Introduction

Stock market indices serve a number of purposes on global financial markets. Generally they help investors assess the condition of the markets and compare the return on specific investments. Brokerage firms and stock exchanges have also been offering financial instruments that reflect price movements of certain equity benchmarks. This makes indices crucial not only due to their informational role, but also thanks to their investment purposes. In this article we’ll try to explain what stock indices are and how to take advantage of them while investing in the stock market.

What is a stock market index?

First and foremost – what is an index? A stock market index, or just a stock index, is basically a tool which measures a section of the stock market. In other words, it is a method to track the performance of a group of assets in a standardised way as the index may replicate a particular stock market, sector, geographic segment, or any other area of the market. Those benchmarks are being developed in a transparent way and methods of their construction are specified. Obviously there are also indices that refer to the bond market, commodities or interest rates, yet in this article we are going to focus solely on stock indices.

The construction might vary significantly as indices may be based on different methods (e.g. market-capitalisation weighting, free-float adjusted market-capitalisation weighting or equal weighting). Nevertheless, the core idea remains the same – a stock market index is a collection of stocks that replicates the price movements of those bundled securities.

The importance of indices

Stock indices are of great importance for global financial markets. First of all, they help investors assess the results of the stock market – daily, weekly, monthly etc. This way market participants are actually able to determine the market sentiment and compare different stock markets. Indices also serve as equity benchmarks as actively managed funds use them to compare funds’ performance. Stock indices are often associated with terms “index trading” or “index investing”. Both concepts have gained in importance in recent years. The rise of index funds and ETFs gained many enthusiasts as it is a low-cost solution that provides diversification benefits. We explained the idea of diversification in our article titled “Portfolio Diversification – how to diversify trading portfolio?” <link>. On the other hand, the index trading, may refer to CFDs – an instrument that might be useful for both speculative and hedging purposes.

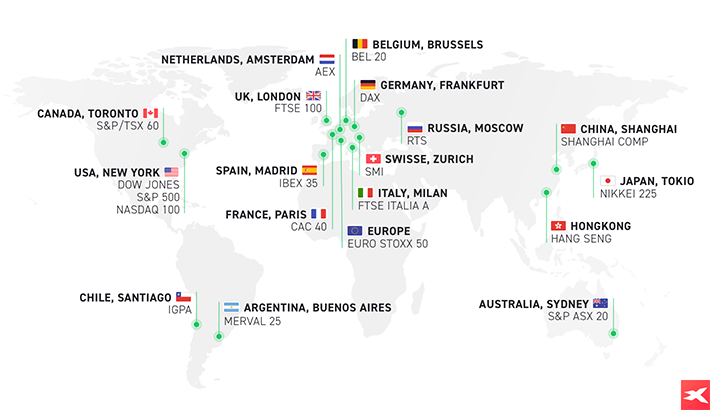

Major world indices

Having explained stock indices meaning and their importance for global markets, it is now time to list several major world indices. As you can imagine, investors mostly pay attention to indices from developed economies as those benchmarks reflect market sentiment on major stock exchanges, including: New York Stock Exchange (NYSE), Nasdaq, London Stock Exchange (LSE), Euronext or Shanghai Stock Exchange (SSE). XTB offers a wide range of CFDs on indices and such contracts are named in a simple manner that should ring a bell among investors. Below we present several most important indices:

- US30 – contract for index consisting of 30 large companies listed in the United States on the NYSE or the NASDAQ.

- US500 – contract for index consisting of 500 largest companies in the United States. It is often considered a barometer of the overall stock market’s performance. The index is a common benchmark as far as active portfolios’ performance is concerned.

- US100 – contract for index consisting of 100 largest non-financial companies listed on the NASDAQ stock market.

- UK100 – contract for index consisting of 100 companies listed on the London Stock exchange with the highest market capitalisation.

- EU50 – contract for index consisting of 50 largest and most liquid Eurozone stocks. It is dominated by companies from France and Germany.

- JAP225 – contract for index consisting of 225 large companies listed in Japan.

- HKComp – contract for index tracking the performance of stocks listed on the Hong Kong Stock Exchange.

- AUS200 - contract for index consisting of 200 largest companies listed in Australia.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.. Source: (do uzupełnienia)

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.. Source: (do uzupełnienia)

Index trading with CFDs

First, it should be noted that in theory an index cannot be either bought or sold directly as stock indices are just indicators (benchmarks) that move according to the stocks held within. However, many financial instruments reflect price movements of major world indices e.g. futures, options, ETFs, CFDs or index funds. That is why terms like “index investing” or “index trading” are often used in everyday situations.

Contracts for difference (CFDs) are commonly used for speculative and hedging purposes. Those contracts have many advantages such as: high liquidity, low entry barriers and low transaction costs, diversification purposes, long market hours, the ability to go long or short with leverage. Obviously one has to remember that CFDs are associated with higher risk as leveraged trading could potentially amplify either gains or losses. It does not change the fact that short-selling implements more flexibility and enables many useful strategies. You’ll learn more about short trading from our article titled “Short Selling - What is short trading” <link>

Nowadays CFDs serve mostly speculative purposes. Traders might simply open long positions in order to take advantage of prices moving up, or open short positions and benefit from prices moving down. Using leverage could potentially amplify either gains or losses. Indices trading could be a part of different strategies – for instance a belief that small caps will outperform blue chip stocks (then traders ought to go long on a small cap index) or an assumption that a certain stock exchange will slump e.g. due to geopolitical reasons (then traders ought to short the index from the given country).

