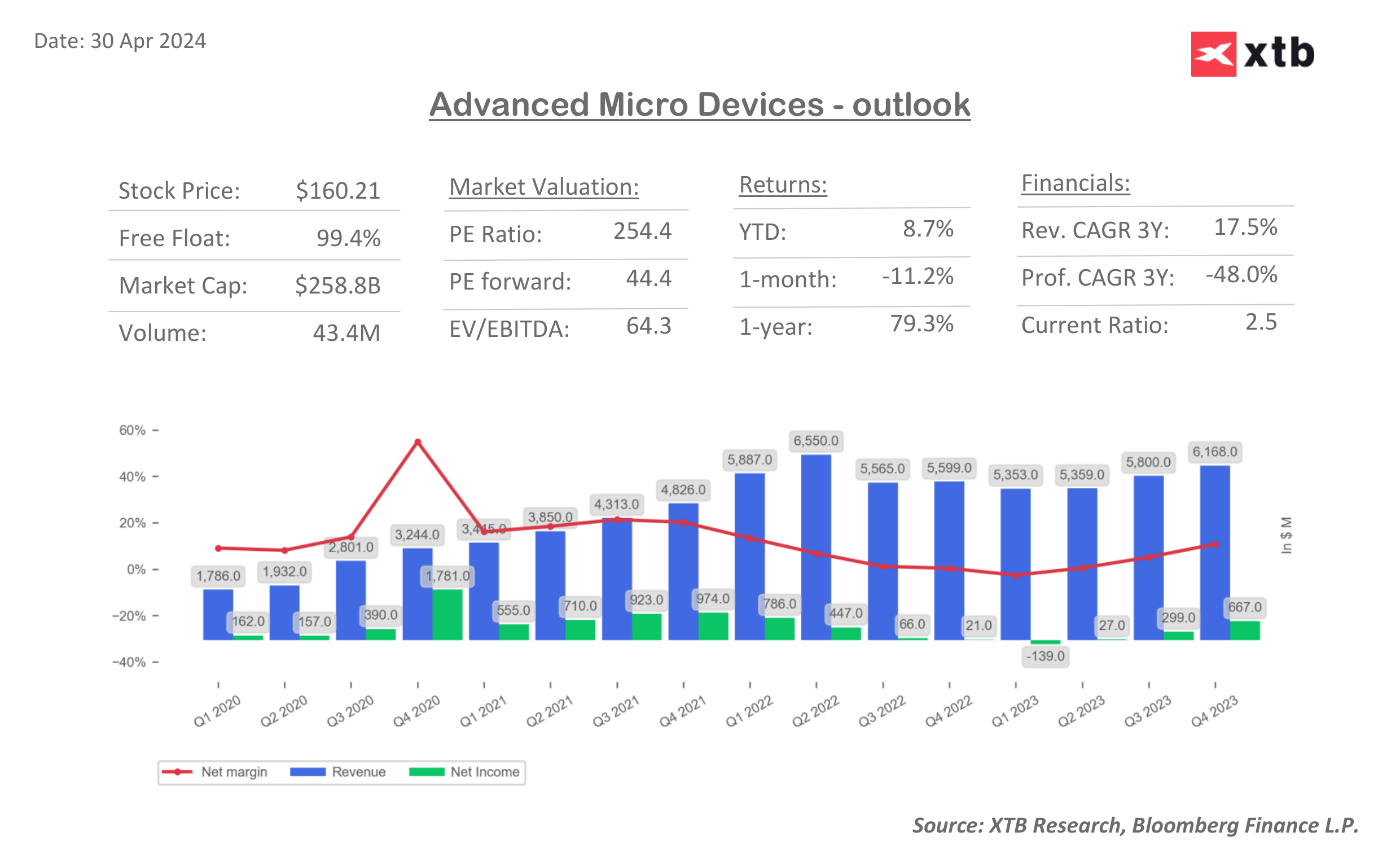

Shares of Advanced Micro Devices (AMD.US) are gaining 0.70% in pre-market trading ahead of the publication of their first-quarter results, which are expected to be released after the close of the Wall Street session.

Market consensus for AMD's results

Financial data for the first quarter:

- Adjusted EPS: 61 cents, compared to Bloomberg's consensus estimate of 62 cents.

- Revenue: $5.45 billion, compared to $5.6 billion in the previous quarter.

- Data center revenue: $2.31 billion, accounting for a significant portion of overall revenue.

- Gaming revenue: $965.5 million, which marks a decline compared to the previous quarter and year-on-year.

- Client revenue: $1.29 billion.

- Other revenue: $922.6 million.

- Adjusted gross margin: 52%.

- Adjusted operating profit: $1.11 billion.

- Adjusted operating margin: 20.8%.

- Free cash flow: $2.22 billion.

- Capital expenditures: $118.4 million.

- R&D expenditures: $1.5 billion.

