Oil:

- OPEC maintains expectations of clear demand growth next year, albeit with declining Chinese participation

- There has been speculation about a return to a nuclear agreement with Iran, which could restore about 1-2 million barrels per day of supply. Kpler points to an increase in production of about 1.7 million barrels per day in the 7-9 month time frame after the agreement is reached. In addition, he expects a 5-10% move in oil if sanctions removal talks are advanced

- Some global benchmarks (oil in Nigeria and oil in Malaysia) have already surpassed the $100 per barrel level, which may indicate that major benchmarks will also approach this level very soon

- SEB in its analysis indicates that with current fundamentals, the $100/barrel level only needs further emerging news regarding production cuts

- UBS indicates that oil will move in the $90-100 per barrel range by the end of the year with a level of $95 by year-end

- Standard Chartered indicates a level of $93 per barrel of Brent by the end of the year, but does not rule out exceeding $100

- Citi has a slightly different approach and indicates that geopolitical issues will lead to a breach of the $100 per barrel level, but even the $90 level is unsustainable in the long run, given the expectation of supply growth in the coming years.

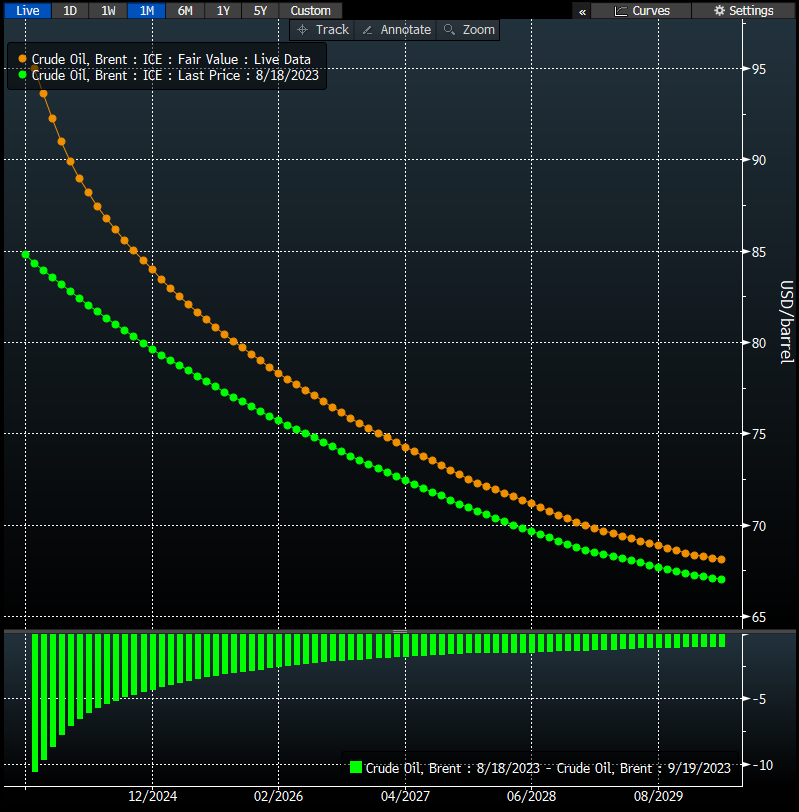

- The forward yield curve is getting steeper, looking at the shape of the curve a month ago. This shows that short-term demand is clearly increasing or we are facing a significant reduction in available supply

