In this article you will learn:

- What is a financial crisis?

- Is investing during a recession ever a good idea? What about cash?

- Key aspects of investing during a recession

- Investing in stocks during a recession

- Buying commodities during a recession

The coronavirus pandemic sparked the biggest market sell-off since the global financial crisis in 2008. While the economy literally collapsed due to imposed lockdown measures, financial markets slumped as well. However, even with key economies still under strict lockdown, global markets made a surprisingly quick rebound. Brokerage firms have experienced a real bonanza, as the stock market was flooded with new investors. Those traders, as well as people who have never invested before, might wonder: what even is a financial crisis and what can I invest in during a recession?

In this article, we’ll try to clarify the above aspects of investing during a recession. We’ll also touch on recession proof stocks and the key rules needed for traders to protect their money from economic collapse.

What is a financial crisis?

Let’s begin with the basics, namely a brief definition of a financial crisis. Broadly speaking, a financial crisis is a situation where the value of assets drops rapidly, or when financial institutions experience liquidity problems. Both cases usually lead to a panic sell-off on the financial markets. While financial crises might be limited to a single region, country or asset class (e.g. the Portuguese real estate market), they are more likely to spread globally these days. Financial markets have become heavily interconnected amid financial liberalisation, which started several decades ago. Direct roots of such crises might vary - it could be a speculative bubble burst, a war leading to a market crash, or even a global pandemic. One thing is certain – investors ought to be prepared for such circumstances as any crisis will likely affect their portfolio, but at the same time learn how to create market opportunities.

Is investing during a recession ever a good idea? What about cash?

First of all, it’s worth stressing that one should never invest money that is needed for everyday essential expenses. As a rule of thumb, people should always have a financial cushion at their disposal – ideally in cash. We cannot really predict the future and as we realised in 2020, certain crises might be particularly intense for numerous industries.

However, every recession or crisis might involve a certain degree of investment opportunities as well. A rapid sell-off on the global financial markets will inevitably make different asset classes extremely cheap. Even though nobody can be 100% certain that a given asset will recover, some of them are very likely to rebound sooner or later. Therefore, investors should always be ready, because once a financial crisis occurs, things may happen very fast – a panic selling usually makes prices look like a waterfall.

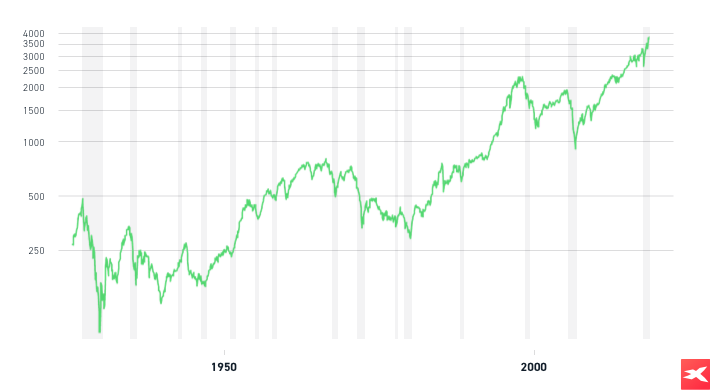

Please be aware that the presented data refers to past performance data and such is not a reliable indicator of future performance.

Please be aware that the presented data refers to past performance data and such is not a reliable indicator of future performance.

There is a belief that stock indices should move higher in the long-run as the global economy is on the rise as well. As one can notice on the chart above, some market crashes were severe indeed and stocks needed many years to recover losses. Therefore, the “buy when there’s blood in the streets” approach may seem more reasonable, as opposed to buying during a red-hot bull market. Source: macrotrends.net

Key aspects of investing during a recession

A financial crisis is usually associated with a recession, which marks a period of declining economic performance across the economy. Investing in such circumstances involves huge risk as market volatility is high and the future remains highly uncertain. There are several aspects of investing in recession, which should be taken into consideration.

Diversification

“Do not put all your eggs in one basket,” the old saying says. A diversified portfolio is going to reduce the specific risk, thus minimising the total risk. This does not only mean investing in numerous instruments, but also buying different asset classes. Depending on the investor's risk appetite, a part of the portfolio may consist of relatively low risk investments (solid dividend stocks, government bonds, precious metals and cash), while the rest of the money might be allocated in more risky assets (e.g. growth stocks or CFD contracts).

Timing

The right timing might be critical when things happen fast and the markets dive. When markets remain highly volatile, it might turn out that a trader’s portfolio slumps even further and they lose money. However, when volatility fades away, the probability of making better investment decisions rises. Of course, predicting the perfect entry points with absolute certainty is virtually impossible.

