This Thursday at 5 PM GMT markets will learn the WASDE report from the USDA, with the penultimate report on the 2023/2024 season. The previous March report showed slightly better wheat data, but now the market consensus points to a renewed increase in ending stocks, which could theoretically be a negative factor for prices.

On Thursday, important data for wheat. Investors should pay attention to ending stocks and exports. There is the potential for worse export data due to the cancellation of wheat shipments to China and lower grain inspections. Source: Bloomberg

In addition, Monday's winter wheat crop quality data are worth noting. The share of wheat rated best rose to 56% at the start of the season, the best rating since 2020 and well above the 27% rating a year earlier. Theoretically, the good quality of the crop suggests possible higher yields, which could be a negative factor for prices. However, it is worth noting that the high share of winter wheat in the past was at the same time also an indication that the price hole is near. There is a very high probability that the grain quality rating will deteriorate during the summer, if temperatures are higher than expected and moisture remains at lower levels than standard.

High grain quality at the beginning of the season gives a high chance of deterioration of this rating during the season. Source: Bloomberg Finance LP

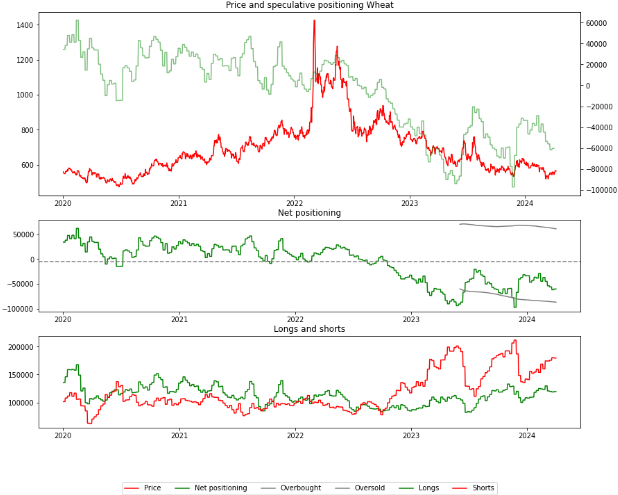

Moreover, we have recently seen an increase in speculative short positions in the market, which means positioning for low commodity prices at the start of the new season.

Source: Bloomberg Finance LP, XTB

The price has broken above the upper limit of the downward price channel, but has reacted to the area of 570 cents per bushel at the Fibonacci retracement of 38.2 of the last downward wave. It appears that the price may fall into consolidation in the near term, as it did after breaking through a similar downward channel in October. Seasonality does not give a definite signal in the near term.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.