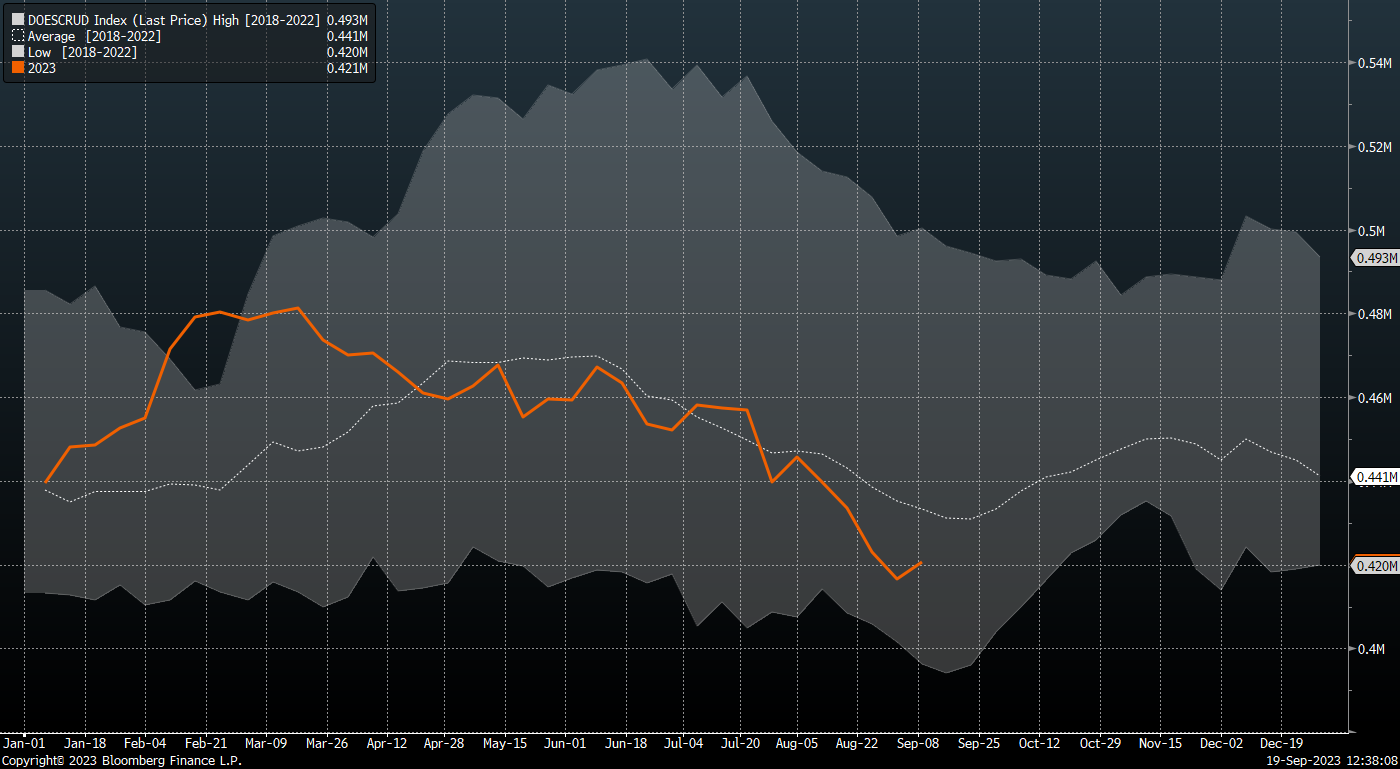

- US inventories rose according to the previous week's data, but looking at the expected deficit, they are likely to fall to the lowest levels since 2015, significantly below 400 million barrels.

The futures curve shows a clear advantage of demand over supply in the coming months. The biggest jump in contract prices is expected by the end of 2024. Source: Bloomberg Finance LP, XTB

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appInventories have risen slightly, but the trend indicates that stocks will likely break out of their 5-year range in early October, indicating a significant shortage in the market. Source: Bloomberg Finance LP, XTB

OIL Brent is testing the vicinity of the upper limit of the upward trend channel. In the event of a supply signal at the resistance associated with the upper limit of the channel, key support is located at $90 per barrel, which is confirmed by the 100-week average. Source: xStation5

Gold:

- Gold has broken permanently above $1925 per ounce for the first time since September 5 and remains above the 100-session average.

- The previous such breakout in August was not long-lasting, but earlier in July led to a nearly $60 rally that ended at $1985 per ounce

- Seasonality suggests a local bottom should take place this week

- Gold is trying to test the upper limit of the triangle formation. It is a formation in a downtrend

- An upside breakout would give scope for a rise to levels above $2,000 per ounce

- The key factor for gold will be the behavior of the dollar and yields after the Fed decision on Wednesday at 7 p.m. BST

- The dollar index is starting to fall (inverted axis) from similar levels as in March, when there was a clear rally in gold

![]()