Investing over a longer period

Due to reasons mentioned above, investing all at once (also known as lump-sum investing) seems risky amid ongoing market turmoil. Therefore, investing over time, or the dollar-cost averaging strategy, might be a better decision for risk-averse investors, as spreading out an investment into smaller chunks should reduce the risk related to volatility.

Nerves of steel

Every investor has a different risk appetite. Investing during a recession is certainly going to be extremely upsetting for some traders – just imagine a portfolio losing 10% of its value in a single day. Some market participants are not able to cope with such an environment, even though markets could potentially rally somewhere in the near future. Therefore, one should be aware that crisis investing always requires nerves of steel.

Investing in stocks during a recession

Economic contractions make investors fearful about the future of many companies. The uncertainty contributes to panic sell-off, which actually can have some potential benefits for investors as it creates opportunities in the equity markets. Some stress out that investing during a recession is like trying to catch a falling knife, which is true as the risk of a double-dip recession or further sell-off is always there. However, with some precaution (four rules that we have listed above), some investors might achieve a rate of return, particularly if they apply a long-term approach.

Recession proof stocks

Many rational investors would rather focus on safe stocks to invest in during a recession. So, is it possible to identify stocks that do well in a recession? It would be reasonable to invest in high-quality companies with good fundamentals, especially strong balance sheets and low debt ratio. Apart from that, stocks for a recession should be marked by steady and predictable cash flows. These counter-cyclical companies are often to be found among industries that historically do well during tough times. Below we present some industries, which may be considered relatively recession-resistant:

- Healthcare – modern healthcare is essential all year long in developed economies. The demand for healthcare services should remain relatively stable even during a recession – some companies might even benefit from a crisis, for example the Covid-19 pandemic.

- Consumer staples – foods & beverages, household goods, hygiene products or tobacco are considered to be non-cyclical, which means that they are always in demand. A rapid market sell-off might be an opportunity to buy some well-established consumer staples stocks.

- Utilities – supplying communities with electricity, gas or water is absolutely crucial and may be reduced only to a certain extent (mainly in plants due to suppressed output). Therefore, some investors may consider utility companies as potential stocks to buy in a recession.

On a whole, smart investing during a recession could also be associated with dividend stocks, as such companies are usually considered well-established businesses and market leaders. Most importantly, they often have all the markings of recession proof stocks, as they are usually classified as value stocks.

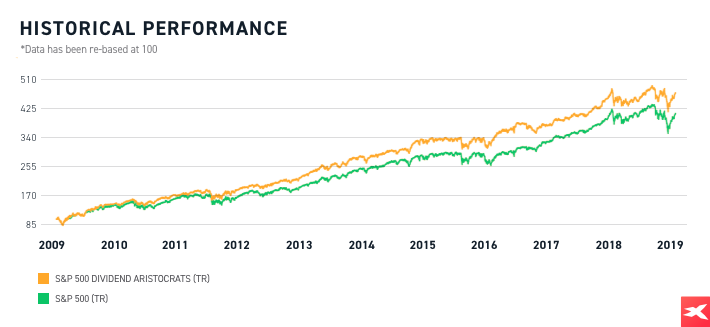

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

S&P 500 Dividend Aristocrats Total Return (including dividends) has outperformed the S&P 500 Total Return since 2009. Source: S&P Dow Jones Indices

The Covid-19 crisis – tech stocks outperformed

The coronavirus crisis was slightly different than the previous ones, as people around the world were literally forced to stay at home due to imposed lockdowns. It definitely changed our lives in many ways – working from home and the rising importance of e-commerce are among the biggest developments. Therefore, there are some sectors that clearly benefited from the pandemic:

- Information technology – software & services stocks, hardware companies, and semiconductors all gained due to imposed lockdowns, as millions of people were forced to stay indoors and work from home. There are many well-established players in these industries, who managed to gain even more advantage. Smart investing during a recession would require to get at least minor exposure to this vital sector.

- Communication services – telecom companies may be described as relatively stable businesses and seem like a good pick during a recession. On the other hand, some media and entertainment stocks rallied, as staying indoors made people play more video games or sign up for major streaming services (such as Netflix or Disney+). Investing in relatively stable sectors can be considered a reasonable move for traders to protect their money from economic collapse.

