- European stocks recorded third day of losses

- Mixed moods on Wall Street

- US jobless claims lowest since 1968

European indices finished today's session lower and benchmark DAX 30 declined for the third session in a row as investors digested latest hawkish minutes from the FOMC and ECB. ECB policymakers argued that the current high level of inflation and its persistence called for immediate steps toward monetary policy normalization. At the same time, concerns over the situation in Ukraine and the impact of harsher sanctions against Russia continued to dominate market sentiment.

Major US indices launched today's session lower amid concerns that aggressive Fed tightening could hurt growth. Due to rising inflation several FED members considered a 50-basis-point hike while agreeing on balance sheet reductions. Also today's data from the labour market reinforced the narrative of an aggressive tightening. Weekly jobless claims fell to 166k, a level not seen since 1968. In the latest developments, the Senate passed a bill to ban oil and gas imports from Russia. On the corporate front, HP Inc stock jumped over 15% after Warren Buffett’s Berkshire Hathaway disclosed a stake in the tech hardware maker. Nevertheless moods improved in the evening as Dow Jones and S&P 500 managed to erase most of the early losses.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appDuring today's session, we can observe crude oil weakness in which the price broke below the psychological barrier of $ 100 per barrel (both WTI and BRENT). Black gold prices are falling for the third day in a row as allies have released nearly 60 million barrels of oil from strategic reserves. It is worth remembering that President Biden announced the release of 180 million barrels from US reserves, but the IEA predicts that Russian oil production will fall by a quarter this month. Gold gained over 0.5% today, however when we look at the bigger picture, the hawkish policy of the largest central banks may weigh on prices in the future.

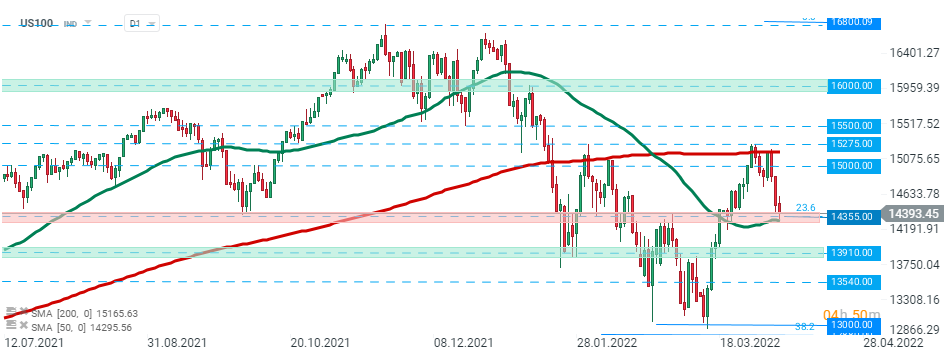

US100 extends losses for a third consecutive session. Index is currently testing major support around 14355 pts which is marked with 23.6% Fibonacci retracement of the upward wave launched in March 2020 and previous price reactions. Source: xStation5

US100 extends losses for a third consecutive session. Index is currently testing major support around 14355 pts which is marked with 23.6% Fibonacci retracement of the upward wave launched in March 2020 and previous price reactions. Source: xStation5