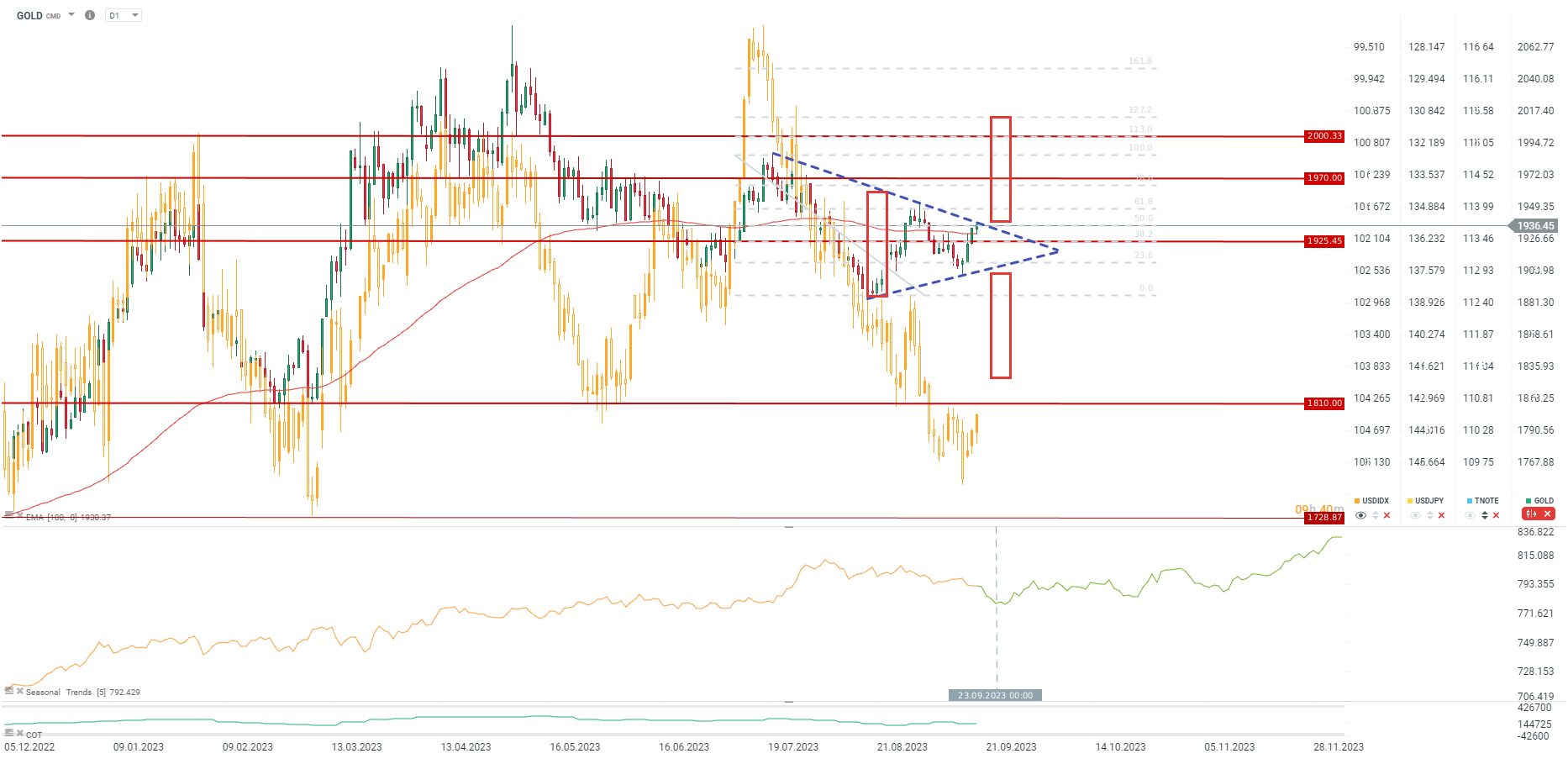

An interesting technical situation presents itself on GOLD related to, among other things, seasonality just before an important macro event in the form of the Fed decision. Source: xStation5

Gas:

- Natgas remains in consolidation between $2.5 and $2.83/MMBTU

- However, it is worth keeping in mind the upcoming rollover, which will most likely drive prices above $3/MMBTU.

- The oversupply in the market continues, which can also be seen from the clear drop in the forward curve in the short term

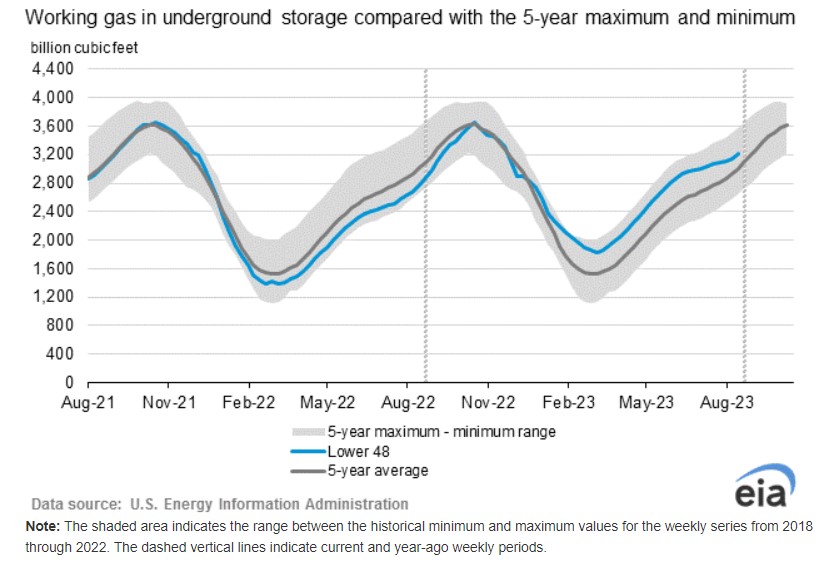

- On the other hand, inventory levels are approaching the 5-year average, which shows a decreasing oversupply

