Futures contracts on WHEAT are losing more than 3.5% after yesterday's session, when a candlestick reversal formation was finally established. Actually we don't see any news to support the wheat prices fall, although it's worth noting that we're after a full week of gains driven by Russia's rupture of a grain deal with Ukraine on the Black Sea and a forecast of dry weather in the US. Recent sessions have been record highs for wheat since February 2022.

The increases at the beginning of the week were related to the failure to extend the agreement on agricultural exports from Ukraine. However, it is worth remembering that the situation is much different than last year - Ukraine is also exporting via other routes, and the production situation in Europe is much better than last year. Also in the US, USADA predicts higher grain supplies. Nevertheless, today's move is most likely a profit-taking reason, so next week the price may return to increases if basic wheather forecast in US will be unchanged - drought.

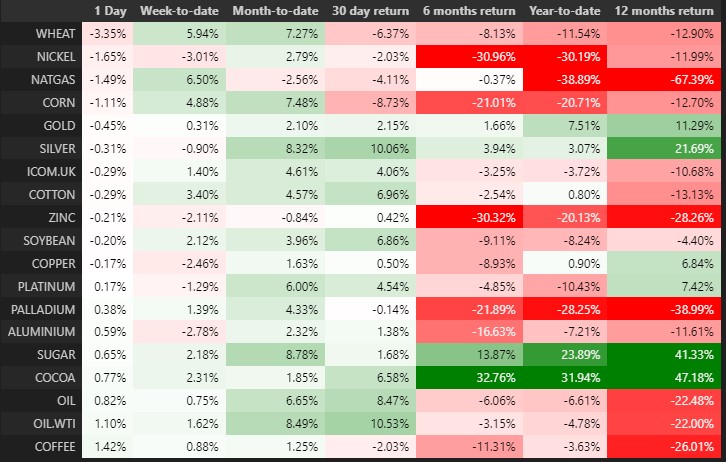

Wheat is the worst performing commodity today. On the other hand, besides gas, it is still the strongest commodity this week. Source: XTB

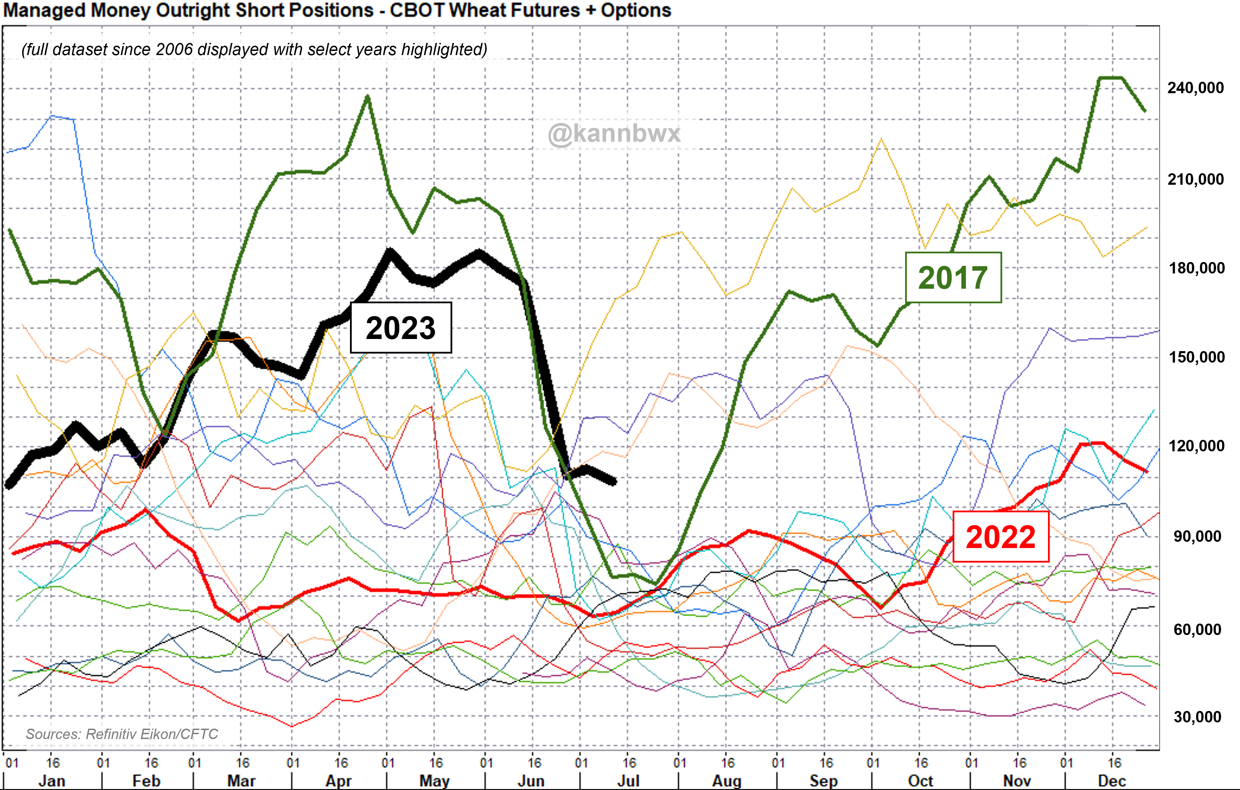

Due to seasonality elements such us harvest, drought risk, supply shocks etc. historically bearish positioning on wheat have sometimes cooled down in June and July. Source: Refinitiv, CFTC

Due to seasonality elements such us harvest, drought risk, supply shocks etc. historically bearish positioning on wheat have sometimes cooled down in June and July. Source: Refinitiv, CFTC

Key support for WHEAT is around 675 cents per bushel, which is at the retracement of 61.8 of the upward wave. Previously, during the upward wave in June, the price stopped the following declines precisely at the 61.8 Fibonacci retracement. Source: xStation5

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.