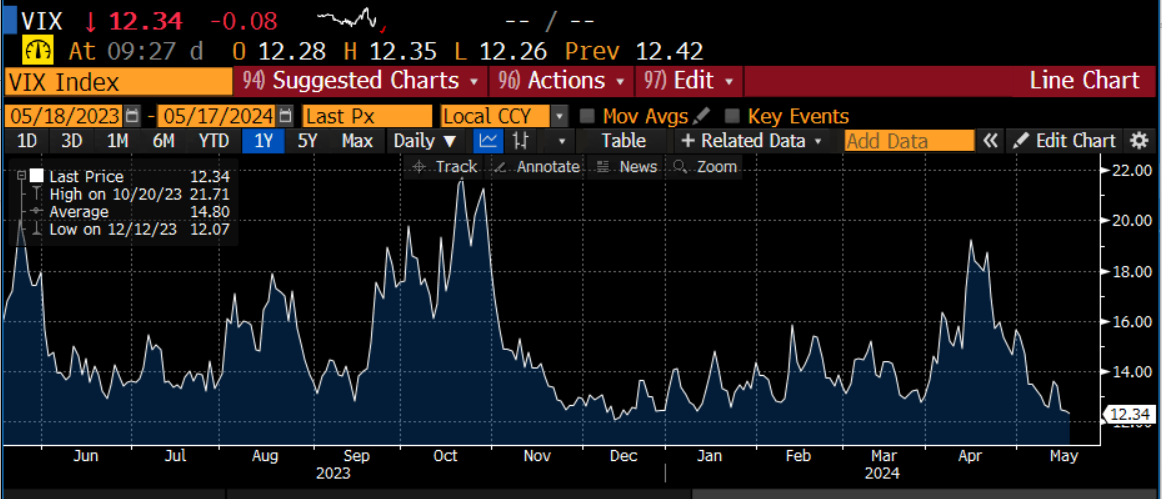

What a difference a couple of days make. One day stock markets are making record highs and banking on rate cuts, the next stocks are giving back gains and rate cut expectations are being pared back. The driver for the tapering off of risk sentiment is mostly central bank speakers. The Fed is flip flopping from sounding dovish and then switching to a more hawkish stance. This is what happens when you become data dependent and ditch forward guidance – communications become difficult for the market to interpret and volatility rises. Except, in this case, volatility is not rising, and stock markets have made record highs as the Vix, Wall Street’s fear gauge, has tumbled to its lowest level of the year so far.

So, what is happening? There are two ways to look at this: 1, a decent earnings season has helped to keep investors and traders sanguine about the prospects for global equities this year. Also, even though there is some confusion amongst traders about when the Fed will cut rates this year, the market is still of the belief that they will cut at some stage. In the big picture, whether they cut rates in September or December should not cause long term damage to risk sentiment. 2, volatility is resurfacing in other areas of the market. For example, in commodities. The vix does not stay low forever, so the fact it is at low levels now could also be a warning that volatility could flare up down the line.

Commodities outperforming Stocks

The fact that stocks are pulling back on Friday is likely to be some profit taking and is not a cause for concern. For example, the Eurostoxx 600 is down slightly today, but is snapping its longest winning streak since 2021. In contrast to stocks, commodity prices are higher across the board, and are on course to outperform European equity indices this week. For example, Brent crude is higher by 1.46% in the past 5 days, this compares with a decline of 0.76% for the Eurostoxx 50 index and an increase of 1.22% for the Dow Jones, which broke above the 40,000 level on Thursday, before pulling back.

Dr Copper comes back with a bang

By far the best performer in the commodity space is copper, which is higher by more than 5% so far this week. When Dr Copper is rising sharply it can be a sign of strength in the global economy – which should be good news for stocks. The copper boom is also part of the AI craze. The world is going to need a lot of copper to power the AI revolution and to move towards a green energy future. Copper futures have had a strong run in 2024, as the strong demand and sluggish supply put upward pressure on the price, and there could be further to go. The rise in the price of copper could also be a warning about global rate cuts: economic growth is strong, and commodity prices could reflate the global economy, which may lead to another modification of rate cut expectations in the coming weeks.

The timing of rate cuts from the Fed may not impact markets

In the last two days Fed officials have spoken about the need for rates to remain higher for longer to ensure inflation does not get out of control. Added to this, hawkish Fed member Bostic said that if he sees further improvement in inflation in the US, this could lead to a rate cut later this year. We have mentioned that the timing of the US Presidential election could also impact when the Fed cuts rates. The election is in November, September is the last meeting before the election. If they cut in September, then they could come under political scrutiny. To avoid political scrutiny, it would be easier for the Fed to cut in either July or December. We would need to see a massive downturn in inflation pressures to get the Fed to cut in July, in our view. Thus, we may see some recalibration in rate cut expectations in the weeks ahead.

ECB: one and done in June?

German ECB member Schnabel, warned against the prospect of back-to-back rate cuts in June and July in a speech on Friday, due to inflation worries. The market is currently pricing in just under three rate cuts from the ECB this year, with rate cuts priced in for June and September. If inflation starts to rise again in the summer, potentially on the back of rising commodity prices, then we could see the pace of rate cuts slow further. This has pushed up European bond yields, however, EUR/USD has pared back some earlier gains as hawkish Fed officials have put upward pressure on the dollar. Even so, the dollar is still one of the weakest currencies in the G10 so far this week.

Overall, risk sentiment is on pause. The market is focusing instead on the higher for longer mantra coming from the ECB and the Fed, as rising commodity prices threaten the disinflation trend for global economies.

Chart: Vix index

Source: XTB and Bloomberg

Source: XTB and Bloomberg

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Join NFP Live Now

NFP Market Live

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.