- Freeport McMoran (FCX.US) is one of the largest copper producers and the world's largest molybdenum producer;

- The company jointly operates gold mining operations with the U.S. and Indonesian governments at the world's largest resource mine, Grasberg (Papua New Guinea);

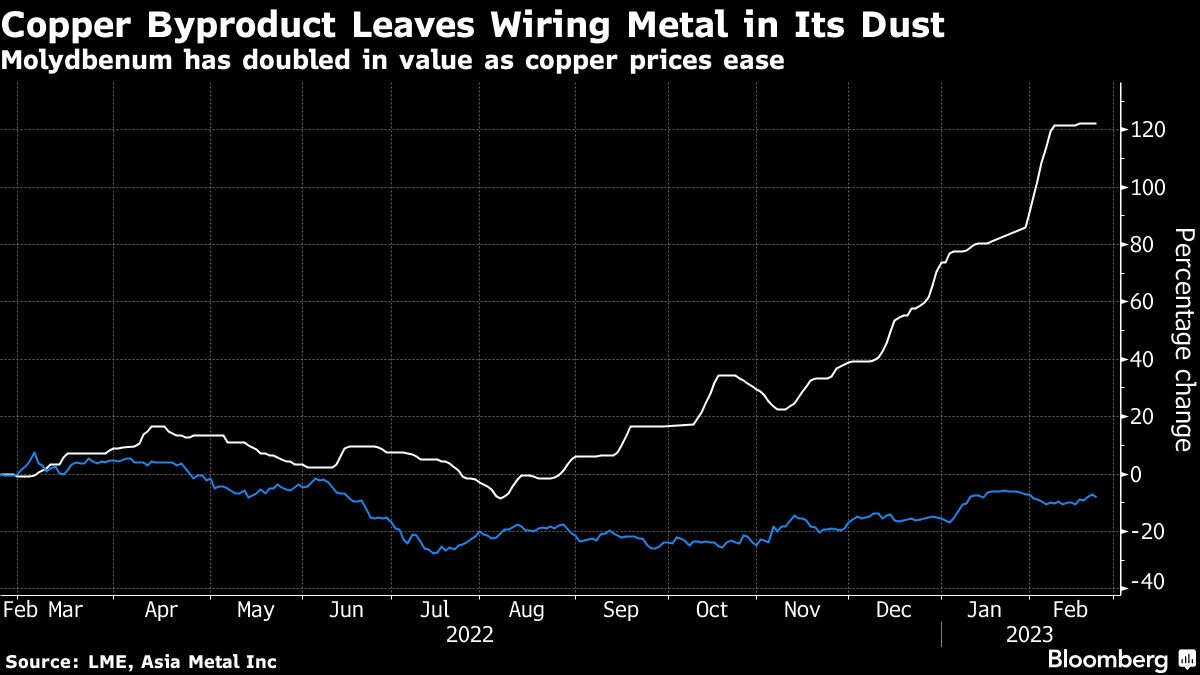

- Prices for molybdenum used in the defense, industrial (steel hardening) and space industries have risen powerfully recently due to limited supply, historically high demand and difficult supply chains;

- Sentiment around copper improved after China's economy opened up and the dollar weakened. Still, macro factors including the vision of a possible recession and financial crisis are holding back the bulls.

- Freeport McMoran earns much higher margins on molybdenum sales but it still accounts for a much smaller portion of the company's overall revenues and profits. The largest molybdenum mine is Climax Mine, in Colorado. The favorable geographic diversification (short and secure supply chain) for the U.S. makes it likely that the U.S. will be inclined to buy the more expensive raw material from Freeport McMoran instead of using Chinese competition.

In a recent letter to shareholders, BlackRock fund chairman L.Fink pointed out that geopolitics will play an increasingly important role in the global economy, and the era of seeking to maximize profitability is over as tensions escalate. Countries may choose security and supply chain at the expense of a higher price (pro-inflation factor). Freeport McMoran's business is cyclical - free cash flow in 2022 is down almost 70% y/y. The P/E ratio is 15, the P/B ratio just over 2.

If the global economy manages to avoid a broader financial crisis and the Fed gradually loosens monetary policy over time, Freeport McMoran's mined commodity prices and margins could rise. With the prospect of higher arms spending, molybdenum appears to be one of the most strategic minerals, and its deposits are extremely rare. Freeport operates two very large mines, Cerro Verde and El Abra, in Chile, the country with the largest copper deposits in the world.

Molybdenum prices have risen despite declines in copper prices. In February, molybdenum futures made their debut on the London Stock Exchange, thanks to increased interest from speculators. Source: LME, Asia Metal, Bloomberg

COPPER, D1 interval. Copper futures have rebounded from the 38.2 Fibonacci retracement of the upward wave that began in spring 2020, and the 'golden cross' formation signals a possible reversal of the downward trend. Source: xStation5 Freeport McMoran (FCX.US) shares, H1 interval. Increases were stopped at the 38.2 Fibonacci retracement of the upward wave initiated in the summer of 2022.If the sell-off deepens, the next important support may turn out to be the level of $33, at the 61.8 Fibo retracement. Source: xStation5

Freeport McMoran (FCX.US) shares, H1 interval. Increases were stopped at the 38.2 Fibonacci retracement of the upward wave initiated in the summer of 2022.If the sell-off deepens, the next important support may turn out to be the level of $33, at the 61.8 Fibo retracement. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.