What is risk and how can you limit it?

How to invest on the stock exchange in a safer manner and minimise the risk of loss? A lot of traders, who would like for their capital to increase on the one hand, but on the other, they would not want to see substantial losses in their brokerage accounts, may ask themselves this question. The following saying applies to the financial markets – nothing ventured, nothing gained. In theory, the larger the potential expected profit, the symmetrically larger the risk. If a trader expects rates of return of a few hundred percent, as is the case with, for example, the cryptocurrencies market, he or she must be aware of the fact that this market can fall by a few dozen percent in a short time. Whereas, if the trader expects a rate of return of a few or a dozen or so percent, he or she must acknowledge that theoretically the risk of such an investment may result in a decline of 10–15 per cent.

The risk itself is not bad; it is not an obstacle, but a thing a trader needs to accept if he or she participates in trading on the financial markets. However, the crucial thing for a trader in terms of making safe investments is his or her propensity to take risks. You need to understand what type of a risk you are willing to take when investing your money, and how to increase the safety of your investments. Since every individual is different, they will also have different approaches to accepting gains and losses. One trader will not have any emotional or psychological problems with a loss of 30–50 per cent in his or her account balance. However, another trader may be terrified seeing his or her account balance reduced by 5–10 per cent.

Thus, it is important that you determine your tolerance to different types of risk. Each investment entails risk to a certain extent. Understanding the type of risk or a combination of types of risk is crucial to limiting it and consequently, to safe investing on the stock exchange. The most important thing in order to feel comfortable when making investment decisions is above all the knowledge that it is worth investing only so much money that one can afford to lose. This means that only the money that is not needed to pay the current liabilities, such as bills, payments, settlements with counterparties, etc. should enter the market.

You also have to be aware of the existence of many asset classes from which you can choose. You can invest in stocks, commodities, currencies and ETFs. The asset classes are also divided into safer ones, i.e. less volatile, and those that are more risky, i.e. more volatile. For example, the shares of Coca Cola seem to create much steadier trends than the shares of Tesla. The situation in the currency market is similar. The USD/CHF or EUR/GBP exchange rates may be less volatile than the GBP/JPY or EUR/JPY exchange rates. The volatility of a given market can tell you right away which of them can be less risky and vice versa.

How to invest money in a safer manner?

Under several headings, we will try to present the ways to reduce the risk of investing money, i.e. the ways to improve the safety of invested funds.

ETFs

If you are not an expert when it comes to selecting companies and shares for your investment portfolio, you can use the ready-made solutions in the form of passive ETFs. They are intended to, for example, mimic the entire index like S&P 500 or, for example, the best dividend-paying companies. The full list of ETF CFDs offered by XTB is available here.

These are the instruments with low transaction costs. They provide exposures to many company shares simultaneously and there are a lot of them to choose from – over 200.

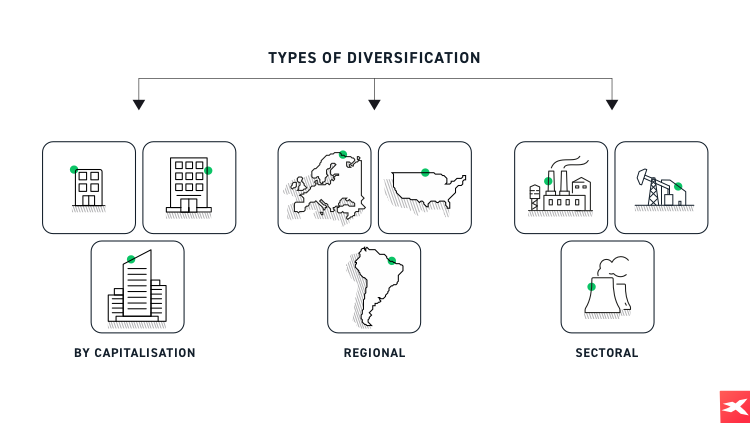

Diversification by capitalisation

Diversification is nothing more than making sure that you “don’t put all your eggs in one basket” because if this basket falls down, all the eggs will crack. Diversification according to market capitalisation is one of its several forms. Market capitalisation refers to the total value of all publicly traded shares of a given company. This is the method for determining the size of the company.

In general, large caps are large corporations and small caps are considerably smaller both in terms of profits and the headcount. Large-cap companies also have more stable share prices, which are distinguished by both slower growth and lower risk of price collapse.

Smaller companies have more space for development and can quickly increase their value. But they can also go bankrupt just as quickly. For example, S&P 500 is an index representing 500 of the largest companies in the United States, while Russell 2000 represents 2000 American smaller-cap companies. In this case, you are also able to choose appropriate companies using a share filtering tool that is embedded in XTB’s xStation platform.

Regional diversification

The possibility to diversify investments by instruments from different regions of the world / countries is another form of diversification. For example, instead of holding only American companies, you can compose your portfolio from companies based in the United States, Great Britain and Germany. You can also apply diversification by stock indices. Apart from the indices from the USA or Europe, XTB provides access to CFDs on stock indices from Asia or South America.

Similarly as in the case of different shares and sizes of companies, the risk and potential gain can be balanced by distributing money to financial instruments from many regions of the world. In general, the less developed economies and regions in which you invest, the larger the growth potential and the risk of loss. Thus, it is possible to compose a portfolio based e.g. in 50% on developed markets and in 50% on developing markets.

Sectoral diversification

Just as some regions offer faster potential growth or decline, certain sectors have a tendency for larger risk and potential return than others. For example, the technological sector frequently records spectacular increases. It also happened to suffer disastrous collapses. A good example in this case is the bursting of a dot-com economic bubble and a 78% drop in the technological index Nasdaq in the years 2000–2002. Other sectors may be a lot more stable. In this case, it is worth considering the shares of public utility or consumer goods companies.

Diversification by capitalisation or by regions of the world may not be of much use if we have companies from only one sector. Thus, it is worth giving this issue some thought.

Secure yourself in case of a crisis

Some traders may choose to add ETFs or CFDs on bonds or gold for example, to their investment portfolio. These instruments usually go up in price when a crisis hits the economy. Therefore, apart from the described methods of diversification, it is also worth considering cross-market diversification. You can also smoothly change the size of exposure on individual markets. In emergency situations, one can reduce exposure on shares and increase exposure on bonds or gold, and in the case of an economic boom, one can combine the components of the portfolio the other way round. In addition, it is always worth having ready money in order to be able to buy a certain instrument at a bargain price in the event of local crashes.

One of the basic investment portfolios includes, for example, 25% of exposures on the stock market, e.g. through ETFs on S&P 500, 25% of exposures on the bond market, 25% of exposures on the gold market and maintaining 25% of cash. This is a theoretical example, but in practice, it can contribute to the fact that investing on the stock exchange may reduce risk.

In summary, is safe investing on the stock exchange possible? Nothing ventured, nothing gained – but this risk can be controlled, estimated and adjusted to the changing market conditions to a certain extent. In this way, we can make investments more balanced, diversified and consequently, independent from only one factor, which contributes to the fact that risk can be distributed more evenly. XTB offers a vast selection of financial instruments that can be adjusted to virtually any risk profile determined by the trader.