OPEC+ changes game rules - surprise output cut lifts oil prices

As recently as two weeks ago the world was enjoying extremely low oil prices (for today's standards). Brent price dropped to $70 per barrel and was the lowest since December 2021. However, we had to pay even $15 more for the very same Brent barrel this morning! Such a volatile change in oil prices can be reasoned with unexpected output cut from OPEC countries, Russia and Kazakhstan. It looked like lower oil prices will help global economy emerge quicker from period of high inflation but it does not look so certain anymore.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appOil prices are much higher almost all across the futures curve then they were a week ago! Source: Bloomberg, XTB

OPEC cuts production by over 1 million barrels

OPEC+ advisory committee was set to meet on the first working day of April and make recommendation for output levels in the next month. Meeting indeed took place but it was not a trigger for the massive move. OPEC countries agreed over the weekend to make voluntarily output cuts in order to stabilize prices on the oil market. It goes without saying that this is a response to recent sell-off on the oil market, when prices dropped amid deteriorating sentiment around banks. However, those drops were mostly recovered already. Nevertheless, a 1.16 million barrel output cut was announced with Saudi Arabia being responsible for around 500k bpd and Iraq for another 211k bpd. United Arab Emirates, which were recently rumored to be considering OPEC exit in an attempt to expand production, agreed toa 144k bpd cut. Kuwait is set to cut production by 128k bpd.

However, production cuts were also announced outside of OPEC. Russia announced that it will extend its 500k bpd cut through year-end (was set to end in June). Kazakhstan, also a member of OPEC+, lowered its production by 78k bpd.

OPEC cut production earlier but this time it will be more 'real'

One should not forget that this is not the first time OPEC will cut production. Cartel announced a 2 million barrel cut in October last year. However, 'real' output cut was much smaller as countries were already undercomplying with quotas. Nevertheless, cuts will amount now to a total of 3.66 million barrels, what amounts to around 3.7% of global supply. New production cuts are not simply an adjustment to reality like it was before. Current output cuts are set to be delivered via countries that have means to produce more. Moreover, a surprising nature of the decision is having a big impact.

Politics play a role - Saudi Arabia is furious

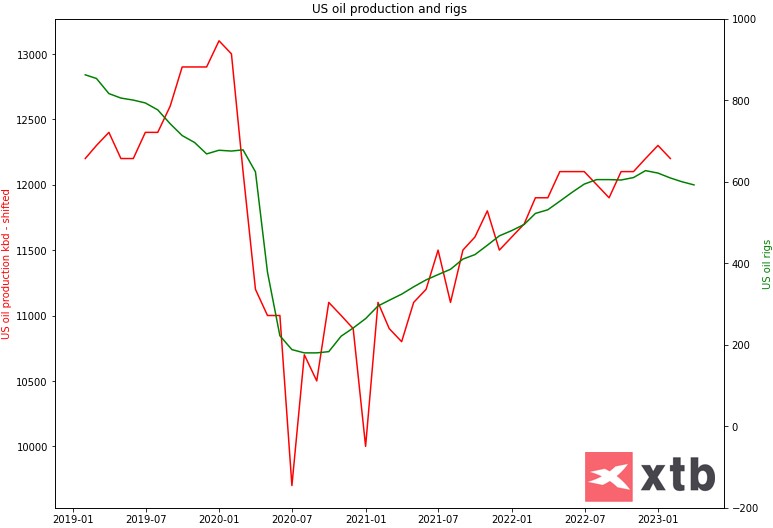

OPEC, and more precisely OPEC+, now has a much bigger impact on prices than it used to be a few years ago. US shale sector is not as significant player in global oil market as it was - US oil companies are more focused on splitting profits via buybacks rather than investing into capacity. Number of unfinished drilling rigs dropped significantly while number of active drilling rigs suggests that United States has limited potential to boost output in the next two months.

The US has limited scope to increase production amid lack of new investments. US active oil rigs (leading) and US production. Source: Bloomberg, XTB

OPEC is not afraid of US shale and is not afraid of US administration either. US authorities flooded market with US strategic oil reserves which currently sit at the lowest level since 1980s! It means that United States does not have too much 'ammo' to offset OPEC cuts. As much as a million barrels of oil were released from US strategic reserves at one point! Given that those releases have stopped and OPEC announced additional production cut of over 1 million bpd, effect on prices is clearly bullish.

Saudi Arabia approached United States to start rebuilding strategic reserve with Saudi crude. However, public denial that SPR refilling will start anytime soon has made Saudi Arabia furious. Some promises may have been made to Saudi Arabia earlier which were crashed by EIA statement on SPR refiling.

How much less oil will there be and what impact will it have?

OPEC+ production goal is not being fulfilled right now. It is set at slightly above 40 million barrels per day and current production in the OPEC+ group sits at slightly above 38 million barrels per day. In spite of the fact that cuts are voluntary and have been a surprise for the market, they still relate to production target so the real impact on the production would likely be halve of that. Given a current, slight oversupply on the market, market balance should not change dramatically in Q2 2023 - market will shift from small surplus to small deficit. Key factor in the second half of the year will be demand in China and changes in US inventories. Nevertheless, case for gains in the later part of the year has strengthened and it may hamper efforts to bring inflation down.

Oil market is balance right now, meaning that supply meets demand. It should be noted, however, that in the first phase of pandemic, market was in a significant deficit, which often amounted to 2-3 million barrels. Unless demand increases, current actions by OPEC+ should not lead to a deficit bigger than 1 million bpd. It is significant in historical terms but when we take a look at recent years - not so much. Source: Bloomberg, XTB

What's next for prices?

JPMorgan and Goldman Sachs are among the most bullish banks when it comes to oil. The former signals that 1 million barrel deficit may lead to a $15-25 per barrel rally on the oil market. Given pre-weekend prices, it would suggest a target in the $100-105 area. Goldman Sachs boosted its December 2023 Brent price forecast from $90 to $95. In our opinion, the room for gains may be limited by the fact that the impact of announced cuts on 'real' production will be limited and will remain unknown until end-May. The second half of the year will be key, especially demand in China and the United States. Unless demand recovers, deficit alone may be not enough to justify $100 per barrel price levels.

Oil launched a new week with a massive bullish price gap, breaking above 50- and 100-session moving averages for the first time since June 2022. On the other hand, ongoing rebound still has not exceeded the range of the largest upward correction in the ongoing downtrend. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.