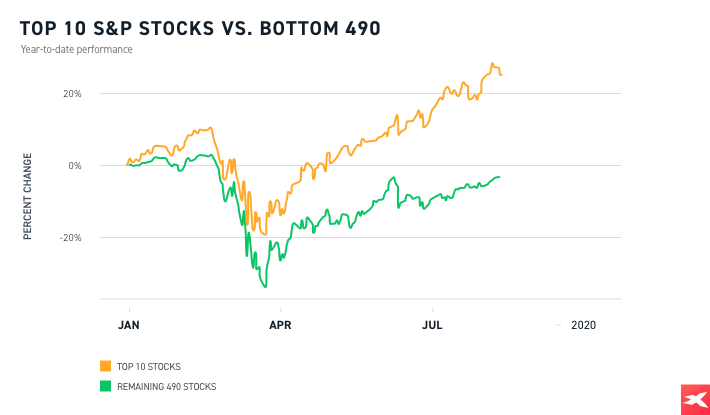

Even though these industries have become expensive in terms of market valuations, certain stocks are set to remain winners in the years to come. There is a belief that the biggest players are on their way to become even larger, and their stock prices have also outperformed the broad market on a regular basis. Obviously some point out that there is a possibility of a bubble, as there is a significant gap between several mega-cap stocks and everyone else in the S&P 500 index reflecting the US economy. However, it shows that so far investors have favoured the mentioned tech giants.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

The ten biggest stocks in the S&P500 index have outperformed the remaining 490 stocks from the index following February-March drop. More than half of those 10 stocks are tech sector giants. Source: thestreet.com

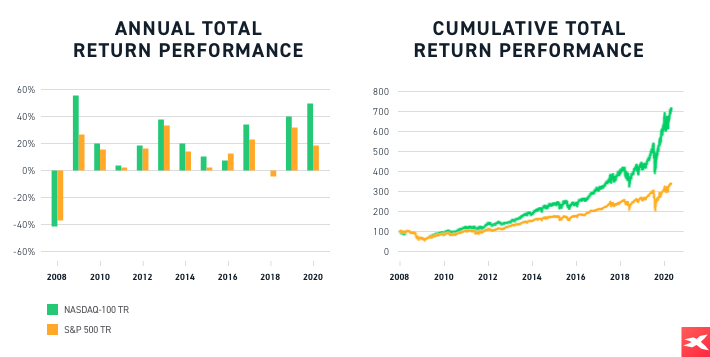

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

The tech stocks index (Nasdaq100) has been outperforming the S&P 500. Tech stocks managed to widen its advantage during the pandemic. According to some market participants, current levels are already too high so extra caution is needed. Source: Nasdaq.com

Buying commodities during a recession

What about gold?

The idea of investing in precious metals has many supporters – there is no coincidence that central banks hold gold as a reserve asset. Gold is often said to be a “safe haven”, meaning that it is regarded as a relatively safe asset during high inflation periods or financial markets turbulences. Moreover, gold has gained many enthusiasts due to expansionary monetary policy conducted by major central banks. Asset purchase programmes (known as quantitative easing) are said to be destroying fiat currencies. As a result, many investors are eager to allocate at least a small part of their money in gold, which leads to a rapid increase in ETF gold holdings among others.

While precious metals altogether may be a good pick given today’s central banks’ approach, it is worth pointing out that its price could also plunge during a sudden market crash. Investors sell precious metals during a financial crisis in order to cover margin calls, which leads to a freefall in gold prices. Therefore, the old saying “cash is king” is usually appropriate, as cash is extremely valued. However, precious metals are expected to rebound once the market panic is over, which was also the case during the recent coronavirus slump.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Gold prices plunged during coronavirus panic sell-off along with other asset classes. However, gold managed to rebound as precious metals are seen as safe havens during increased uncertainty and crises. Source: xStation5

Other commodities

Some commodities (e.g. oil, copper) are strictly related to economic conditions. Meanwhile, recessions contribute to lower demand on many goods, which causes commodities prices to fall. The mechanism here is quite simple and might be explained by laws of demand and supply – if the demand slumps and supply remains at the same level, the price would inevitably slide. However, should economic recovery (or at least hopes of economic recovery) arrive, the demand for industrial commodities rises, which eventually leads to price increase. Oil might be seen as an example in this case, as Brent and WTI prices started to pick up once the demand rebounded. Moreover, vaccination programmes along with enormous stimulus packages and monetary easing lifted hopes of economic recovery, which is expected to have a positive impact on oil demand.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Oil prices tanked due to the Covid-19 crisis as global demand on oil collapsed. However, prices began to rise along with reopening economies during summer. Even despite another wave of coronavirus cases, hopes of economic recovery accelerated in November, which caused oil prices to soar. Source: xStation5

Conclusion

Stock market recessions are always tough times for investors, as everybody is worried about their portfolios. However, no matter how devastating the crisis is, people eventually start to wonder how to make money during a recession stock market, which by definition should push asset prices higher. Nobody is able to predict the best entry or exit points, but using common sense and implementing some portfolio risk management strategies could provide traders with a decent rate of return – if not in the short-run, then potentially in the long-run. Therefore, conducting some research and trying to figure out what could happen next in the global economy is always essential.