Introduction

Every investor must have heard about portfolio diversification at a certain stage of their investing career. It is perceived as an absolutely essential part of institutional investors’ strategies. However, the importance of diversification among retail investors often tends to be overlooked. Many probably wonder - what does diversification mean and how to diversify your portfolio? We will try to answer these questions in this article.

The importance of diversification

The idea behind portfolio diversification is really intuitive. It is all about opening multiple positions in order to reduce the total risk of the portfolio. “Do not put all eggs in one basket,” the old saying says. The same can (and should) be applied to investing. As all investments involve risk, the proper diversification is crucial as it is expected to reduce the overall risk of a trading portfolio.

Key rules of diversification

There are several simple ways to put some diversification strategies into use.

- Number of securities - the idea of diversification is based on increasing the number of securities in a trading portfolio. However, investors applying the approach “the more stocks I own, the better” miss an important point.

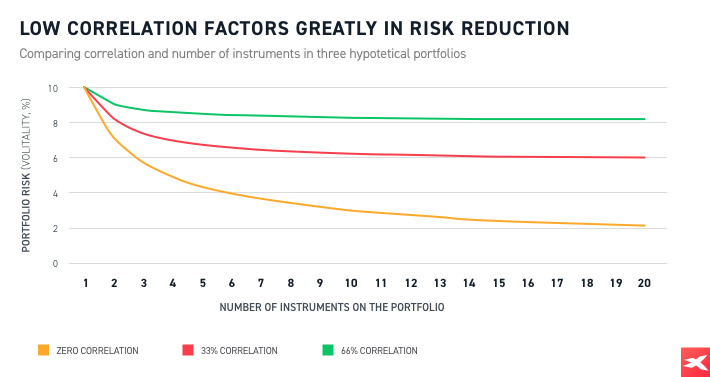

- Correlation – a portfolio may be considered diversified when it is assembled of negatively correlated assets (or at least assets that have low correlation). Therefore, the risk can be mitigated as prices of certain assets move in different directions.

- Industry diversification – a diversified portfolio should have exposure to many industries. It means that a stock portfolio ought to be a mix of companies from different industries in the economy.

- Geographical diversification – Diversifying an investment portfolio across different geographic areas is expected to reduce the total risk too.

- Multi-Asset – finally, investors who want to build a balanced portfolio should get familiar with different types of assets. Such strategy may include stocks, bonds, commodities, precious metals, cash, and real estate. A carefully selected multi-asset portfolio should diversify risk, thus protecting the wealth against volatility and market swings.

Please be aware that the presented data refers to past performance data and such is not a reliable indicator of future performance.

Please be aware that the presented data refers to past performance data and such is not a reliable indicator of future performance.

Low correlation contributes greatly to risk reduction when compared to portfolios with higher correlated holdings. Therefore, diversified investments with low or negative correlation should be of great importance for risk-averse investors. Source: Columbia Management Investment Advisers (via yieldstreet.com)

How to diversify your portfolio with CFDs

Two types of instruments may be found particularly helpful for stock investors who want to assemble a diversified portfolio – CFDs and ETFs.

CFDs are financial derivatives, that allow traders to take advantage of prices moving up (long positions) or prices moving down (short positions) on underlying financial instruments. For this reason, it is possible to hedge positions if an investor suspects that some rapid market swings might occur. By opening the opposite position (e.g. initially a trader owns 1000 shares of XYZ company and then he or she shorts 1000 shares of XYZ company in a CFD transaction), the position is being neutralised.

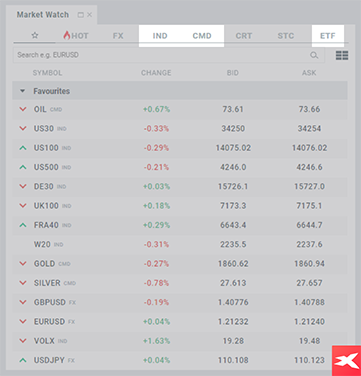

The XTB’s trading platform provides access to a broad array of financial instruments, including contracts for difference (CFDs), such as GOLD, SILVER, OIL or stock indices - DE30, US500, US30 among others. CFDs may help you diversify your trading portfolio.

