US wheat prices dropped below local lows from late February and March last week and are now at their lowest levels in 4 years, heading toward the 500 cents per bushel mark. The price declines in the US are driven by two factors:

- Export data is not impressive, indicating that the dollar remains strong and does not encourage larger purchases from the US. Moreover, harvests in other regions around the world, especially in Russia and Australia, look better, which does not increase demand for American wheat

- The harvests in the US also look good. So far, 76% of the winter wheat has been harvested, and today at 9:00 pm BST we will learn more data about last week. We will also learn about the quality of the spring wheat. Last week, the share of the best quality wheat in the USA reached 77%, which is close to the highs of recent years. More importantly, in North Dakota – a key state in the Plains region where wheat is grown, production prospects per acre have risen to the highest level in history.

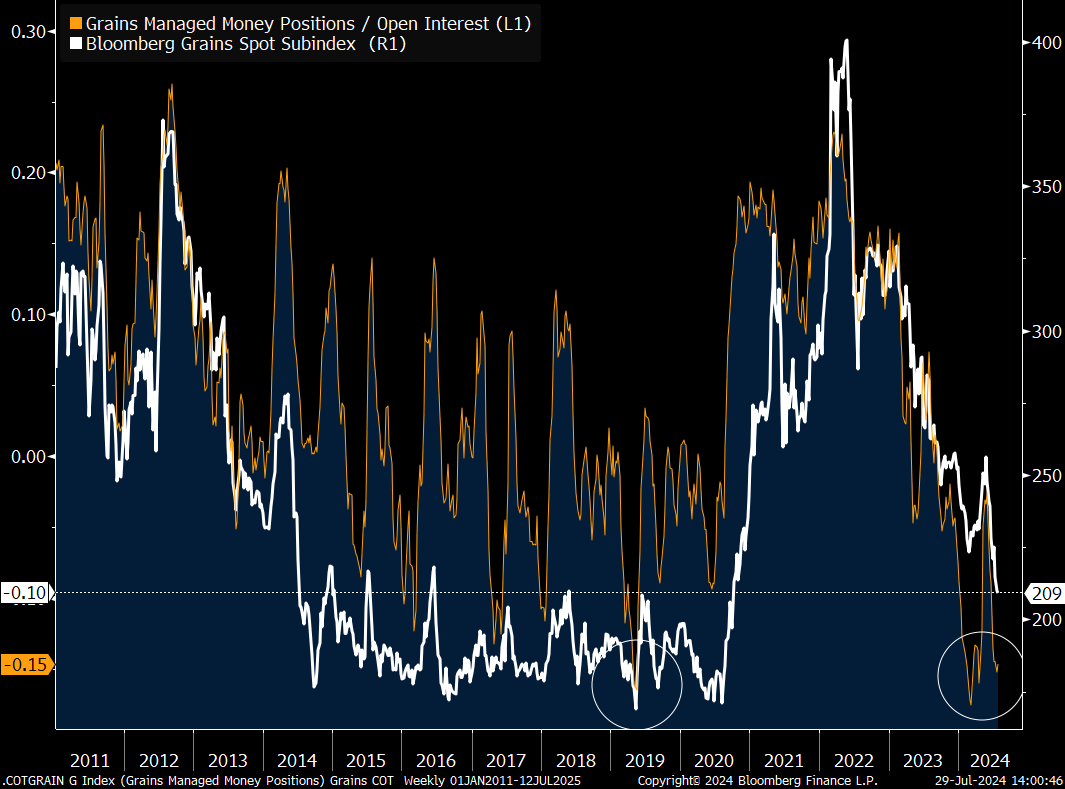

It is also worth noting the still relatively low oil prices, which mean lower production costs and less profitability for processing agricultural raw materials into biofuels (mainly corn and soybeans in the US). Since the supply of corn and soybeans is expected to be higher, the demand for wheat (mainly for feed) also decreases. Therefore, we are observing a clear increase in short positions across the entire grain market relative to the number of open positions.

Short positions on grains, opened by hedge funds, relative to all open positions in the market. Source: Bloomberg Finance LP, XTB Research

Wheat has reached its lowest point since August 2020. Looking at speculative positions, extremely low positioning for wheat is behind us, but other commodities like soybeans and corn are being sold heavily. The next significant support level for wheat is at 500 cents per bushel, and from a technical standpoint – the local lows from 2020, which are around 490 cents per bushel. Source: Bloomberg Finance LP, XTB Research

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.