The world's largest uranium producer, Kazakhstan's Kazatomprom (KAP.UK) listed on the London Stock Exchange last week announced that the first batch of AFA 3G ТМ nuclear fuel has been shipped from the Ulba nuclear fuel plant to China. The company's shares are doing slightly better beating the FTSE index average:

- Rail platforms with 34 Kazatomprom shipping containers containing fuel assemblies equivalent to just over 30 tons of enriched uranium under special exhortation have been delivered to China and accepted by China's General Nuclear Power Corp:

"The implementation of the innovative nuclear fuel production project is an example of Kazatomprom's contribution to mitigating the effects of global climate change and achieving the global low-carbon goal. The Ulba plant allowed the company to diversify its production by expanding its composition and producing a high-tech, export-oriented, high-value-added uranium product. The successful delivery of the product to Chinese partners has confirmed Kazatomprom's reputation as a reliable and beneficial supplier to the global nuclear fuel market." - Yerzhan Mukanov, Kazatomprom CEO, commented on the deliveries. "The first delivery of the finished product marks the beginning of regular deliveries, and this is important not only for our companies, but significant for Kazakhstan and China," - the company reported.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app- Kazatomprom, thanks to favorably located raw material deposits in Kazakhstan, mines uranium using the ISR method and processes it in the country, which enables it to reduce logistics costs and sell fuel at the lowest prices on the global nuclear fuel market. The Ulba metallurgical plant is used to process uranium and began operations in November 2021 after, among other things, helping the French company Framatome and obtaining an agreement with the recipient, China's General Nuclear Energy Corporation;

- It is the only plant in Kazakhstan producing nuclear fuel, with contracted supplies 20 years ahead. The plant's current capacity is 200 tons of enriched uranium per year. The massive amount of supplies contracted for the future could enable the company to increase revenues if the spot price of uranium continues to rise as global demand for nuclear-generated power continues to grow;

- China plans to build 150 nuclear reactors in the next 15 years, an amount greater than the number of reactors built in the past 35 years, worldwide. China currently has 51 nuclear power plants, with 20 under construction. Nuclear accounts for about 5% of the energy produced in China with the Middle Kingdom intending to emphasize development toward uranium and nuclear power in the coming decades.

Kazatomprom as the world's largest uranium producer, with access to rich deposits exploited by the efficient in-situ recovery (ISR) method, is likely to be a beneficiary of the long-term trend:

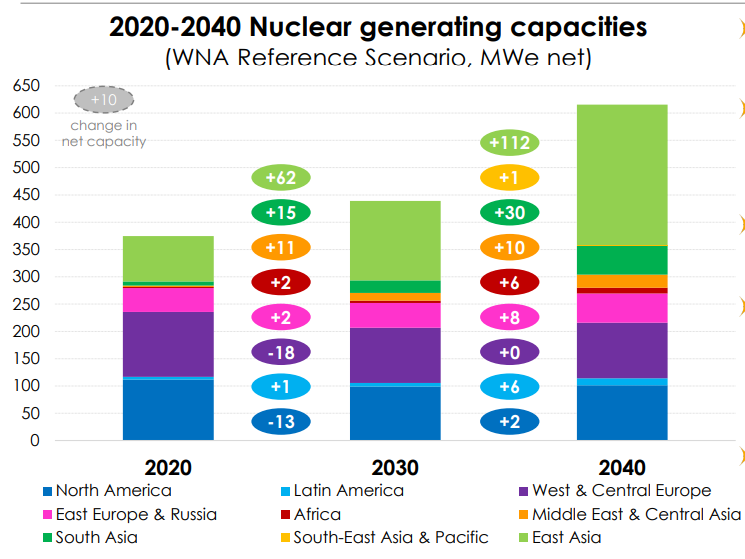

Kazatomprom points out that the reason for the competitiveness of the uranium ore and nuclear fuel it sells is access to the ISR mining method, which significantly reduces operating costs. In addition, it estimates that the supply of uranium will still be significantly lower than demand creating favorable conditions for an increase in the price of the raw material in the future. Since the beginning of the year, faced with the prospect of an economic slowdown, prices per pound of uranium ore have fallen from $50 to around $40 in the fourth quarter of the year. The price drop and geopolitical risks related to Russia's neighborhood have caused the company's shares to reprice from their 2021 valuation. Source: Kazatomprom The company assumes that East Asia's uranium supply needs will grow most significantly compared to other regions of the world, by 2040. However, the forecast comes from Q1 when sentiment around nuclear was still more negative in both Europe and the US. The unfolding energy crisis and deglobalization trends, however, have identified nuclear power as an efficient, zero-carbon energy source and an increasing number of politicians and businesses in the EU and the US are opposing the closure of nuclear power plants. Source: Kazatomprom

The company assumes that East Asia's uranium supply needs will grow most significantly compared to other regions of the world, by 2040. However, the forecast comes from Q1 when sentiment around nuclear was still more negative in both Europe and the US. The unfolding energy crisis and deglobalization trends, however, have identified nuclear power as an efficient, zero-carbon energy source and an increasing number of politicians and businesses in the EU and the US are opposing the closure of nuclear power plants. Source: Kazatomprom

Kazatomprom (KAP.UK) shares, H1 interval. The company's shares are gaining nearly 4% today amid weaker sentiment on the floor of the UK stock exchange. Source: xStation5

Kazatomprom (KAP.UK) shares, H1 interval. The company's shares are gaining nearly 4% today amid weaker sentiment on the floor of the UK stock exchange. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.