Traders will be offered rate decisions from two Antipodean central banks this week - Reserve Bank of Australia and Reserve Bank of New Zealand. RBA will be the first one to make an announcement, with rate decision scheduled for Tuesday, 4:30 am BST. Let's take a quick look at what the market expects from Australian central bankers this week.

Since last RBA meeting...

The latest RBA rate decision was announced on Tuesday, September 5 and it was a decision to keep rates unchanged. It was the third 'hold' from RBA in a row, following a cumulative 400 basis points of rate hikes since May 2022. RBA noted in a decision statement that inflation is past its peak and continues to decline but prices of many services continue to rise and rent inflation remains elevated. Uncertainty in the economic outlook was cited as the main reason behind the decision to hold.

Data from Australia released since the previous meeting has been generally hawkish. Jobs report for August came in strong with strong pick-up in employment as well as participation rate. CPI inflation picked up from 4.9% in July to 5.2% in August. Job vacancies data for August showed a big drop, signaling tightness of the labour market.

What market expects from RBA?

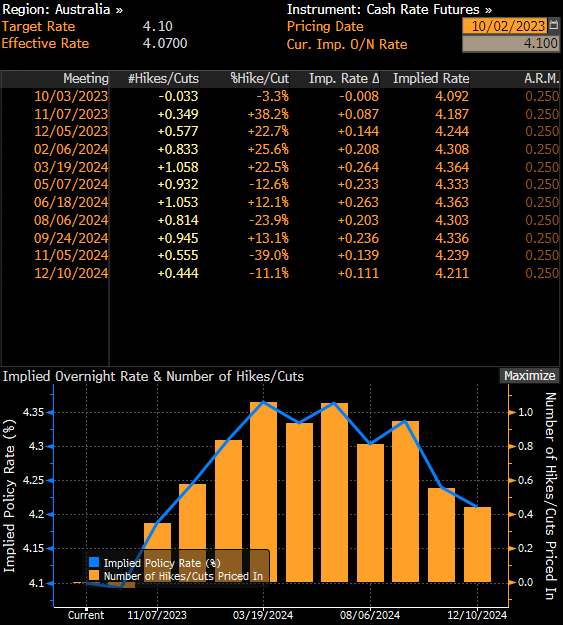

While developments in the Australian economy since the last RBA decision were rather hawkish, neither money markets, nor economists are expecting the central bank to hike rates tomorrow.

Out of over 20 economists surveyed by Bloomberg, only one expects the Reserve Bank of Australia to deliver a 25 basis point rate hike tomorrow. Others are expecting the RBA to keep rates unchanged with the official cash rate staying at 4.10%. Money markets do not expect a change either but it should be noted that a 25 basis point rate hike is priced-in for Q1 2024.

The most likely scenario seems to be a decision to hold rates unchanged while keeping a hawkish bias in the statement. However, should Australian data continue to come in hawkish, it cannot be ruled out that RBA will decide to deliver a hike quicker than market expects - possibly before year's end. Nevertheless, any clear guidance on this is highly unlikely tomorrow.

Money markets expect the RBA to keep the cash rate unchanged at 4.10% tomorrow. Source: xStation5

A look at AUDUSD

Taking a look at AUDUSD chart at D1 interval, we can see that the pair has been trading sideways recently between 0.6350 support and 0.6500 resistance. Pair has recently failed to break above the 50-session moving average (green line) near the midpoint of the range and is pulling back towards the lower limit of the range today. A failure to deliver at least a slightly hawkish message in the light of recent data from Australia may trigger weakness on AUD market and a potential break below the lower limit. In such a scenario the textbook range of the downside breakout would suggest a possibility of a move to as low as 0.6200.

Source: xStation5

Source: xStation5

Morning wrap (10.02.2026)

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.