The dovish rate cut in the US has shaken up the mood in the global economy. While money markets had been righteously betting on a more decisive 50 bp cut, the economists surveyed for Bloomberg found themselves against all odds, opting in vast majority for standard 25 bps. With tension partially released in the US, all eyes are turning to the Bank of Japan, set to make their policy announcement tomorrow.

What to expect from BoJ?

Bank of Japan is widely expected to leave its policy rate unchanged, with a target rate remaining at its current 0.25 percent level. Money market is currently confident that BoJ will remain on track with its current rates, leaving almost no room for any move in policy.

Money markets pricing in 1% chance for a rate cut, virtually indicating no policy change upon the next meeting. Source: xStation5

Not so hawkish Ueda

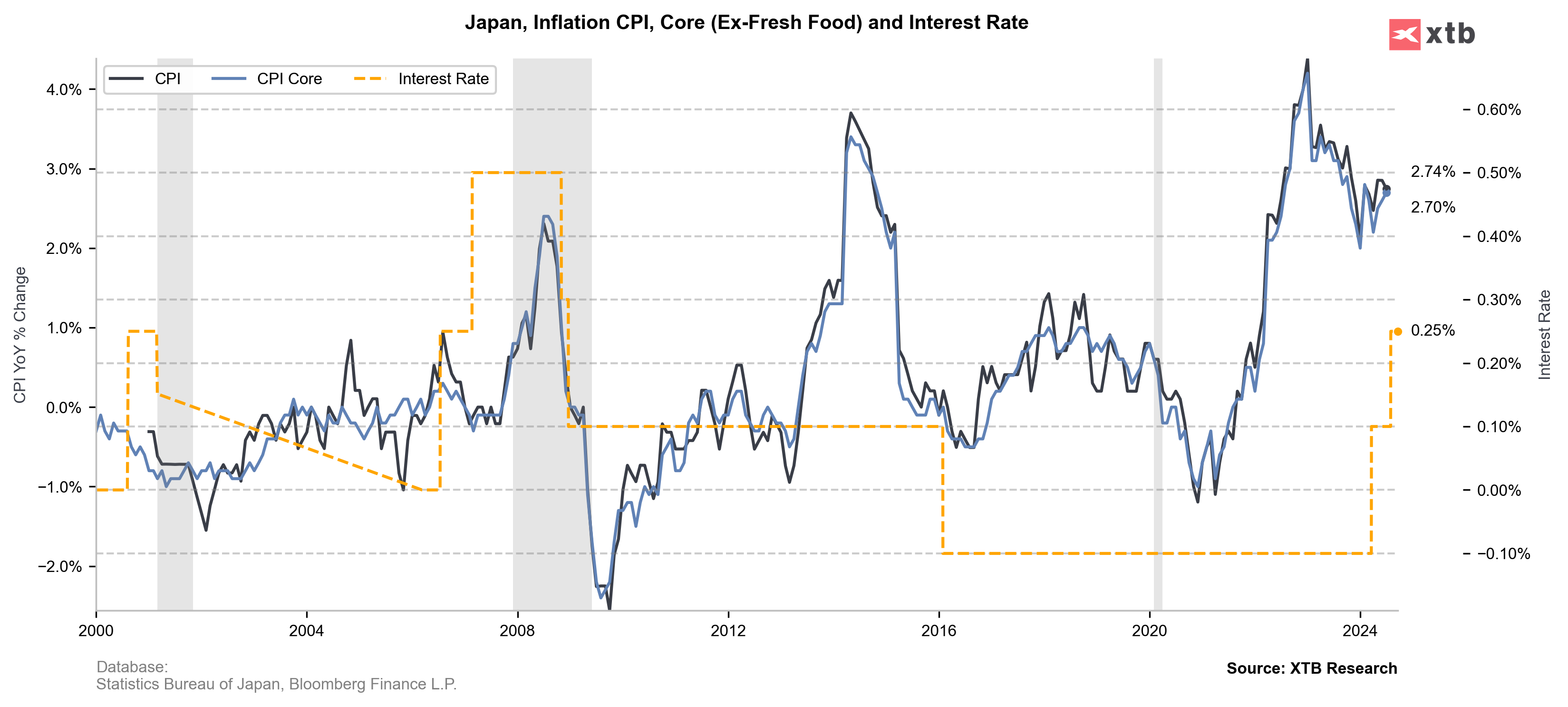

A recently unexpected rate hike in Japan caused widespread anxiety on financial markets, due to the sharp turn in direction of monetary policy in Japan and the US. While July’s labor data exercised significant pressure on Fed to cut interest rates more aggressively, BoJ’s Ueda underlined the central bank’s readiness to raise interest rates, if the inflation keeps going up. However, despite CPI for July being slightly above the expectations (2.74%, exp.: 2.7%, previous: 2.85%) there’s a firm consensus that BoJ will postpone potential adjustments further into the year, as it first wants to see the effects of the recent 0.15 bp hike.

Interest rate in Japan is at its 16-year high. BoJ’s monetary policy has already brought the inflation down from its recent peaks, while upcoming CPI readings remain crucial for additional policy adjustments. Source: XTB Research / Bloomberg Finance L.P.

At the moment, the market is pricing that the BoJ will raise interest rates by 22 basis points over the next 12 months. This means that effective interest rates will remain in the 0.25% region in the near term. This could result in renewed downward pressure on the yen in the long term against banks (and the currencies they represent) maintaining “more hawkish” policies. Source: Bloomberg Finance L.P.

USDJPY gains despite Fed’s 50 bp cut

Muted expectations towards BoJ’s policy has helped dollar to gain against yen, while appreciating against all of the other major currencies. We could expect a potential reversion around 143-143.100 rate once the Japan central bank’s decision sinks in and CPI data set the mood for the upcoming month.

From a technical point of view, however, the USDJPY pair continuously remains in a dynamic downtrend, as evidenced by the downward skewed moving averages. Source: xStation5

Morning wrap (10.02.2026)

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.