Expectations for the second quarter:

- Revenue: $5.72 billion.

- Adjusted gross margin: 53%.

Annual expectations:

- Revenue: $25.88 billion.

- Adjusted gross margin: 53.5%.

Analysts predict a report consistent with expectations, with potential growth in the MI300 sector. The new type of MI300 chip, which aims to compete with Nvidia's offering, is projected to bring the company a total annual revenue of around $4 billion in a year, indicating growth potential for the AI portfolio. AMD is also expected to see growth in the overall AI segment and promising prospects for the upcoming quarters, including the aforementioned MI300 chip.

AMD's financial dashboard for the recent quarters.

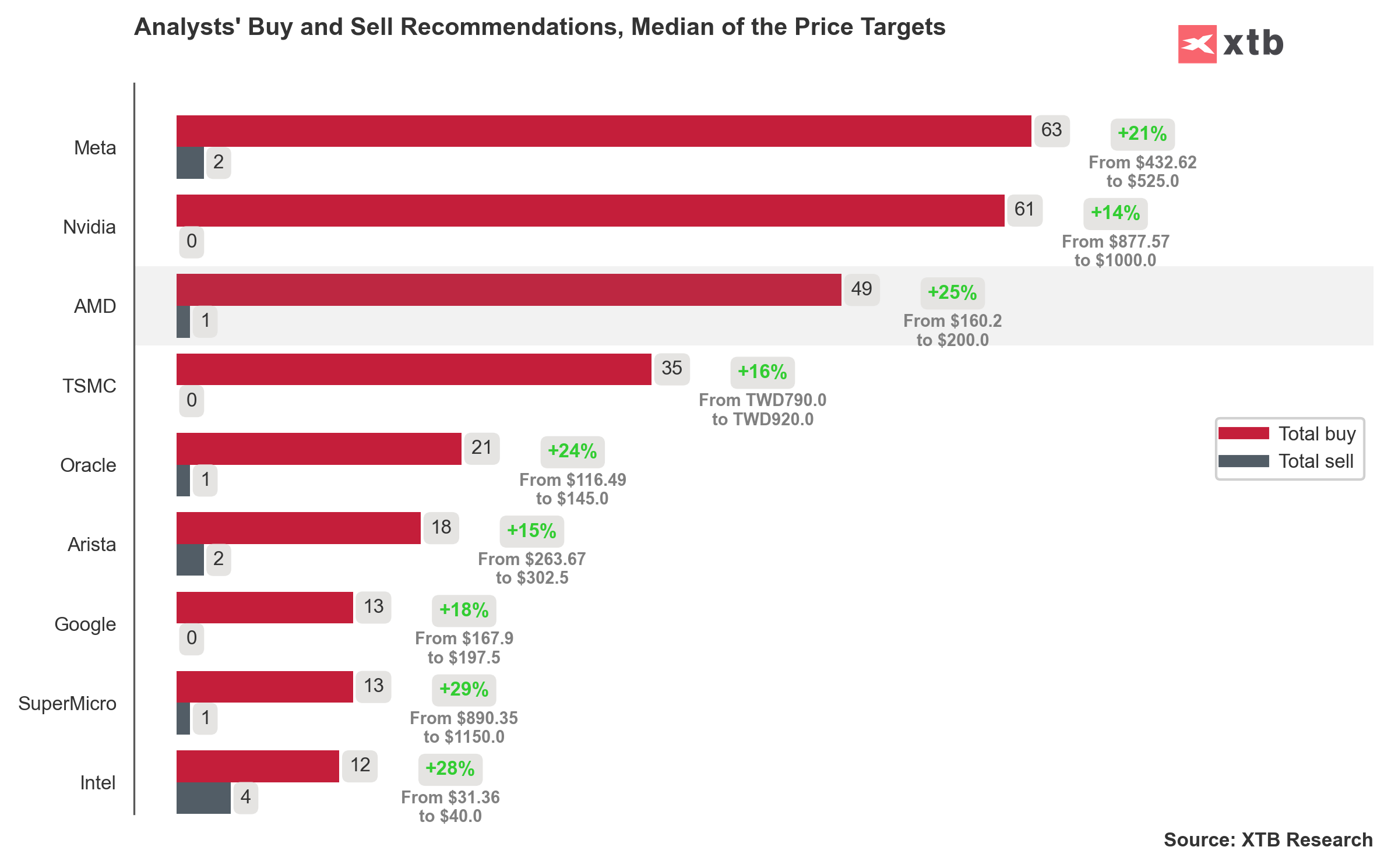

Analysts' recommendations for AMD remain relatively positive compared to other companies in the sector. The median recommendation indicates a potential 25% increase in stock value to around $200.

AMD's shares are also performing well compared to the competition. Since the introduction of ChatGPT, the shares have gained nearly 161%. The chart excludes shares of Super Micro Devices and Nvidia due to their high returns.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.