-

Around 140 companies from S&P 500 reported earnings

-

Positive earnings surprises, mixed sales surprise

-

Results much lower on year-over-year basis

-

Major tech companies to reported Q3 results on Thursday

While global stock markets are taking a dive on the back of a rapidly deteriorating pandemic situation, traders should not forget about the ongoing earnings season. Around 140 companies from the S&P 500 index have already reported results for the third quarter of 2020 and those turned out to be better than expected. Investors brace for a Super Thursday this week, when 4 major tech companies will release their Q3 results.

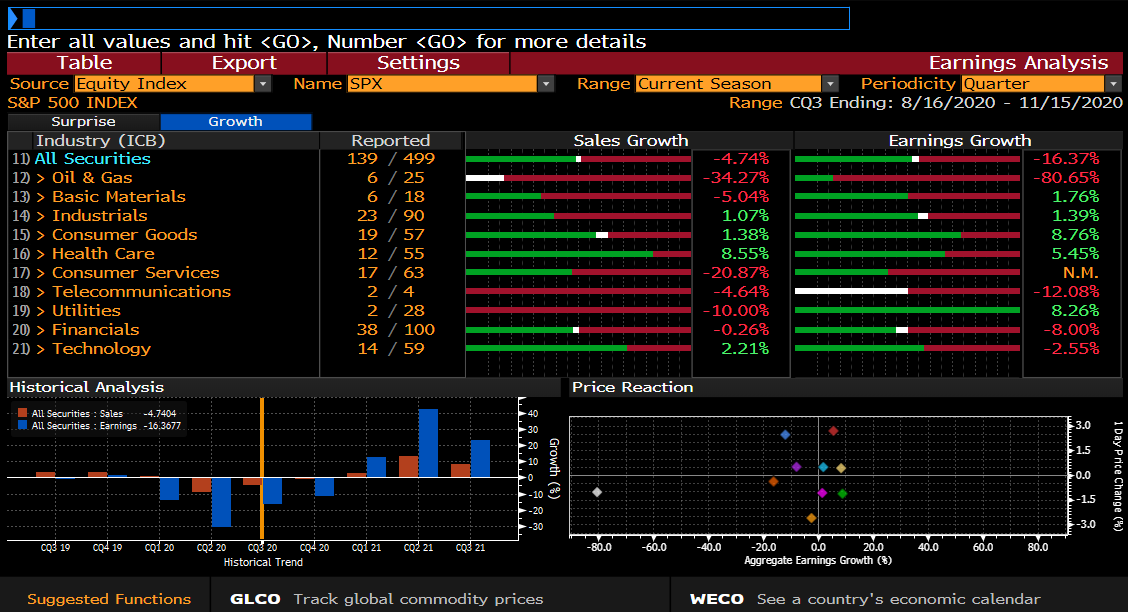

Every major sector in the S&P 500 index has presented better than expected Q3 earnings. Situation looks less rosy when it comes to sales surprise. Source: Bloomberg

Every major sector in the S&P 500 index has presented better than expected Q3 earnings. Situation looks less rosy when it comes to sales surprise. Source: Bloomberg

Companies surprise with earnings...

So far, around 140 companies from the S&P 500 index have reported Q3 results. As one can see on the chart above, both sales and earnings turned out to be higher than expected at the index level. Oil companies, miners and financial stocks provided the biggest positive earnings surprises as commodity prices rebounded and Wall Street trading bonanza continued. Situation is a bit mixed when it comes to sales data - most sectors delivered better expected results but utilities missed expectations. Nevertheless, one should keep in mind that analysts' tend to underestimate earnings of US companies therefore one should not give too much weight to the fact that reports are better than expected.

In spite of positive earnings surprises, most sectors reported massive declines in earnings and sales on the year-over-year basis. Source: xStation5

In spite of positive earnings surprises, most sectors reported massive declines in earnings and sales on the year-over-year basis. Source: xStation5

… but results still look grim on year-over-year basis

However, focusing on consensus estimates often masks a real picture. Taking a look on the chart above, one can see that in spite of most sectors reporting better than expected results, earnings turned out to be much lower year-over-year. Oil&Gas sector is a perfect example as earnings of 6 companies that have already reported turned out to be 80% above consensus while at the same time they were 80% lower than a year ago. A point to note when it comes to future quarters is that many US banks as well as other institutions do not think that the next round of government stimulus will arrive before year's end. This points to more struggles down the road with small businesses being the most vulnerable.