- If the increase in inventories in the following weeks is smaller, prices could stay above $3 after rolling over

- Seasonality, however, indicates that larger increases may not occur until early October

Gas inventories are approaching their 5-year average, which could be an important factor for prices. Source: EIA

Price remains in consolidation. Rollover at 21 September, however, will result in a "technical" breakout from this range and, most likely, the $3 level will be an important support. Source: xStation5

Wheat:

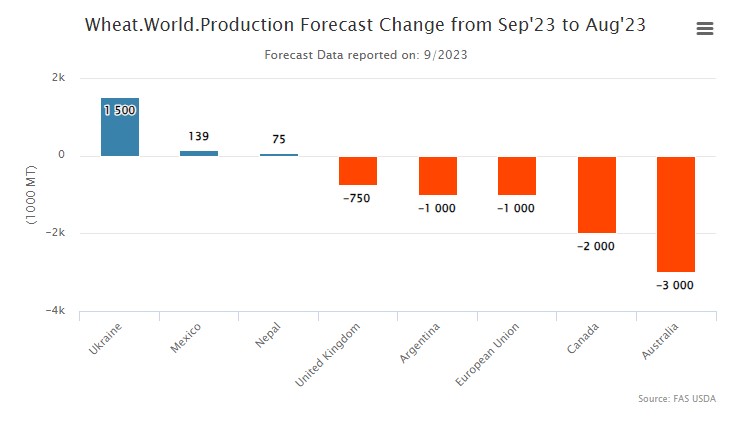

- The latest WASDE report brought no change for the United States, but showed a sharp decline in production globally and a drop for estimated ending stocks.

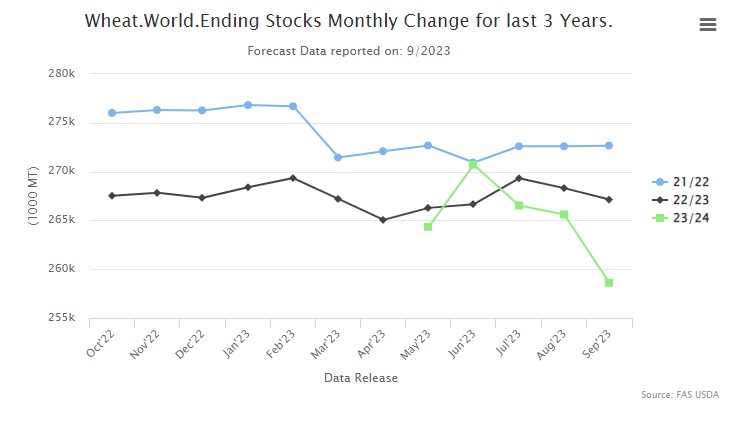

- The forecast for global production in the 23/24 season was lowered to 787.3 million tons from 793.4 million tons. Ending demand was essentially unchanged, which will result in a decline in ending stocks to 258.6 million tons (the previous forecast was 265.6 million tons, and beginning stocks were 267.1 million tons)

- The reason for the lowered forecast for global production is the droughts in Canada, Argentina and Australia. Production expectations in Russia remain high. At the same time, a slow return of higher production from Ukraine is expected all the time

- The EC has decided not to extend restrictions on imports of Ukrainian cereals, including wheat, leading to the imposition of unilateral bans by Central European countries: Poland, Slovakia and Hungary. In view of this, there were fears that even more Ukrainian wheat would not be able to reach global markets without the return of the agreement on exports by sea

- Russia got rid of a large part of its stocks through increased exports, so after the harvest season it will be possible to return to the agreement on the export of Ukrainian agricultural goods by sea

- It is worth remembering that for the past year, about 60% of agricultural exports have been routed through neighboring countries, while 40% have been routed by sea. Before the war between Ukraine and Russia, almost 100% of exports were conducted by sea.

- Data on increasing exports from Russia, expectations of increased production in Ukraine and the possible return of the agreement on exports by sea are causing wheat prices to fall sharply. Already, prices have fallen nearly 4% from their recent local peak, following a nearly 7% rebound associated with the release of the WASDE report

- The return of the consensus could drive prices down to the 550-565 range, the lowest levels since mid-2020.

Clear changes in production forecasts compared to the previous WASDE report. A large increase in potential production in Ukraine can be seen, but production in Canada, Australia, Argentina and the EU is down due to droughts. Source: USDA

Ending stocks were assessed significantly lower than in previous seasons, which may also indicate that a local bottom on wheat may be approaching. Source: USDA

Most of the negative news is already priced into WHEAT, and positive news for prices is starting to emerge. Nonetheless, the return of the Ukraine export agreement by sea could drive prices down to the 550-565 range, an important zone that served as resistance in 2015-2019. Source: xStation5