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance. Source: xStation5

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance. Source: xStation5

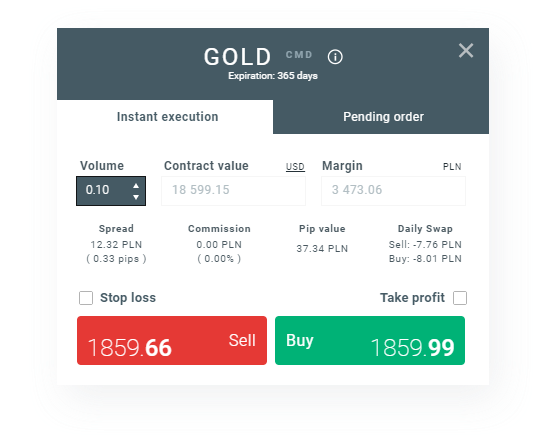

Let’s have a look at one the most popular market, namely the gold market. CFDs are leveraged instruments which means that investors are able to gain market exposure using a relatively small deposit. However, CFDs are also associated with higher risk as leveraged trading could potentially amplify either gains or losses.

1 lot of the GOLD contract is equal to 100 ounces. However, it is worth to point out that CFDs enable micro lot trading so that traders can easily customize the size of their position. For instance, if a trader wants to go long on gold, he or she can choose the volume that they can afford (e.g. 0,10 lot). Moreover, traders do not need own large amounts of money as the leverage amounts to 1:20 in this case.

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance. Source: xStation5

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance. Source: xStation5

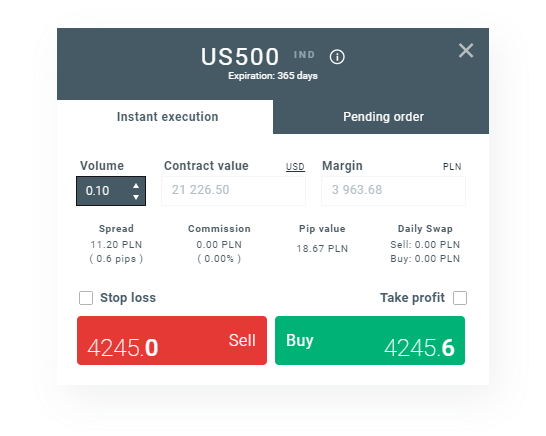

Trading other CFDs is done in a similar way. As far as indices are concerned, CFDs reflect largest equity benchmarks from major stock exchanges. For instance, US500 tracks the performance of 500 largest American stocks quoted on organised market - this relates to the S&P 500 index. Here the leverage amounts to 1:20 as well and the minimum position size that traders can open is 0.01 lot.

Please be aware that the presented data refers to past performance data and such is not a reliable indicator of future performance. Source: xStation5

Please be aware that the presented data refers to past performance data and such is not a reliable indicator of future performance. Source: xStation5

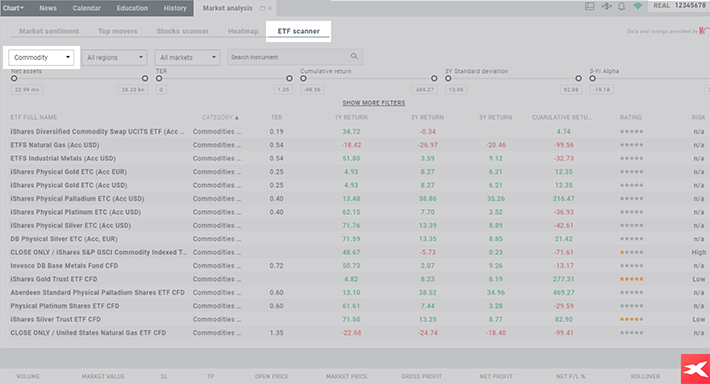

On the other hand, exchange traded funds (ETFs) could be an interesting solution for investors who want to achieve an exposure to different markets. Instead of buying multiple stocks, one can diversify risk by buying an ETF focused on a specific sector in the financial markets (e.g. energy, financials, precious metals etc). There are ETFs tracking major stock indices, bonds, precious metals markets and other commodities – the variety of these instruments is very broad. That is why both ETFs and CFDs have become a popular solution among many traders. One has to admit that risk diversification has become easily accessible for retail traders these days.