US500 topped in mid-October and started to move lower within a downward channel. Index pulled back from the topside of the channel and is now testing support at the 3,415 pts, that also coincides with the 38.2% retracement of the recent upward move. Breaking below it would pave the way towards the lower limit of the channel near 50% retracement. However, the upcoming US GDP report and earnings of Big Tech have a scope to turn the tide. Will they manage to do it? We shall know this Thursday! Source: xStation5

US500 topped in mid-October and started to move lower within a downward channel. Index pulled back from the topside of the channel and is now testing support at the 3,415 pts, that also coincides with the 38.2% retracement of the recent upward move. Breaking below it would pave the way towards the lower limit of the channel near 50% retracement. However, the upcoming US GDP report and earnings of Big Tech have a scope to turn the tide. Will they manage to do it? We shall know this Thursday! Source: xStation5

Super Thursday approaches

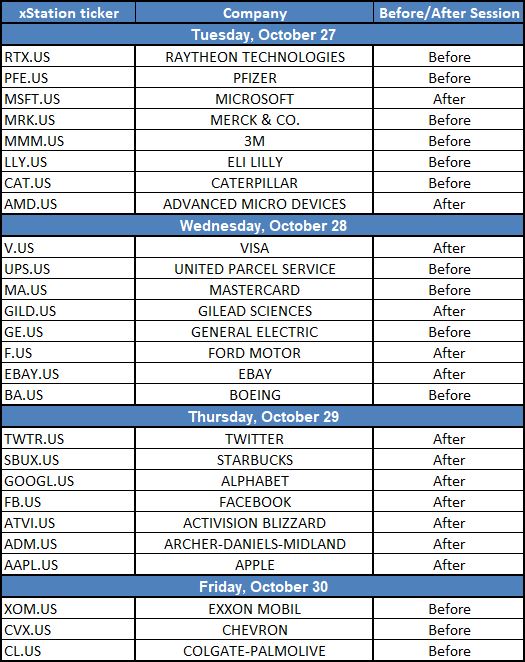

Thursday is unquestionably the most interesting day this week for investors following US earnings season. This is because investors will be served earnings reports from 4 major tech companies - Alphabet (GOOGL.US), Amazon (AMZN.US), Apple (AAPL.US) and Facebook (FB.US). Adding Microsoft (MSFT.US) to this mix, which is expected to report on Tuesday, we get over 20% of S&P 500 weight! Stock rally of the US tech sector has eased somewhat recently as a new antitrust case against social media giants has been launched recently. However, earnings reports may hint at a continuation of solid performance and provide fresh fuel for gains. Investors should also keep in mind that Thursday will see the release of the US Q3 GDP report that is expected to show record rebound after Q2 plunge. Busy earnings calendar combined with a key GDP release is likely to keep stock markets moving in the second half of the week.

Key US earnings releases this week. Source: Bloomberg, XTB

Key US earnings releases this week. Source: Bloomberg, XTB

🔌 STMicroelectronics s’envole après un partenariat stratégique élargi avec AWS 🚀

📉 Marchés financiers : reprise fragile ou simple rebond technique ? 🤔

🛡️ Kongsberg Gruppen explose en Bourse : la défense aérienne enfin revalorisée 🚀

A la mi-séance : Les indices européens tentent un rebond après la chute record de Wall Street 🔨

"Ce contenu est une communication marketing au sens de l'art. 24, paragraphe 3, de la directive 2014/65 /UE du Parlement européen et du Conseil du 15 mai 2014 concernant les marchés d'instruments financiers et modifiant la directive 2002/92 /CE et la directive 2011/61 /UE (MiFID II). La communication marketing n'est pas une recommandation d'investissement ou une information recommandant ou suggérant une stratégie d'investissement au sens du règlement (UE) n°596/2014 du Parlement européen et du Conseil du 16 avril 2014 sur les abus de marché (règlement sur les abus de marché) et abrogeant la directive 2003/6 / CE du Parlement européen et du Conseil et directives 2003/124 / CE, 2003/125 / CE et 2004/72 / CE de la Commission et règlement délégué (UE) 2016/958 de la Commission du 9 mars 2016 complétant le règlement (UE) n°596/2014 du Parlement européen et du Conseil en ce qui concerne les normes techniques de réglementation relatives aux modalités techniques de présentation objective de recommandations d'investissement ou d'autres informations recommandant ou suggérant une stratégie d'investissement et pour la divulgation d'intérêts particuliers ou d'indications de conflits d'intérêt ou tout autre conseil, y compris dans le domaine du conseil en investissement, au sens de l'article L321-1 du Code monétaire et financier. L’ensemble des informations, analyses et formations dispensées sont fournies à titre indicatif et ne doivent pas être interprétées comme un conseil, une recommandation, une sollicitation d’investissement ou incitation à acheter ou vendre des produits financiers. XTB ne peut être tenu responsable de l’utilisation qui en est faite et des conséquences qui en résultent, l’investisseur final restant le seul décisionnaire quant à la prise de position sur son compte de trading XTB. Toute utilisation des informations évoquées, et à cet égard toute décision prise relativement à une éventuelle opération d’achat ou de vente de CFD, est sous la responsabilité exclusive de l’investisseur final. Il est strictement interdit de reproduire ou de distribuer tout ou partie de ces informations à des fins commerciales ou privées. Les performances passées ne sont pas nécessairement indicatives des résultats futurs, et toute personne agissant sur la base de ces informations le fait entièrement à ses risques et périls. Les CFD sont des instruments complexes et présentent un risque élevé de perte rapide en capital en raison de l'effet de levier. 75% de comptes d'investisseurs de détail perdent de l'argent lors de la négociation de CFD avec ce fournisseur. Vous devez vous assurer que vous comprenez comment les CFD fonctionnent et que vous pouvez vous permettre de prendre le risque probable de perdre votre argent. Avec le Compte Risque Limité, le risque de pertes est limité au capital investi."