ZIM Integrated Shipping Services (ZIM.US) gains over 23% after the company reported strong second-quarter results that exceeded market consensus. The company saw a significant 48% year-over-year increase in revenues, reaching $1.93 billion. ZIM's carried volume grew by 11%, reaching a record 952 thousand TEUs, with a 40% rise in the average freight rate per TEU.

Highlights

- Total Revenues: $1.93 billion (a 48% year-over-year increase from $1.31 billion in Q2 2023)

- Net Income: $373 million (up from a loss of $213 million in Q2 2023)

- Earnings Per Share (EPS): $3.08 per share (up from a loss of $1.79 per share in Q2 2023)

- Adjusted EBITDA: $766 million (up 179% year-over-year)

- Carried Volume: 952 thousand TEUs (up 11% year-over-year)

- Average Freight Rate per TEU: $1,674 (a 40% year-over-year increase)

- Net Debt: $3.25 billion (up from $2.31 billion as of December 31, 2023)

- Updated Full-Year 2024 Guidance: Adjusted EBITDA of $2.6 billion to $3 billion, and Adjusted EBIT of $1.45 billion to $1.85 billion

The company raised its full-year 2024 guidance, now expecting adjusted EBITDA between $2.6 billion and $3 billion, and adjusted EBIT between $1.45 billion and $1.85 billion. This improvement reflects the company's strategic focus on increasing spot market exposure and capitalizing on favorable demand trends, particularly in the Transpacific trade. ZIM also declared a dividend of $0.93 per share, amounting to $112 million, representing 30% of second-quarter net income.

ZIM has made significant strides in upscaling its capacity and enhancing its cost structure, positioning itself for continued growth. With ongoing fleet modernization, including the delivery of fuel-efficient LNG-powered containerships, ZIM expects to achieve double-digit volume growth in 2024. Despite market challenges, the company remains confident in its ability to drive profitable growth in the upcoming quarters.

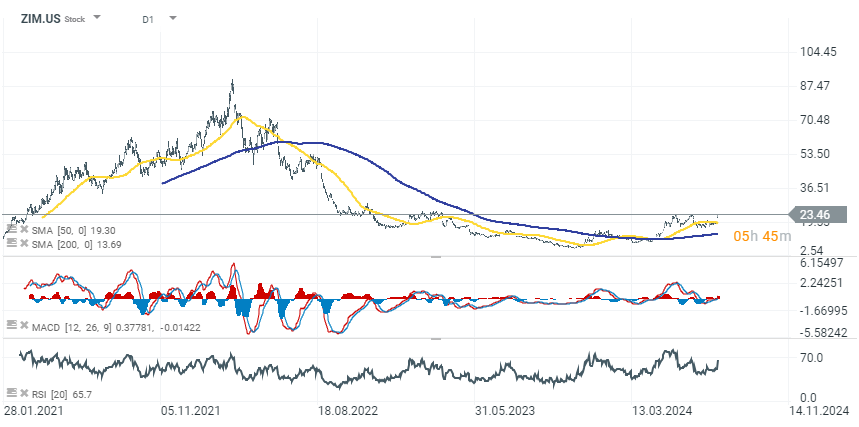

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.