Portfolio diversification with commodities

Diversifying properties that investors seek to balance their exposure to stocks and bonds can be obtained by investing in commodities. As markets have become heavily interconnected in recent years, commodities may turn out to be a missing piece of the portfolio puzzle.

Traders can pursue diversification in investing by trading commodities through XTB trading platform. There are several ways to do that:

- Trade commodities with CFDs – agricultural commodities (e.g. CORN, SOYBEAN), energy commodities (e.g. OIL, NATGAS), industrial metals (e.g. COPPER, ALUMINIUM), precious metals (e.g. GOLD, SILVER) and many others. Here we would highly recommend our article titled “Gold Trading - How to start online gold trading” <link>.

- Trade commodities with ETFs – various ETFs enable investors to gain exposure to some commodities e.g. gold, silver, industrial metals or natural gas. Exchange traded funds may be a great way to diversify risk amid rising inflations expectations in 2021.

Academic research and professional investors have found evidence that cross-asset class correlations spiked in recent years. Meanwhile, commodities are set apart by distinct risk factors, compared to stocks and bonds, therefore they should be taken into consideration while assembling a diversified trading portfolio. In fact, commodities provide a natural hedge against losses in equity and debt holding amid higher inflation periods. Inflation expectations have been soaring nowadays which may be associated with surging commodities prices, reopening of major economies and pent-up demand, but also enormous fiscal and monetary stimulus.

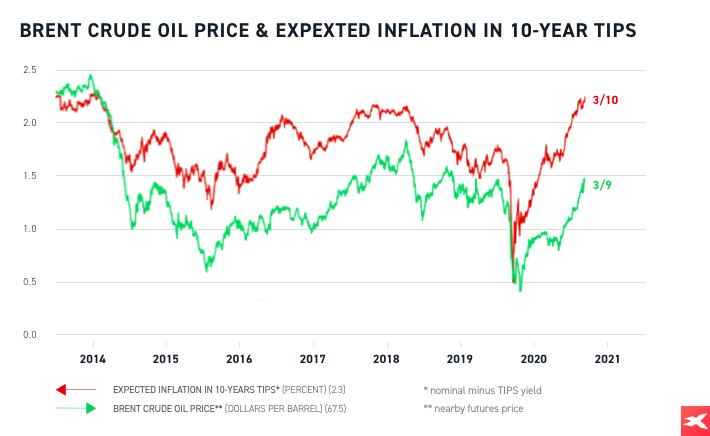

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance.

Oil price changes have been positively and significantly correlated with inflation expectations. Source: Yardeni Research (yardeni.com)

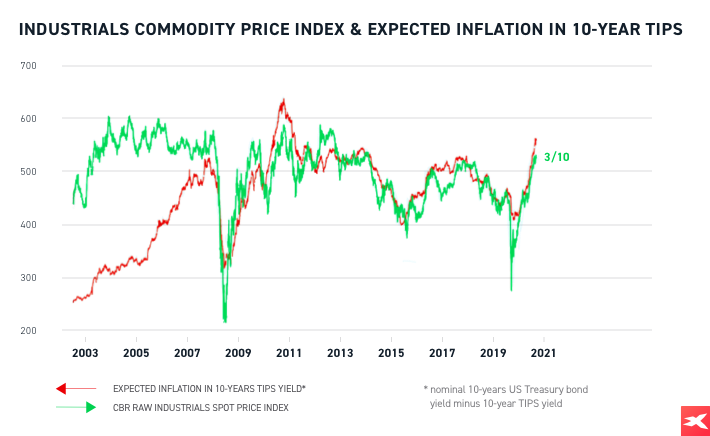

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance.

Prices of industrial commodities weigh on inflation expectations as well. Source: Yardeni Research (yardeni.com)

Apart from that, investors might also seek indirect exposure to the prices of commodities. Investing in stocks, which prices are heavily dependent on certain commodities, is another way of creating a diversified portfolio. As an example, copper mining companies rely on copper which means that their shares are positively and significantly correlated with copper prices. The same scheme can be applied to other commodities (e.g. gold miners or oil producers). It is worth to point out that such solution may have an important advantage over direct investment in commodities as some companies may also pay dividends. We have discussed key aspects of dividend investing in our article titled “Investing in dividend stocks” <link>.

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance.

Our ETF scanner may be found helpful when looking for ETFs based on commodities. Source: xStation 5