense sector, with defense companies coming under pressure amid Kremlin comments and positive signals from China. Source: xStation5

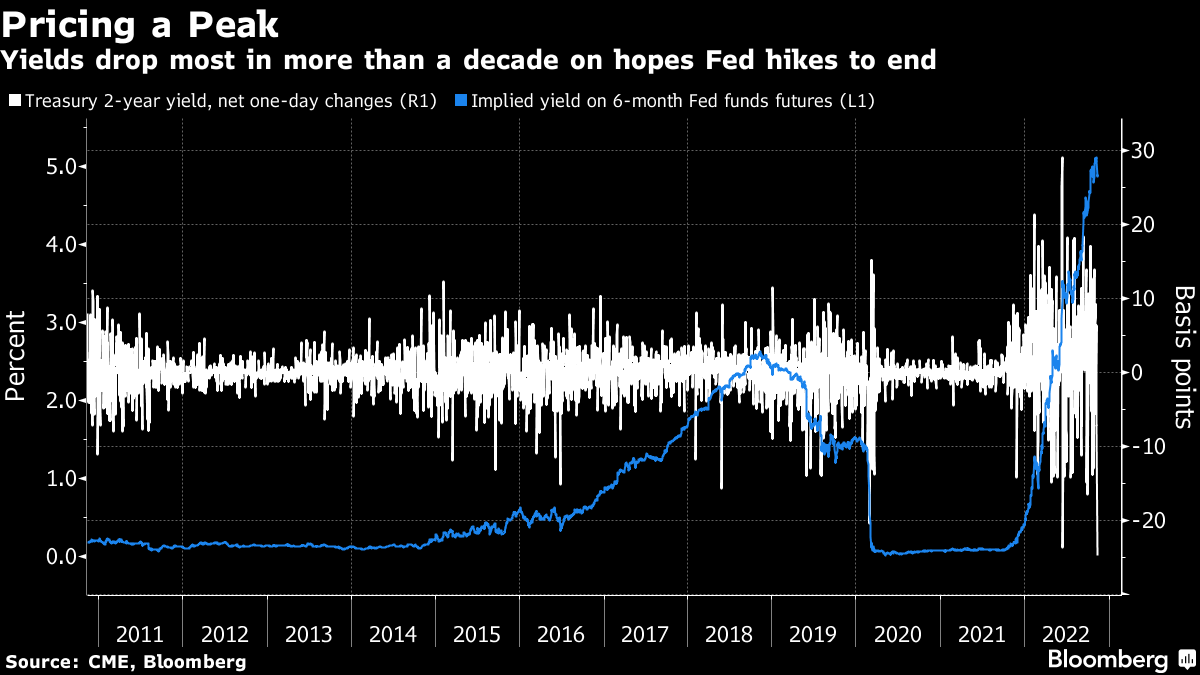

US stock market by sector. Dominating the increases today is the technology sector where Amazon and Microsoft stocks are leading the way. Oil companies Chevron and ExxonMobil are also doing well. A clear slowdown is credited to the Aerospace & Defense sector, with defense companies coming under pressure amid Kremlin comments and positive signals from China. Source: xStation5 The week on Wall Street ends with a rally in bonds, whose prices were driven by lower inflation in the US. The headline annual CPI came in below the weakest estimates of analysts surveyed, something that hasn't happened since late 2020. After the reading, Philadelphia Fed chief Patrick Harker said he expected the pace of hikes to slow. Yields fell the most in more than 10 years. In addition, the International Monetary Fund shared optimism about a potential turnaround in global monetary policy. Director Kristalina Georgieva said inflation could be close to a peak. Source: Bloomberg

The week on Wall Street ends with a rally in bonds, whose prices were driven by lower inflation in the US. The headline annual CPI came in below the weakest estimates of analysts surveyed, something that hasn't happened since late 2020. After the reading, Philadelphia Fed chief Patrick Harker said he expected the pace of hikes to slow. Yields fell the most in more than 10 years. In addition, the International Monetary Fund shared optimism about a potential turnaround in global monetary policy. Director Kristalina Georgieva said inflation could be close to a peak. Source: Bloomberg

The US100 is again higher today. Bullish price action could be extended to local resistance at 11750 points, where the recent maxima are located. On the other hand, if sellers manage to regain control at the end of the trading week we can expect a drop to 11,500 points and mixed sentiment at Monday's opening. Source: xStation5

The US100 is again higher today. Bullish price action could be extended to local resistance at 11750 points, where the recent maxima are located. On the other hand, if sellers manage to regain control at the end of the trading week we can expect a drop to 11,500 points and mixed sentiment at Monday's opening. Source: xStation5