The past week has been arguably the most tumultuous for UK politics since the EU referendum in 2016, with the Brexit saga continuing to wrangle on with seemingly little progress being made. As was widely expected PM May’s deal was met with a resounding rejection in the house of commons, with the margin of the parliamentary defeat the largest ever suffered by a government.

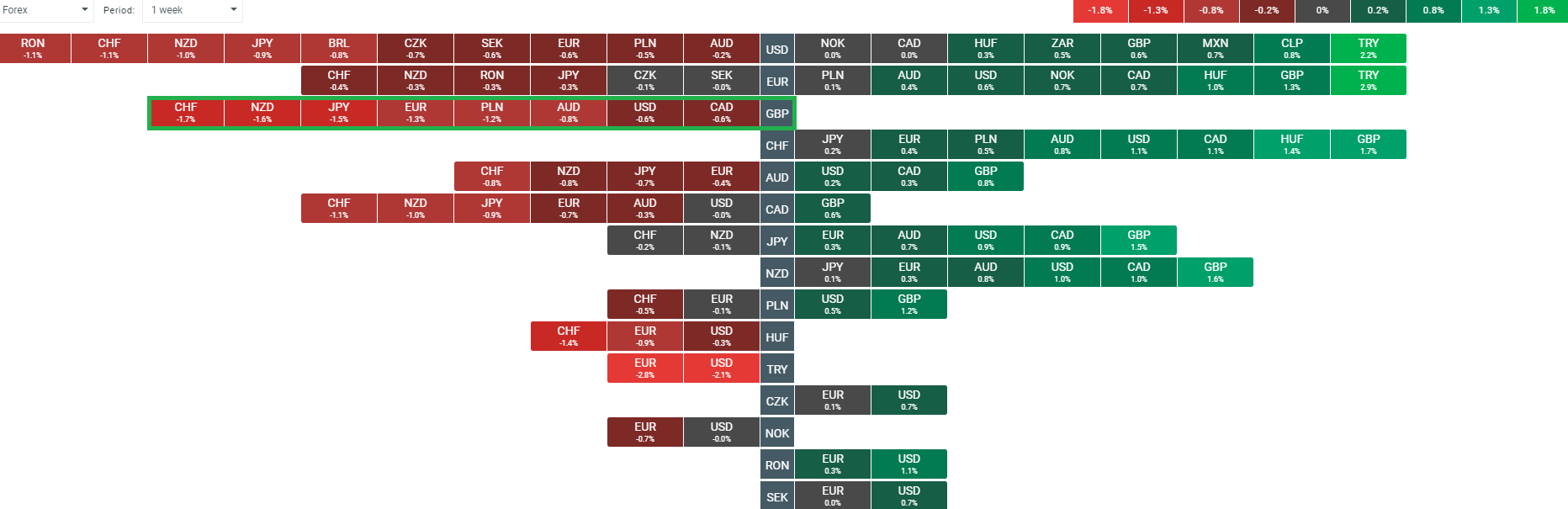

Despite all the background noise, it’s been a pretty good week for the pound, with the currency rising against all its major peers. The markets are seemingly pricing in a shift towards a softer version of Brexit and downplaying the chances of a no-deal. Source: xStation

Predictably, the opposition tabled a vote of no confidence which ultimately failed to replace the government but unlike the leadership challenge against Theresa May last month, there is no fixed time before MPs can repeat this process. This would likely fail again, and prove to be a fruitless endeavour with the Conservatives and DUP seeing this as paving the way for a General Election where they have little to gain and much to loss and this puts paid to hopes of a General Election anytime soon.

Where next?

Second Commons vote on May’s deal

Officially the next key event to watch out for is a second commons vote on PM May’s deal scheduled for 29th January but given that the first attempt fell short by 116 votes there would have to be significant developments on this front to create the necessary swing. One of the big stumbling blocks was the “temporary” Irish backstop with many MPs fearful this would become permanent as it requires a joint agreement between the UK and EU for it to cease. Written assurances from Presidents Tusk and Juncker which declared their intention was not to trap the UK in this agreement permanently weren’t enough to satisfy the skeptics and it will likely require a firm end date to the backstop arrangement to bring them around. Even if this is achieved then it is unlikely that the bill will pass without cross-party support - something which hitherto has been missing.

The Conservative party are split on Brexit, with the majority backing May’s deal. Should the PM achieve a limit/scrap on the backstop then she may get another 45 votes but would likely still come up short of the 318 needed. Relevant number of MPs are as follows: Support 202; Limit/scrap backstop 45; Better deal 39; No deal 17; 2nd referendum 9; Norway 1. Source: BBC.co.uk

Article 50 extension

Given the challenging parliamentary arithmetic, in all likelihood the second vote on May’s deal will return the same outcome as the first and with there not being enough time to renegotiate a significantly different deal with the EU the only possible outcomes are a no deal Brexit or an extension of Article 50 beyond the 29th March deadline. There are challenges to overcome for an extension to be granted, not least the approval of the other 27 EU members and the not so small matter of EU parliamentary elections at the end of May, but these shouldn’t prove insurmountable hurdles to clear. This now seems to be the base case and would be moderately positive for the pound as it will almost certainly lead to a softer Brexit.

The GBPUSD has returned to its 200 day simple moving average in recent trade for the first time since April last year. This indicator has proved fairly adept at identifying the long term trend of the market in recent years, with an uptrend in place when price is above it and a downtrend when the market is below it. A move back above 1.30 would see price trade above the 220 SMA once more and could be seen as the start of a longer term uptrend. Source: xStation

The GBPUSD has returned to its 200 day simple moving average in recent trade for the first time since April last year. This indicator has proved fairly adept at identifying the long term trend of the market in recent years, with an uptrend in place when price is above it and a downtrend when the market is below it. A move back above 1.30 would see price trade above the 220 SMA once more and could be seen as the start of a longer term uptrend. Source: xStation

No deal

After the Conservatives survived the motion of no-confidence, PM May announced that she was looking to work with other parties in order to achieve a breakthrough. Given the hard Brexiteer wing of the Tory party it is pretty safe to say that the PM will only get a deal through parliament if she receives cross-party support and this now seems to be where May will focus her attention domestically. Leader of the opposition Jeremy Corbyn has stated that he wants no deal taken off the table before he will sit down to discuss other options with the PM, but for now May is resisting taking this action. Recent events have caused many to believe that the chances of a no-deal have diminished significantly, but it may be more than a little presumptuous to jump to this conclusion just yet.

It’s often forgotten that there was a pretty strong push higher in the pound ahead of the EU referendum with the GBPUSD rate rising $0.10 in the 6 full sessions before the vote. This was on the belief that remain would win and exacerbated the drop from $1.50 to $1.32 (around 12%) in the day that followed the vote. The decline from the low seen just over a week before Britons went to the ballot box was $1.40 and from there the decline was “only” 6%. Given the latest gains we could be set for a similar move in the event of a no-deal. History doesn’t repeat itself, but it often rhymes…. Source: xStation

It’s often forgotten that there was a pretty strong push higher in the pound ahead of the EU referendum with the GBPUSD rate rising $0.10 in the 6 full sessions before the vote. This was on the belief that remain would win and exacerbated the drop from $1.50 to $1.32 (around 12%) in the day that followed the vote. The decline from the low seen just over a week before Britons went to the ballot box was $1.40 and from there the decline was “only” 6%. Given the latest gains we could be set for a similar move in the event of a no-deal. History doesn’t repeat itself, but it often rhymes…. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.