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance.

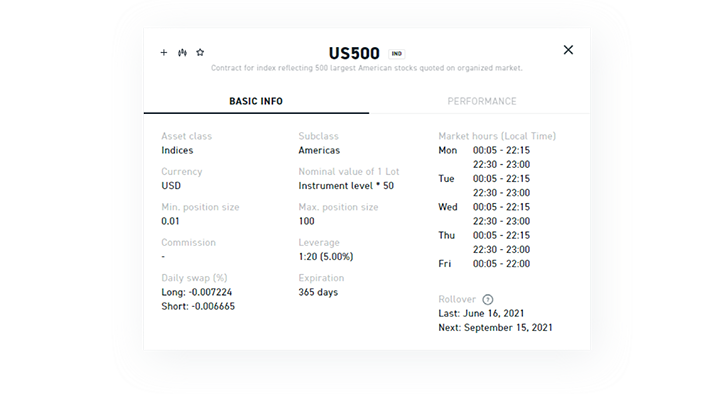

XTB’s xStation 5 platform gives you all essential information about CFDs for major world indices. Source: xStation 5

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance.

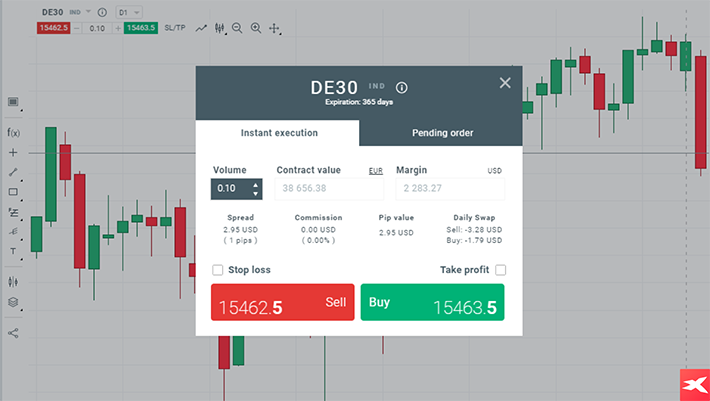

CFDs are leveraged instruments, which means that investors are able to gain market exposure using a relatively small deposit. In other words, traders do not need to own large amounts of money to start investing. In this case (DE30 on the chart above) the leverage is 1:20, meaning that the required margin amounts to 5% of the contract value. Nevertheless, one should keep in mind that CFDs are also associated with higher risk as leveraged trading could potentially amplify either gains or losses. Source: xStation 5

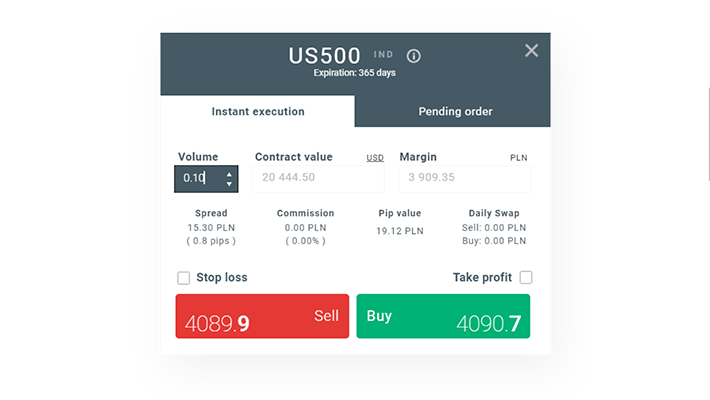

Apart from speculative purposes, CFDs serve various hedging strategies. Let’s imagine that an investor owns several US stocks that are components of the S&P 500 index. The portfolio is worth roughly 20,000 USD. An investor suspects that a market correction is looming (for instance there is a lot of uncertainty about a pandemic or some geopolitical conflict), yet he or she does not want to sell those stocks. In order to hedge the portfolio, investor might use a CFD contract reflecting S&P 500 price movements (the key assumption is that investor owns at least several different stocks that are positively correlated with the stock index).

Opening a short position is going to effectively neutralise his or her position. In this case an investor might want to use an index calculator to assess the size of a position needed to hedge the portfolio: 0.10 lot corresponds to around 20,000 USD. Now, in case stocks from the portfolio go down, investor will benefit from CFD short position. As a rule of thumb, the stock portfolio will be hedged.

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance. Source: xStation 5

Please be aware that the presented data refers to the past performance data and such is not reliable indicator of future performance. Source: xStation 5

Also, it is worth to mention that trading CFDs involves rollovers. It is crucial to understand that the majority of indices CFDs are based on prices of futures contracts. For each market there is usually a long list of futures contracts with different expiry dates ranging from one month to many years into the future and the highest volume is usually on the nearest contract. When the current active contract expires, futures traders need to open another futures contract. However, CFDs traders do not need to take any measures as the rollover takes place automatically. In a nutshell, a rollover is a technical operation that moves trader’s position to the next available contract - the process is cost-free and profit-neutral from the trader’s perspective. You’ll certainly learn more about rollovers from our article titled “Everything you need to know about rollovers!” <link: https://www.xtb.com/en/what-are-rollovers-kb>

Summary

Summing up, indices trading could be a very helpful tool that investors and traders should definitely be aware of. Despite the fact that trading indices could be risky due to leverage mechanism, it could also be a perfect solution to hedge a trading portfolio thus reducing the risk. Therefore, the knowledge about indices trading should be seen as an essential trait of every sound investor.