The US dollar has not had a very good run lately. Slightly weaker data from the economy, especially from the real estate market, and a more hawkish attitude from other central banks have weakened the world's most important currency. Expectations for interest rate hikes have fallen somewhat, but it seems that the Fed is not changing direction for now. The FOMC minutes may confirm this.

Let's get ready for two double hikes

• FOMC Minutes are likely to confirm the desire for two 50bp rate hikes in June and July

• Further fate of the increases will depend on inflation and inflation expectations

• Market hopes that inflation has already peaked and will fall from the recent 8.3%

• Market expectations for hikes have weakened. Currently, 95% of a 50bp hike in July is being priced in and only 30% of a 50bp hike in September

In terms of expectations for hikes, the minutes should not change market sentiment. Of course, there is a chance to present a clear plan of how the Fed will react to weakening or even accelerating inflation. The market will also be looking for an answer to the question of what's next for hikes after the neutral interest rate, which is estimated at 2.5% and is possible even this year.

Will the Fed be forced to sell assets?

• At the May meeting, the decision was made to begin a balance sheet reduction program

• The Fed will reduce its balance sheet by USD 47.5 billion per month for 3 months: USD 30 billion government bonds and USD 17.5 billion MBS (mortgage-backed securities)

• Starting in September, the Fed will reduce its balance sheet by 95 billion USD: 30 billion USD government bonds and 35 MBS

• It appears that the Fed may be forced to sell MBSs, due to too few maturities. Additionally, it may do so at lower prices, realizing a loss

The market will be waiting for more details on the balance sheet reduction program. In terms of government bonds, we should rather not expect more comments (although there is a risk of further increase in yields, which may force e.g. Japan and China to sell off their reserves). The market will focus on the outlook for MBS. It is estimated that the monthly maturity of these securities may be as low as $20 billion, which would mean that the Fed would have to sell its securities to meet its reduction target. Furthermore, mortgage overpayments in the U.S. are projected to decline due to rising interest rates, which could lead to a drop in MBS prices. In that case, the Fed could sell MBS at a loss. Williams from the New York Fed confirmed that there could be a problem with MBS reduction and the Fed may have to sell these securities.

What does this mean for the market?

If the Fed sells assets, it will be a very good sign for the dollar. Theoretically, the stock market should not react strongly to this information, but if it worsens consumer sentiment, Wall Street may score a continuation of declines. On the other hand, if the Fed does not provide any new information, it should be perceived as a dovish event. Then the Dollar may return to weakness and the stock market should receive support due to the fact that the Fed has no concrete plan for further tightening.

EURUSD is rebounding strongly for the 2nd week in a row. Key resistance is around the 1.0800 level. Lack of new guidance for monetary tightening may prolong dollar weakness. On the other hand, if the Fed is forced to sell assets, the dollar should clearly react with a return to appreciation. Source: xStation5

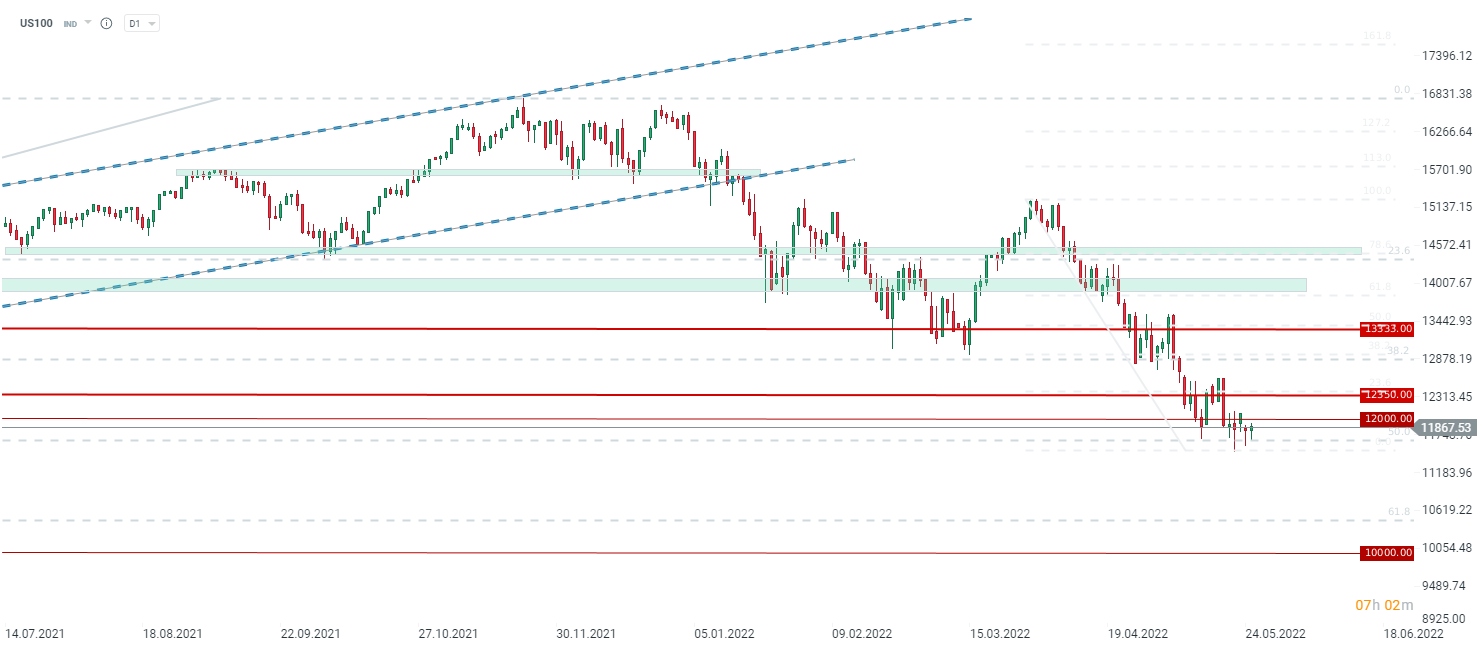

US100 is trying to find a new low and is holding important support all the time. The key for the bulls is to go above the 12000-12300 points zone. The lack of new tightening guidance should help Wall Street. On the other hand, the economy is starting to send worrying signals. A further strong fight of the Fed against inflation, e.g. in the form of asset sales, would be perceived negatively by the Wall Street. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.